Indiana Metal Works Services Contract - Self-Employed

Description

How to fill out Metal Works Services Contract - Self-Employed?

Have you ever been in a location where you frequently need documents for either business or personal reasons? There are numerous authentic document templates accessible online, but finding ones you can trust is not easy. US Legal Forms offers thousands of form templates, including the Indiana Metal Works Services Contract - Self-Employed, which can be tailored to comply with state and federal regulations.

If you are already familiar with the US Legal Forms website and possess an account, simply Log In. After that, you can download the Indiana Metal Works Services Contract - Self-Employed template.

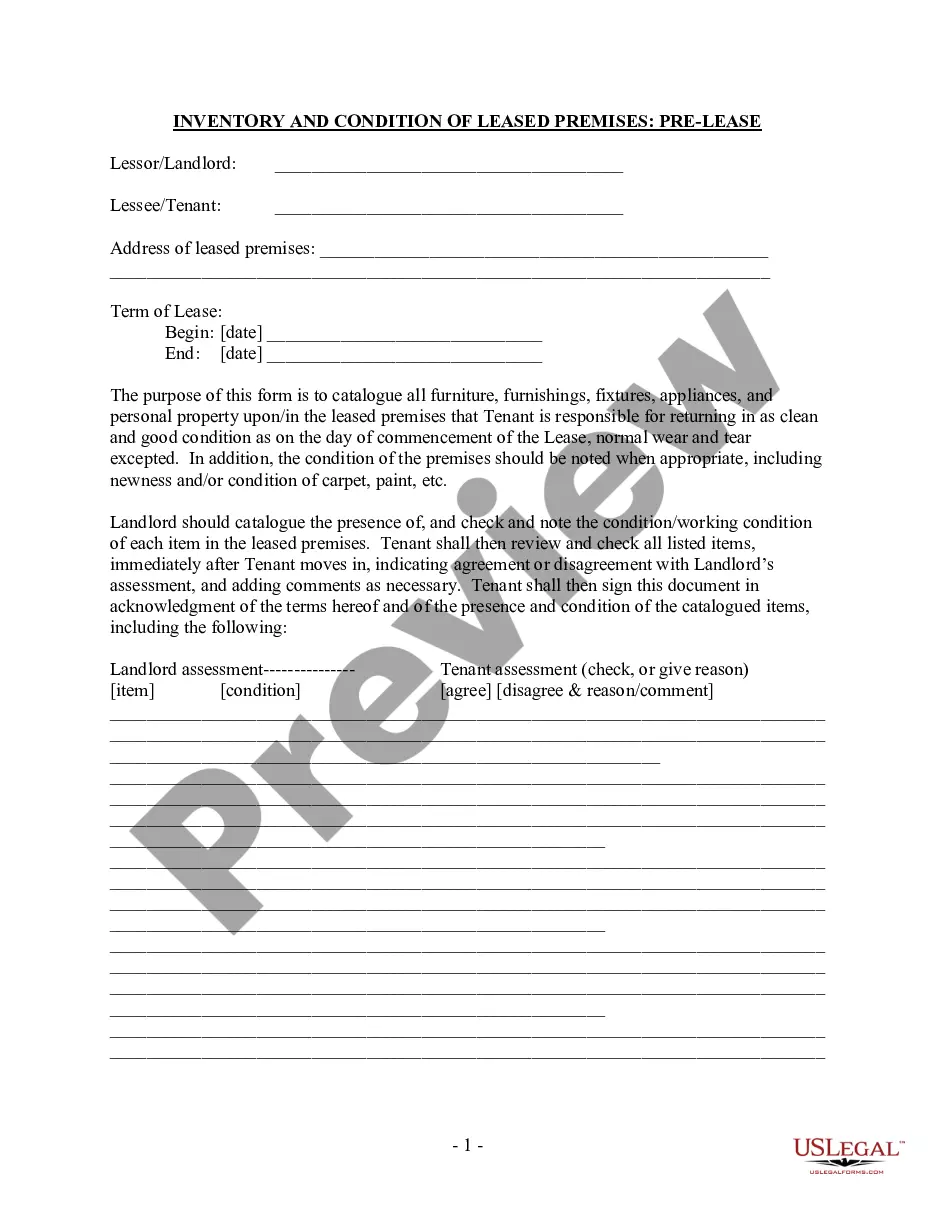

If you do not have an account and wish to start using US Legal Forms, follow these instructions: Obtain the form you require and ensure it corresponds to the correct region/area. Use the Review button to evaluate the form. Check the description to confirm you have chosen the right form. If the form is not what you are looking for, utilize the Lookup field to find the form that fits your needs and requirements. If you locate the appropriate form, click Acquire now. Select the payment plan you prefer, complete the necessary information to create your account, and process the payment using your PayPal or credit card. Choose a convenient document format and download your copy.

