Indiana Proposal to approve adoption of stock purchase assistance plan

Description

How to fill out Proposal To Approve Adoption Of Stock Purchase Assistance Plan?

If you need to complete, obtain, or produce lawful file themes, use US Legal Forms, the greatest variety of lawful kinds, which can be found on the web. Utilize the site`s basic and handy lookup to get the documents you need. Different themes for business and person functions are categorized by types and says, or keywords and phrases. Use US Legal Forms to get the Indiana Proposal to approve adoption of stock purchase assistance plan in just a number of clicks.

If you are previously a US Legal Forms consumer, log in to the profile and then click the Down load option to have the Indiana Proposal to approve adoption of stock purchase assistance plan. You can even accessibility kinds you formerly acquired from the My Forms tab of the profile.

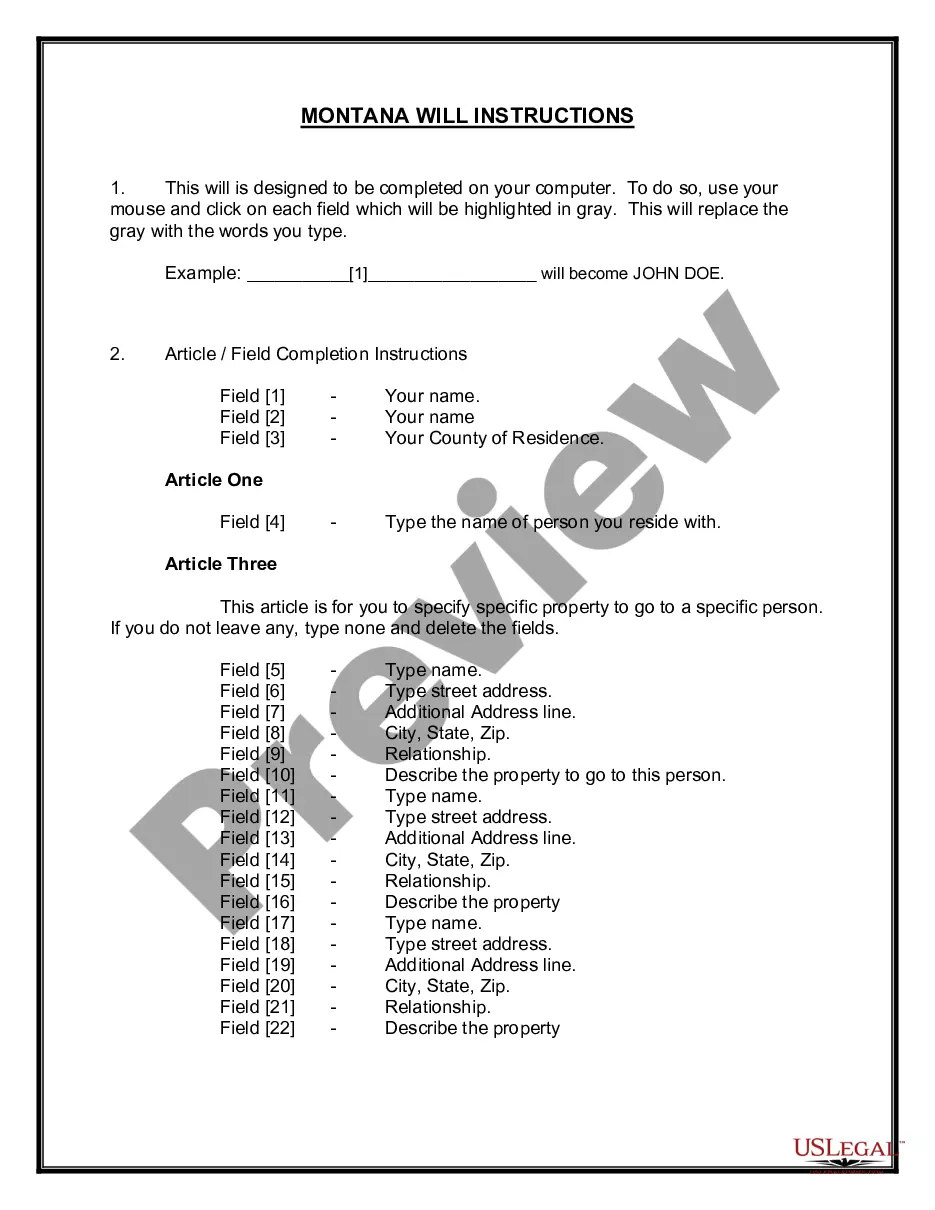

If you use US Legal Forms initially, follow the instructions listed below:

- Step 1. Make sure you have chosen the shape for your proper town/region.

- Step 2. Take advantage of the Review solution to check out the form`s content. Don`t forget to read through the explanation.

- Step 3. If you are not satisfied with the kind, utilize the Look for discipline towards the top of the monitor to discover other versions of the lawful kind web template.

- Step 4. When you have discovered the shape you need, click the Get now option. Opt for the pricing plan you like and put your references to register to have an profile.

- Step 5. Process the financial transaction. You should use your charge card or PayPal profile to complete the financial transaction.

- Step 6. Choose the structure of the lawful kind and obtain it on the gadget.

- Step 7. Complete, revise and produce or indication the Indiana Proposal to approve adoption of stock purchase assistance plan.

Each and every lawful file web template you acquire is your own property eternally. You possess acces to every kind you acquired in your acccount. Go through the My Forms area and choose a kind to produce or obtain yet again.

Compete and obtain, and produce the Indiana Proposal to approve adoption of stock purchase assistance plan with US Legal Forms. There are thousands of skilled and express-distinct kinds you can utilize to your business or person requirements.

Form popularity

FAQ

There are four basic types of adoption: public agency, domestic private agency, international, and independent. Requirements, costs, and timing will vary between and within these different types.

To be eligible for reimbursement of up to $1,500 per child, parents must complete an Indiana Adoption Program application, be determined eligible for special needs, and enter into an agreement for payment of nonrecurring adoption expenses prior to the finalization of the adoption. 12.

The Title IVE Adoption Assistance Program (also referred to as IVE-AAP or AAP) provides financial assistance for the benefit of eligible special needs adoptive children. In effect in Indiana since October 1, 1982, this federal program provides monthly payments and/or Medicaid for eligible adoptive children.

4. What is the maximum basic monthly adoption assistance maintenance payment in Indiana? Ages 0-4Ages 5-13Foster Care with Services$31.72/day$33.71/dayTherapeutic Foster Care$43.86/day$45.85/dayTherapeutic Plus$67.61/day$69.60/dayNon-Ward baby$23.95/day$23.95/day1 more row

While there are no adoption agencies that pay you in Indiana, your adoption- and pregnancy-related expenses will be taken care of at no cost to you. The type of adoption financial assistance in Indiana that you may receive can include: Attorney fees.

The Indiana Adoption Program includes an adoption manager and 19 adoption consultants serving Indiana's 92 counties. The adoption consultants assist in the adoptive placement of waiting children by working collaboratively with families, case managers and service providers.

If a child is eligible, you may receive a monthly payment and Medicaid for the child after adoption. The child's Family Case Manager will provide the application to you at the appropriate time. Your attorney can assist you with the application process.