Indiana Agreement to Devise or Bequeath Property of a Business Transferred to Business Partner

Description

How to fill out Agreement To Devise Or Bequeath Property Of A Business Transferred To Business Partner?

Are you currently in a situation where you require documentation for both business or personal activities each day.

There are numerous legal document templates accessible online, but locating reliable ones can be challenging.

US Legal Forms offers thousands of template options, including the Indiana Agreement to Devise or Bequeath Property of a Business Transferred to Business Partner, which are designed to comply with state and federal regulations.

Once you find the appropriate form, click Acquire now.

Select the pricing plan you prefer, enter the required information to create your account, and pay for your order using PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Indiana Agreement to Devise or Bequeath Property of a Business Transferred to Business Partner template.

- If you do not have an account and wish to begin using US Legal Forms, follow these steps.

- Find the form you need and ensure it corresponds to the correct city/area.

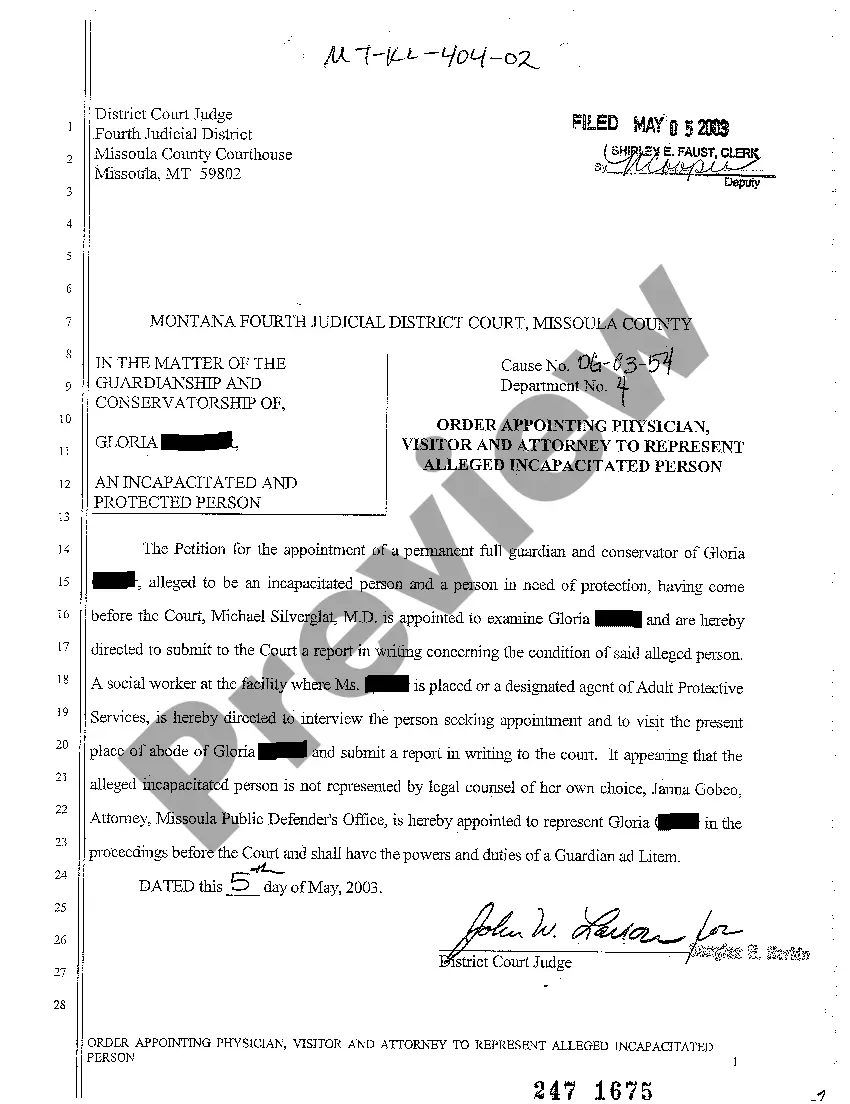

- Use the Review button to examine the form.

- Check the description to confirm that you have selected the right form.

- If the form is not what you are looking for, utilize the Search box to locate the document that fulfills your criteria.

Form popularity

FAQ

A claim for reasonable financial provision must be made within six months after probate or letters of administration have been issued, although the court can extend this period in certain circumstances (eg if the applicant has not made an earlier claim because of negotiations with the executors or administrators).

No. This form should not be filed in court. This form should be filled out and given to the person or company that has the property that you have a right to. For example, if you are trying to get the funds out of your deceased spouse's bank account, you would give the form to the bank.

How long do you have to make a claim? The Act has a strict time limit for making a claim of six months from the date of the Grant of Probate or Letters of Administration. In very exceptional circumstances this may be extended to allow a late claim, but as a rule you must stick to the six month deadline.

Step 1 Wait Forty-five (45) Days. A period of forty-five (45) has to pass before you can use a small estate affidavit in the State of Indiana.Step 2 Prepare Affidavit. Download Form 54985.Step 3 Notify Every Person Identified.Step 4 Get It Notarized.Step 5 Collect the Assets.

In Indiana, a small estate is an estate that has a value of $50,000 or less after liens, encumbrances, and reasonable funeral expenses are subtracted. All joint assets and beneficiary designations are not included in the $50,000 estate amount.

Claims must be filed within three months of the date of creditor receiving notice of the opening of an estate administration. Additionally, claims must be filed, if at all, within nine months of the date of death, regardless of whether notice was received.

Requirements for using the Small Estate Claim Form:The value of the gross estate must be $50,000 or less.The person must have died at least 45 days ago.There must not be any petition for an appointment of representative filed in or granted by any court.More items...?

Time-frame/Deadline to file Claim Indiana code 29-1-14-1 provides that all claims against a deceased person are barred if not filed within nine (9) months after the date death. This means that you must file a claim in the debtor's estate within nine (9) months of the date of their death.

In general, expect it to take at least six months up to a year before probate is closed and the assets distributed to the heirs. If there are disputes, claims against the estate or other delays, it could take much longer.

There is a strict time limit within which an eligible individual can make a claim on the estate. This is six months from the date that the grant of probate was issued. For this reason, executors are advised to wait until this period has lapsed before distributing any of the estate to the beneficiaries.