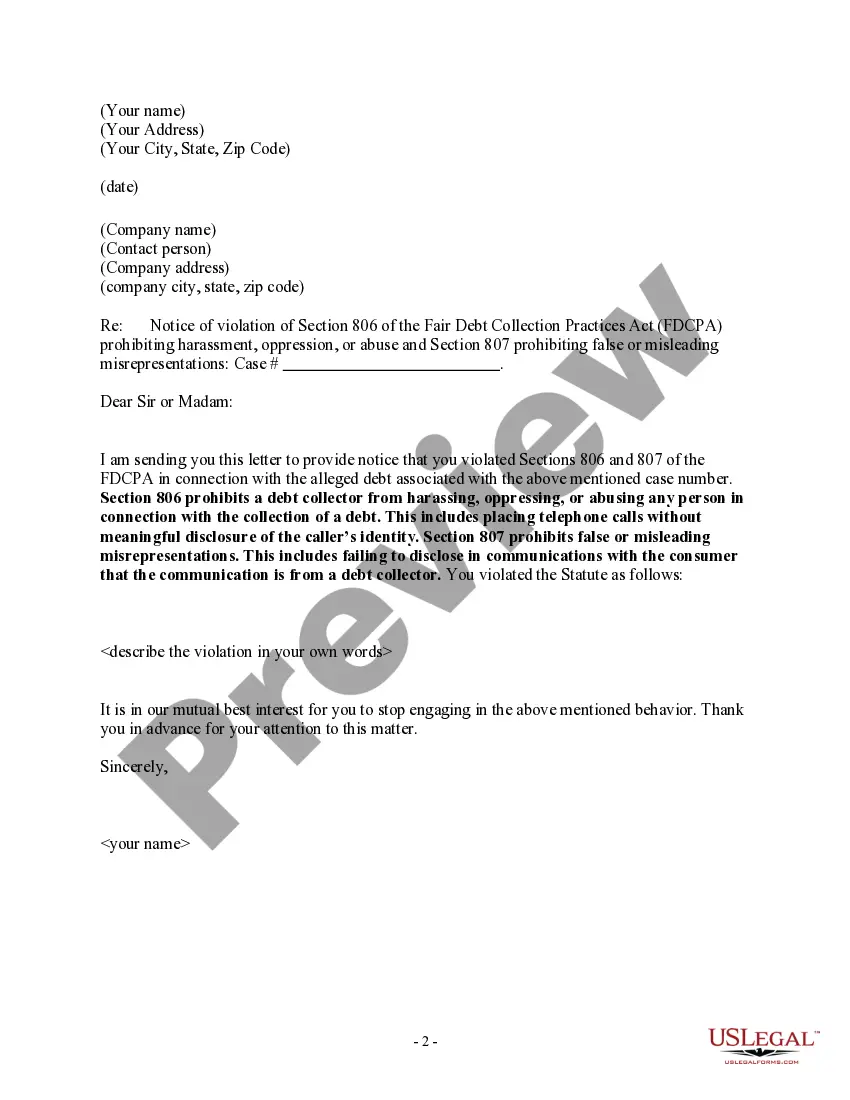

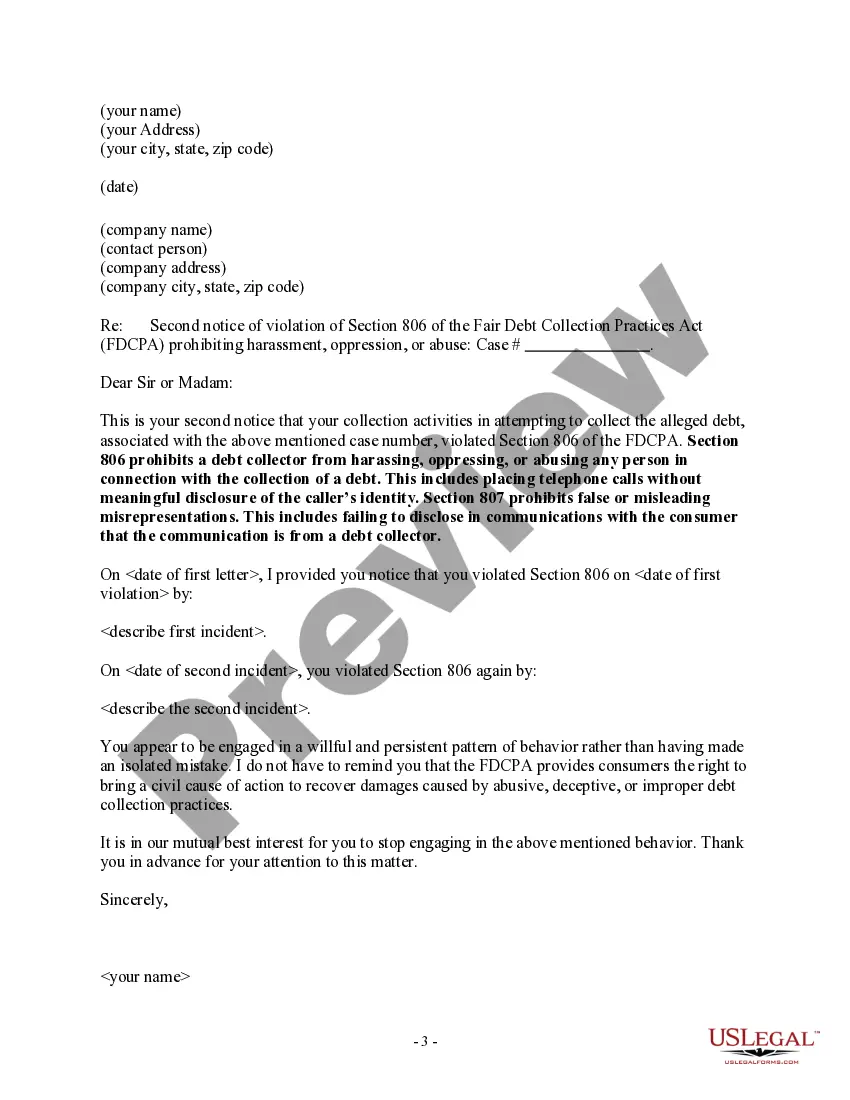

Section 806 of the Fair Debt Collection Practices Act says a debt collector may not harass, oppress, or abuse any person in connection with the collection of a debt. This includes placing telephone calls without meaningful disclosure of the caller's identity.

