Indiana Software Maintenance and Support Agreement

Description

How to fill out Software Maintenance And Support Agreement?

Have you ever been in a location where you require documentation for occasional business or personal use almost daily.

There are numerous legal document templates accessible online, but locating reliable ones can be challenging.

US Legal Forms offers thousands of form templates, such as the Indiana Software Maintenance and Support Agreement, designed to comply with state and federal regulations.

Utilize US Legal Forms, one of the largest collections of legal documents, to save time and avoid mistakes.

The service provides expertly crafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and start making your life a bit simpler.

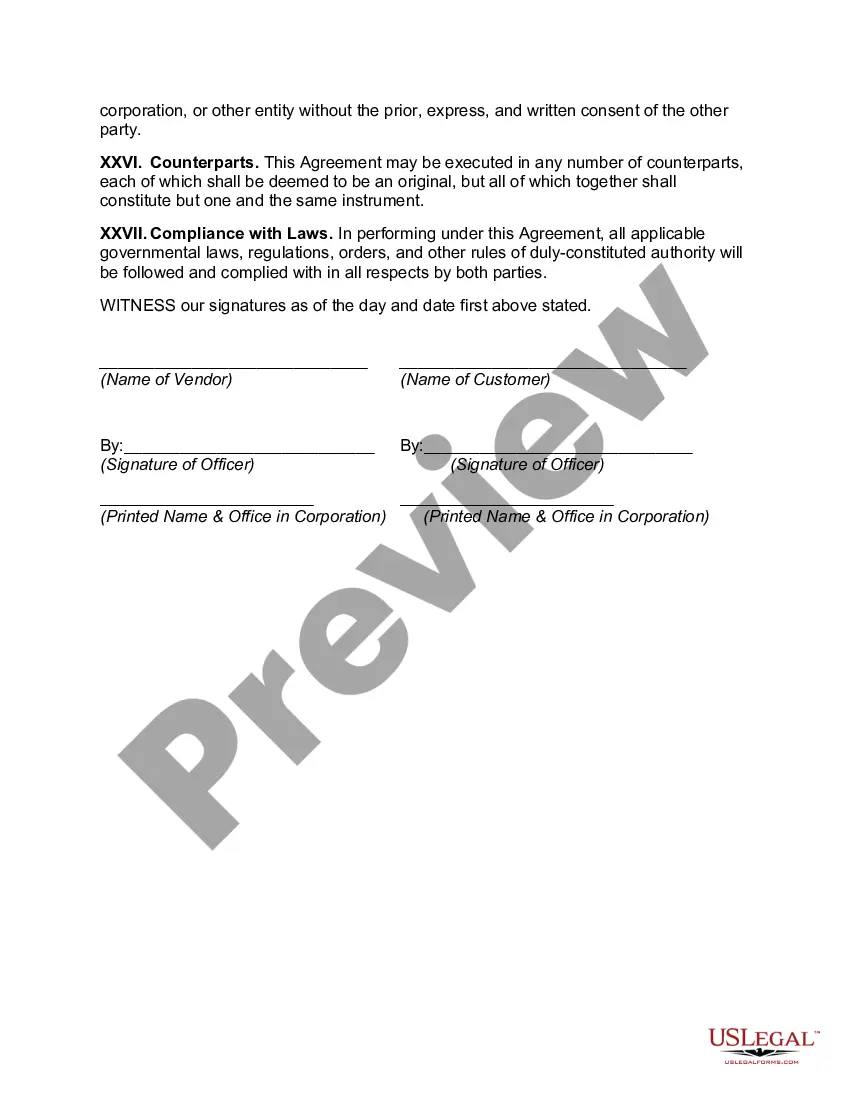

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Indiana Software Maintenance and Support Agreement template.

- If you do not have an account and want to start using US Legal Forms, follow these instructions.

- Obtain the form you need and ensure it corresponds to the correct area/state.

- Use the Preview button to review the document.

- Check the details to confirm that you have selected the correct form.

- If the form is not what you are looking for, use the Search field to find the form that fits your needs and requirements.

- Once you find the appropriate form, click Get now.

- Choose the pricing plan you prefer, provide the necessary information to create your account, and place an order using your PayPal or credit card.

- Select a convenient file format and download your copy.

- Find all of the document templates you have purchased in the My documents section. You can obtain an additional copy of the Indiana Software Maintenance and Support Agreement any time, if needed. Simply fill out the relevant form to download or print the document template.

