Indiana Software Maintenance Agreement

Description

How to fill out Software Maintenance Agreement?

Have you ever been in a situation where you require documents for various organizational or personal tasks almost every day.

There are numerous legal document templates accessible online, but finding reliable ones is not straightforward.

US Legal Forms offers thousands of document templates, such as the Indiana Software Maintenance Agreement, which are designed to comply with state and federal regulations.

Once you find the appropriate form, click on Purchase now.

Choose your desired pricing plan, fill in the necessary information to create your account, and pay for the order using your PayPal or credit card. Select a convenient document format and download your copy. Access all the document templates you have purchased in the My documents section. You can obtain an additional copy of the Indiana Software Maintenance Agreement any time you need. Just click the required form to download or print the document template. Utilize US Legal Forms, the most extensive variety of legal forms, to save time and avoid errors. The service provides properly crafted legal document templates that you can use for various purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Indiana Software Maintenance Agreement template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it corresponds to the correct city or county.

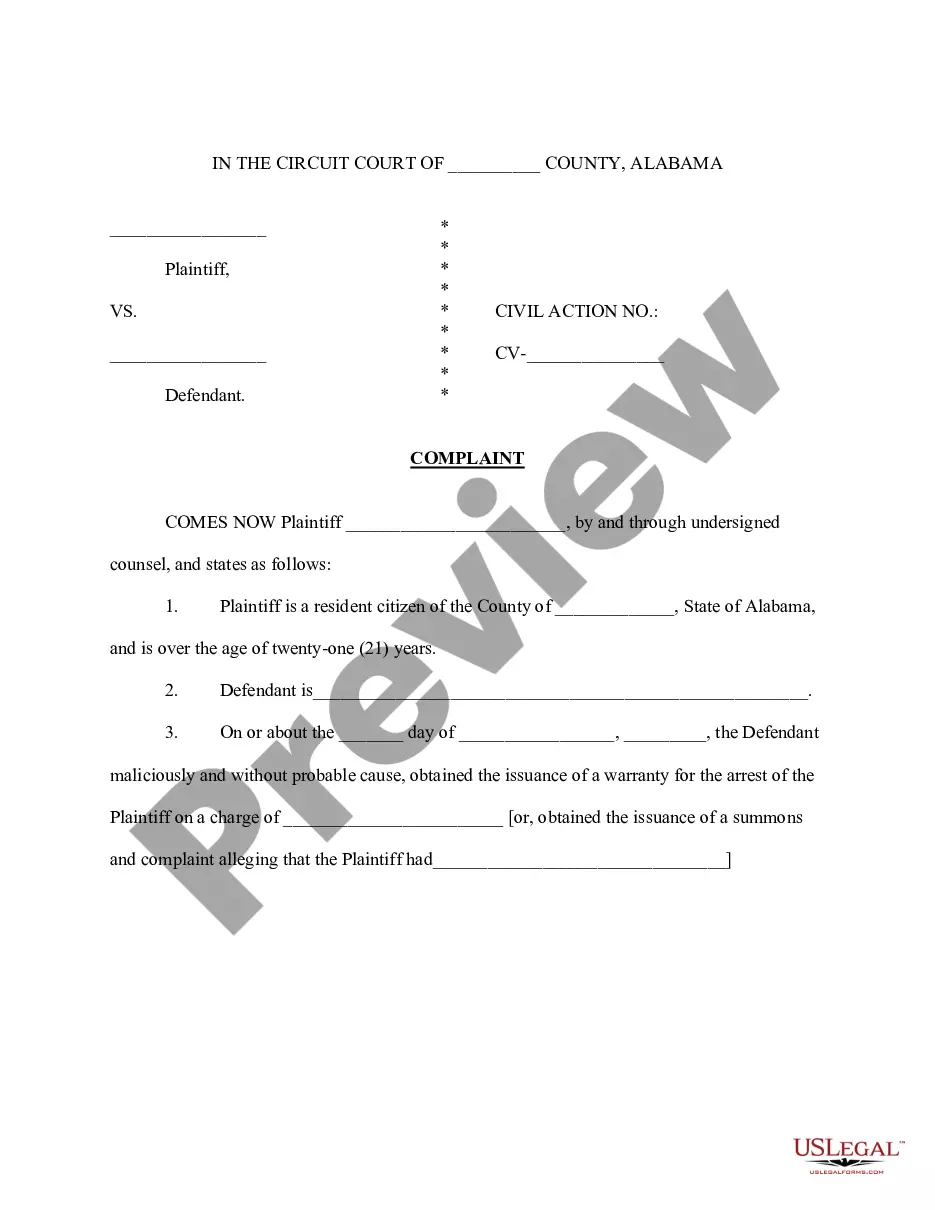

- Utilize the Review option to scrutinize the form.

- Check the details to verify that you have selected the right form.

- If the form does not meet your search criteria, use the Search field to find the document that suits your requirements.

Form popularity

FAQ

In the state of Indiana, maintenance contracts are considered to be taxable so long as there is a reasonable expectation that tangible personal property will be provided. Sales of parts purchased for use in performing service under optional maintenance contracts are exempt from the sales tax in Indiana.

SOFTWARE MAINTENANCE CONTRACTS A person is a retail merchant making a retail transaction when the person enters into a computer software maintenance contract to provide future updates or upgrades to computer software. These contracts are therefore subject to sales tax.

Sales and use tax does not apply to SaaS, which California defines as, A customer gains access to software on a remote network without receiving a copy of the software, while the seller retains exclusive possession and control of it. While California has not specifically codified the SaaS revenue stream, the state

Making good on his State of the State promise to provide clarity on the previously murky topic of software-as-a-service (SaaS) and its sales tax status, today Governor Holcomb signed Senate Bill 257 into law.

Thus, much federal purchasing, leasing, and renting of tangible personal property; the use of utilities; meals consumed in restaurants; and other normally taxable goods or services (including accommodations for fewer than 30 days) are exempt from Indiana sales and other transaction-based taxes.

The cost of the downloaded software is incidental (less than 10% of the total price of the transaction) to the service, so the transaction with the business customer is exempt from sales tax. The service provider, however, is subject to Indiana sales/use tax on the purchase of this software.

California: SaaS is not a taxable service. However, software or information that is delivered electronically is exempt. The ability to access software from a remote network or location is exempt. Under California sales and use tax law, there must be a transfer of TPP, in order to have a taxable event.

Are services subject to sales tax in Indiana? "Goods" refers to the sale of tangible personal property, which are generally taxable. "Services" refers to the sale of labor or a non-tangible benefit. In Indiana, services are generally not taxable.

As a general rule, transactions involving computer software are not subject to Indiana Sales or Use Tax provided the software is in the form of a custom program specifically designed for the purchaser.