Indiana Notice to Debt Collector - Not Disclosing the Caller's Identity

Description

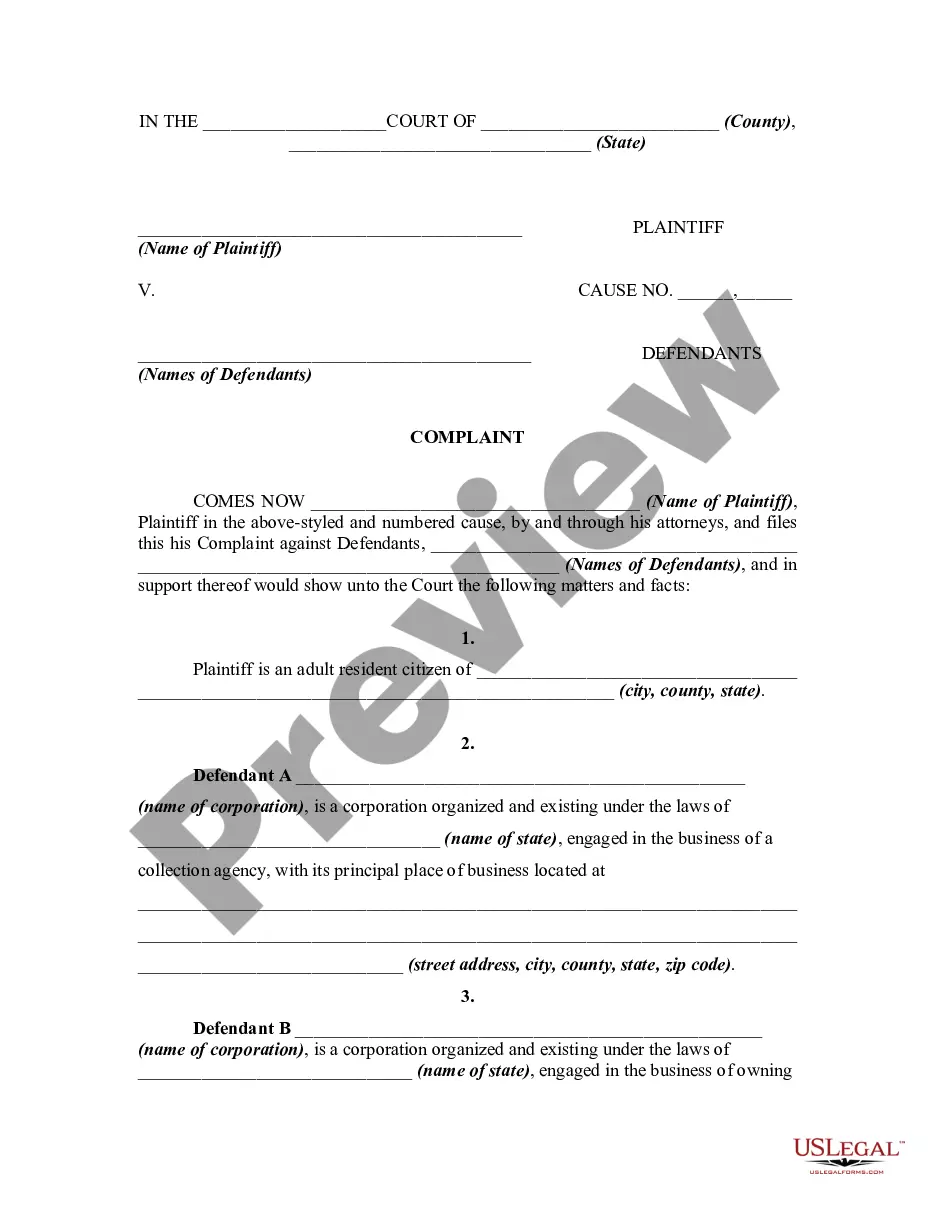

How to fill out Notice To Debt Collector - Not Disclosing The Caller's Identity?

You can spend multiple hours online trying to locate the authentic document template that meets the state and federal standards you require.

US Legal Forms offers a vast array of legal documents that have been reviewed by experts.

It's easy to obtain or print the Indiana Notice to Debt Collector - Not Disclosing the Caller's Identity from our service.

To find another version of the document, use the Search field to locate the template that suits your needs and requirements.

- If you already have a US Legal Forms account, you may Log In and then click the Download button.

- After that, you can fill out, edit, print, or sign the Indiana Notice to Debt Collector - Not Disclosing the Caller's Identity.

- Every legal document template you purchase is yours permanently.

- To obtain another copy of any purchased form, visit the My documents tab and click the relevant option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, make sure you have chosen the correct document template for the state/region of your choice.

- Check the form description to ensure you have selected the right document.

- If available, use the Preview option to view the document template as well.

Form popularity

FAQ

3 Things You Should NEVER Say To A Debt CollectorNever Give Them Your Personal Information. A call from a debt collection agency will include a series of questions.Never Admit That The Debt Is Yours. Even if the debt is yours, don't admit that to the debt collector.Never Provide Bank Account Information.

The Fair Debt Collection Practices Act (FDCPA) It is always your choice whether to provide any information to a debt collector, even a legitimate one, including whether to verify your identity.

