Indiana Product Sales Order Form

Description

How to fill out Product Sales Order Form?

Have you ever found yourself in a situation where you require documentation for various organizational or personal matters almost every workday.

There are countless legal document templates available on the internet, but locating reliable versions is quite challenging.

US Legal Forms offers a vast selection of form templates, including the Indiana Product Sales Order Form, designed to meet federal and state standards.

Once you obtain the correct form, click Buy now.

Choose the pricing plan you prefer, fill in the necessary details to create your account, and purchase the order using your PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Indiana Product Sales Order Form template.

- If you do not have an account and wish to use US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct area/region.

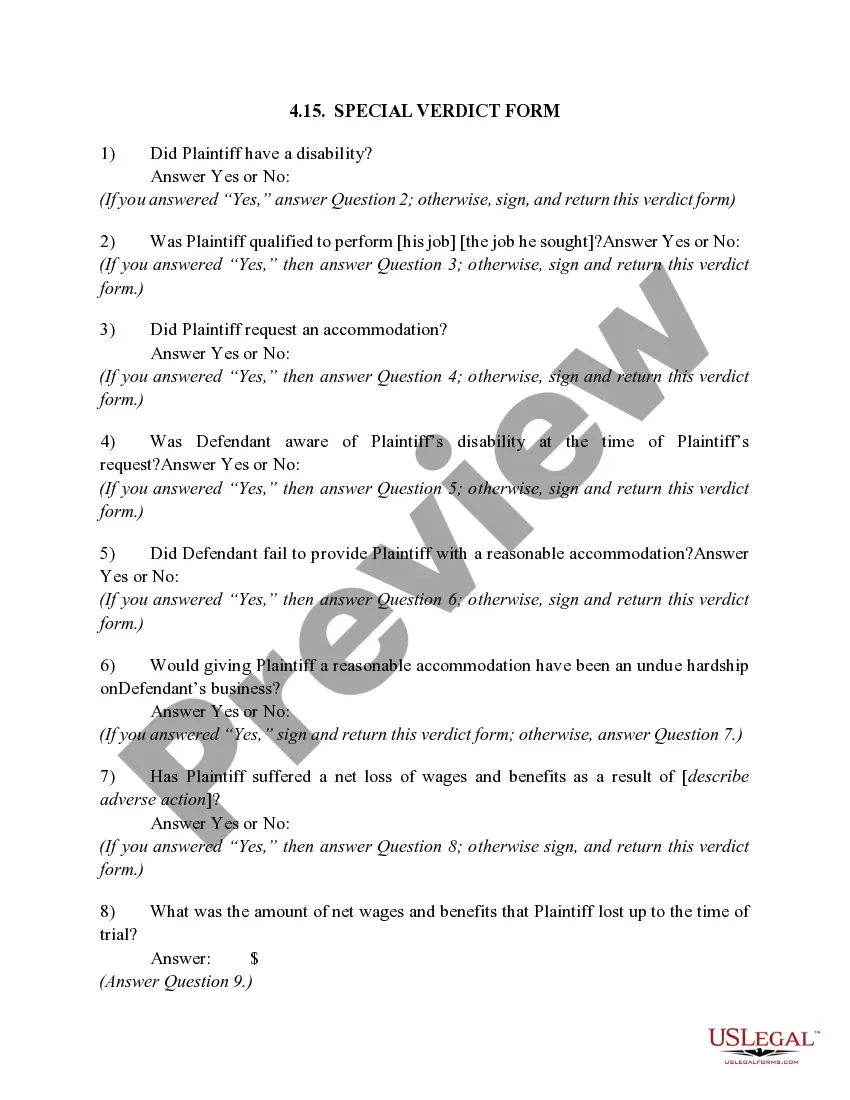

- Use the Review button to examine the form.

- Read the description to confirm that you have selected the right form.

- If the form does not match your requirements, utilize the Lookup field to find a form that suits your needs.

Form popularity

FAQ

What goods are exempt from sales and use tax?equipment directly used or consumed in the direct production of tangible personal property, as well as for property incorporated into goods for sale;property predominantly used in providing public transportation;certain medical equipment, drugs and devices;groceries;More items...?

How to get a Tax ID numberyour accountant or financial institution may be able to help you obtain a Tax ID Number.you can use the IRS Business & Specialty Tax Line listed above (800-829-4933)you can manually fill out Form SS-4 and mail it to the IRS.you can submit an online application for a Tax ID number yourself.

The Indiana Department of Revenue is set to start enforcing a law passed in 2017 on Oct. 1. If you buy products online from out-of-state companies, you'll be charged the state's 7 percent sales tax. The law lets the state collect the sales tax from online retailers even if they don't have a physical store in Indiana.

If your business sells goods or tangible personal property, you'll need to register to collect a seven percent sales tax. This registration allows you to legally conduct retail sales in the state of Indiana.

Purpose: Form BT-1 is an application used when registering with the Indiana Department of Revenue for Sales Tax, Withholding Tax, Out-of- State Use Tax, Food and Beverage Tax, County Innkeepers Tax, Tire Fee, and Motor Vehicle Rental Excise Tax, or a combination of these taxes.

The basic rule for collecting sales tax from online sales is: If your business has a physical presence, or nexus, in a state, you must collect applicable sales taxes from online customers in that state. If you do not have a physical presence, you generally do not have to collect sales tax for online sales.

2713 Taxpayer Identification Number (TID). The TID is requested when adding a location to an. existing business account or when registering an existing location for other tax types.

Generally, purchases of tangible personal property, accommodations, or utilities made directly by Indiana state and local government entities are exempt from sales tax.

Yes. An out of state vendor may voluntarily register to collect Indiana sales tax even if they do not have a physical presence in Indiana or meet either of the economic nexus thresholds.

A Taxpayer Identification Number (TIN) is an identification number used by the Internal Revenue Service (IRS) in the administration of tax laws. It is issued either by the Social Security Administration (SSA) or by the IRS.