Indiana Proposed amendment to Article 4 of certificate of incorporation to authorize issuance of preferred stock with copy of amendment

Description

How to fill out Proposed Amendment To Article 4 Of Certificate Of Incorporation To Authorize Issuance Of Preferred Stock With Copy Of Amendment?

Are you in a position where you require paperwork for possibly enterprise or personal reasons just about every working day? There are plenty of authorized papers templates available on the net, but discovering kinds you can rely on isn`t simple. US Legal Forms delivers 1000s of form templates, much like the Indiana Proposed amendment to Article 4 of certificate of incorporation to authorize issuance of preferred stock with copy of amendment, which are written to meet state and federal requirements.

If you are presently knowledgeable about US Legal Forms website and also have a free account, just log in. Next, you are able to download the Indiana Proposed amendment to Article 4 of certificate of incorporation to authorize issuance of preferred stock with copy of amendment design.

Should you not provide an profile and would like to begin using US Legal Forms, abide by these steps:

- Discover the form you will need and ensure it is to the correct city/region.

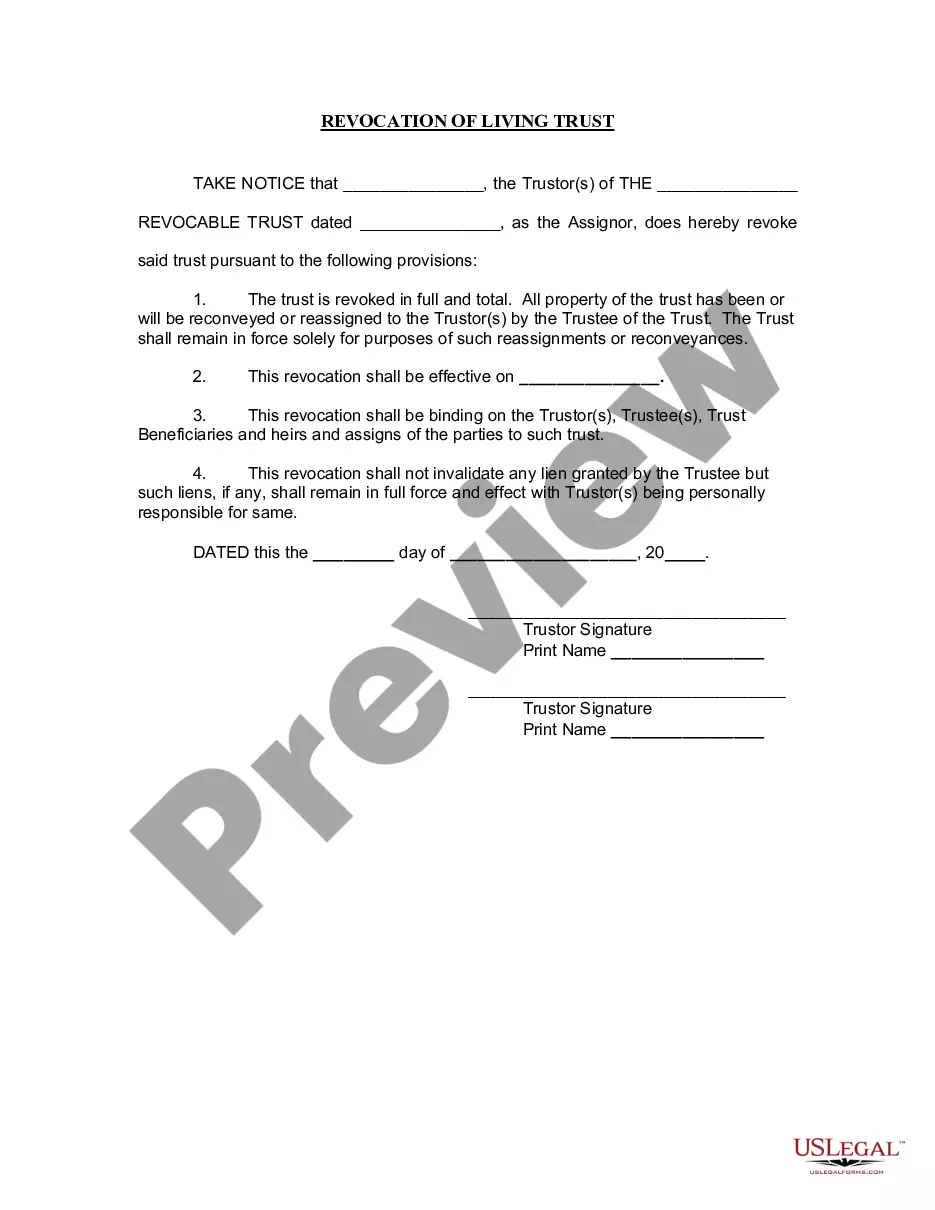

- Utilize the Review option to examine the shape.

- See the description to ensure that you have chosen the proper form.

- When the form isn`t what you`re looking for, make use of the Lookup area to get the form that fits your needs and requirements.

- Once you discover the correct form, click on Get now.

- Pick the rates program you would like, complete the desired details to generate your bank account, and purchase an order making use of your PayPal or bank card.

- Pick a convenient paper format and download your copy.

Get all the papers templates you may have bought in the My Forms menus. You may get a extra copy of Indiana Proposed amendment to Article 4 of certificate of incorporation to authorize issuance of preferred stock with copy of amendment at any time, if needed. Just go through the required form to download or print out the papers design.

Use US Legal Forms, the most extensive variety of authorized forms, in order to save some time and stay away from mistakes. The service delivers professionally produced authorized papers templates that you can use for a variety of reasons. Produce a free account on US Legal Forms and commence making your way of life easier.

Form popularity

FAQ

Indiana Code Section 23-0.5-2-13 requires LLCs to submit a biennial business entity report to the Secretary of State every other year. You can file online for a $31 fee or by mail for a $50 fee.

Business and Other Associations § 23-1-35-1. (3) in a manner the director reasonably believes to be in the best interests of the corporation. (3) a committee of the board of directors of which the director is not a member if the director reasonably believes the committee merits confidence.

Indiana Code § 23-0.5-3-1. Permitted Names; Falsely Implying Government Agency Status or Connection :: 2022 Indiana Code :: US Codes and Statutes :: US Law :: Justia.

Foreign Entity Registration in Indiana; Failure to Register.

(a) Whenever an injury or death, for which compensation is payable under chapters 2 through 6 of this article shall have been sustained under circumstances creating in some other person than the employer and not in the same employ a legal liability to pay damages in respect thereto, the injured employee, or the injured ...

To make amendments to your Indiana Articles of Incorporation, you provide Indiana form 38333, Articles of Amendment of the Articles of Incorporation to the Indiana Secretary of State (SOS). You can file the amendment online (see link below).

Per the Indiana theft laws contained in Indiana Code 35-43-4-2, when someone has knowingly received or is found in possession of stolen property that is valued at $750 or more, but less than $50,000, they may be charged with a Level 6 Felony.

How to Amend Articles of Incorporation Review the bylaws of the corporation. ... A board of directors meeting must be scheduled. ... Write the proposed changes. ... Confirm that the board meeting has enough members attending to have a quorum so the amendment can be voted on. Propose the amendment during the board meeting.