Indiana Stock Option and Award Plan

Description

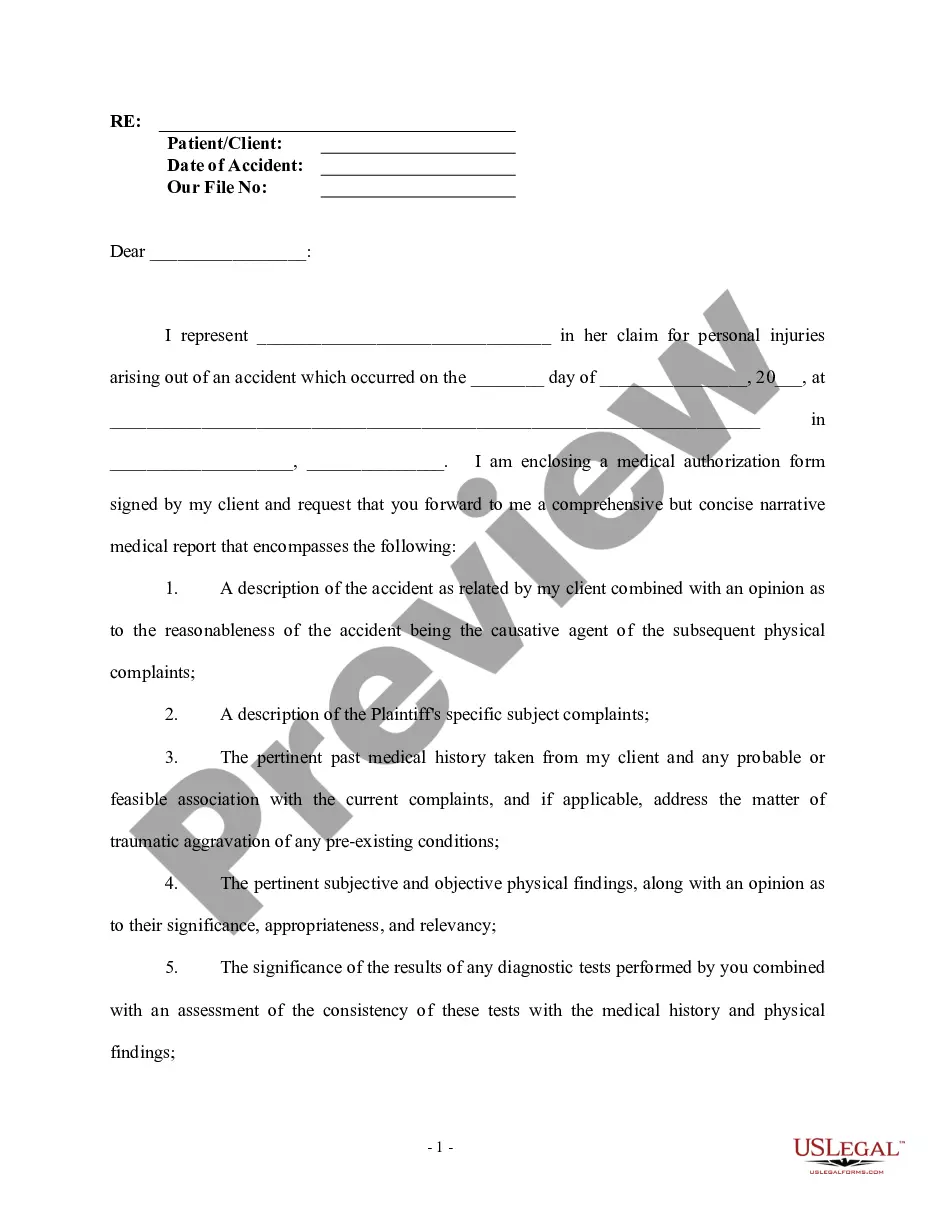

How to fill out Stock Option And Award Plan?

Are you currently in a situation where you require documents for either business or personal purposes almost every day.

There are numerous legal document templates available online, but finding reliable ones can be challenging.

US Legal Forms offers thousands of form templates, including the Indiana Stock Option and Award Plan, designed to meet state and federal requirements.

Select a convenient format and download your copy.

Access all the document templates you have purchased in the My documents menu. You can obtain another copy of the Indiana Stock Option and Award Plan anytime, if necessary. Just click on the desired form to download or print the document template. Use US Legal Forms, the largest collection of legal forms, to save time and avoid mistakes. The service provides professionally crafted legal document templates that can be utilized for various purposes. Create your account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and have your account, simply Log In.

- Then, you can download the Indiana Stock Option and Award Plan template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it corresponds to the correct city/state.

- Use the Review option to inspect the form.

- Read the description to make sure you've selected the right form.

- If the form isn't what you require, utilize the Search area to find the form that meets your needs and specifications.

- Once you have the appropriate form, click on Get now.

- Choose the payment plan you desire, fill in the required information to create your account, and pay for your order using your PayPal or credit card.

Form popularity

FAQ

The incentive stock option limitation for $100,000 refers to the maximum value of shares that can be granted as incentive stock options in a calendar year, specifically under the Indiana Stock Option and Award Plan. If options exceed this amount, they may be categorized differently for tax purposes. This limitation ensures that employees can enjoy tax benefits while adhering to federal regulations. It is important to consult with a legal or tax professional to navigate these rules effectively.

An award that gives you the ability to purchase shares of company stock at a specified price for a fixed period of time.

From the employee's standpoint, a stock option grant is an opportunity to purchase stock in the company for which they work. Typically, the grant price is set as the market price at the time the grant is offered.

With a stock award, you receive the company's stocks as compensation. Depending on the type of stock, you may have to wait for a certain period before you can fully own it. A stock option, on the other hand, only gives you the right to buy the company's stocks in the future at a certain price.

Exercising a stock option means purchasing the issuer's common stock at the price set by the option (grant price), regardless of the stock's price at the time you exercise the option.

Stock options are an employee benefit that grants employees the right to buy shares of the company at a set price after a certain period of time. Employees and employers agree ahead of time on how many shares they can purchase and how long the vesting period will be before they can buy the stock.

Stock options are usually granted for a specific period (option term) and must be exercised within that period. A common option term is 10 years, after which, the option expires. While time-based vesting remains popular, companies are increasingly granting equity that vests upon meeting certain performance criteria.

An employee stock option is the right given to you by your employer to buy ("exercise") a certain number of shares of company stock at a pre-set price (the "grant," "strike" or "exercise" price) over a certain period of time (the "exercise period").

An option grant is a right to acquire a set number of shares of stock of a company at a set price.

Share-option schemes A share option is the right to buy a certain number of shares at a fixed price, some period of time in the future, within a company. Employees can generally exercise their share options - ie buy the shares - after a specified period, known as the vesting period.