Indiana Assignment and Bill of Sale to Corporation

Description

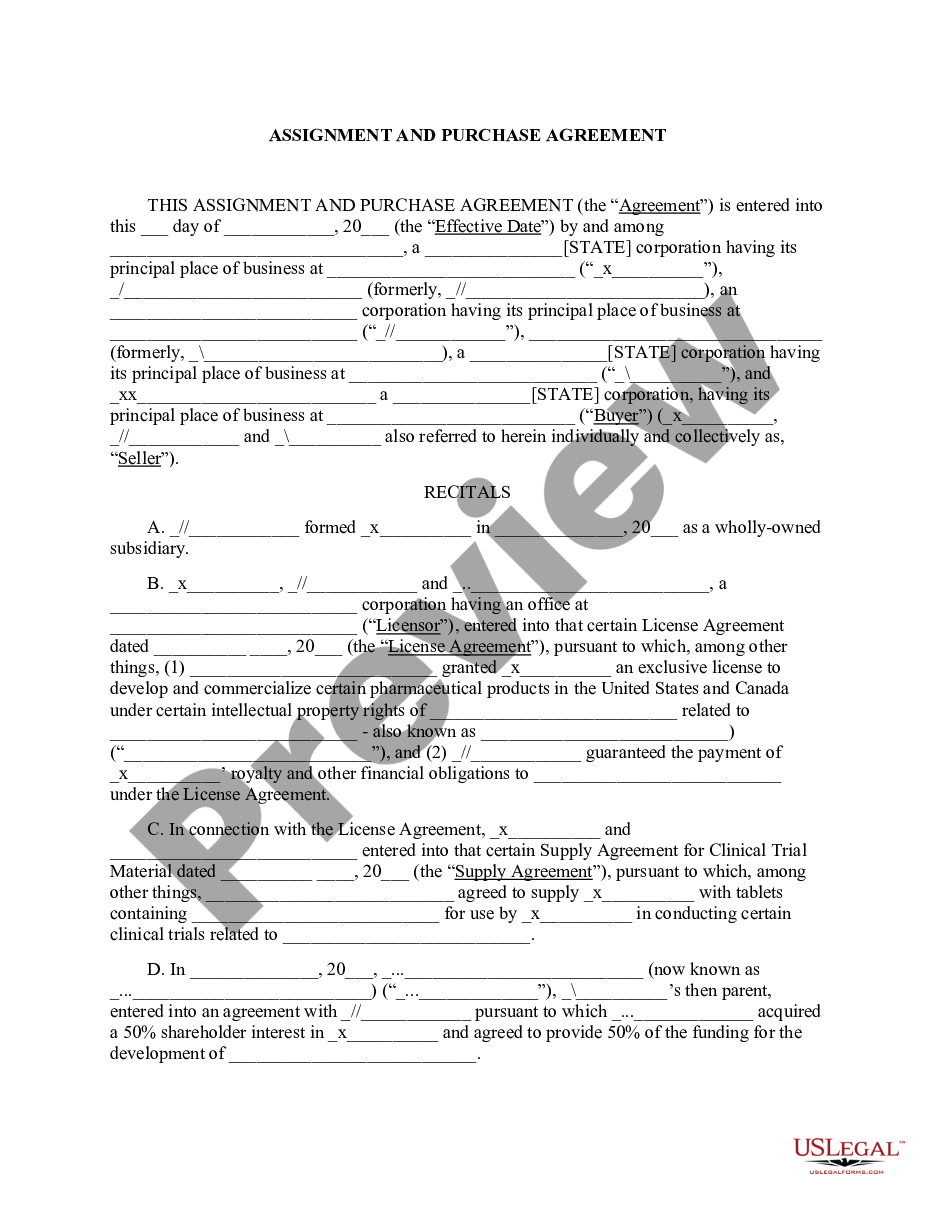

How to fill out Assignment And Bill Of Sale To Corporation?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a wide array of legal template formats that you can download or print. By using the website, you can access thousands of forms for business and personal use, organized by categories, states, or keywords.

