Indiana Private Placement Subscription Agreement

Description

How to fill out Private Placement Subscription Agreement?

If you need to complete, obtain, or print out authorized file layouts, use US Legal Forms, the most important selection of authorized types, which can be found on-line. Utilize the site`s simple and practical lookup to get the paperwork you require. Different layouts for company and personal purposes are categorized by groups and says, or search phrases. Use US Legal Forms to get the Indiana Private Placement Subscription Agreement in a number of mouse clicks.

When you are previously a US Legal Forms consumer, log in to the accounts and click on the Down load switch to have the Indiana Private Placement Subscription Agreement. Also you can access types you earlier acquired inside the My Forms tab of your accounts.

Should you use US Legal Forms the very first time, follow the instructions under:

- Step 1. Ensure you have chosen the form for that proper area/nation.

- Step 2. Use the Preview option to examine the form`s content. Never overlook to see the explanation.

- Step 3. When you are unhappy together with the form, take advantage of the Lookup discipline on top of the display to locate other versions of your authorized form design.

- Step 4. Upon having identified the form you require, click on the Buy now switch. Opt for the costs prepare you like and include your credentials to register on an accounts.

- Step 5. Process the transaction. You can utilize your Мisa or Ьastercard or PayPal accounts to perform the transaction.

- Step 6. Find the format of your authorized form and obtain it on your gadget.

- Step 7. Full, modify and print out or signal the Indiana Private Placement Subscription Agreement.

Each and every authorized file design you purchase is yours for a long time. You might have acces to every single form you acquired with your acccount. Click on the My Forms segment and decide on a form to print out or obtain once again.

Compete and obtain, and print out the Indiana Private Placement Subscription Agreement with US Legal Forms. There are thousands of skilled and state-specific types you may use for the company or personal demands.

