Indiana Promissory Note with Payments Amortized for a Certain Number of Years

Description

How to fill out Promissory Note With Payments Amortized For A Certain Number Of Years?

If you need to acquire, retrieve, or print sanctioned document templates, utilize US Legal Forms, the largest assortment of legal documents available online.

Take advantage of the site's straightforward and convenient search to locate the forms you require.

Various templates for business and personal use are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, click the Get now button. Select the payment plan you prefer and enter your details to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Use US Legal Forms to access the Indiana Promissory Note with Payments Amortized for a Specific Number of Years in just a few clicks.

- If you are an existing US Legal Forms user, Log In to your account and click the Download button to retrieve the Indiana Promissory Note with Payments Amortized for a Specific Number of Years.

- You can also access documents you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for your specific city/region.

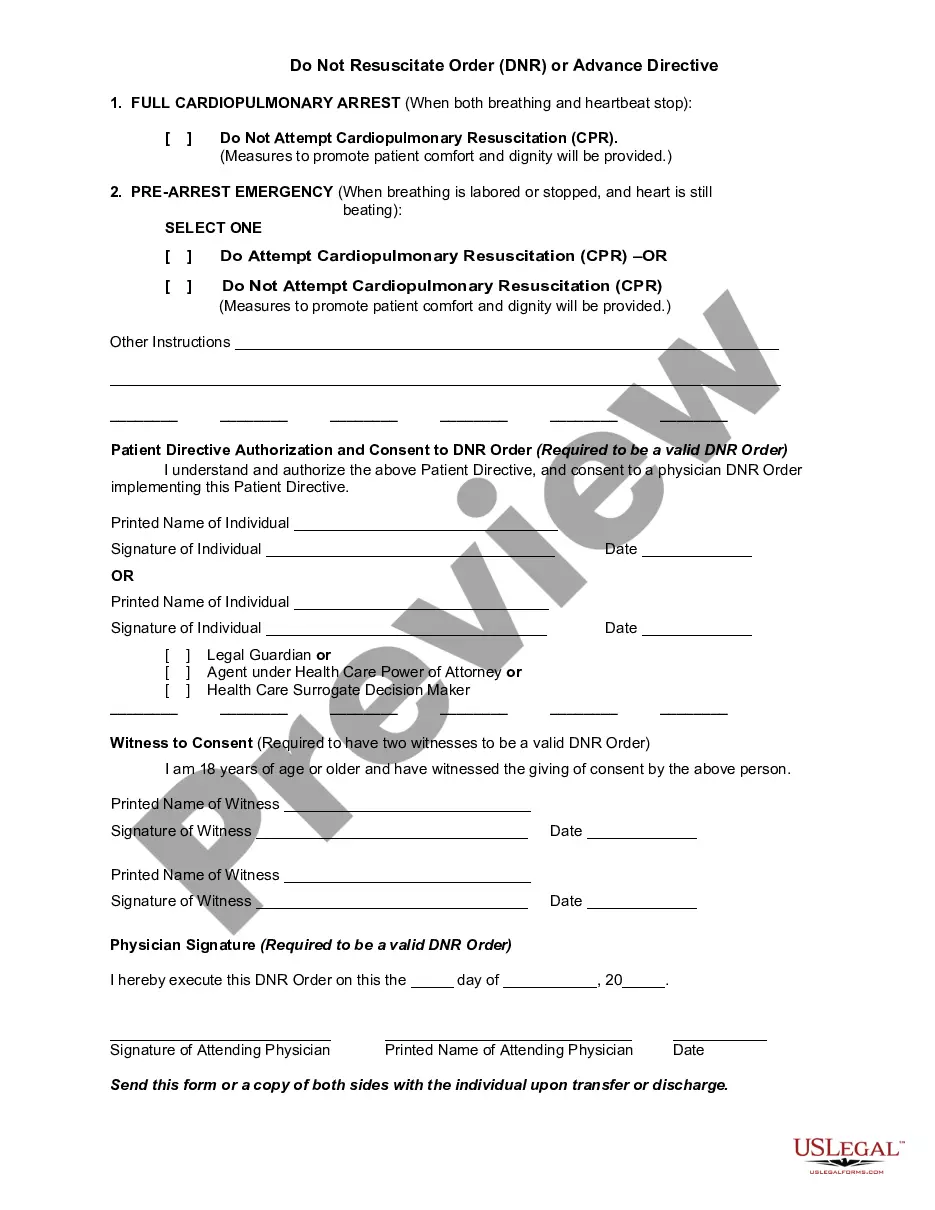

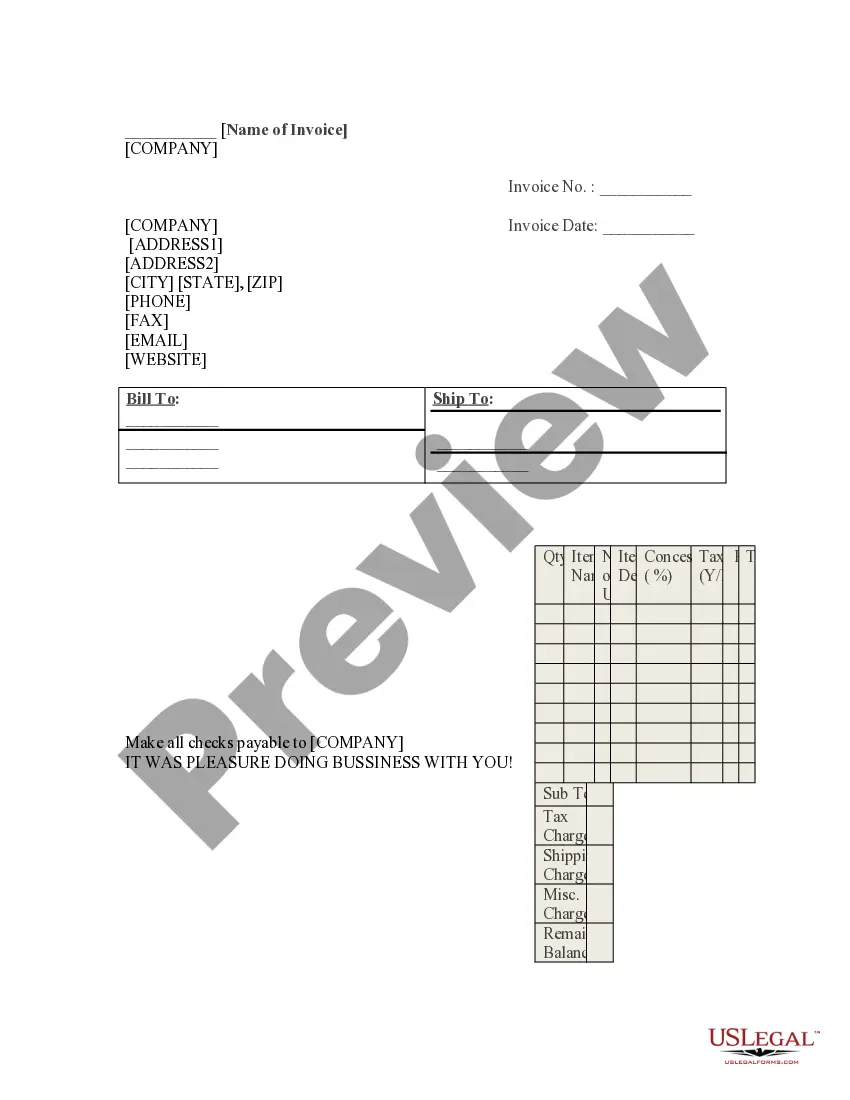

- Step 2. Use the Preview option to examine the form's content. Don't forget to check the overview.

- Step 3. If you're not satisfied with the form, use the Search box at the top of the screen to find other variations of the legal document template.

Form popularity

FAQ

A promissory note can be voided under certain circumstances, such as fraud, misrepresentation, or if one party lacked the legal capacity to enter into a contract. Additionally, if the terms are deemed illegal or violate public policy, the note may become void. By opting for an Indiana Promissory Note with Payments Amortized for a Certain Number of Years, you aim to establish clear, fair terms that mitigate the risk of such issues arising.

The statute of limitations on a promissory note in Indiana is generally six years from the date of the default or last payment. After this period, creditors can lose the right to collect the remaining debt. This emphasizes the importance of using an Indiana Promissory Note with Payments Amortized for a Certain Number of Years to establish clear repayment expectations and timing.

