Indiana Profit Sharing Plan

Description

How to fill out Profit Sharing Plan?

US Legal Forms - one of many most significant libraries of lawful kinds in the USA - delivers a wide array of lawful record themes you can down load or print out. Using the website, you will get thousands of kinds for organization and personal functions, sorted by groups, states, or keywords.You can find the most recent types of kinds just like the Indiana Profit Sharing Plan within minutes.

If you already have a registration, log in and down load Indiana Profit Sharing Plan from your US Legal Forms local library. The Acquire key will appear on every single kind you see. You have accessibility to all in the past downloaded kinds in the My Forms tab of your bank account.

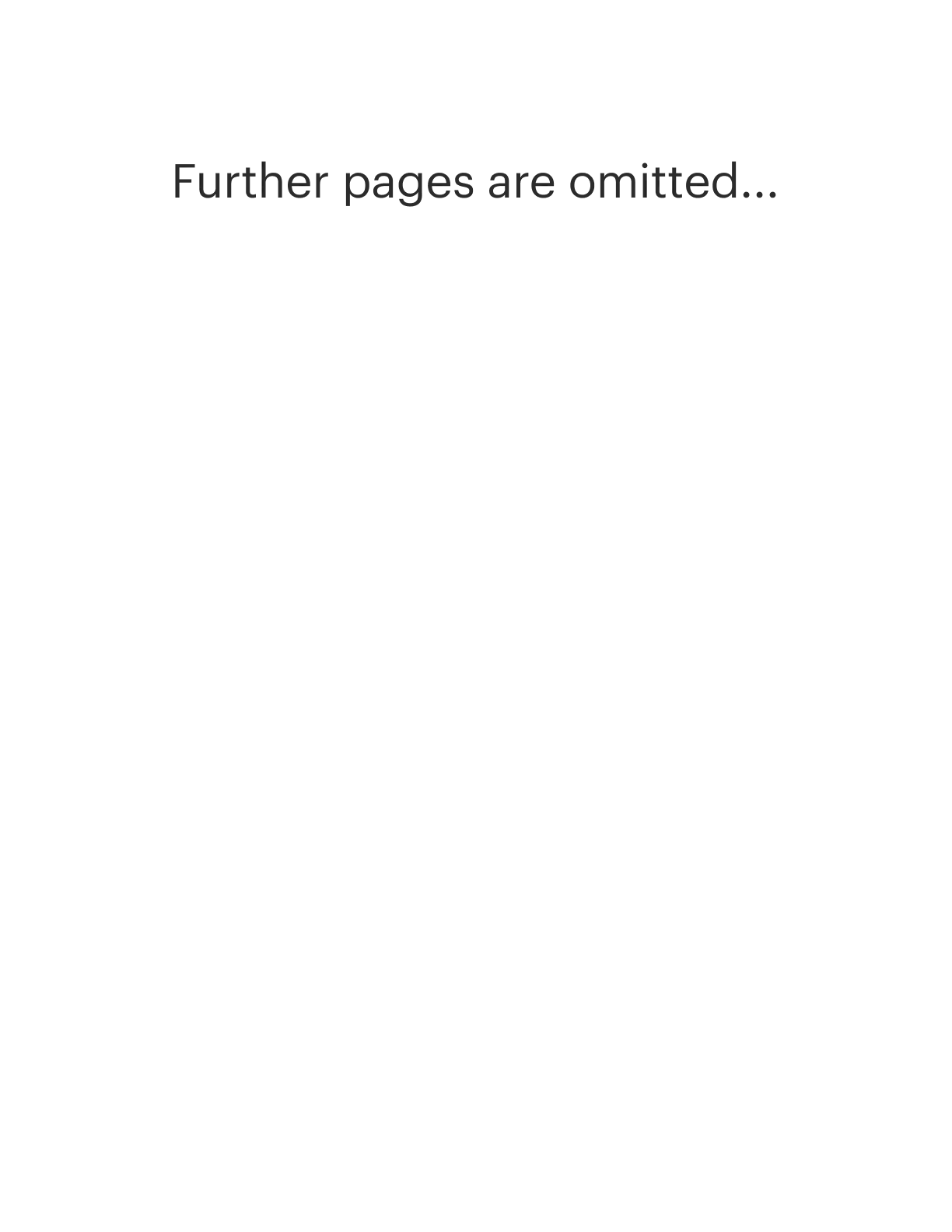

If you want to use US Legal Forms initially, allow me to share simple instructions to help you get started off:

- Be sure to have picked the right kind for your personal metropolis/county. Select the Preview key to analyze the form`s articles. Look at the kind explanation to actually have selected the correct kind.

- In case the kind doesn`t match your needs, utilize the Research area towards the top of the display to obtain the the one that does.

- When you are content with the shape, verify your choice by simply clicking the Purchase now key. Then, opt for the rates strategy you like and provide your accreditations to sign up to have an bank account.

- Procedure the deal. Make use of Visa or Mastercard or PayPal bank account to complete the deal.

- Pick the structure and down load the shape on your own product.