Form popularity

FAQ

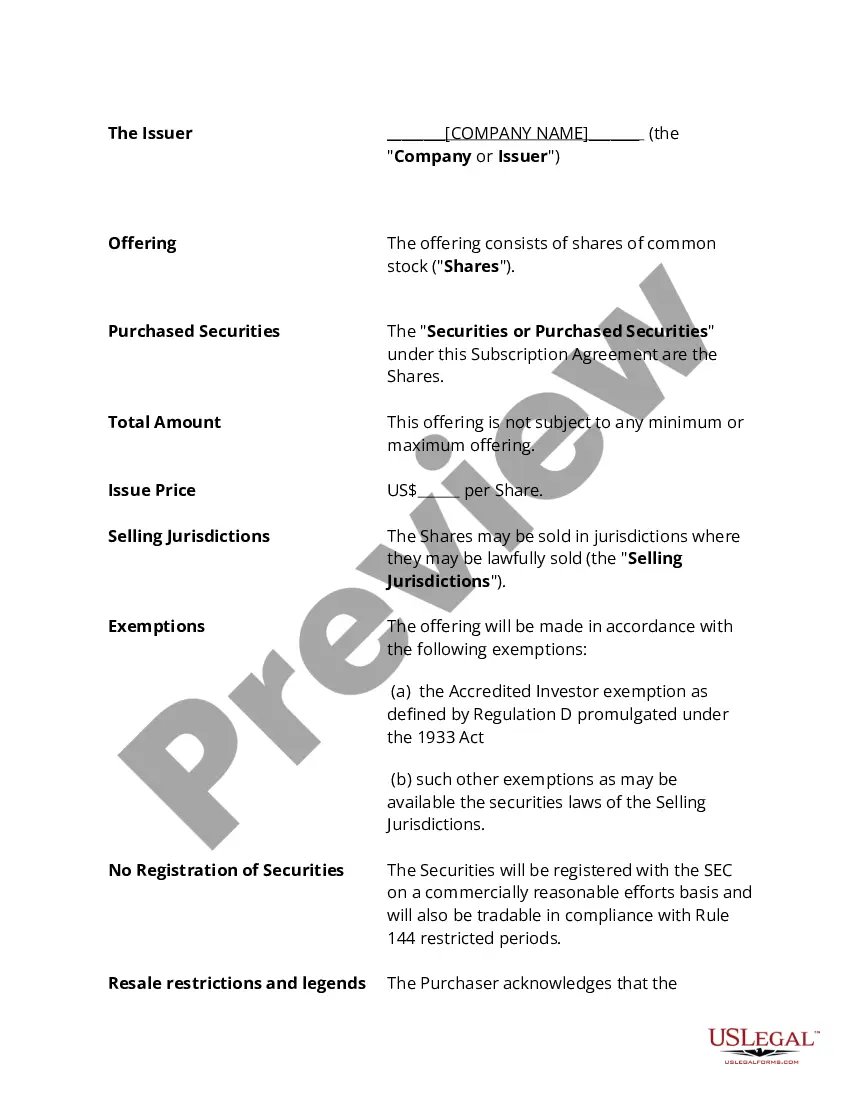

A subscription contract can be defined as regular or continuous use of a certain service or product by paying a certain amount. In this type of contract, the buyer has the right to demand a product or service from the other party for a certain period or continuously by paying a certain amount.

Bond Subscription Agreement means the subscription agreement dated the Issue Date relating to the Bonds between the Obligors, the Financial Guarantors, the Lead Manager and the Purchaser; Sample 1Sample 2.

