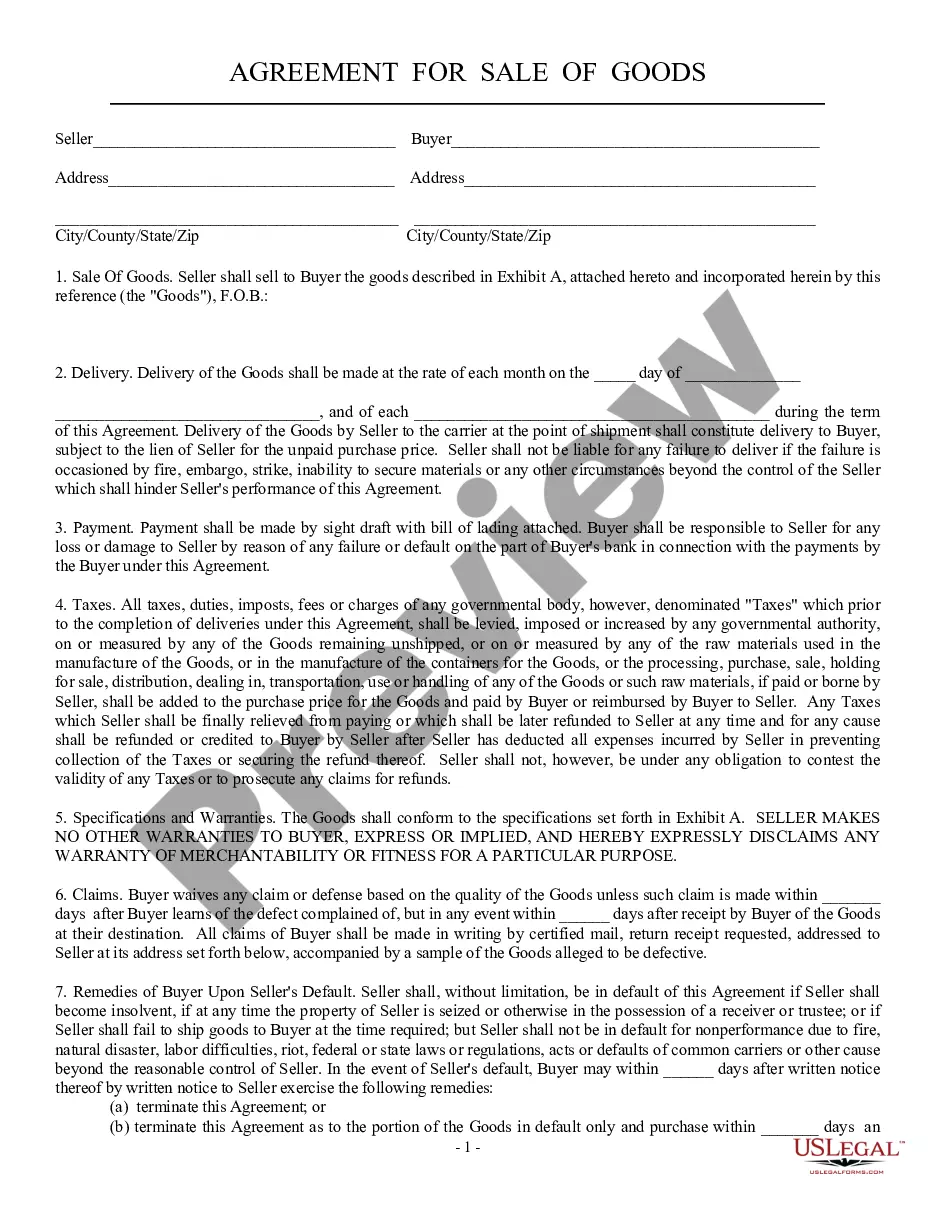

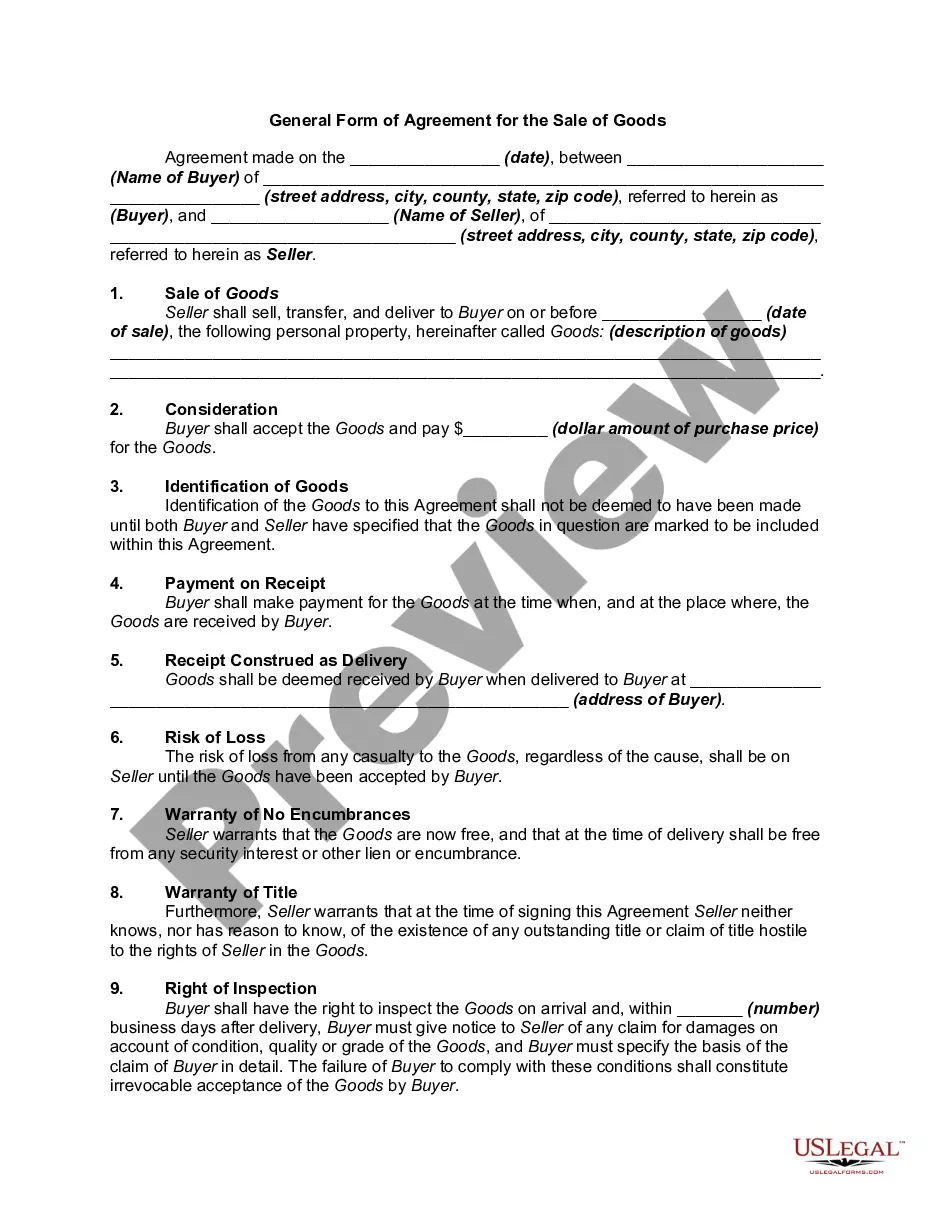

Indiana Sale of Goods, Short Form

Description

How to fill out Sale Of Goods, Short Form?

US Legal Forms - one of the largest collections of legal documents in the USA - provides a diverse array of legal form templates that you can download or print.

By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can obtain the latest versions of forms such as the Indiana Sale of Goods, Short Form in a matter of minutes.

If you already have a subscription, Log In and download the Indiana Sale of Goods, Short Form from the US Legal Forms library. The Download button will appear on every form you view.

Complete the transaction. Use your credit card or PayPal account to finish the purchase.

Select the format and download the form onto your device. Make modifications. Fill out, edit, print, and sign the downloaded Indiana Sale of Goods, Short Form. Each template added to your account has no expiration date and is yours indefinitely. So, to download or print another version, simply visit the My documents section and click on the form you need. Access the Indiana Sale of Goods, Short Form with US Legal Forms, the most extensive library of legal form templates. Utilize a large selection of professional and state-specific templates that meet your business or personal needs.

- If you're new to US Legal Forms, here are simple steps to get started.

- Ensure you have selected the appropriate form for your city/state.

- Click the Review button to verify the form's contents.

- Check the form overview to ensure you have chosen the correct one.

- If the form does not meet your needs, utilize the Search field at the top of the screen to find a suitable one.

- If you are satisfied with the form, confirm your choice by clicking on the Buy now button.

- Select the pricing plan you prefer and provide your credentials to register for an account.

Form popularity

FAQ

The ST-105 form in Indiana is a sales tax exemption certificate used by buyers to claim exemption on qualifying purchases. This is especially relevant for entities involved in the Indiana Sale of Goods, Short Form. Presenting the ST-105 form to sellers ensures no unnecessary sales tax is charged during eligible transactions.

The NP1 form in Indiana is typically used for the registration of a nonprofit organization. When a nonprofit engages in the Indiana Sale of Goods, Short Form, this form helps establish its tax-exempt status. Understanding the NP1 process is crucial for compliance and fiscal responsibility.