- Make alterations. Load, edit and print out and indicator the downloaded Indiana Profit Sharing Plan.

Each web template you included with your money lacks an expiry date and is also the one you have eternally. So, if you would like down load or print out another backup, just visit the My Forms area and click on on the kind you want.

Obtain access to the Indiana Profit Sharing Plan with US Legal Forms, one of the most extensive local library of lawful record themes. Use thousands of skilled and express-certain themes that meet up with your organization or personal requirements and needs.

Form popularity

FAQ

There are three basic types of profit sharing plans: traditional, age-weighted and new comparability.

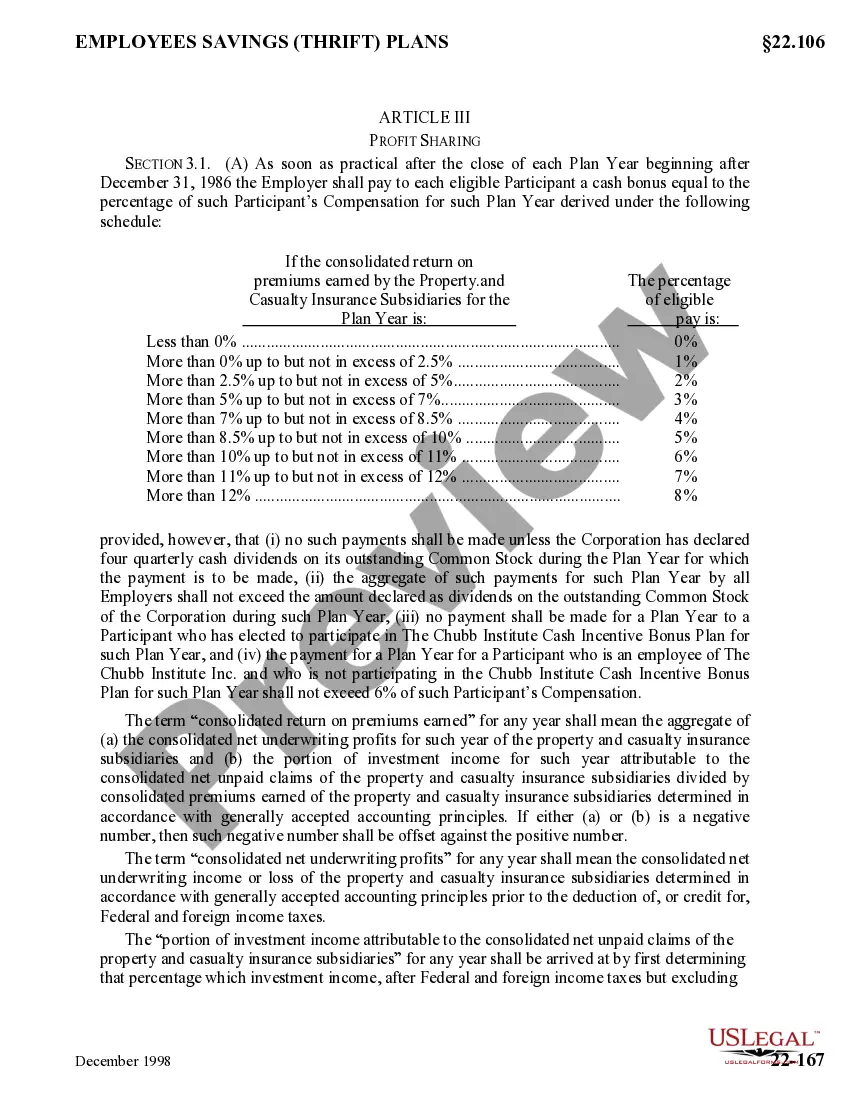

Limitations to profit sharing plans Employers can only deduct contributions to retirement plans of up to 25% of total employee compensation. Total contributions for each employee (including employer contributions and employee deferrals) may not exceed 100% of the employee's compensation.

Profit Sharing Plan Eligibility Has one year of service. Has attained age 21. Works 1,000 hours or more during a plan year. Has not bargained in good faith for pension benefits.

If you, the employer, make contributions to a profit sharing plan, you can deduct up to 25 percent of the compensation paid during the taxable year to all participants. Your contributions to the plan can either be fully vested (nonforfeitable) when made, or they can vest over time ing to a vesting schedule.

sharing plan accepts discretionary employer contributions. There is no set amount that the law requires you to contribute. If you can afford to make some amount of contributions to the plan for a particular year, you can do so. Other years, you do not need to make contributions.

Benefit at Retirement The PERF pension is a defined benefit plan. This means that the pension is calculated by using a formula set by law. Normally participants are eligible for full retirement benefits at age 65 with 10 or more years of service in a PERF plan.

sharing plan is a great way for a business to give its employees a sense of ownership in the company, but there are typically restrictions as to when and how a person can withdraw these funds without penalties.

The TRF benefit consists of two parts: the monthly pension benefit and the Annuity Savings Account (ASA). The monthly pension benefit is determined by salary history, years of service, age, and the retirement option selected. TRF members become vested in the pension benefit after 10 years of qualified Indiana service.