Indiana Social Worker Agreement - Self-Employed Independent Contractor

Description

How to fill out Social Worker Agreement - Self-Employed Independent Contractor?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a vast selection of legal form templates that you can download or print.

By utilizing the website, you can discover thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can quickly locate the latest forms such as the Indiana Social Worker Agreement - Self-Employed Independent Contractor.

If you already have an account, Log In and download Indiana Social Worker Agreement - Self-Employed Independent Contractor from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously downloaded forms in the My documents section of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the purchase.

Select the file format and download the form to your device. Make modifications. Fill out, edit, and print or sign the downloaded Indiana Social Worker Agreement - Self-Employed Independent Contractor. Each template added to your account has no expiration date and belongs to you permanently. Therefore, if you wish to download or print another copy, simply navigate to the My documents section and click on the desired form. Access the Indiana Social Worker Agreement - Self-Employed Independent Contractor with US Legal Forms, the most comprehensive collection of legal document templates. Utilize thousands of professional and state-specific templates that fulfill your business or personal needs and requirements.

- If you're using US Legal Forms for the first time, follow these simple steps to get started.

- Ensure you have selected the correct form for your area/county.

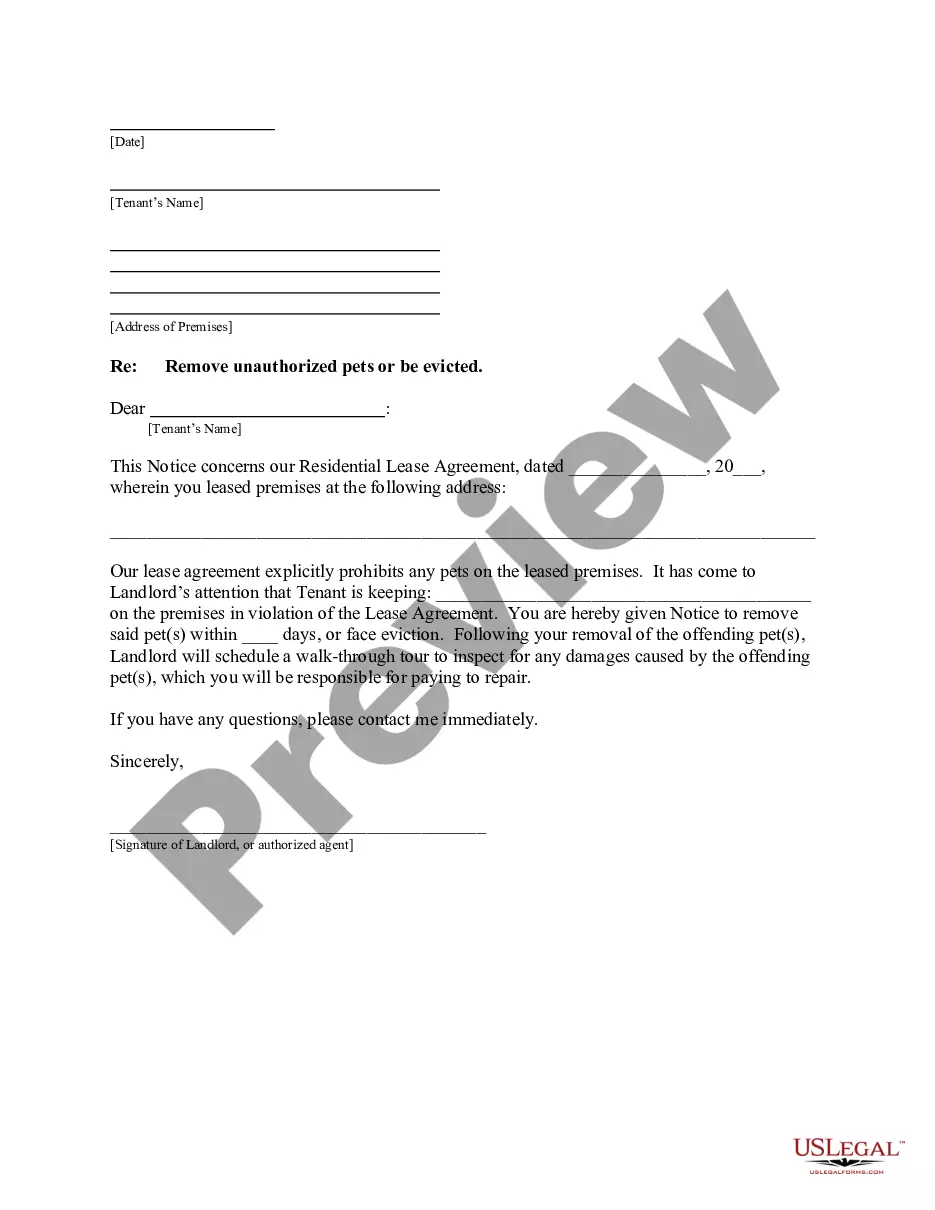

- Click the Preview button to review the form's content.

- Check the form description to confirm you have the right form.

- If the form doesn't meet your needs, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Download now button.

- Then, choose the pricing plan you prefer and provide your details to register for an account.

Form popularity

FAQ

Creating an independent contractor agreement involves outlining the scope of work, payment terms, and obligations of both parties. You should include specific details relevant to your services as a social worker. Using resources like the Indiana Social Worker Agreement - Self-Employed Independent Contractor template from uslegalforms can simplify the process, ensuring that you cover all essential aspects.

Yes, independent contractors in Indiana may need to obtain a business license to operate legally. This requirement can vary by city or county, so it's wise to check local regulations. A valid license can enhance your credibility and compliance. When drafting your Indiana Social Worker Agreement - Self-Employed Independent Contractor, ensure that you include compliance with relevant licensing requirements.