Yes, there is a time limit on a promissory note, most often tied to the statute of limitations for debt collection. This time limit signifies how long a lender can enforce the terms of the note legally. By implementing an Indiana Promissory Note with Payments Amortized for a Certain Number of Years, you can clearly outline the payment schedule, avoiding confusion regarding due dates.

In Indiana, the statute of limitations for debt collection typically lasts for six years. This means that lenders have six years from the date of the last payment to file a lawsuit for recovery. Utilizing an Indiana Promissory Note with Payments Amortized for a Certain Number of Years can clarify repayment terms, providing peace of mind knowing the timeframe for legal claims.

A document that promises payment of a specific amount to a specific person is called a promissory note. This legal document outlines the borrower's obligation to repay the lender a specified sum, often detailing the payment schedule. By using an Indiana Promissory Note with Payments Amortized for a Certain Number of Years, you create a formal agreement that protects both parties and promotes trust.

To fill out a promissory note sample, begin by identifying the parties involved, including the borrower and lender. Next, specify the principal amount, interest rate, payment schedule, and any collateral involved. Utilizing a template can help you create an Indiana Promissory Note with Payments Amortized for a Certain Number of Years, ensuring that you include all necessary details and legal requirements for enforceability.

The payment on a fully amortized installment note represents both interest and principal reductions that you make during each payment period. As you continue making these payments, the principal balance decreases while the interest portion diminishes over time. When using an Indiana Promissory Note with Payments Amortized for a Certain Number of Years, this method gives you a clear understanding of your financial obligations and helps in effective budgeting.