In Indiana, certain organizations, such as non-profits and government agencies, may qualify for sales tax exemption. Additionally, some items purchased for resale under the Indiana Sale of Goods, Short Form may also be exempt. Knowing the requirements can help businesses save on costs during transactions.

The ST-103 form in Indiana is essentially the same as form ST 103, used for sales tax exemption. It should be presented to the seller when purchasing items exempt from sales tax under the Indiana Sale of Goods, Short Form. Using this form correctly can provide significant savings for eligible purchasers.

Form ST 103 in Indiana is used to claim a sales tax exemption on tangible personal property. This form is particularly relevant for businesses conducting transactions under the Indiana Sale of Goods, Short Form. By filling out this form, eligible buyers can ensure they do not incur extra sales tax costs.

In Indiana, nonresidents who earn income from Indiana sources must file an Indiana nonresident return. This includes individuals engaged in sales or providing services under the Indiana Sale of Goods, Short Form. Ensuring proper filing will help avoid penalties and keep you compliant with state regulations.

Yes, an inheritance tax waiver form is required in Indiana if the estate involves property. This form is necessary to clear the tax obligations prior to the transfer of assets. Completing this form can streamline processes for beneficiaries during transactions related to the Indiana Sale of Goods, Short Form.

The BT-1 form in Indiana is used for registering a business for sales tax purposes. When engaging in the Indiana Sale of Goods, Short Form transactions, businesses must complete this form to obtain a Sales Tax Permit. This form helps ensure compliance with the state's tax laws and regulations.

When you buy goods out of state and bring them into Indiana, you may be subject to Indiana sales tax on those purchases. This is referred to as use tax and typically matches the state sales tax rate. Understanding how this applies in the context of the Indiana Sale of Goods, Short Form can help you budget appropriately and ensure compliance.

Yes, Indiana does impose state taxes on various transactions, including sales tax on goods sold. This is in addition to local taxes that may apply in different areas of the state. Familiarizing yourself with these tax structures is essential for anyone participating in the Indiana Sale of Goods, Short Form.