In Indiana, independent contractors typically do not need workers' compensation insurance. However, if you are classified as an employee instead of a self-employed individual, you may be required to have coverage. It is essential to carefully review your classification and consult legal advice if needed. The Indiana Social Worker Agreement - Self-Employed Independent Contractor can help clarify your status.

Yes, Non-Disclosure Agreements (NDAs) apply to independent contractors, including those in the field of social work. When working under an Indiana Social Worker Agreement - Self-Employed Independent Contractor, an NDA helps protect sensitive client information. By signing this agreement, you commit to maintaining confidentiality, which is crucial in building trust with clients while also complying with industry standards.

Yes, an independent contractor is considered self-employed. This means they operate their own business, manage their own taxes, and have the freedom to choose their clients. In the context of an Indiana Social Worker Agreement - Self-Employed Independent Contractor, this classification allows you to enjoy flexibility while fulfilling your professional duties. This agreement outlines the responsibilities and expectations, ensuring clarity in your self-employment status.

Writing an independent contractor agreement requires you to begin with a clear outline of the project's details. Start by defining the parties involved, followed by a description of the work to be performed, payment rates, and deadlines. Utilizing a template, like the Indiana Social Worker Agreement - Self-Employed Independent Contractor, can simplify this process and ensure all necessary elements are included. Finally, review and revise the document before finalizing it with signatures.

Filling out an independent contractor agreement involves several key steps to establish a clear understanding between both parties. Start by entering basic information, such as names and contact details of the contractor and employer. Specify the scope of work, payment terms, and deadlines within the Indiana Social Worker Agreement - Self-Employed Independent Contractor. Lastly, both parties should review the document to ensure accuracy before signing it.

When employing an independent contractor, you will need to gather essential paperwork to ensure a smooth collaboration. This typically includes a signed Indiana Social Worker Agreement - Self-Employed Independent Contractor, which outlines the terms of the relationship. Additionally, you should collect the contractor's W-9 form for tax purposes and any relevant licenses or certifications. Proper paperwork protects both parties and clarifies expectations.

Yes, you can certainly have a contract if you're self-employed. In fact, an Indiana Social Worker Agreement - Self-Employed Independent Contractor is essential for establishing clear terms of your working relationship with clients. This contract can outline responsibilities, compensation, and other critical details, ensuring both parties are on the same page. Using platforms like uslegalforms can simplify this process by providing templates tailored for your specific needs.