Indiana Provision of Agreement to Devise or Bequeath Property to Person Performing Personal Services

Description

How to fill out Provision Of Agreement To Devise Or Bequeath Property To Person Performing Personal Services?

Selecting the best legitimate document template can be challenging. Obviously, there are numerous designs available online, but how do you find the authentic version you require.

Utilize the US Legal Forms website. This service offers a vast array of templates, including the Indiana Provision of Agreement to Devise or Bequeath Property to Person Performing Personal Services, which can be utilized for both business and personal purposes. All documents are reviewed by professionals and comply with federal and state regulations.

If you are already registered, Log In to your account and select the Download button to access the Indiana Provision of Agreement to Devise or Bequeath Property to Person Performing Personal Services. Use your account to search for the legal documents you have previously ordered. Navigate to the My documents tab in your account and download another copy of the document you require.

Choose the file format and download the legal document template to your device. Complete, modify, print, and sign the obtained Indiana Provision of Agreement to Devise or Bequeath Property to Person Performing Personal Services. US Legal Forms is the largest collection of legal documents where you can find numerous form templates. Utilize the service to obtain properly crafted paperwork that adheres to state requirements.

- First, ensure you have selected the correct form for your city/area.

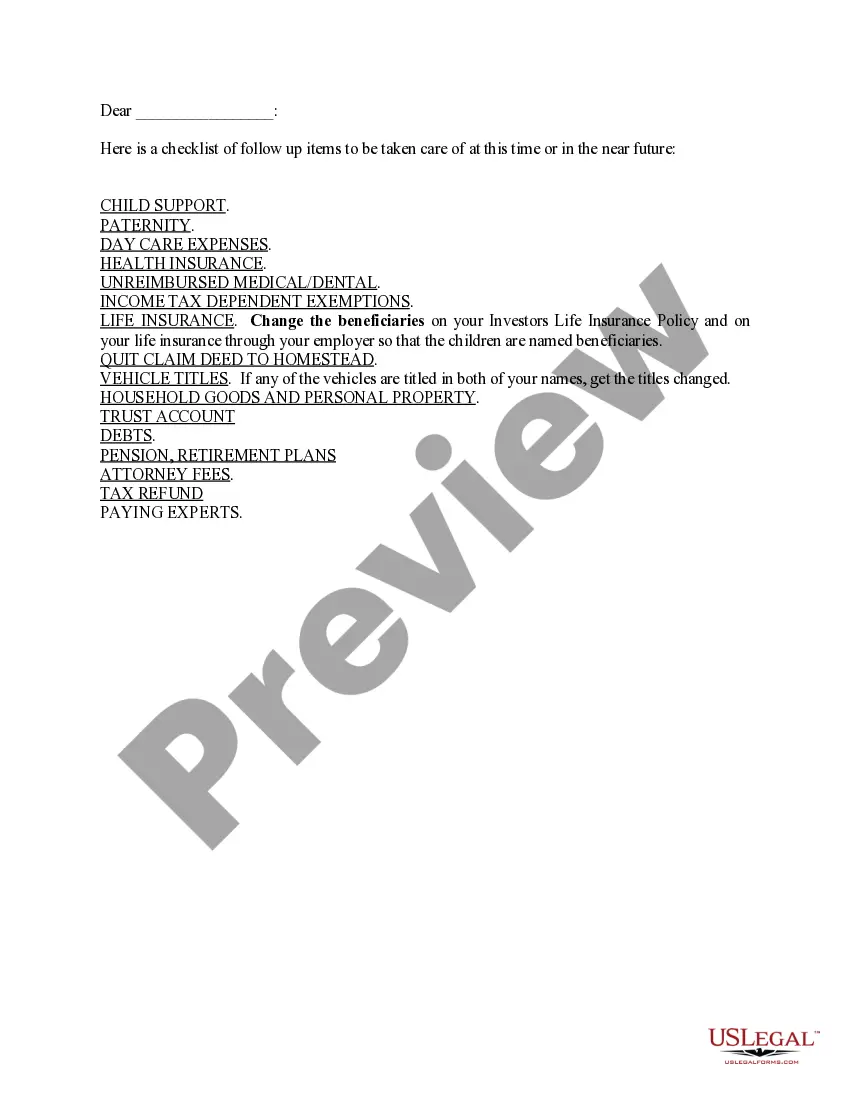

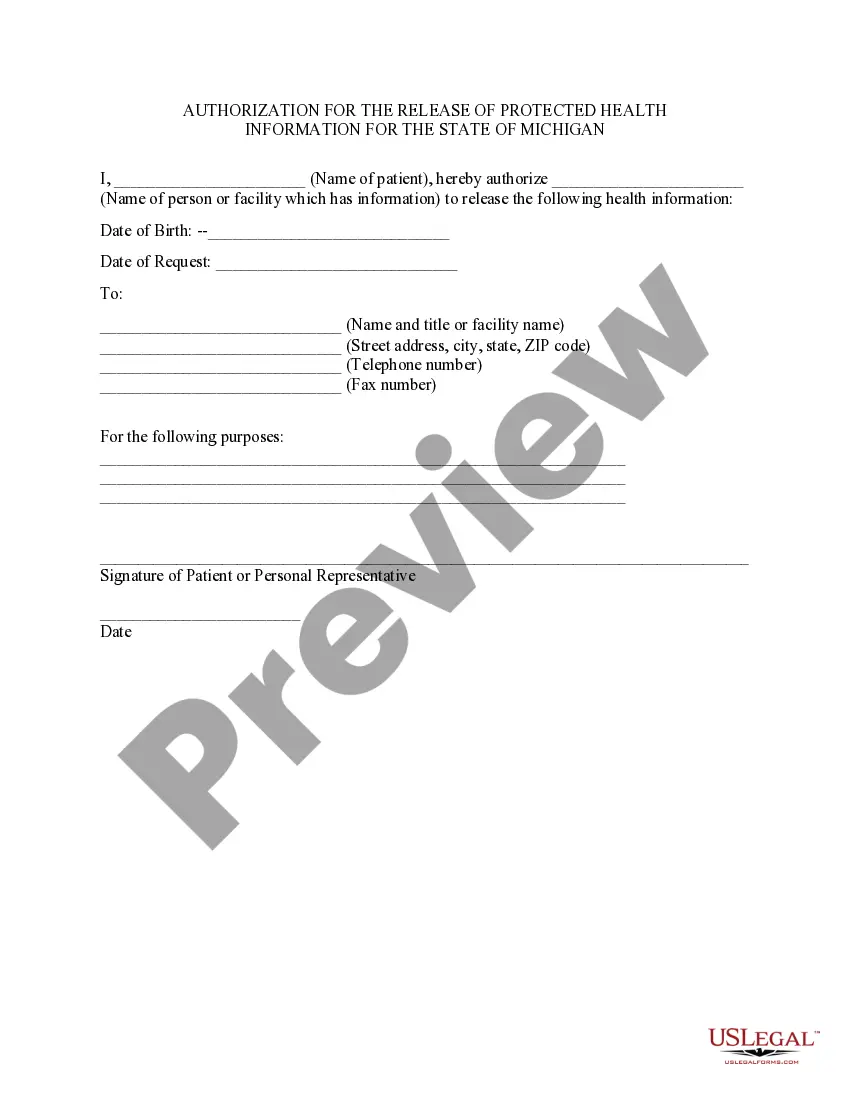

- You can preview the form using the Preview button and read the form description to confirm it is suitable for your needs.

- If the form does not fulfill your requirements, use the Search field to find the appropriate form.

- Once you are certain that the form is acceptable, click on the Get now button to obtain the form.

- Select your preferred pricing plan and provide the necessary information.

- Create your account and finalize the payment through your PayPal account or credit card.

