Indiana Sample Stock Purchase Agreement between Goshen Rubber Companies, Inc., shareholders and Wynn's International, Inc.

Description

How to fill out Sample Stock Purchase Agreement Between Goshen Rubber Companies, Inc., Shareholders And Wynn's International, Inc.?

Are you within a position the place you need to have paperwork for sometimes organization or person functions just about every day time? There are tons of authorized file layouts accessible on the Internet, but getting versions you can trust is not easy. US Legal Forms delivers 1000s of develop layouts, much like the Indiana Sample Stock Purchase Agreement between Goshen Rubber Companies, Inc., shareholders and Wynn's International, Inc., that happen to be published to fulfill state and federal specifications.

When you are already informed about US Legal Forms web site and possess a merchant account, basically log in. Following that, it is possible to acquire the Indiana Sample Stock Purchase Agreement between Goshen Rubber Companies, Inc., shareholders and Wynn's International, Inc. template.

If you do not have an bank account and need to begin using US Legal Forms, abide by these steps:

- Obtain the develop you will need and ensure it is to the proper town/region.

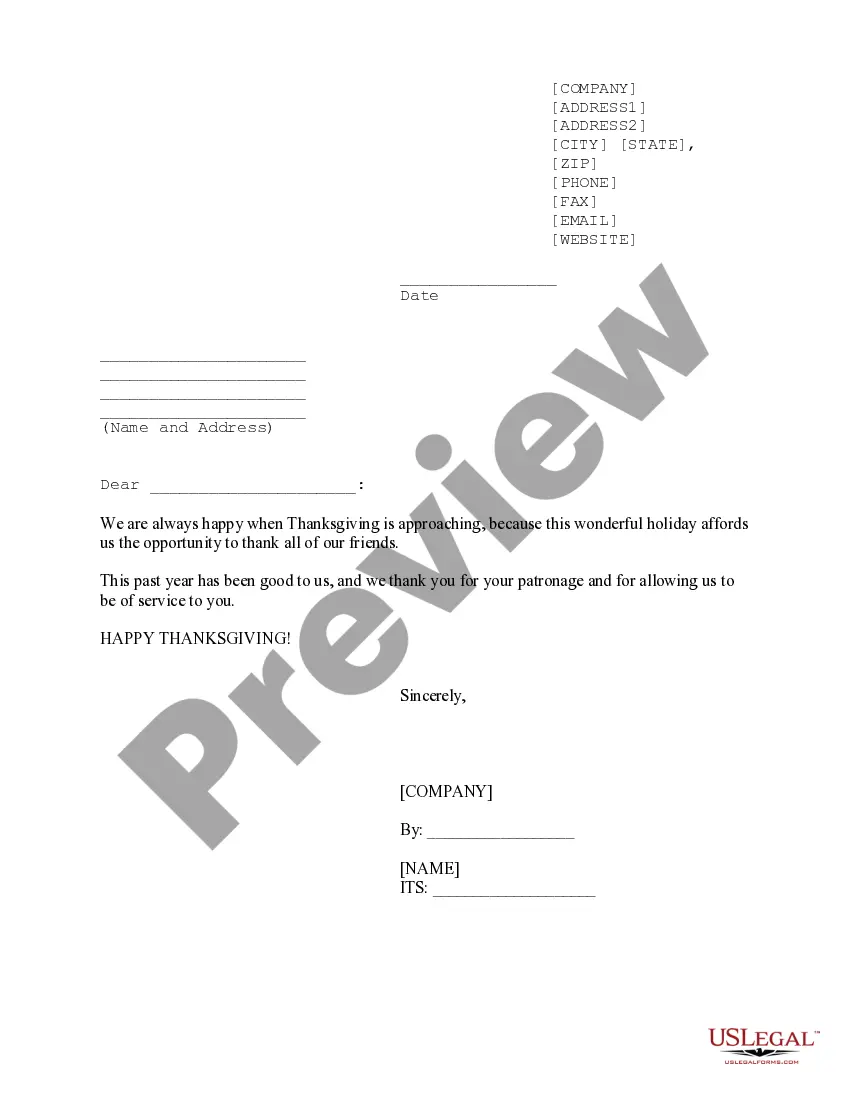

- Use the Review option to examine the shape.

- Read the outline to actually have chosen the correct develop.

- In the event the develop is not what you`re trying to find, take advantage of the Lookup discipline to discover the develop that meets your requirements and specifications.

- Whenever you discover the proper develop, simply click Acquire now.

- Opt for the pricing plan you need, submit the necessary information and facts to make your bank account, and buy the order with your PayPal or charge card.

- Choose a handy paper format and acquire your version.

Find each of the file layouts you might have bought in the My Forms menu. You can obtain a further version of Indiana Sample Stock Purchase Agreement between Goshen Rubber Companies, Inc., shareholders and Wynn's International, Inc. anytime, if necessary. Just click the essential develop to acquire or print the file template.

Use US Legal Forms, by far the most substantial variety of authorized forms, to save some time and steer clear of faults. The support delivers skillfully made authorized file layouts that you can use for a selection of functions. Produce a merchant account on US Legal Forms and initiate generating your way of life a little easier.

Form popularity

FAQ

The Shareholder's Agreement is generally used to resolve disputes between the corporation and the Shareholder. The Share Purchase Agreement, on the other hand, is a document that justifies the exchange of shares held by the Buyer and Seller.

Common due diligence issues unique to stock purchases include the seller's title to the target company's stock, terms of key contracts, identifying the target company's liabilities, and the nature and condition of the target company's assets.

Stock purchase agreements (SPAs) are legally binding contracts between shareholders and companies. Also known as share purchase agreements, these contracts establish all of the terms and conditions related to the sale of a company's stocks.

Some of the key items that are listed in a stock purchase agreement are: Name of the company whose shares are being bought and sold; Name of the buyer and seller of shares; The number of shares being sold and the par value of those shares; The date and place of the transaction;

A stock purchase agreement typically includes the following information: Your business name. The name and mailing address of the entity buying shares in your company's stocks. The par value (essentially the sale price) of the stocks being sold. The number of stocks the buyer is purchasing.

This means that the Seller is entitled to the cash on the balance sheet on the closing date of the transaction, and that the Seller is responsible for debts owed by the company (defined as Indebtedness).

A stock sale agreement, also called a share purchase agreement, is used to transfer the ownership of stock in a company from a seller to a buyer. Stock are units of ownership in a company that are divided among stockholders.