Indiana Assignment of Debt

Description

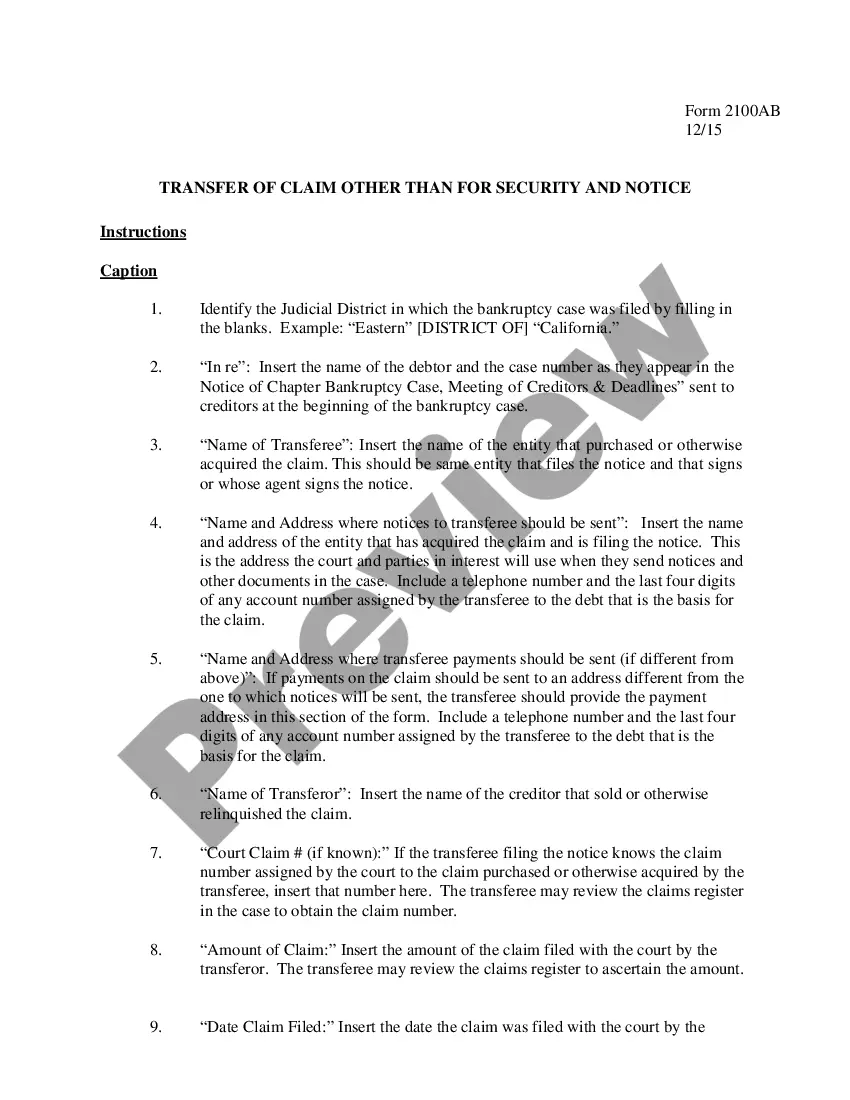

How to fill out Assignment Of Debt?

You can dedicate time online looking for the legal document template that satisfies the state and federal requirements you will require.

US Legal Forms presents thousands of legal variations which may be examined by professionals.

You can conveniently download or print the Indiana Assignment of Debt from my services.

If available, use the Review button to browse through the document template as well. If you wish to obtain another version of the form, utilize the Search area to find the template that fits your needs and requirements.

- If you possess a US Legal Forms account, you can Log In and then click the Download button.

- After that, you can complete, modify, print, or sign the Indiana Assignment of Debt.

- Every legal document template you obtain is yours permanently.

- To retrieve another copy of a purchased form, visit the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions outlined below.

- First, ensure that you have selected the correct document template for the county/city of your choice.

- Review the form outline to confirm you have chosen the correct type.

Form popularity

FAQ

Proof of debt assignment typically refers to the documentation that confirms a debt has been transferred from one party to another. This may include an assignment agreement, proof of claims, or notification letters. To navigate the complexities of the Indiana Assignment of Debt effectively, using platforms such as US Legal Forms can help you obtain and prepare the necessary documentation.

Yes, an assignment of debt often needs to be in writing to be enforceable in Indiana. Written documentation provides a clear record of the transfer and helps protect the rights of both parties involved. If you're dealing with an Indiana Assignment of Debt, it's advisable to utilize services like US Legal Forms to ensure your paperwork is accurate and legally binding.

In Indiana, the statute of limitations typically gives creditors six years to collect a debt. After this period, a debt may be considered uncollectible in most cases, meaning that the creditor cannot legally pursue payment. Familiarizing yourself with the timelines related to the Indiana Assignment of Debt is crucial for managing your financial obligations.

For an assignment to be valid in Indiana, it must involve a clear transfer of rights from the original creditor to the assignee. This means that the debtor should be informed, and any necessary documentation should be properly executed. Understanding the regulations surrounding the Indiana Assignment of Debt helps ensure compliance and smooth transactions.

In Indiana, debt collectors are required to provide you with a written notice about the debt they are collecting. This notice must include the amount owed, the name of the creditor, and your rights as a debtor. If you have questions about your rights regarding the Indiana Assignment of Debt, you can refer to reliable sources or legal platforms like US Legal Forms for guidance.

To get out of debt in Indiana, start by assessing your financial situation and creating a budget. You can consider options like debt relief programs, credit counseling, or even negotiating with creditors. Utilizing resources based on the Indiana Assignment of Debt can guide you through this process effectively. Taking these steps can lead you toward financial freedom.

The 777 rule refers to a method that helps individuals manage interactions with debt collectors. It involves taking specific steps to ensure your rights are protected, especially under the Indiana Assignment of Debt. Understanding this rule can prevent collectors from engaging in aggressive tactics. You can feel more confident in addressing financial issues by knowing your rights.

Yes, debt forgiveness programs do exist, and they provide significant relief for qualifying individuals. These programs can eliminate a portion of your debt or forgive certain types altogether, depending on your situation. In the context of the Indiana Assignment of Debt, many residents may find viable opportunities through state-supported options. Exploring these programs can lead to a brighter financial future.

The Indiana debt relief program offers various options for residents struggling with debt. This program provides services that can reduce debt amounts through negotiation and settlement. By leveraging the Indiana Assignment of Debt, individuals can discover effective strategies for managing their debts. This program can be a vital resource on your journey to financial recovery.

Indeed, there are government-sponsored debt relief programs designed to assist individuals facing financial hardship. These initiatives aim to educate and provide resources for debt management and reduction. Under the Indiana Assignment of Debt, residents can learn about options that may be available to them. Utilizing these resources can help you regain control over your financial situation.