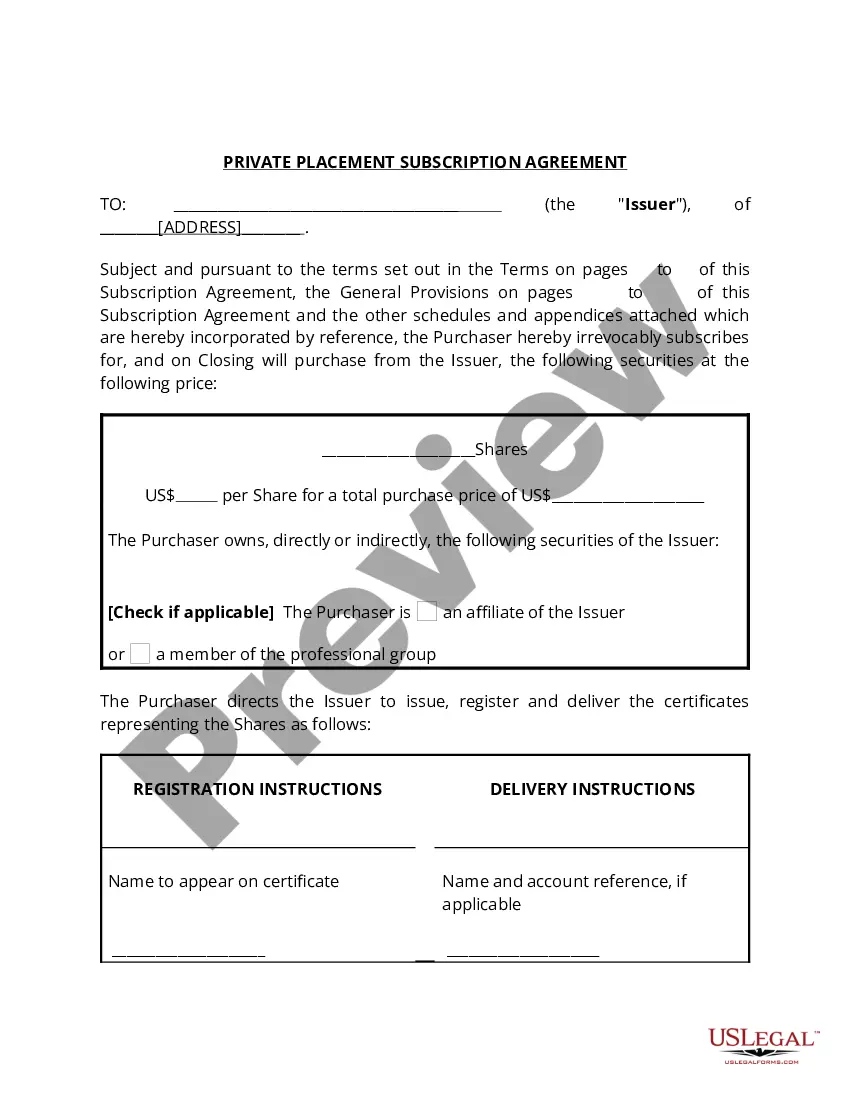

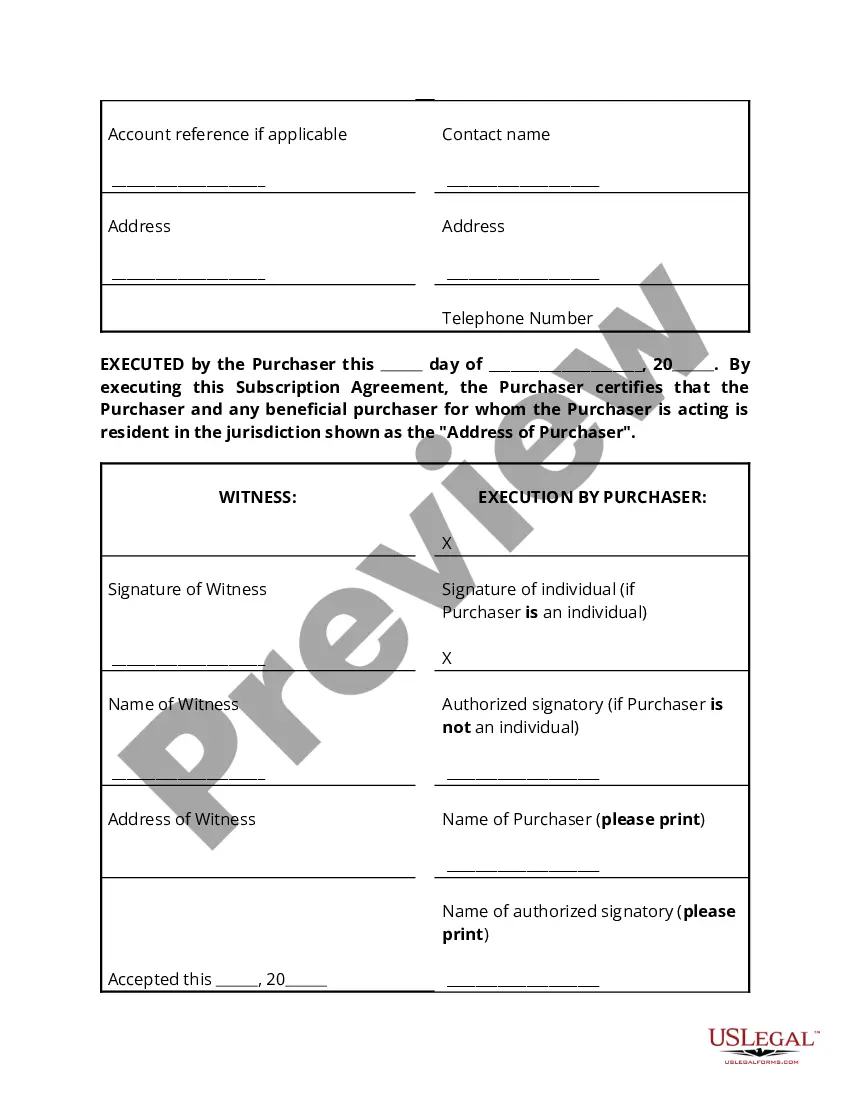

A subscription agreement is a formal agreement between a company and an investor to buy shares of a company at an agreed-upon price. It contains all the details of such an agreement, including Outstanding Shares, Shares Ownership, and Payouts.

A subscription agreement is a formal agreement between a company and an investor to buy shares of a company at an agreed-upon price. It contains all the details of such an agreement, including Outstanding Shares, Shares Ownership, and Payouts.

A subscription agreement is a formal agreement between a company and an investor to buy shares of a company at an agreed-upon price. It contains all the details of such an agreement, including Outstanding Shares, Shares Ownership, and Payouts.

