Indiana Matching Gift Form

Description

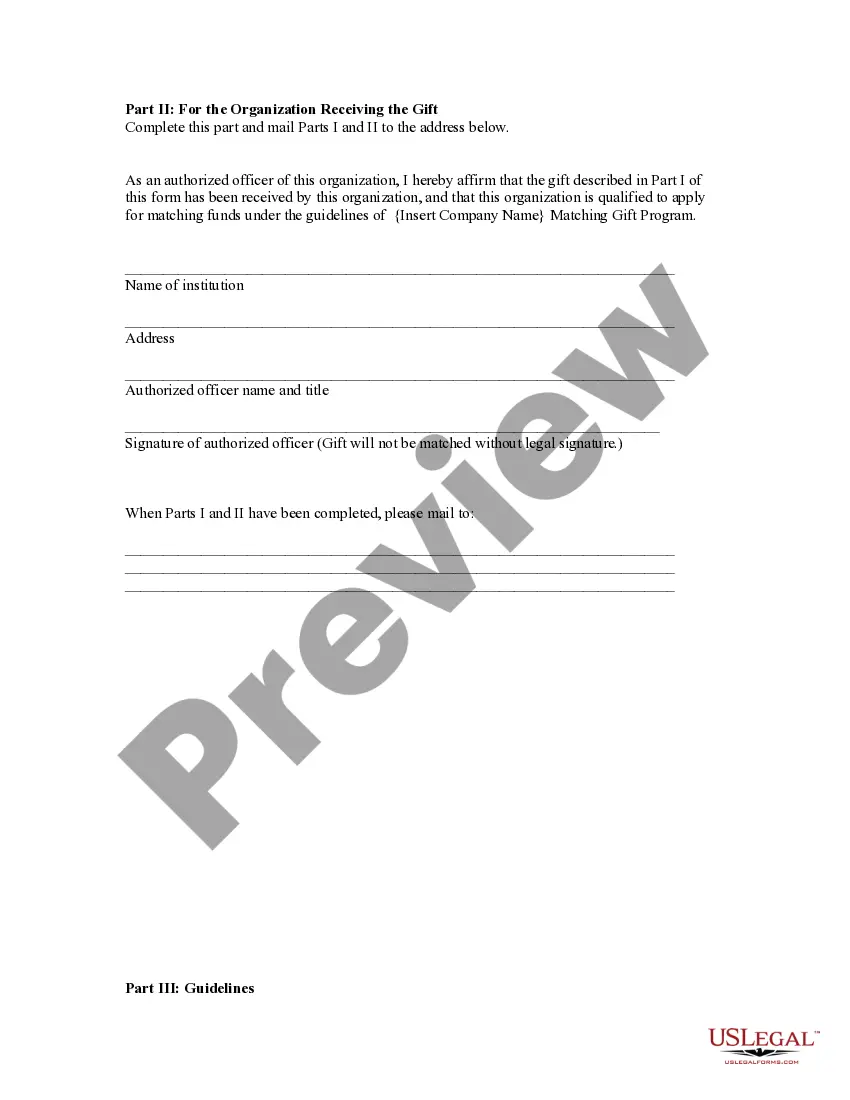

How to fill out Matching Gift Form?

Finding the right valid document template can be challenging.

Of course, there are numerous templates accessible online, but how can you find the proper document you require.

Use the US Legal Forms website. The service offers thousands of templates, such as the Indiana Matching Gift Form, that can be utilized for business and personal purposes.

If the form does not meet your expectations, use the Search field to find the correct form. Once you're sure the form is suitable, choose the Purchase now button to obtain the form. Select the pricing plan you prefer and enter the necessary information. Create your account and pay for your order using your PayPal account or credit card. Choose the file format and download the valid document template to your device. Complete, edit, print, and sign the received Indiana Matching Gift Form. US Legal Forms is indeed the largest repository of legal forms where you can find various document templates. Use the service to download professionally crafted documents that adhere to state requirements.

- All forms are verified by experts and comply with state and federal regulations.

- If you are already registered, Log In to your account and click on the Download button to obtain the Indiana Matching Gift Form.

- Utilize your account to access the legal documents you have previously acquired.

- Navigate to the My documents section of your account to receive another copy of the document you need.

- If you are a new user of US Legal Forms, here are straightforward steps for you to follow.

- First, ensure you have selected the correct form for your city/state. You can review the form using the Review option and read the form description to verify it suits your needs.

Form popularity

FAQ

In the Find More Gifts dialog box, enter as much as you know about the gift and click Search. (Enter search criteria that will return as few results as possible. Don't search for all gifts in 2014 to match against, for example.) Salesforce adds potential Opportunities to the list so you can select the ones that apply.

