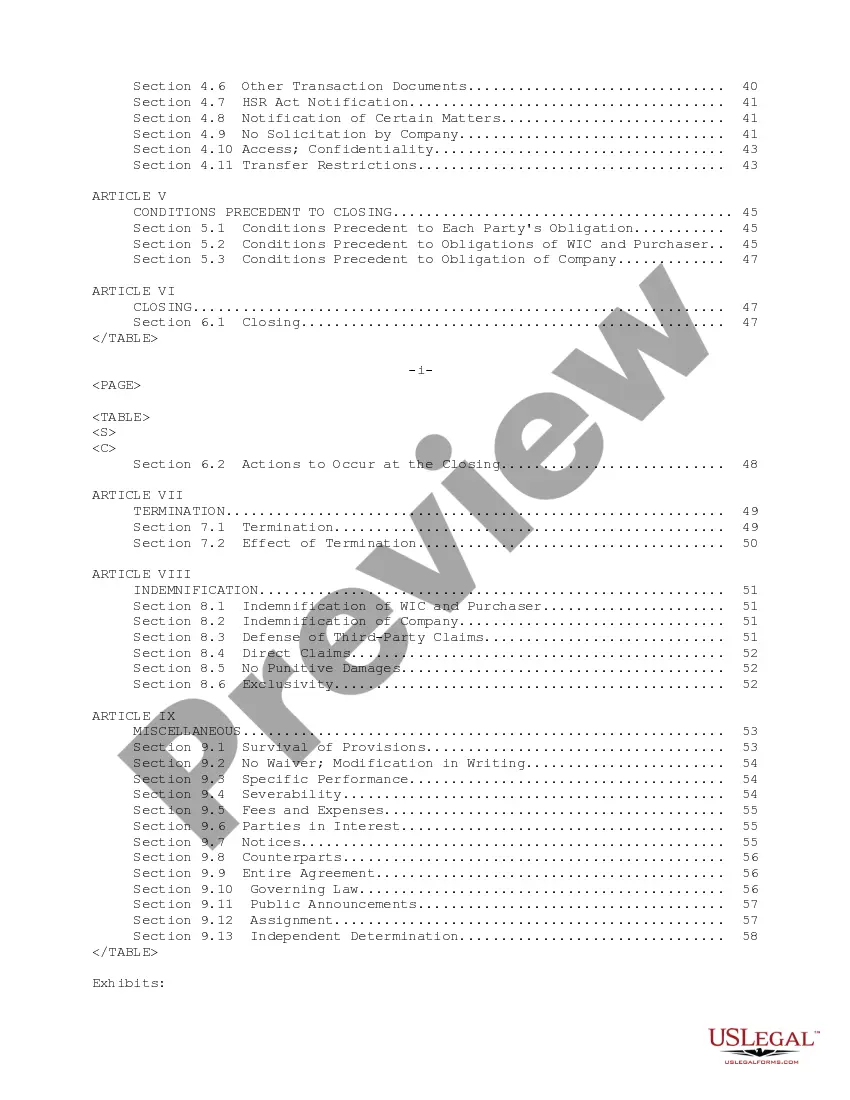

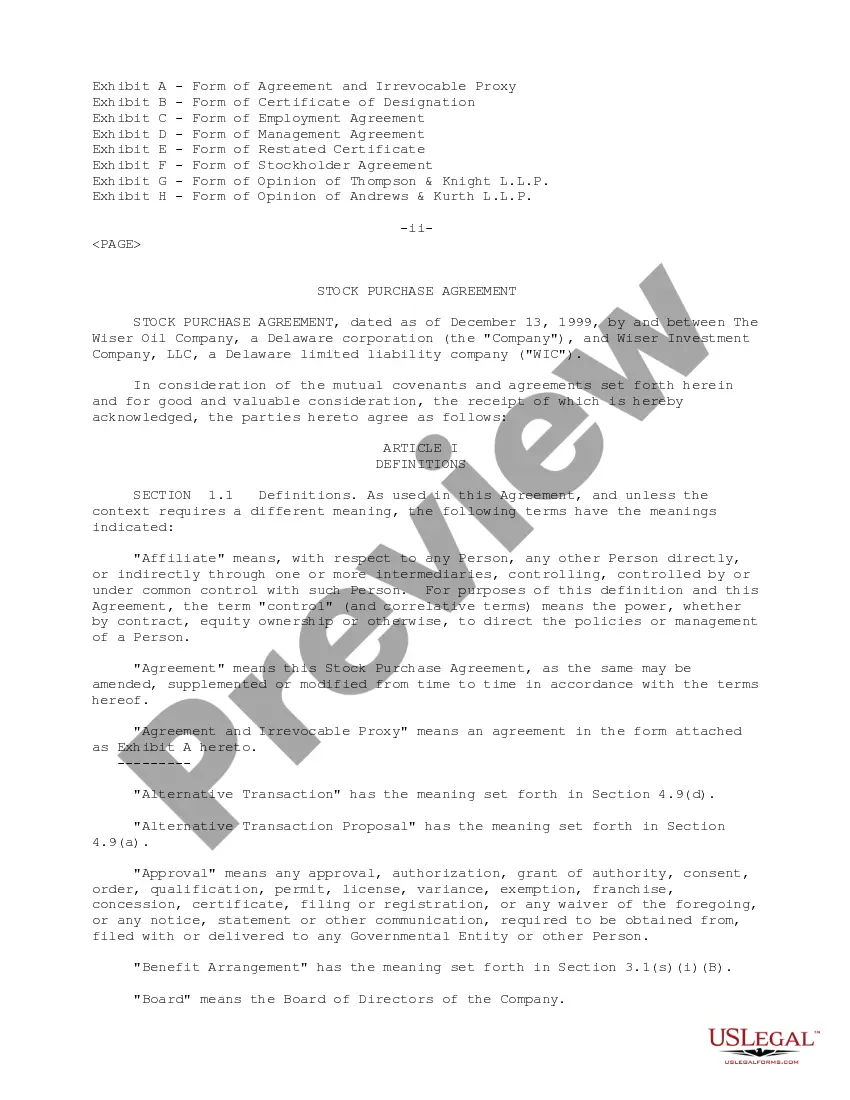

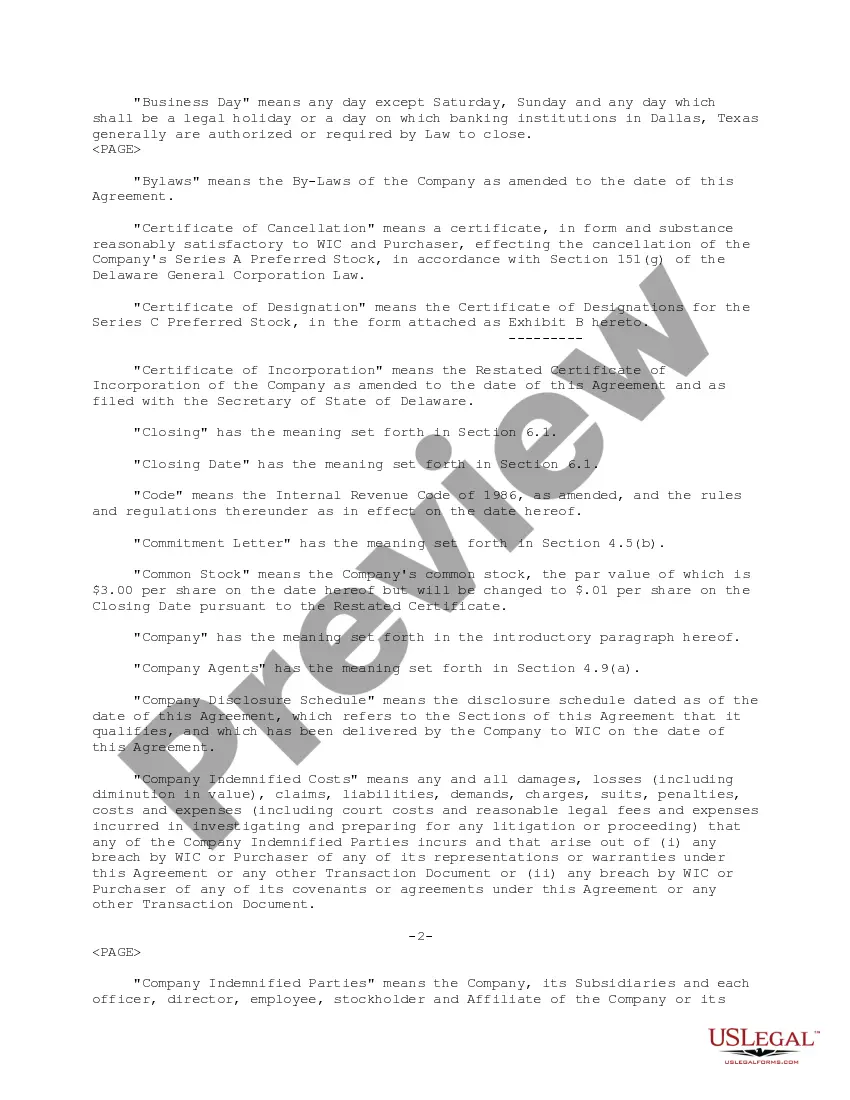

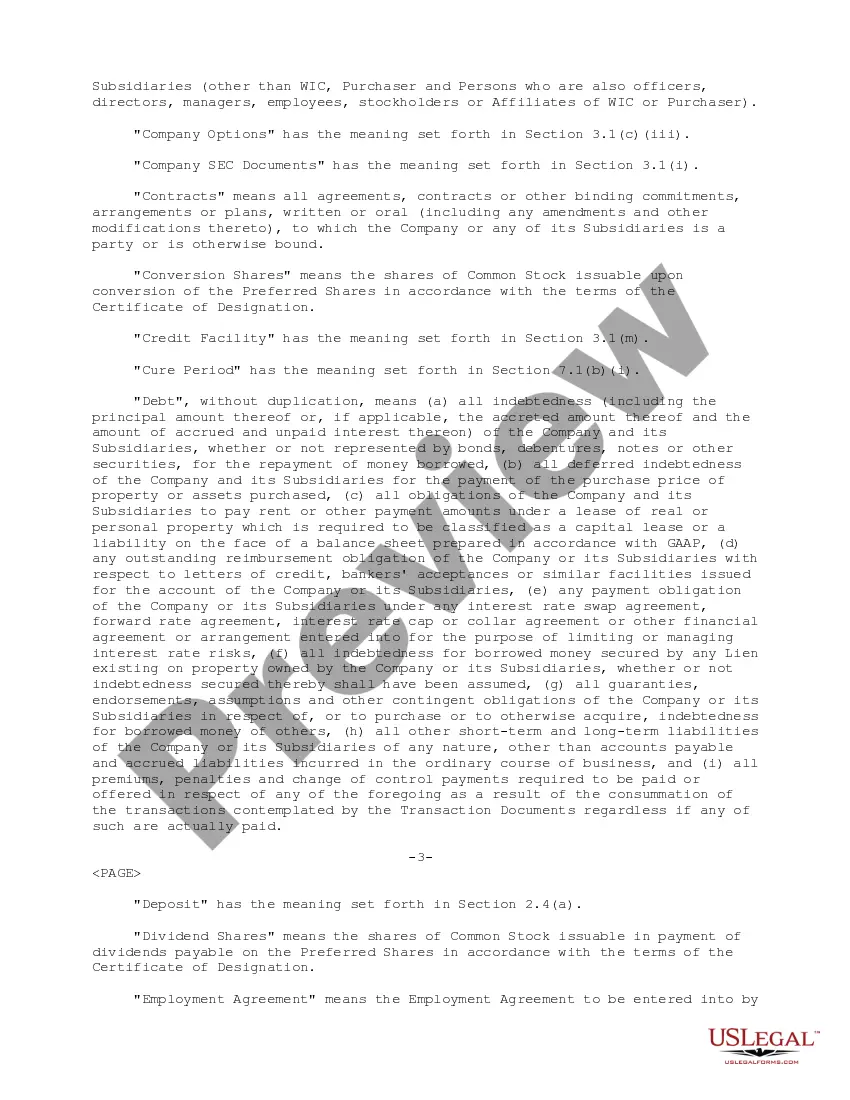

Indiana Sample Stock Purchase Agreement between The Wiser Oil and Wiser Investment Company

Description

How to fill out Sample Stock Purchase Agreement Between The Wiser Oil And Wiser Investment Company?

US Legal Forms - one of many largest libraries of legitimate varieties in the States - gives an array of legitimate file themes you can down load or produce. Using the web site, you can get thousands of varieties for company and individual functions, categorized by groups, claims, or keywords and phrases.You can get the most recent variations of varieties such as the Indiana Sample Stock Purchase Agreement between The Wiser Oil and Wiser Investment Company in seconds.

