This is a Promissory Note for use in any state. The promissory note is unsecured, with a fixed interest rate, and contains a provision for installment payments.

Indiana Unsecured Installment Payment Promissory Note for Fixed Rate

Description

How to fill out Unsecured Installment Payment Promissory Note For Fixed Rate?

You can spend several hours online attempting to locate the approved document template that meets the state and federal requirements you need. US Legal Forms offers thousands of legal forms that are examined by experts. You can download or print the Indiana Unsecured Installment Payment Promissory Note for Fixed Rate from our service.

If you already have a US Legal Forms account, you may Log In and then click the Acquire button. Afterwards, you can complete, edit, print, or sign the Indiana Unsecured Installment Payment Promissory Note for Fixed Rate. Each legal document template you purchase is yours indefinitely. To obtain another copy of any acquired form, navigate to the My documents tab and click the corresponding button.

If you are using the US Legal Forms website for the first time, follow the straightforward instructions below: First, ensure that you have selected the correct document template for the area/town you choose. Review the form outline to confirm you have selected the right form. If available, utilize the Review button to examine the document template as well. To find an additional version of the form, use the Search field to locate the template that fulfills your requirements and needs. Once you have identified the template you desire, click Buy now to proceed. Choose the pricing plan you prefer, enter your details, and register for an account on US Legal Forms. Complete the purchase. You can use your credit card or PayPal account to pay for the legal form. Select the format of the document and download it to your system. Make alterations to your document if necessary. You can complete, revise, sign, and print the Indiana Unsecured Installment Payment Promissory Note for Fixed Rate. Acquire and print thousands of document templates using the US Legal Forms website, which offers the largest selection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

Form popularity

FAQ

Promissory notes can be either secured or unsecured, depending on the agreement between the borrower and lender. An Indiana Unsecured Installment Payment Promissory Note for Fixed Rate is a popular choice for those who prefer not to provide collateral. This type of note allows for more accessible borrowing but may come with higher interest rates due to the associated risks.

Yes, a promissory note usually includes a fixed term or timeframe for repayment. With an Indiana Unsecured Installment Payment Promissory Note for Fixed Rate, you agree to complete your payments within a specified period, making it easier to plan your finances. This fixed timeline helps both parties understand their obligations and avoid confusion.

Promissory notes do not have to be secured, but securing a note can offer benefits to both parties. An Indiana Unsecured Installment Payment Promissory Note for Fixed Rate allows you to borrow without putting up collateral, making it easier for individuals without significant assets. However, it's essential to understand that this might lead to higher interest rates.

Yes, a promissory note can certainly be unsecured. An Indiana Unsecured Installment Payment Promissory Note for Fixed Rate does not require collateral, which means you do not have to risk your assets. This option provides borrowers with flexibility but may involve higher interest rates due to the increased risk for lenders.

An Indiana Unsecured Installment Payment Promissory Note for Fixed Rate can be considered a form of fixed income, as it specifies a set interest rate and payment schedule. This means you can expect predictable payments over the life of the note. While it provides stability, it's essential to understand that the rate of return may not be as high as other investment options. Use USLegalForms to create a note that meets your financial goals.