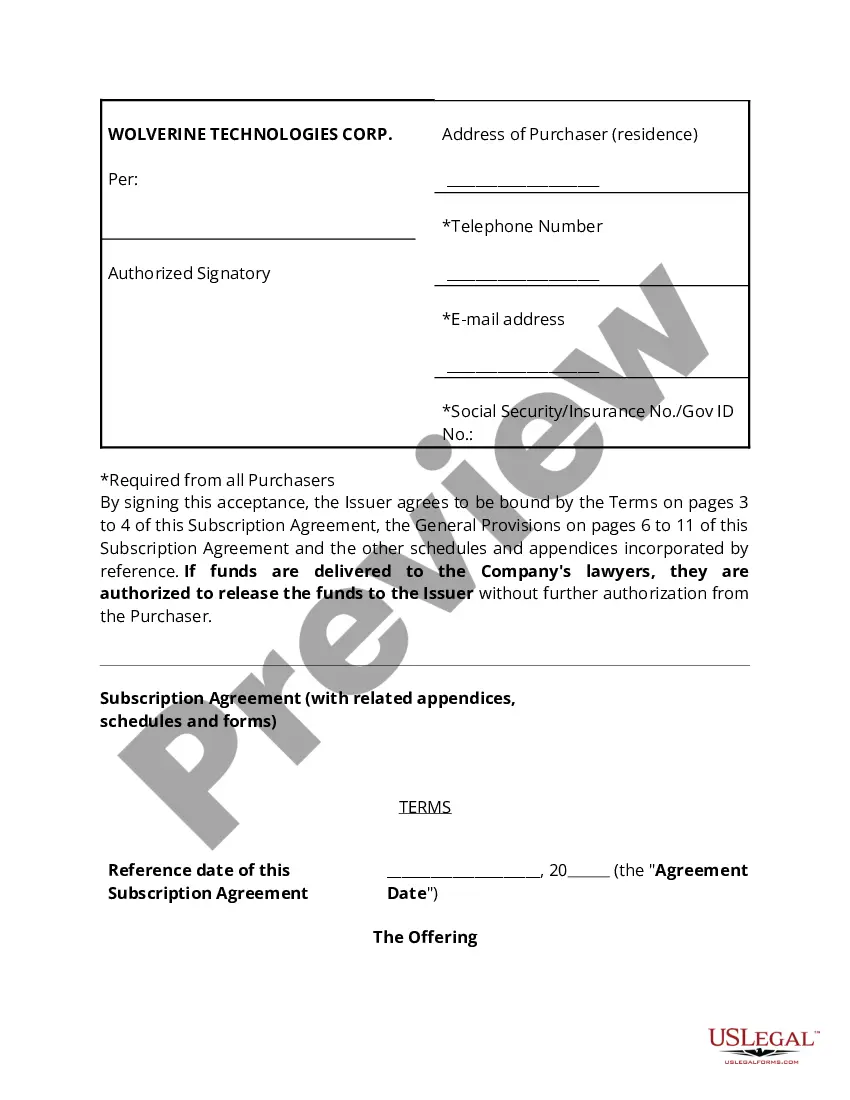

The Private Placement Memorandum also includes the Subscription Agreement which is the actual "sales contract" for the shares of stock being placed. This is the document that the investor will sign and send in with their investment capital.

A PPM is a Private Placement Memorandum. It's a legal document given to all prospective investors in a real estate investment, whether they invest as an LLC or individuals. It's designed to provide potential investors with full disclosure based on the requirements of the federal securities law.

How does a PPM differ from an Operating Agreement? A PPM provides information on the investment opportunity: information about the terms of the deal, the risks of the investment, etc. The Operating Agreement is the governing document concerning the operation of the subject entity.

The term subscribed refers to newly issued securities that an investor agrees or intends to buy prior to the official issue date. When investors subscribe, they expect to own the number of shares they designate once the offering is complete.

A Share Subscription Agreement is a legally binding contract between a company and an investor or subscriber. It outlines the terms and conditions under which the investor agrees to purchase newly issued company shares.