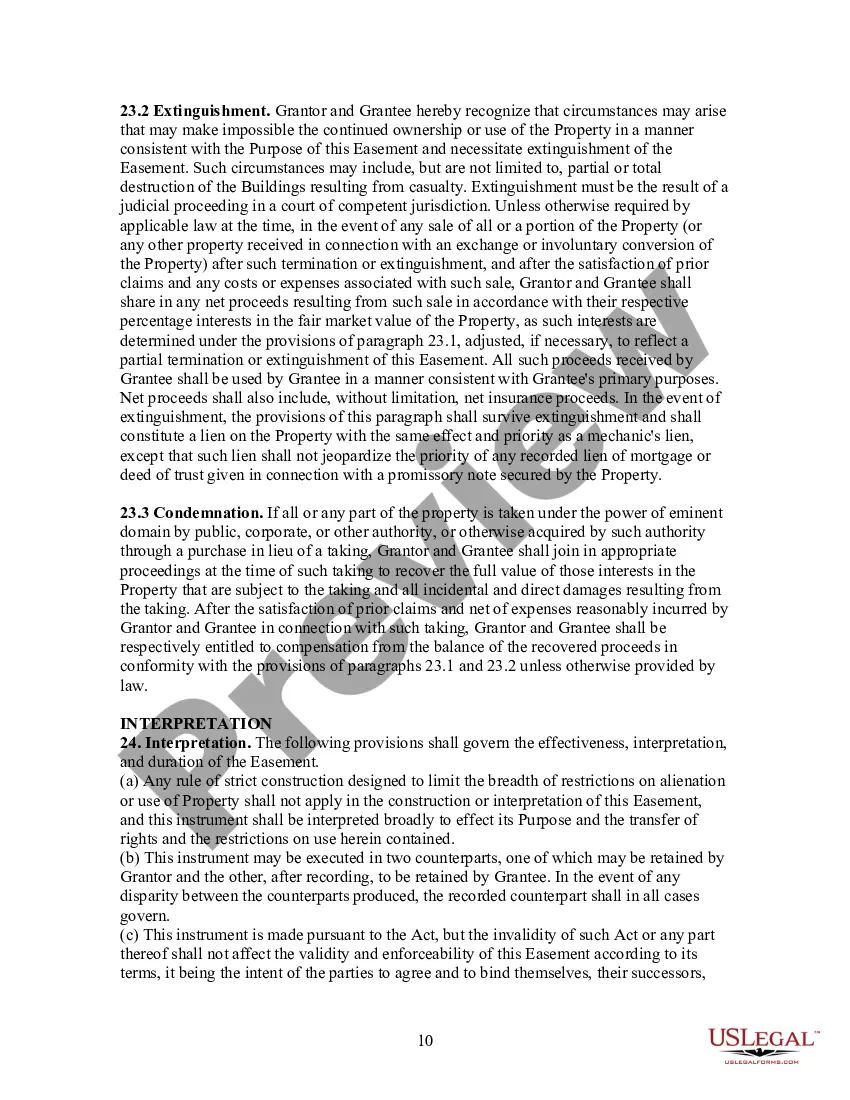

Massachusetts Conservation Easement

Description

How to fill out Conservation Easement?

You may devote hrs on the Internet trying to find the legitimate document template that fits the federal and state needs you will need. US Legal Forms provides a huge number of legitimate types which can be evaluated by pros. You can actually acquire or print out the Massachusetts Conservation Easement from our assistance.

If you have a US Legal Forms bank account, you may log in and then click the Obtain switch. Following that, you may complete, change, print out, or sign the Massachusetts Conservation Easement. Each and every legitimate document template you acquire is your own eternally. To obtain yet another copy of the obtained type, go to the My Forms tab and then click the corresponding switch.

If you are using the US Legal Forms internet site the very first time, adhere to the easy guidelines listed below:

- First, be sure that you have chosen the correct document template for your region/city of your choice. Browse the type information to ensure you have picked out the appropriate type. If readily available, make use of the Preview switch to look with the document template as well.

- If you wish to get yet another version in the type, make use of the Look for field to obtain the template that fits your needs and needs.

- After you have located the template you desire, just click Get now to proceed.

- Select the costs strategy you desire, type your accreditations, and sign up for a merchant account on US Legal Forms.

- Complete the transaction. You may use your credit card or PayPal bank account to cover the legitimate type.

- Select the structure in the document and acquire it for your device.

- Make alterations for your document if possible. You may complete, change and sign and print out Massachusetts Conservation Easement.

Obtain and print out a huge number of document layouts using the US Legal Forms website, which provides the largest collection of legitimate types. Use skilled and status-distinct layouts to handle your organization or specific needs.

Form popularity

FAQ

Amendments to existing CRs must go through the submission and review process in the same manner as a new CR. Parties are encouraged to contact DCS to discuss proposed amendments prior to formal submission. Practitioners are strongly encouraged to follow DCS' Model Conservation Restriction (link below).

What is a Conservation Easement? A conservation easement is a voluntary legal agreement between a landowner and a land trust like MLR that permanently limits the uses of the land in order to protect its conservation values.

The Conservation Land Tax Credit program recognizes and rewards landowners who donate a real property interest either outright, or through a Conservation Restriction. The donation must permanently protect an important natural resource such as forest land that is in the public's interest.

In Florida, Section 704.06, Florida Statutes, defines a ?Conservation Easement? as ?. . . a right or interest in real property which is appropriate to retaining land or water areas predominantly in their natural, scenic, open, agricultural, or wooded condition; retaining such areas as suitable habitat for fish, plants, ...

To download IRS Form 8283, go to the IRS website. Generally, you can either print out Form 8283 and mail a paper copy to the IRS or file it electronically.

There are significant financial benefits available to landowners who agree to protect their land with a conservation easement including a deduction for federal income taxes and a credit for state income taxes. In addition, there is property tax credit and possible federal estate tax exemptions.

Form 8283, Noncash Charitable Contributions, is used to report noncash contributions and is generally required of taxpayers whose noncash contributions exceed $500.

Conservation Restrictions are legal agreements that prohibit certain acts and uses, while allowing others, on private or municipally-owned property in order to permanently protect conservation values present on the land.