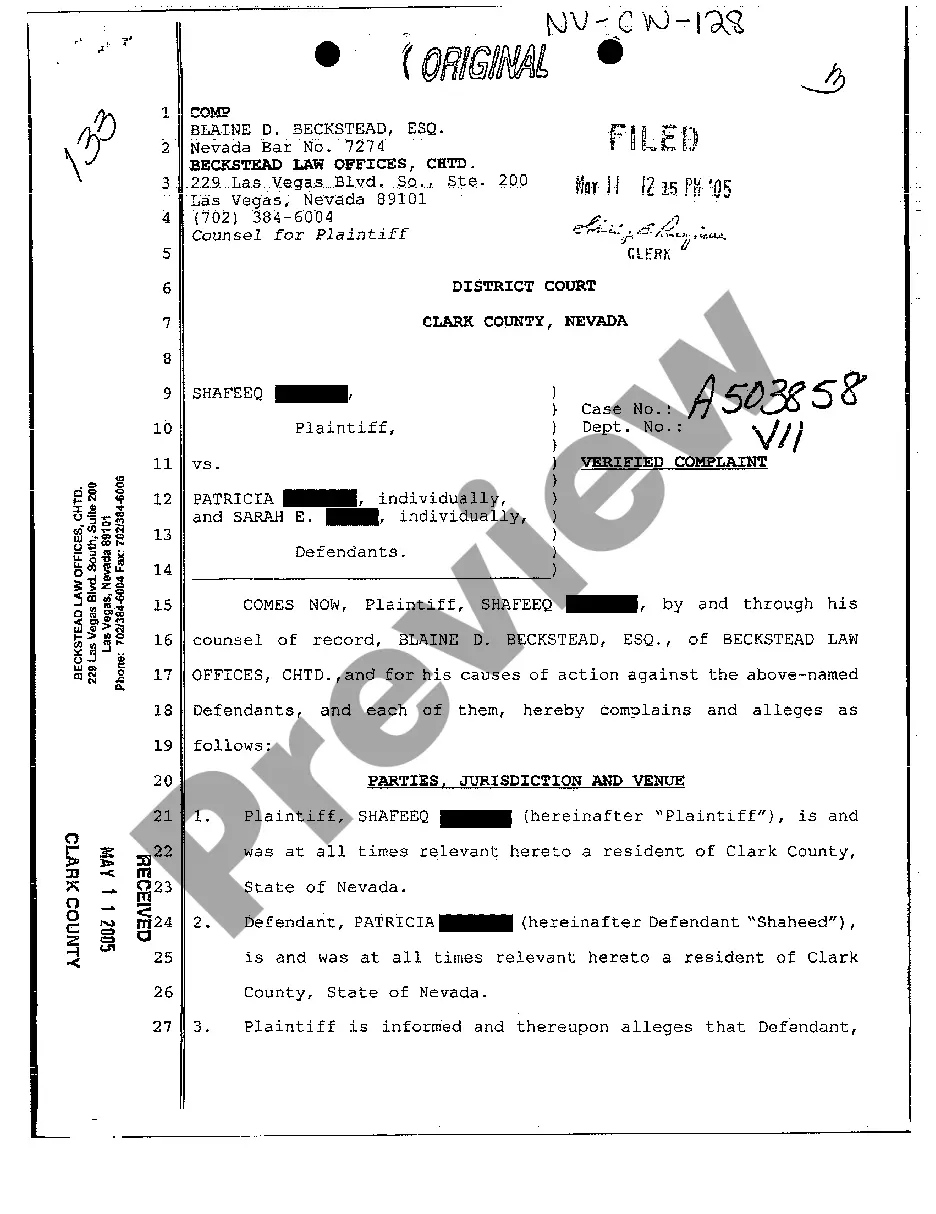

Enforcing an Indiana Unsecured Installment Payment Promissory Note for Fixed Rate typically involves sending a formal demand for payment to the borrower. If the borrower fails to respond, you may need to take legal action by filing a lawsuit in a court. Keeping detailed records of all communications and payments is crucial for strengthening your case. USLegalForms offers guidance and templates that can simplify this process for you.

To create a valid Indiana Unsecured Installment Payment Promissory Note for Fixed Rate, ensure it includes essential elements like the date, the amount borrowed, the interest rate, and the repayment schedule. Both parties must sign the document for it to be legally binding. Additionally, it is wise to include the terms and conditions that govern the agreement to avoid misunderstandings in the future. You can find comprehensive templates and resources on platforms like USLegalForms to assist you.

A promissory note does not necessarily need to be notarized to be legal; however, notarization adds an extra layer of validity. While many states, including Indiana, allow for an unsecured promissory note to be enforceable without notarization, having it notarized can help prevent disputes later. Consider using the Indiana Unsecured Installment Payment Promissory Note for Fixed Rate for a clear and legally sound agreement.

To write up a legal IOU, start by stating the amount owed and the names of both the debtor and creditor. Clearly outline the terms of repayment, including any interest rates or payment deadlines. While an IOU is less formal than a promissory note, using the Indiana Unsecured Installment Payment Promissory Note for Fixed Rate can provide a more structured approach to documenting the debt.

To obtain a legal promissory note, you can start by visiting a reliable platform like US Legal Forms. They offer templates specifically designed for an Indiana Unsecured Installment Payment Promissory Note for Fixed Rate. Simply choose the right template, customize it to fit your needs, and ensure that both parties sign the document. This process helps you create a legally binding agreement that outlines the terms of repayment.