- Find all the document templates you have purchased in the My documents section. You can obtain another copy of the Indiana Metal Works Services Contract - Self-Employed at any time, if needed. Just select the required form to download or print the document template.

- Utilize US Legal Forms, the most extensive collection of legitimate forms, to save time and avoid mistakes. The service provides properly crafted legal document templates that you can use for various purposes. Create an account on US Legal Forms and start making your life easier.

Form popularity

FAQ

Yes, you can be your own general contractor in Indiana, which offers significant advantages for self-employed individuals. Working under an Indiana Metal Works Services Contract - Self-Employed allows you to manage your projects directly, giving you control over timelines and budgets. Keep in mind that you still need to adhere to local building codes and regulations. USLegalForms can assist you in understanding your responsibilities as a general contractor.

In general, Indiana does not require a state-level contractor license, which can be appealing for self-employed individuals. Those working with an Indiana Metal Works Services Contract - Self-Employed can enjoy more flexibility. However, some municipalities impose their own licensing requirements, so be sure to confirm the local rules. USLegalForms provides valuable information on navigating these local laws and ensuring compliance.

Several states do not mandate general contractors to have a license, including Massachusetts and Oklahoma. This can benefit self-employed contractors under the Indiana Metal Works Services Contract - Self-Employed, allowing them to enter the market with less bureaucratic overhead. However, while licensing may not be necessary, local ordinances or regulations might still apply. It's wise to research specific state requirements thoroughly.

In Indiana, specific cities often require contractors to obtain a local license to operate legally. However, the state does not have a statewide contractor licensing requirement, making it easier for contractors who work under the Indiana Metal Works Services Contract - Self-Employed. Still, checking local regulations is crucial to avoid any legal issues. You can find useful resources on the USLegalForms platform to guide you through this process.

Whether you need a business license as an independent contractor in Indiana depends on your specific business activities and local laws. It's essential to check with your county and city regulations to ensure compliance. If you're operating under an Indiana Metal Works Services Contract - Self-Employed, obtaining the necessary licenses is crucial for legitimizing your business. Resources like uslegalforms can help you navigate these requirements effectively.

In Indiana, certain professionals, including sole proprietors and independent contractors, are typically exempt from workers' compensation requirements. If you are self-employed under an Indiana Metal Works Services Contract - Self-Employed, you likely do not need this insurance. However, it's wise to assess potential risks in your work. Seeking legal advice can further clarify your obligations.

An independent contractor often needs general liability insurance, which protects against claims of injury or damage. Depending on your work, you might also consider professional liability or errors and omissions insurance. If your work aligns with the Indiana Metal Works Services Contract - Self-Employed, evaluating your specific risk exposures can guide you in selecting the right coverage. Consulting an insurance advisor will help you navigate your options.

In Indiana, 1099 employees, or independent contractors, typically do not need workers' compensation insurance. However, if you hire subcontractors, you might need this coverage for them, depending on your business arrangement. For those operating under an Indiana Metal Works Services Contract - Self-Employed, understanding these nuances helps ensure compliance and protects your business. Always consult with a specialist to be certain.

Legal requirements for independent contractors vary by state, but generally, you need to declare your business and potentially obtain necessary licenses. In Indiana, it is advisable to familiarize yourself with laws governing self-employment. Furthermore, ensuring your Indiana Metal Works Services Contract - Self-Employed meets legal standards is essential for protecting your interests. Consulting a legal professional can help clarify these requirements.

Independent contractors generally do not qualify for workers' compensation. In Indiana, coverage often applies to traditional employees rather than self-employed individuals. If you are working under an Indiana Metal Works Services Contract - Self-Employed, it's crucial to understand your responsibilities. You may need to consider alternative forms of coverage for workplace injuries.