Indiana Proposal to amend stock purchase plan

Description

How to fill out Proposal To Amend Stock Purchase Plan?

Are you in the situation the place you require papers for both company or personal functions nearly every day? There are plenty of legal record themes available on the Internet, but finding kinds you can depend on is not straightforward. US Legal Forms offers thousands of kind themes, much like the Indiana Proposal to amend stock purchase plan, which are written to meet federal and state specifications.

In case you are already acquainted with US Legal Forms website and have a merchant account, basically log in. After that, it is possible to acquire the Indiana Proposal to amend stock purchase plan template.

Unless you provide an accounts and want to begin to use US Legal Forms, adopt these measures:

- Find the kind you want and ensure it is to the proper town/area.

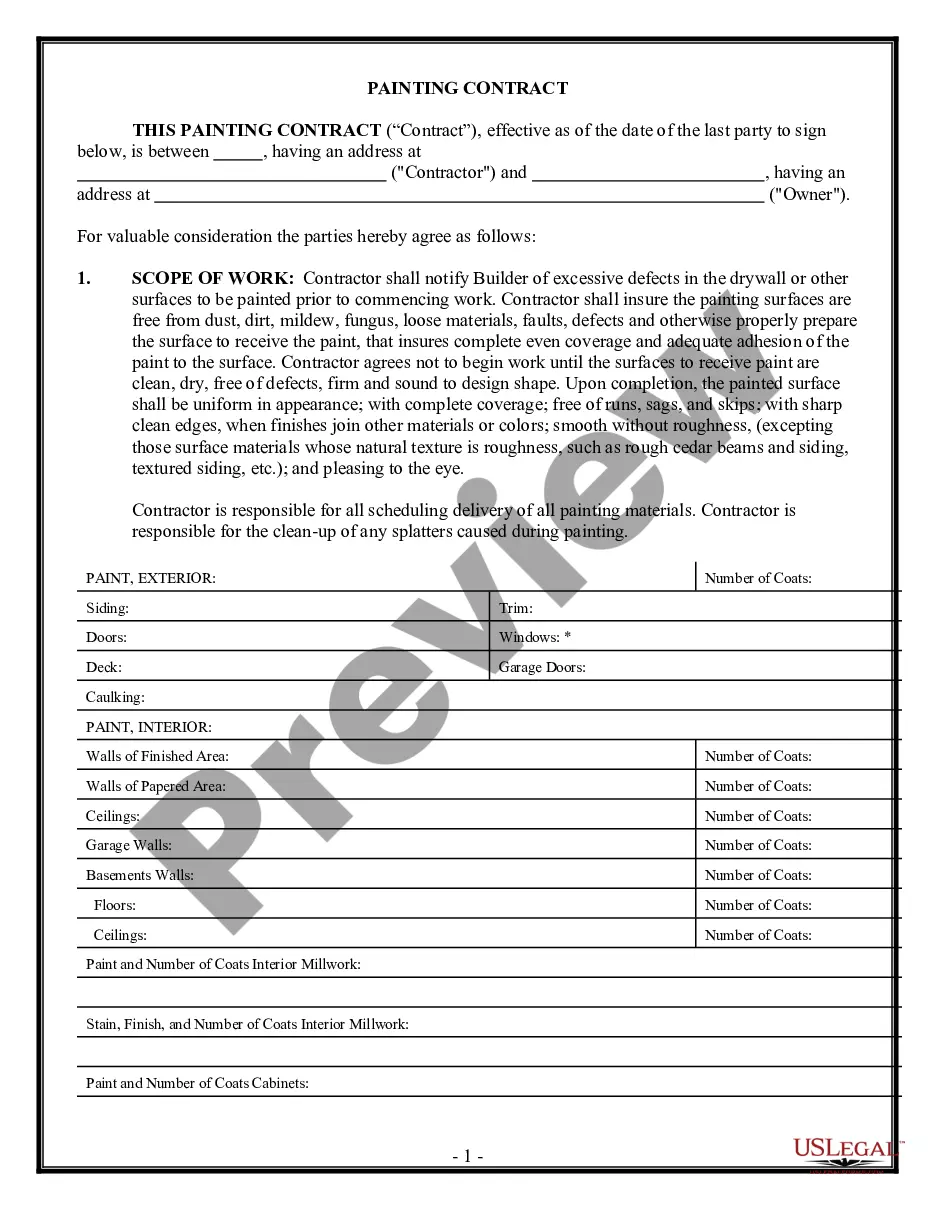

- Utilize the Review switch to examine the form.

- Look at the explanation to ensure that you have selected the appropriate kind.

- When the kind is not what you`re looking for, utilize the Look for industry to obtain the kind that fits your needs and specifications.

- If you discover the proper kind, click on Buy now.

- Pick the prices plan you would like, submit the desired details to generate your money, and pay money for an order using your PayPal or bank card.

- Choose a practical paper structure and acquire your backup.

Get all of the record themes you might have bought in the My Forms food list. You can aquire a more backup of Indiana Proposal to amend stock purchase plan anytime, if necessary. Just click on the essential kind to acquire or print the record template.

Use US Legal Forms, by far the most extensive collection of legal varieties, in order to save efforts and steer clear of faults. The services offers professionally made legal record themes that can be used for a variety of functions. Produce a merchant account on US Legal Forms and initiate creating your lifestyle a little easier.

Form popularity

FAQ

Indiana Code § 23-0.5-3-1. Permitted Names; Falsely Implying Government Agency Status or Connection :: 2022 Indiana Code :: US Codes and Statutes :: US Law :: Justia.

A director's consent may be withdrawn by a revocation signed by the director and delivered to the corporation before the delivery to the corporation of unrevoked written consents signed by all the directors.

Sec. 1. The right-of-way, air, light, or other easement from, in, upon, or over land owned by a person may not be acquired by another person by adverse use unless the use is uninterrupted for at least twenty (20) years.

2.28 ?Section 423 Component? means those Offerings under the Plan, together with the sub-plans, appendices, rules or procedures, if any, adopted by the Administrator as a part of this Plan, in each case, pursuant to which rights to purchase Shares during an Offering Period may be granted to Eligible Employees that are ...

A credit restricted felon is anyone who is: (1) at least 21 years old and has been convicted of child molesting involving sexual intercourse or deviate sexual conduct involving a child under 12; (2) convicted of child molest resulting in serious bodily injury or death; or.

What is a qualified section 423 Plan? A. A qualified 423 employee stock purchase plan allows employees under U.S. tax law to purchase stock at a discount from fair market value without any taxes owed on the discount at the time of purchase.

Under a § 423 employee stock purchase plan, you have taxable income or a deductible loss when you sell the stock. Your income or loss is the difference between the amount you paid for the stock (the purchase price) and the amount you receive when you sell it.

An employee stock purchase plan (ESPP) is a company-run program in which participating employees can purchase company stock directly, at a discounted price. Employees contribute to the plan through payroll deductions which build up between the offering date and the purchase date.

Foreign Entity Registration in Indiana; Failure to Register.

The ESOP vs 401K Plan With a 401(k), the employer's contributions are tax-deferred, meaning that the money is taken out of each paycheck before taxes, and those wages are not taxed until withdrawal. Whereas with an ESOP, employees also do not pay taxes on the shares in their account until distribution.