You can find the latest versions of forms such as the Indiana Assignment and Bill of Sale to Corporation in moments.

If you have a subscription, Log In to obtain the Indiana Assignment and Bill of Sale to Corporation from the US Legal Forms library. The Download button will appear on each form you examine. You can access all previously downloaded forms in the My documents tab of your account.

Process the payment. Use your credit card or PayPal account to complete the purchase.

Choose the format and download the form to your device. Make modifications. Fill out, modify, and print/sign the downloaded Indiana Assignment and Bill of Sale to Corporation. Every template you added to your account has no expiration date and belongs to you permanently. So, if you need to download or print another copy, simply go to the My documents section and click on the form you want. Access the Indiana Assignment and Bill of Sale to Corporation with US Legal Forms, the most extensive library of legal document formats. Utilize numerous professional and state-specific templates that meet your business or personal requirements.

- If you are using US Legal Forms for the first time, here are simple steps to get started.

- Ensure you have selected the correct form for your area/county.

- Tap the Review button to examine the form's content.

- Check the form details to confirm you have chosen the right one.

- If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Purchase now button.

- Then, select your preferred pricing plan and enter your information to register for an account.

Form popularity

FAQ

Yes, a notarized bill of sale serves as proof of ownership, especially when the document is executed correctly and includes all necessary information. By utilizing an Indiana Assignment and Bill of Sale to Corporation, you gain extra assurance that the document has been verified by a notary public. This adds credibility to your transaction and can help resolve disputes about ownership in the future.

To make a bill of sale legally binding in Indiana, ensure that both parties clearly understand and agree to the terms outlined in the document. Including the date, signatures of both parties, and a thorough description of the item being sold adds to the document's validity. By crafting a well-structured Indiana Assignment and Bill of Sale to Corporation, you enhance its enforceability and safeguard against potential disputes.

To transfer a title in Indiana, the seller must complete the title assignment on the back of the title and provide a bill of sale if necessary. By executing an Indiana Assignment and Bill of Sale to Corporation, you ensure that the transfer of ownership is documented properly. Make sure to submit all required paperwork to your local Indiana Bureau of Motor Vehicles for a successful title transfer.

In Indiana, a bill of sale does not replace a title, but it can be used alongside the title to demonstrate ownership. When you complete an Indiana Assignment and Bill of Sale to Corporation, you can use this document to complement the existing title during a vehicle transfer. However, it’s essential to check local regulations regarding title transfers and registration.

Yes, a bill of sale is a legally binding document that transfers ownership of an item from one party to another. When you create an Indiana Assignment and Bill of Sale to Corporation, it serves as a receipt for the transaction and can be enforced in a court of law if necessary. It’s important to ensure that all parties involved understand their rights and obligations outlined in the document.

The purpose of an assignment agreement is to formalize the transfer of rights between parties. It outlines the specifics regarding what is being assigned and under what terms. By incorporating an Indiana Assignment and Bill of Sale to Corporation, you not only document the assignment but also provide the necessary proof of ownership for your business assets.

An assignment and a sale are not the same. An assignment refers to the transfer of rights or benefits, primarily within a contract, whereas a sale involves the transfer of ownership of property. When completing an Indiana Assignment and Bill of Sale to Corporation, both elements may be included, ensuring a comprehensive transaction process.

While a bill of sale is important, it is not a substitute for a title in certain cases, such as vehicles. A bill of sale documents the transaction and shows proof of ownership, but a title serves as an official record of ownership with the state. Thus, using an Indiana Assignment and Bill of Sale to Corporation helps document the sale properly but may need to be complemented by obtaining a proper title.

Yes, a bill of sale grants title to business equipment. When you execute the document, you legally transfer ownership to the buyer. Therefore, an Indiana Assignment and Bill of Sale to Corporation provides the necessary framework for documenting this essential change of ownership.

An assignment typically focuses on the transfer of rights or benefits under a contract, while a bill of sale is specifically for tangible personal property. In the context of business, an Indiana Assignment and Bill of Sale to Corporation encompasses both aspects by facilitating both ownership and the associated rights to the property. This ensures clarity in the transaction process.