Debt collectors often ask for Social Security numbers, birth dates or other personal information to ensure they have reached the correct debtor.

Be aware that collection agencies are forbidden from trying to collect a without first notifying you in writing or making a reasonable attempt to do so. Do not share financial and personal information if you are not certain you are dealing with a real collection agency.

For a debt collector to have the legal right to pull your credit report without your consent, you must owe the company a legitimate debt and it must stem from a voluntary credit transaction.

Do not give the caller personal financial or other sensitive information. Never give out or confirm personal financial or other sensitive information like your bank account, credit card, or Social Security number unless you know the company or person you are talking with is a real debt collector.

While these procedures may vary by company and whether the call is inbound or outbound, there is a common thread: generally debt collectors ask the consumer to verify some piece of personal information, such as the last four digits of the consumer's social security number or the consumer's birth date, to ensure they

Your personal information can never be disclosed to a third party as stated by the FDCPA. The only person to who your debt may be disclosed is your spouse. This means that debt collectors may not leave a voicemail message if it is shared with your employer, roommates, or even your children.

Here's some basic information you should write down anytime you speak with a debt collector: date and time of the phone call, the name of the collector you spoke to, name and address of collection agency, the amount you allegedly owe, the name of the original creditor, and everything discussed in the phone call.

9 Ways to Outsmart Debt CollectorsDon't Get Emotional.Make Sure the Debt Is Really Yours.Ask for Proof.Resist the Scare Tactics.Be Wary of Fees.Negotiate.Call In Backup.Know the Time Limits.More items...?