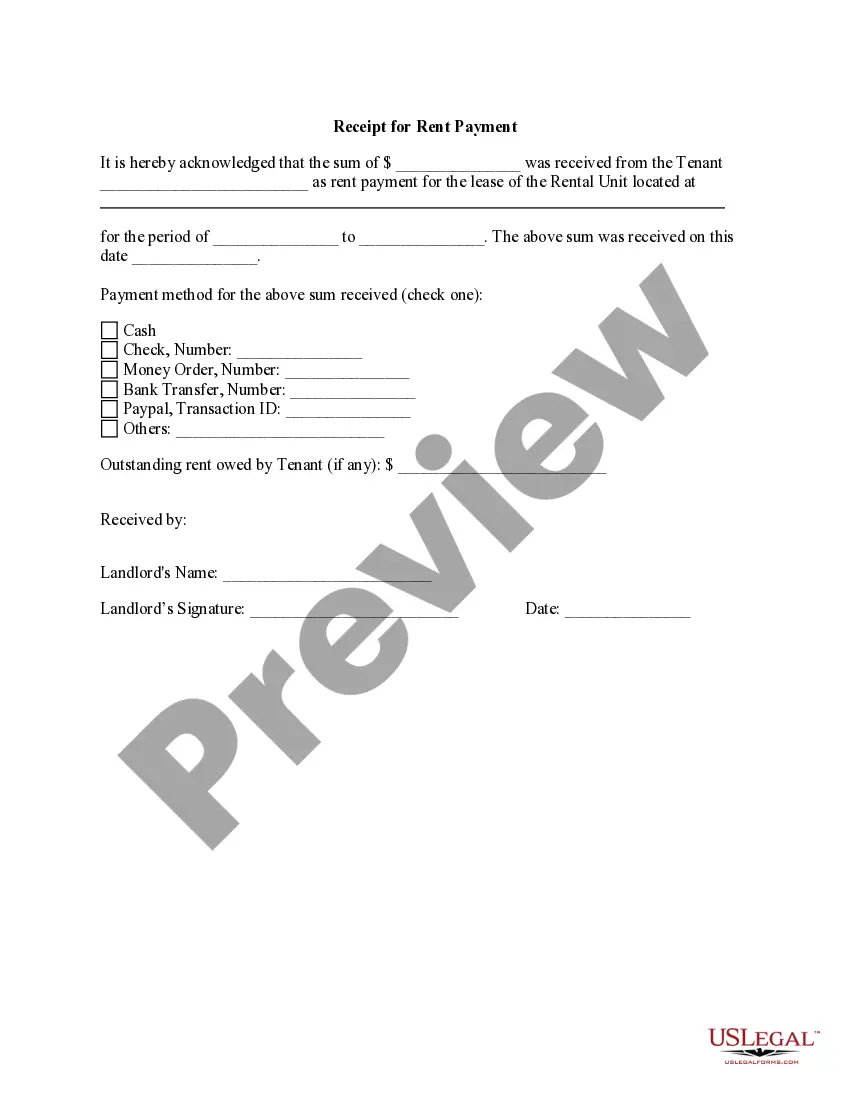

Indiana Receipt of Payment for Obligation

Description

How to fill out Receipt Of Payment For Obligation?

US Legal Forms - one of the largest libraries of lawful forms in the States - offers an array of lawful papers themes you may down load or print out. While using internet site, you may get thousands of forms for enterprise and specific reasons, categorized by types, suggests, or key phrases.You can find the most recent variations of forms such as the Indiana Receipt of Payment for Obligation within minutes.

If you currently have a subscription, log in and down load Indiana Receipt of Payment for Obligation from the US Legal Forms library. The Down load switch will appear on every single develop you view. You have access to all formerly acquired forms from the My Forms tab of your own profile.

If you want to use US Legal Forms the first time, here are basic guidelines to help you get started off:

- Be sure to have picked out the proper develop for the town/region. Select the Preview switch to check the form`s articles. See the develop information to actually have selected the right develop.

- If the develop does not suit your needs, make use of the Research discipline towards the top of the display to get the one which does.

- In case you are content with the shape, validate your choice by clicking on the Get now switch. Then, opt for the rates strategy you want and supply your credentials to sign up to have an profile.

- Procedure the purchase. Make use of bank card or PayPal profile to finish the purchase.

- Find the format and down load the shape on your product.

- Make changes. Load, change and print out and indication the acquired Indiana Receipt of Payment for Obligation.

Each and every format you included with your account lacks an expiration particular date and it is the one you have permanently. So, in order to down load or print out one more copy, just check out the My Forms portion and click on in the develop you will need.

Gain access to the Indiana Receipt of Payment for Obligation with US Legal Forms, one of the most substantial library of lawful papers themes. Use thousands of specialist and condition-particular themes that fulfill your company or specific requirements and needs.

Form popularity

FAQ

Tax Warrants are issued to individuals who have not paid the appropriate individual income taxes, sales tax liabilities or corporate tax liabilities as required by the Indiana Department of Revenue. The Department of Revenue will also add additional fees, penalties and interest associated with these assessments.

The Indiana Department of Revenue's (DOR) Secondary Review Request is a process to review an adjustment to a tax return or to review DOR application denials. You should have received a letter detailing the adjustment to the return or the application denial.

The state income tax rate is 3.23%, and the sales tax rate is 7%. Indiana offers tax deductions and credits to reduce your tax liability, including deductions for renters and homeowners, an earned income tax credit (EITC) and a credit for senior citizens.

Enter your parcel number, name, or street name to view your invoice. Use an e-Check or credit card to make a payment. After you make an online payment, it can take up to five business days for your tax bill to be updated with your new balance.

Indiana's ePay system allows individuals and businesses to make bill payments, estimated tax payments, extension payments and balance due income tax payments. You do not need to register an online account with the ePay system. Go to and click on ?Get Started? near the bottom of the page.

Paying online; or. Completing Form ES-40 and mailing it with your payment.