If you currently have a subscription, log in and down load Indiana Sample Stock Purchase Agreement between The Wiser Oil and Wiser Investment Company from your US Legal Forms collection. The Acquire option will show up on each and every form you look at. You have access to all in the past acquired varieties within the My Forms tab of your respective account.

If you want to use US Legal Forms initially, listed below are basic recommendations to help you get started off:

- Ensure you have picked out the best form for the city/area. Select the Review option to check the form`s articles. Look at the form information to ensure that you have chosen the correct form.

- When the form doesn`t satisfy your specifications, utilize the Look for field towards the top of the screen to obtain the one who does.

- In case you are pleased with the form, verify your choice by clicking the Buy now option. Then, opt for the costs plan you like and provide your credentials to register for the account.

- Procedure the financial transaction. Make use of your charge card or PayPal account to perform the financial transaction.

- Choose the formatting and down load the form on the system.

- Make changes. Complete, revise and produce and indication the acquired Indiana Sample Stock Purchase Agreement between The Wiser Oil and Wiser Investment Company.

Every design you included in your bank account does not have an expiration time which is the one you have for a long time. So, if you wish to down load or produce an additional copy, just go to the My Forms section and click on in the form you want.

Obtain access to the Indiana Sample Stock Purchase Agreement between The Wiser Oil and Wiser Investment Company with US Legal Forms, probably the most substantial collection of legitimate file themes. Use thousands of specialist and status-particular themes that meet up with your organization or individual requirements and specifications.