Indiana Woodworking Services Contract - Self-Employed

Description

How to fill out Woodworking Services Contract - Self-Employed?

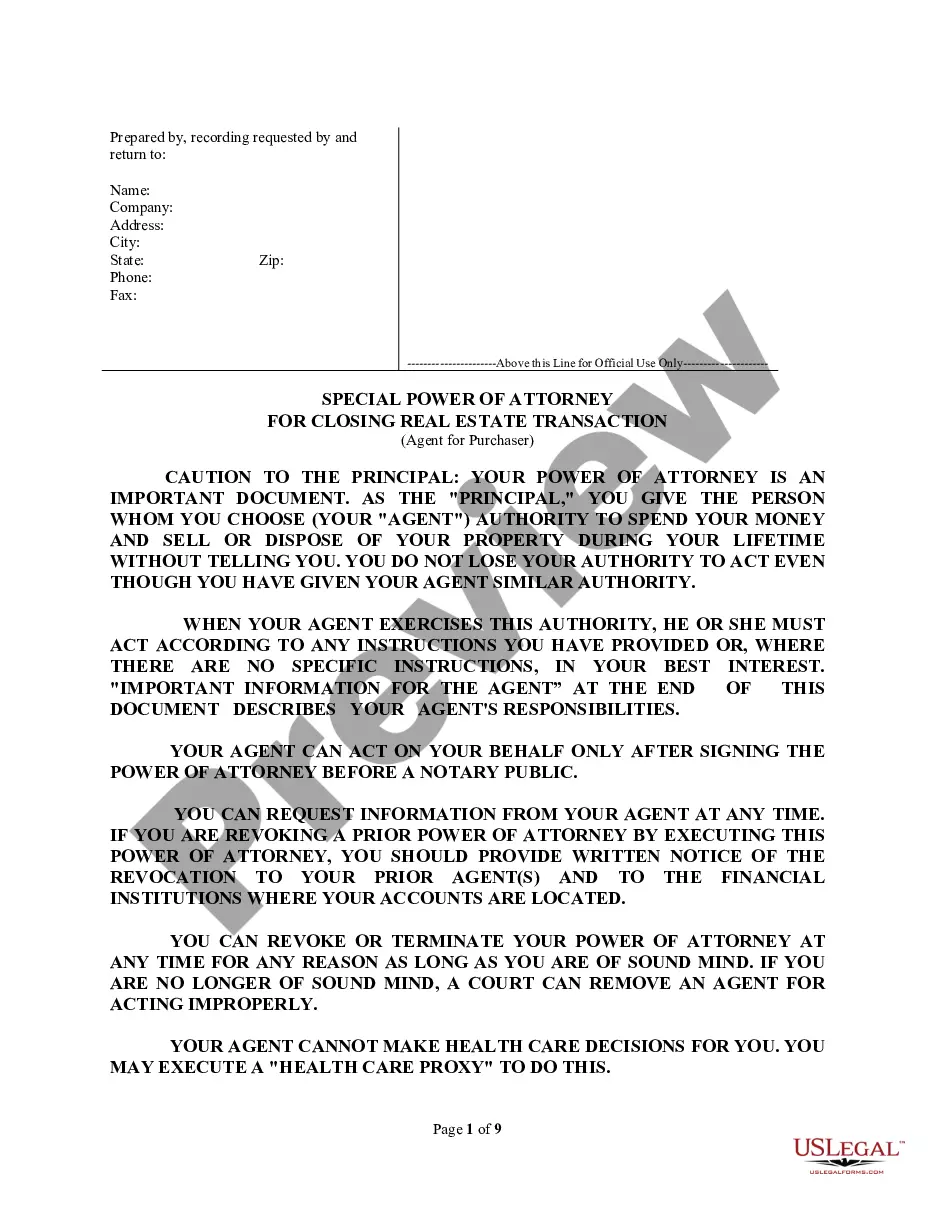

US Legal Forms - one of the largest collections of legal documents in the United States - provides a vast selection of legal form templates that you can download or print. By using the website, you can access thousands of forms for business and personal use, organized by categories, states, or keywords. You can obtain the latest versions of forms such as the Indiana Woodworking Services Contract - Self-Employed in just minutes.

If you already have an account, Log In and download the Indiana Woodworking Services Contract - Self-Employed from your US Legal Forms library. The Download option will appear on every form you view. You can find all previously downloaded forms in the My documents section of your account.

To use US Legal Forms for the first time, here are simple steps to get started: Ensure you have selected the correct form for your city/state. Click the Preview button to review the form's content. Read the form description to confirm you have chosen the right document. If the form does not meet your requirements, use the Search field at the top of the screen to find the one that does.

Access the Indiana Woodworking Services Contract - Self-Employed with US Legal Forms, the most extensive collection of legal document templates. Utilize a multitude of professional and state-specific templates that cater to your business or personal requirements and needs.

- If you are satisfied with the form, confirm your selection by clicking the Buy now button.

- Then, choose the payment plan you prefer and provide your details to create an account.

- Process the payment. Use your credit card or PayPal account to complete the transaction.

- Select the format and download the form to your device.

- Make modifications. Fill out, edit, and print and sign the downloaded Indiana Woodworking Services Contract - Self-Employed.

- Every template you add to your account has no expiration date and is yours indefinitely. So, if you wish to download or print another copy, simply visit the My documents section and click on the form you need.