Form popularity

FAQ

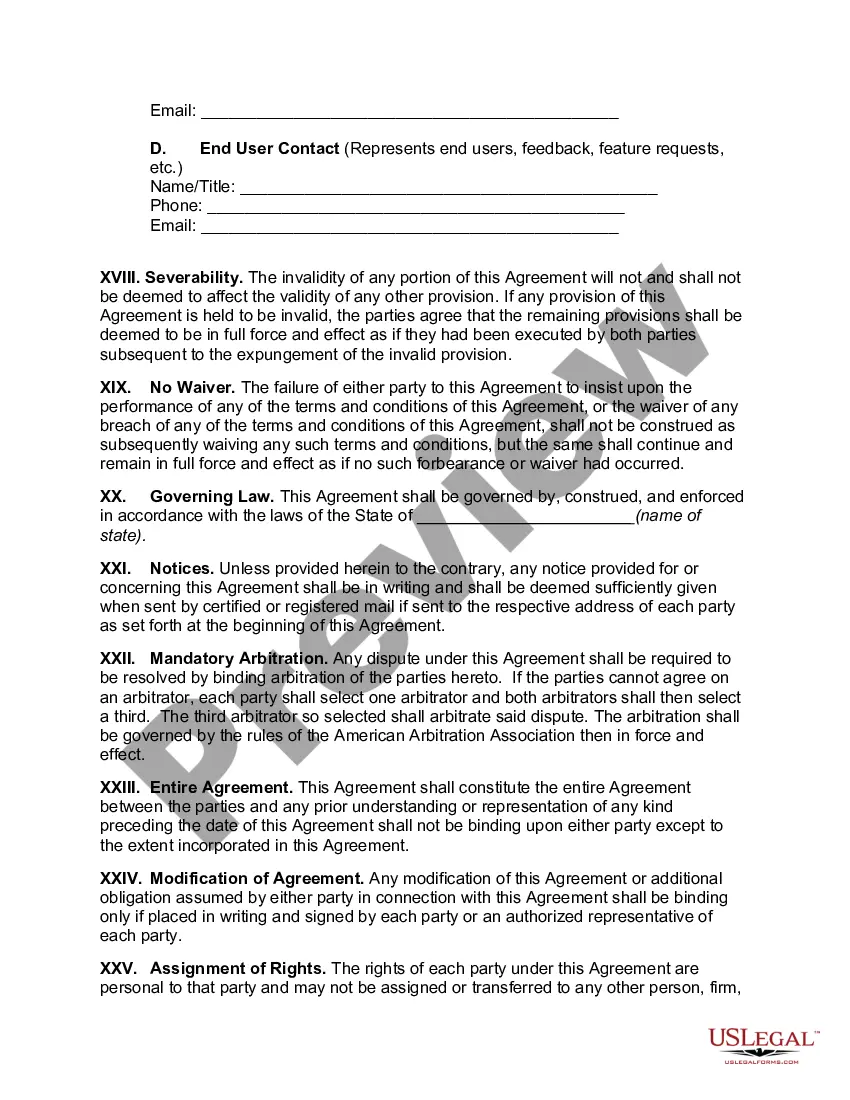

A software maintenance agreement, or SMA, is a legal contract that obligates the software vendor to provide technical support and updates for an existing software product for their customers. It may also extend the expiration date of certain features, such as new releases or upgrades.

Support and Maintenance Agreement means any of Software AG's or Partner's standard forms of written contract setting out the terms and conditions under which the Customer may obtain software support and maintenance services on terms identical to Software AG's Product Support and Maintenance Service Terms and Conditions

A maintenance agreement outlines the steps one party will undertake to insure the upkeep, repair, serviceability of another party's property. Maintenance contracts are commonly used by companies that take care of vehicle fleets, industrial equipment, office and apartment buildings, computer networks, etc.

California: SaaS is not a taxable service. However, software or information that is delivered electronically is exempt. The ability to access software from a remote network or location is exempt. Under California sales and use tax law, there must be a transfer of TPP, in order to have a taxable event.

SOFTWARE MAINTENANCE CONTRACTS A person is a retail merchant making a retail transaction when the person enters into a computer software maintenance contract to provide future updates or upgrades to computer software. These contracts are therefore subject to sales tax.

Purchases of tangible personal property, accommodations, or utilities made directly by the United States government, its agencies, and instrumentalities are exempt from Indiana sales tax. Sales by these same entities are also exempt from sales tax.

As a general rule, transactions involving computer software are not subject to Indiana Sales or Use Tax provided the software is in the form of a custom program specifically designed for the purchaser.

Sections to Be Included in a Product Maintenance and Repair AgreementProvider and buyer contact information.Definitions of common terms.General service terms and specifications.Response time and returns procedure.Support conditions and obligations.Service exclusions.Price, Invoicing, and Payment terms.More items...

In the state of Indiana, maintenance contracts are considered to be taxable so long as there is a reasonable expectation that tangible personal property will be provided. Sales of parts purchased for use in performing service under optional maintenance contracts are exempt from the sales tax in Indiana.

AMC is a maintenance contract or an insurance policy for your technological advancement. It is a software update service for which your company has to pay annually, to the software provider.