Indiana Employment Information Document with Insurance Information

Description

How to fill out Employment Information Document With Insurance Information?

If you wish to comprehensive, acquire, or printing lawful record web templates, use US Legal Forms, the largest assortment of lawful varieties, which can be found online. Make use of the site`s simple and convenient lookup to obtain the documents you want. A variety of web templates for business and personal reasons are sorted by categories and says, or search phrases. Use US Legal Forms to obtain the Indiana Employment Information Document with Insurance Information in a number of mouse clicks.

Should you be already a US Legal Forms consumer, log in in your accounts and then click the Obtain switch to get the Indiana Employment Information Document with Insurance Information. You can also entry varieties you in the past acquired inside the My Forms tab of your respective accounts.

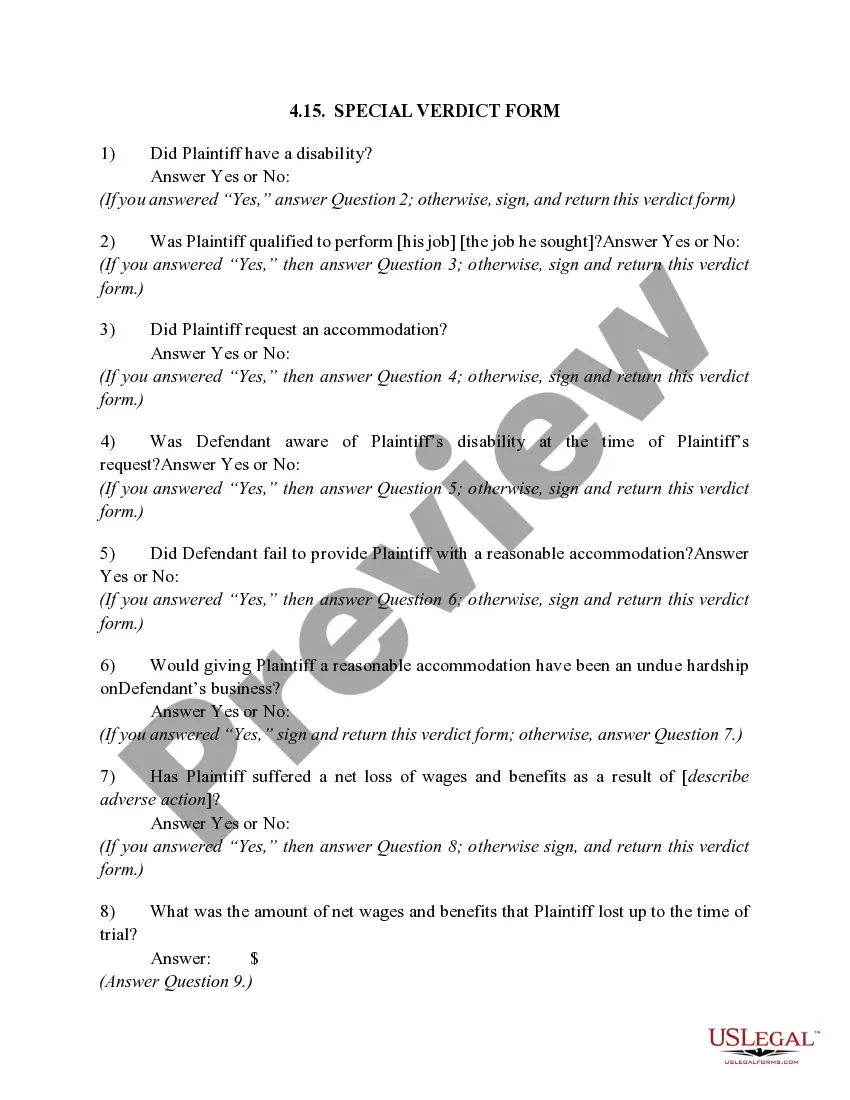

If you work with US Legal Forms the first time, refer to the instructions beneath:

- Step 1. Make sure you have selected the shape for that appropriate area/nation.

- Step 2. Take advantage of the Review option to examine the form`s content. Never forget to read through the outline.

- Step 3. Should you be unsatisfied using the type, make use of the Look for discipline towards the top of the display to get other types of your lawful type web template.

- Step 4. After you have identified the shape you want, click the Buy now switch. Opt for the pricing strategy you favor and add your qualifications to register for an accounts.

- Step 5. Method the transaction. You should use your Мisa or Ьastercard or PayPal accounts to finish the transaction.

- Step 6. Choose the structure of your lawful type and acquire it in your gadget.

- Step 7. Total, change and printing or signal the Indiana Employment Information Document with Insurance Information.

Every lawful record web template you buy is yours forever. You may have acces to every single type you acquired inside your acccount. Go through the My Forms section and pick a type to printing or acquire yet again.

Remain competitive and acquire, and printing the Indiana Employment Information Document with Insurance Information with US Legal Forms. There are thousands of professional and condition-certain varieties you may use for your business or personal demands.

Form popularity

FAQ

You must have earned at least a minimum amount in wages before you were unemployed. You must be unemployed through no fault of your own, as defined by Indiana law. You must be able and available to work, and you must be actively seeking employment.

The Indiana Department of Workforce Development (DWD) has announced that the unemployment quarterly contribution (Form UC-1) and wage (Form UC-5) reports must be filed electronically by all employers, beginning with the first quarter 2019 reports.

What is the Maximum Weekly Benefit Amount? The maximum weekly benefit amount is $390. This amount is set by Indiana law.

Proof of employment can include: paycheck stubs, 2022 earnings and leave statements showing the employer's name and address, and 2022 W-2 forms when available.

If your small business has employees working in Indiana, you'll need to pay Indiana unemployment insurance (UI) tax. The UI tax funds unemployment compensation programs for eligible employees. In Indiana, state UI tax is just one of several taxes that employers must pay.

If you need to get a 1099-G, go to . Type in your user name and password to log onto your account. Then click the View My 1099G icon under the Smartlinks section. Remember to drop off this 1099G when you drop off your tax information.

WorkOne provides free assistance to job seekers and employers. We are your one-stop for employment support. From resumes and job searches to unemployment assistance to helping find funding so you can get trained in new skills - no matter what, we are here for you.

Your unemployment compensation is taxable on both your federal and state tax returns.

The Indiana Department of Workforce Development (IDWD) will release wage or employment history information to a third party only via the Last Known Employer (LKE) website after submitting a completed copy of the attached release form. Please login to your LKE account to submit requests for employment history.

Unemployment Insurance is a collaborative federal-state program financed through mandatory employer payments into two separate trusts, one administered by the United States Department of Labor (USDOL) and one administered by the State Workforce Agency, which in Indiana, is the Department of Workforce Development (DWD).