Indiana Proposal to approve restricted stock plan

Description

How to fill out Proposal To Approve Restricted Stock Plan?

If you wish to complete, down load, or print legitimate file web templates, use US Legal Forms, the largest assortment of legitimate forms, that can be found on-line. Make use of the site`s easy and convenient research to find the papers you will need. Numerous web templates for organization and individual functions are categorized by groups and claims, or keywords. Use US Legal Forms to find the Indiana Proposal to approve restricted stock plan in just a number of mouse clicks.

In case you are presently a US Legal Forms consumer, log in to your account and then click the Obtain key to find the Indiana Proposal to approve restricted stock plan. You may also gain access to forms you in the past delivered electronically in the My Forms tab of your respective account.

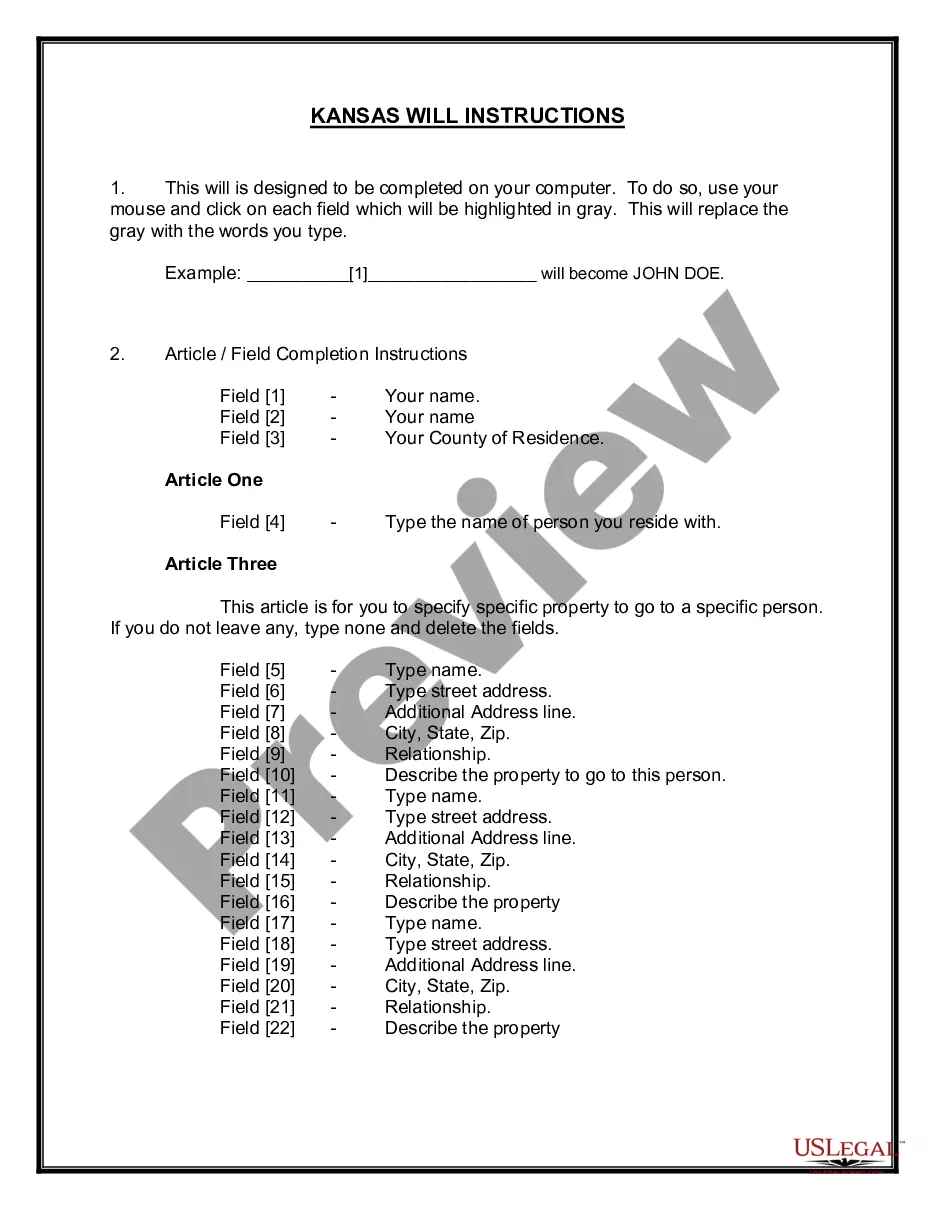

If you use US Legal Forms the very first time, follow the instructions beneath:

- Step 1. Ensure you have selected the form for that proper metropolis/country.

- Step 2. Use the Preview choice to look over the form`s content material. Never overlook to learn the explanation.

- Step 3. In case you are unsatisfied together with the form, make use of the Look for discipline at the top of the monitor to find other versions from the legitimate form format.

- Step 4. Once you have located the form you will need, select the Get now key. Select the prices plan you choose and put your credentials to register on an account.

- Step 5. Procedure the deal. You can use your credit card or PayPal account to finish the deal.

- Step 6. Pick the structure from the legitimate form and down load it in your system.

- Step 7. Complete, modify and print or sign the Indiana Proposal to approve restricted stock plan.

Each and every legitimate file format you buy is the one you have permanently. You have acces to each form you delivered electronically inside your acccount. Click on the My Forms segment and pick a form to print or down load yet again.

Contend and down load, and print the Indiana Proposal to approve restricted stock plan with US Legal Forms. There are thousands of skilled and express-specific forms you can use for your organization or individual requirements.

Form popularity

FAQ

Once they are vested, RSUs can be sold or kept like any other shares of company stock. Unlike stock options or warrants, RSUs always have some value based on the underlying shares. For tax purposes, the entire value of vested RSUs must be included as ordinary income in the year of vesting.

A Restricted Stock Award is a grant of company stock in which the recipient's rights in the stock are restricted until the shares vest (or lapse in restrictions). The restricted period is called a vesting period. Vesting periods can be met by the passage of time, or by company or individual performance.

You may not sell, assign, pledge, encumber, or otherwise transfer any interest in the Restricted Shares until the dates set forth in the Vesting Schedule set forth below, at which point the Restricted Shares will be referred to as ?Vested.? A Restricted Share shall not be subject to execution, attachment or similar ...

Restricted stock units are a form of stock-based employee compensation. RSUs are restricted during a vesting period that may last several years, during which time they cannot be sold. Once they are vested, RSUs can be sold or kept like any other shares of company stock.

Holding period begins at vesting date, when the compensation element of restricted stock is included in income. Holding period begins at grant date, when the compensation element of restricted stock is included in income.

This means that the employee cannot sell or transfer the units until they are vested. However, once the RSUs vest and the employee has shares of company stock, the shares can be treated like any other stock and are available to sell or transfer as the employee wishes.

If you sell RSUs at a loss either 30 days before the sale or 30 days after the sale, you're going to trigger what is called a Wash Sale. Wash sales remove your ability to realize losses and instead add the loss you would have taken to the basis of the shares you purchased.

Typically, your plan withholds some units to cover the estimated tax liability, and then deposits the balance into your account as company stock. If you sell these shares immediately (with no gain or loss since they vested), you'll incur no additional tax impact from the sale.