Form popularity

FAQ

No. This form should not be filed in court. This form should be filled out and given to the person or company that has the property that you have a right to. For example, if you are trying to get the funds out of your deceased spouse's bank account, you would give the form to the bank.

Here are a few methods:Draw lots and take turns picking items.Use colored stickers for each person to indicate what he wants.Get appraisals.Make copies.Use an online service like FairSplit.com to catalog and divide personal property in an estate.More items...?

Residuary Gifts - The residue is what is left after any specific or pecuniary gifts have been made from the estate and all expenses and taxes have been paid. A residuary gift is usually a share in the residue. The gift may be on trust (i.e. have conditions attached) or absolute.

A residuary estate, in the law of wills, is any portion of the testator's estate that is not specifically devised to someone in the will, or any property that is part of such a specific devise that fails. It is also known as a residual estate or simply residue.

Does a Will Have to Be Probated in Indiana? Indiana code requires the will to be filed with the court. This allows the court to verify the will as valid or to handle disputes if anyone contests the will. Even if the estate doesn't need to go through formal probate, the will must be presented to the court.

'Estate' is the collective term for everything that someone owned on the date that they passed away. The residue of the Estate is what's left after all liabilities (debts), expenses, gifts and administration fees have been paid.

It is the executor's or the administrator's responsibility to collect and distribute the assets and to pay any death taxes and expenses of the decedent.

BENEFICIARY - A person named to receive property or other benefits.

Your heir/s is the person/s who inherits the residue of your estate. The residue is whatever assets are left after all your debts, the costs of administration and the legacies have been distributed.

Related Content. The rest of a deceased person's estate which is left after the payment of specific gifts, debts, funeral expenses and inheritance tax.