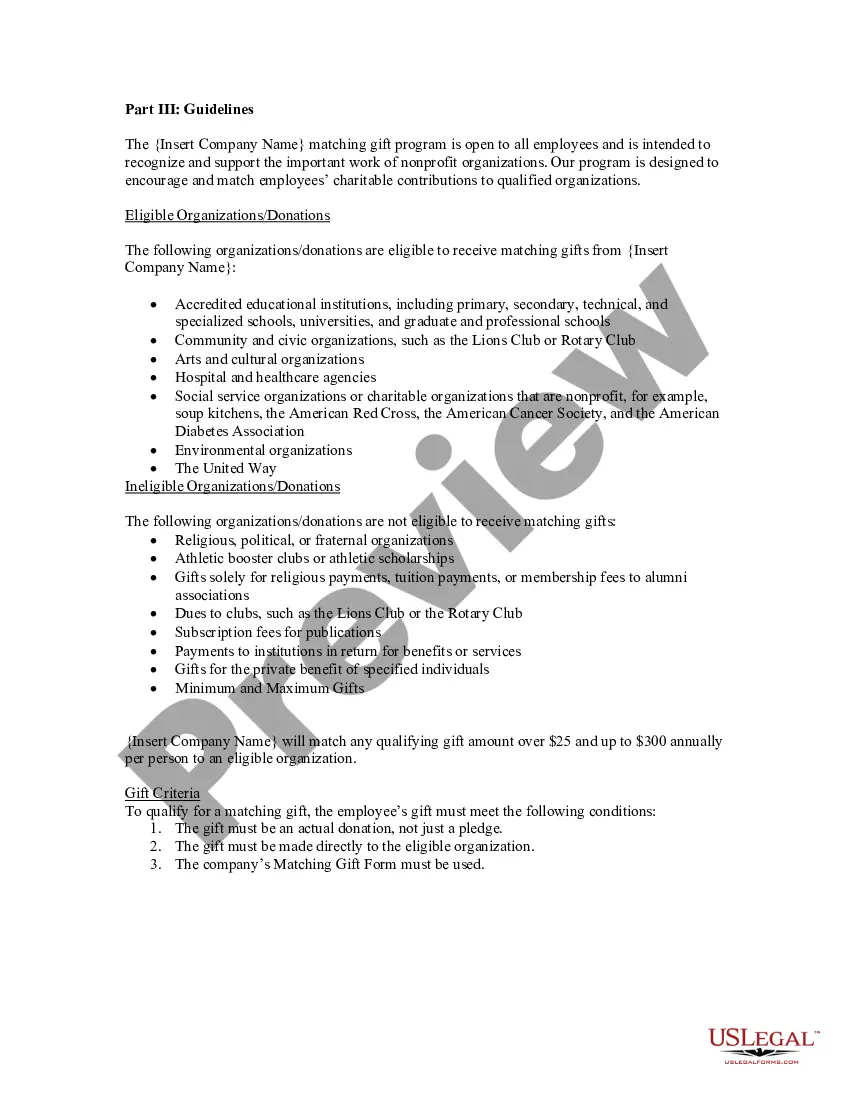

Corporate matching gifts are a type of philanthropy in which companies financially match donations that their employees make to nonprofit organizations. When an employee makes a donation, they'll request the matching gift from their employer, who then makes their own donation.

Since a matching gift is technically a donation, companies can deduct the matches they make from their reported income. Decreasing reported income means a company will not have to pay taxes on the donated money.

Nationwide: Gifts from eligible donors may be designated for a specific use, but the Foundation's matching gifts will be unrestricted for educational purposes.

Follow these tips, lean back in your seat, and watch the credits roll!Study Up on Matching Gifts.Appoint a Matching Gift Specialist.Raise Awareness About Matched Giving.Collect Donor Employer Details.Strive for Easy Accessibility.Keep Records of the Individuals' Matching Gift Statuses.More items...?

Matching gifts are a type of giving program that is set up by companies and corporations as an employee benefit. After an employee donates to a nonprofit, they can submit a matching gift request to their employer and the company will make an additional donation to that nonprofit.

Should you wish to notify the donor that their employer match has been received, please do! I encourage you to be really specific. Your message should include the date, the amount of gift that was matched by the employer, as well as the total amount the donor will be recognized for and over what time frame.

A challenge campaign is just what it sounds like: A 'challenge' is given to donors to raise a certain amount of money by a certain amount of time. If the challenge is complete, there is typically a matching donor(s) that will then match the gifts raised either dollar for dollar or at a certain percentage point.

Gifts to individuals are not deductible. Only qualified organizations are eligible to receive tax deductible contributions. To determine if the organization that you contributed to qualifies as a charitable organization for income tax deduction purposes, refer to our Tax Exempt Organization Search tool.

Matching gifts are a type of giving program that is set up by companies and corporations as an employee benefit. After an employee donates to a nonprofit, they can submit a matching gift request to their employer and the company will make an additional donation to that nonprofit.