Indiana Plan of Acquisition

Description

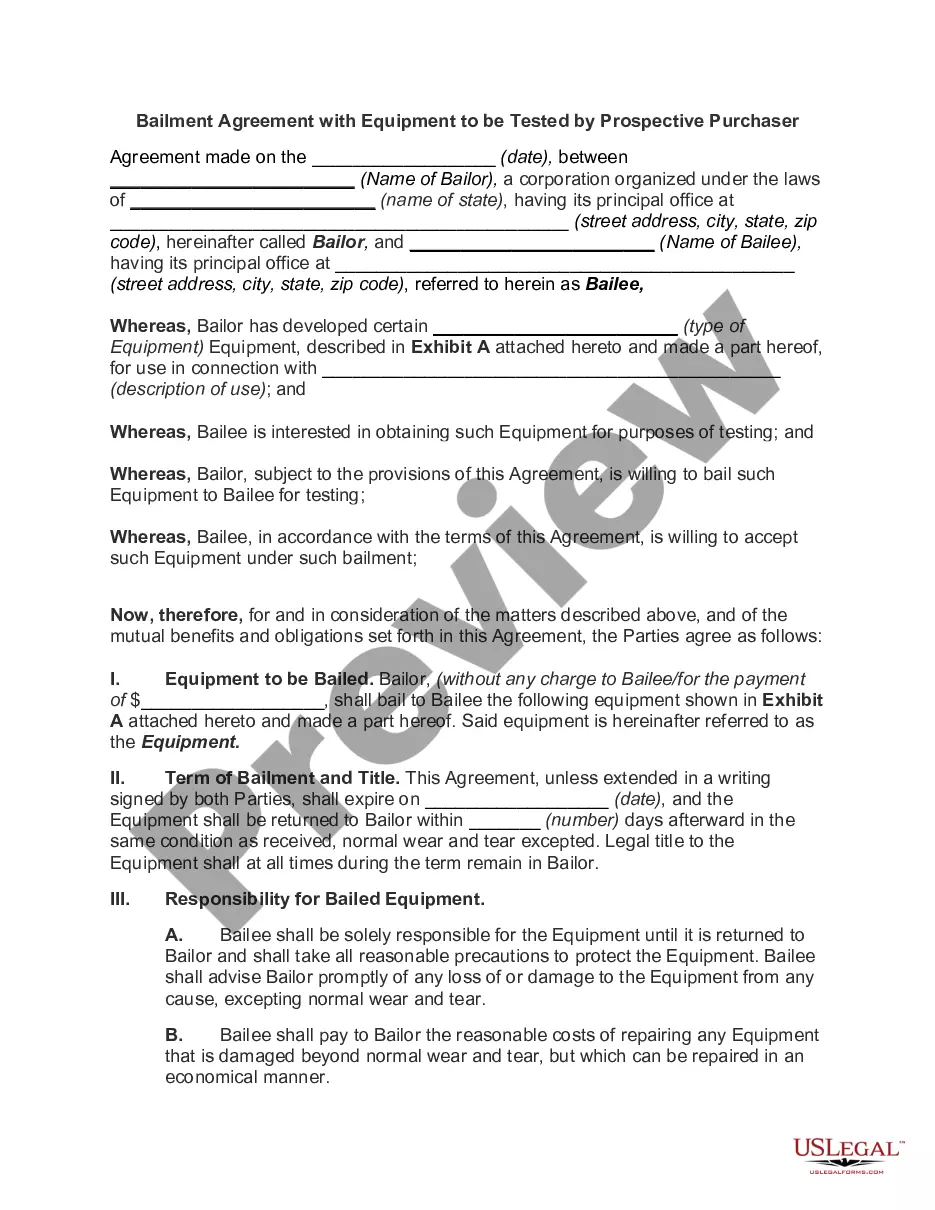

How to fill out Plan Of Acquisition?

Are you inside a place in which you will need documents for sometimes company or person reasons almost every working day? There are a lot of authorized document layouts available online, but discovering versions you can depend on isn`t straightforward. US Legal Forms provides 1000s of develop layouts, like the Indiana Plan of Acquisition, that happen to be published in order to meet federal and state demands.

In case you are previously familiar with US Legal Forms internet site and also have a merchant account, just log in. After that, it is possible to down load the Indiana Plan of Acquisition format.

Unless you provide an profile and want to begin using US Legal Forms, abide by these steps:

- Obtain the develop you will need and ensure it is to the proper town/county.

- Make use of the Preview option to analyze the form.

- Browse the explanation to actually have selected the appropriate develop.

- In the event the develop isn`t what you are looking for, take advantage of the Lookup area to get the develop that suits you and demands.

- When you discover the proper develop, simply click Get now.

- Opt for the costs strategy you need, submit the necessary info to produce your account, and buy your order with your PayPal or Visa or Mastercard.

- Choose a hassle-free document formatting and down load your duplicate.

Locate all of the document layouts you may have purchased in the My Forms food list. You may get a more duplicate of Indiana Plan of Acquisition whenever, if necessary. Just select the essential develop to down load or printing the document format.

Use US Legal Forms, by far the most comprehensive variety of authorized forms, to save lots of time and avoid errors. The services provides expertly produced authorized document layouts that you can use for a variety of reasons. Create a merchant account on US Legal Forms and begin producing your way of life a little easier.

Form popularity

FAQ

(3-digit code: 137) ? Interest earned from a direct obligation of a state or political subdivision other than Indiana (out of state, or OOS) is taxable by Indiana if the obligation is acquired after Dec.

For 2021 and 2022, Taxpayer will claim the otherwise allowable depreciation but will have zero apportionment, effectively disallowing the deduction. For 2023, $115,200 will be permitted as a depreciation deduction, and for 2024 $57,600 will be permitted as a depreciation deduction for the last year.

The Indiana PTE tax rate is equal to the state's individual income tax rate in effect for the taxable year. That rate currently stands at 3.23% for taxable years beginning after Dec. 31, 2016, and before Jan. 1, 2023.

Taxpayers are eligible for a $1,500 tax exemption per year for each dependent child. However, under HB 1001, enacted on , and effective retroactive to January 1, 2023, taxpayers who claim a dependent child for the first time may claim a higher one-time $3,000 exemption for the calendar year.

Tax Add-Back If you claimed a deduction on a Schedule C, C-EZ, E, or F for taxes paid based on, or measured by income and levied at a state level by any state in the U.S., you must add this deduction back to your Indiana return. DO NOT INCLUDE PROPERTY TAXES ON THIS LINE.

Tax Add-Back (3-digit code 100) ? Add back all state taxes based on or measured by income, levied by any state, which were deducted on the federal tax return.

A new add-back (149) is available for the addback of certain meal expenses and for which a deduction is allowable in determining federal adjusted gross income. See page 14 for more information.

Some customers are exempt from paying sales tax under Indiana law. Examples include government agencies, some nonprofit organizations, and merchants purchasing goods for resale. Sellers are required to collect a valid exemption or resale certificate from buyers to validate each exempt transaction.