Indiana Renunciation of Legacy to give Effect to Intent of Testator

Description

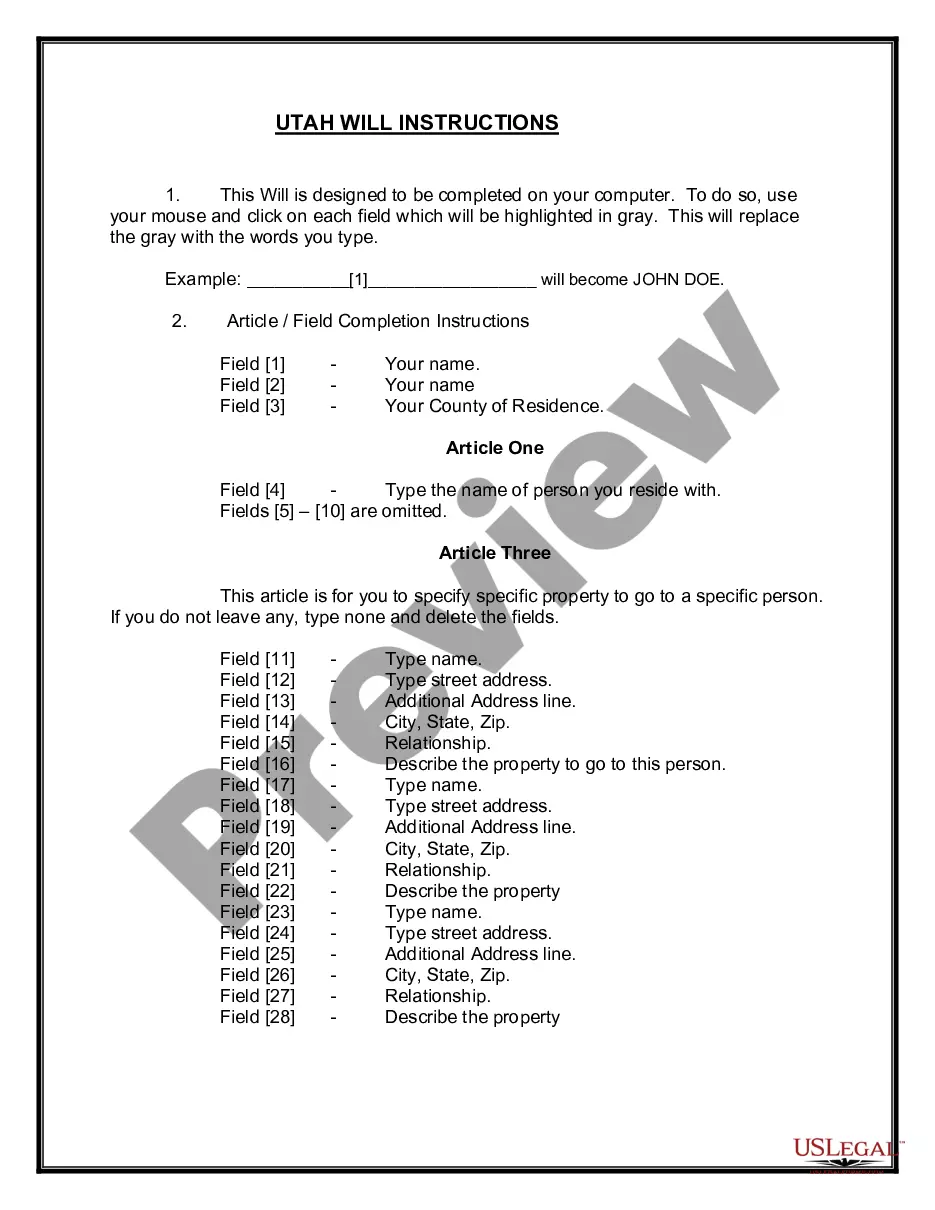

How to fill out Renunciation Of Legacy To Give Effect To Intent Of Testator?

If you have to full, obtain, or print out lawful document layouts, use US Legal Forms, the greatest variety of lawful kinds, which can be found online. Utilize the site`s basic and practical search to get the documents you want. A variety of layouts for business and specific reasons are sorted by types and suggests, or keywords and phrases. Use US Legal Forms to get the Indiana Renunciation of Legacy to give Effect to Intent of Testator in a handful of mouse clicks.

In case you are already a US Legal Forms customer, log in to the bank account and click the Obtain option to find the Indiana Renunciation of Legacy to give Effect to Intent of Testator. You may also gain access to kinds you in the past downloaded within the My Forms tab of the bank account.

If you are using US Legal Forms initially, follow the instructions below:

- Step 1. Ensure you have chosen the form for your proper town/land.

- Step 2. Make use of the Review solution to look over the form`s articles. Never forget to learn the information.

- Step 3. In case you are not satisfied with all the develop, take advantage of the Look for area near the top of the monitor to find other models in the lawful develop template.

- Step 4. After you have located the form you want, click the Buy now option. Select the prices prepare you prefer and include your credentials to register to have an bank account.

- Step 5. Procedure the financial transaction. You should use your charge card or PayPal bank account to accomplish the financial transaction.

- Step 6. Select the structure in the lawful develop and obtain it on your device.

- Step 7. Complete, edit and print out or sign the Indiana Renunciation of Legacy to give Effect to Intent of Testator.

Each and every lawful document template you purchase is your own property for a long time. You may have acces to each and every develop you downloaded inside your acccount. Click on the My Forms portion and pick a develop to print out or obtain once again.

Be competitive and obtain, and print out the Indiana Renunciation of Legacy to give Effect to Intent of Testator with US Legal Forms. There are thousands of specialist and express-particular kinds you can utilize to your business or specific needs.

Form popularity

FAQ

In order to disclaim an inheritance, you will need to write a Disclaimer, which states that you are disclaiming your inheritance in writing. Within your Disclaimer, you will need to explain what is being disclaimed, whether it is only part of your inheritance or all of it, as well as sign the document to make it legal.

Answer: Just because you are nominated as executor of a Will does not mean that you must serve. You can renounce your rights as executor and decline to act by simply signing and having notarized a Renunciation of Nominated Executor form and filing it with the Surrogate's Court in the county in which your aunt resided.

You make your disclaimer in writing. Your inheritance disclaimer specifically says that you refuse to accept the assets in question and that this refusal is irrevocable, meaning it can't be changed. You disclaim the assets within nine months of the death of the person you inherited them from.

It's the right thing to do Disclaiming may get a bequest to a person for whom it makes more sense." If you decide that a bequest won't benefit you, how do you decline it effectively? "Your rejection needs to be written, explicit and signed," says Mooney, "and it must be irrevocable and unconditional."

(a) When a person dies, the person's real and personal property passes to persons to whom it is devised by the person's last will or, in the absence of such disposition, to the persons who succeed to the person's estate as the person's heirs; but it shall be subject to the possession of the personal representative and ...

Under Internal Revenue Service (IRS) rules, to refuse an inheritance, you must execute a written disclaimer that clearly expresses your "irrevocable and unqualified" intent to refuse the bequest.

Ind. Code § 29-1-2-1. Adultery or abandonment. If you are separated from your spouse and "living in adultery" at the time of your spouse's death, or if you have abandoned your spouse without just cause, you will not receive a share of your spouse's estate.

Renunciation of inheritance means that an heir renounces his/her right to inherit any of legacy when the heir does not want to inherit the legacy of the ancestor (a deceased person).