Form popularity

FAQ

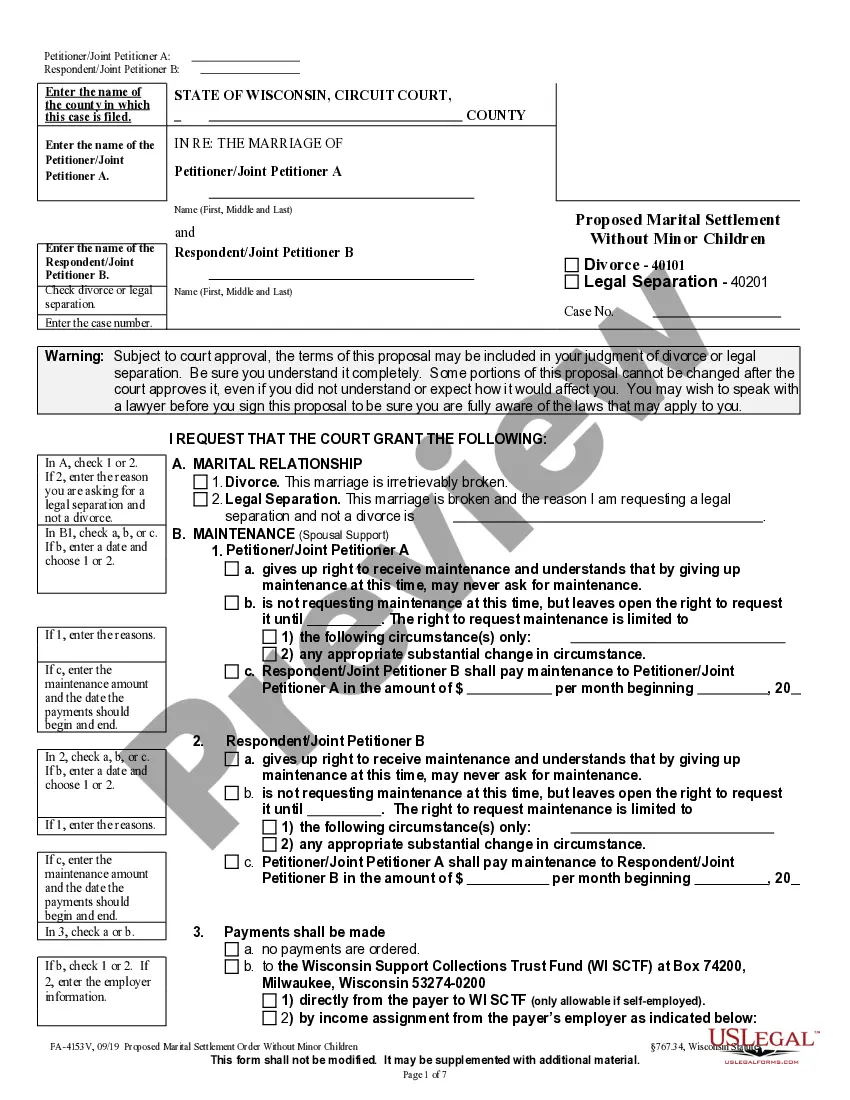

In Indiana, licensing for contractors depends on the type of work you perform. While some local jurisdictions require specific licenses for contractors, others do not. It's crucial to check local regulations and requirements for your business, especially when engaging in projects under the Indiana Woodworking Services Contract - Self-Employed. Our platform, USLegalForms, can help you navigate the licensing requirements and ensure you comply with all regulations.

Yes, it is advisable to register your business if you operate as an independent contractor in Indiana. Depending on your business structure, you may need to file for an LLC or sole proprietorship. Registering your business can enhance your credibility and is particularly important when dealing with contracts, like the Indiana Woodworking Services Contract - Self-Employed. Moreover, it may help you obtain necessary permits and licenses required by local regulators.

Writing a self-employed contract involves detailing your services, payment terms, and responsibilities. Be specific about project expectations and timelines to prevent misunderstandings. For a structured approach, consider templates for an Indiana Woodworking Services Contract - Self-Employed available through uslegalforms that guide you through the process.

As an independent contractor, you need to collect and report certain documents, including your 1099 forms from clients, receipts for business expenses, and relevant tax forms like Schedule C. Staying organized can simplify filing your taxes. Using an Indiana Woodworking Services Contract - Self-Employed helps you maintain clear records of your income and expenses.

To write a contract for a 1099 employee, clearly outline the work relationship, payment arrangements, and job expectations. Distinguish the contractor's independent status from an employee's role in your structure. Consider using an Indiana Woodworking Services Contract - Self-Employed template available through uslegalforms for guidance.

Yes, you can write your legally binding contract, provided you follow the correct legal guidelines. Make sure to include elements like identification of both parties, terms of service, and payment details. Using an Indiana Woodworking Services Contract - Self-Employed template can help you structure your contract to ensure its legality.

Independent contractors in Indiana typically do not need workers' compensation insurance unless they have employees. However, having this insurance can protect you from unforeseen risks. If you decide to offer services under an Indiana Woodworking Services Contract - Self-Employed, consider discussing this need with your insurance agent.

In Indiana, whether you need a business license as an independent contractor depends on your local regulations. Often, specific trades may require a license to operate legally. It’s advisable to check with your local government and ensure your Indiana Woodworking Services Contract - Self-Employed complies with all necessary requirements.

Writing a self-employment contract involves outlining the terms of your agreement with clients. Start by specifying the scope of work, payment terms, deadlines, and responsibilities. You can use templates, like those offered by uslegalforms, to create a professional Indiana Woodworking Services Contract - Self-Employed that includes these crucial elements.

To demonstrate that you are self-employed, gather essential documentation such as tax returns, a business license, or invoices from clients. These documents provide clear evidence of your work as an independent contractor. Utilizing a proper Indiana Woodworking Services Contract - Self-Employed can also strengthen your proof of self-employment during transactions.