Indiana Rental Application Form

Description

How to fill out Rental Application Form?

Finding the appropriate legal document template can be a challenge.

Clearly, there are numerous templates accessible online, but how can you locate the legal form you require.

Make use of the US Legal Forms website.

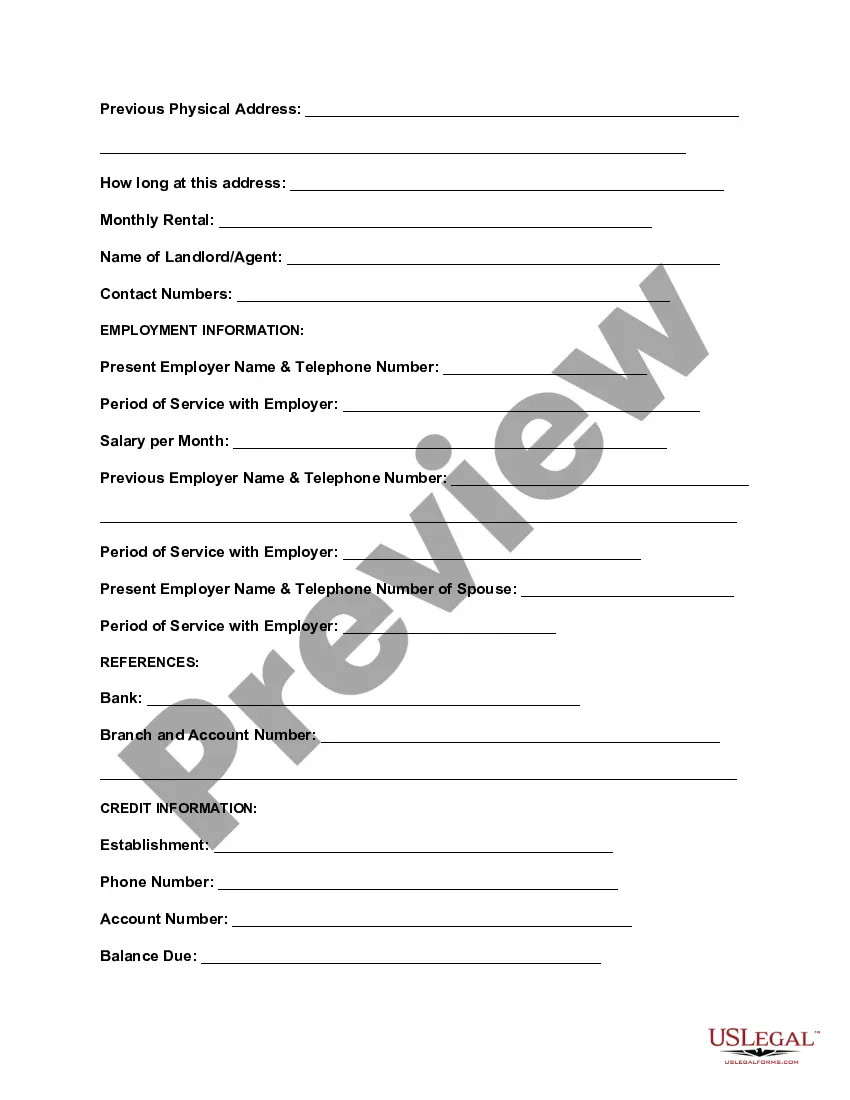

First, ensure you have chosen the correct form for your area/county. You can view the form using the Preview button and review the form details to confirm it is the right one for you.

- The service offers a multitude of templates, such as the Indiana Rental Application Form, suitable for business and personal needs.

- All forms are verified by professionals and comply with federal and state regulations.

- If you are currently registered, Log In to your account and click the Download button to get the Indiana Rental Application Form.

- Use your account to access the legal forms you have previously acquired.

- Go to the My documents section of your account and download another copy of the document you require.

- If you are a new user of US Legal Forms, here are simple steps to follow.

Form popularity

FAQ

While many landlords may require that tenants make three times the rent, this is not universally true. Each landlord or property management company has specific criteria which may vary significantly. Review the requirements when completing your Indiana Rental Application Form to understand what is expected. Being transparent about your financial situation can help you clarify any concerns before applying.

Getting approved for a rental can vary based on various factors, including your financial situation and the specific property. Many landlords require thorough vetting, including credit checks and income verification, as outlined in the Indiana Rental Application Form. If you meet the criteria and present yourself positively, the process can be straightforward. Understanding what landlords seek can help make your application stronger.

The chances of not getting approved for an apartment depend largely on your financial background and the specifics of your Indiana Rental Application Form. If your credit score is low or your income does not meet the minimum requirements, approval chances can decrease. However, demonstrating reliable income, positive rental history, and good credit can significantly improve your chances. Stay informed about what landlords typically look for.

A landlord may refuse rent due to various factors, including potential tenants’ financial stability, rental history, or incomplete applications. When filling out the Indiana Rental Application Form, providing accurate information can help alleviate concerns. Additionally, some landlords might refuse rent if they believe the tenant will adversely affect the property or community. It's important to understand each landlord's unique criteria.

To increase the number of rental applications you receive, consider refining your advertising strategies and reaching out to local community groups. Use online platforms and social media to promote your available properties. Make sure the Indiana Rental Application Form is easily accessible and clearly outlines the requirements. Engaging visuals and clear descriptions can also attract more potential renters.

Rental applications can be denied for several reasons, including insufficient income, poor credit history, or unfavorable rental history. It's essential to understand the criteria that landlords use for the Indiana Rental Application Form. Generally, it is not uncommon for 25% to 30% of applications to face denial. By preparing well and submitting a strong application, you can improve your chances significantly.

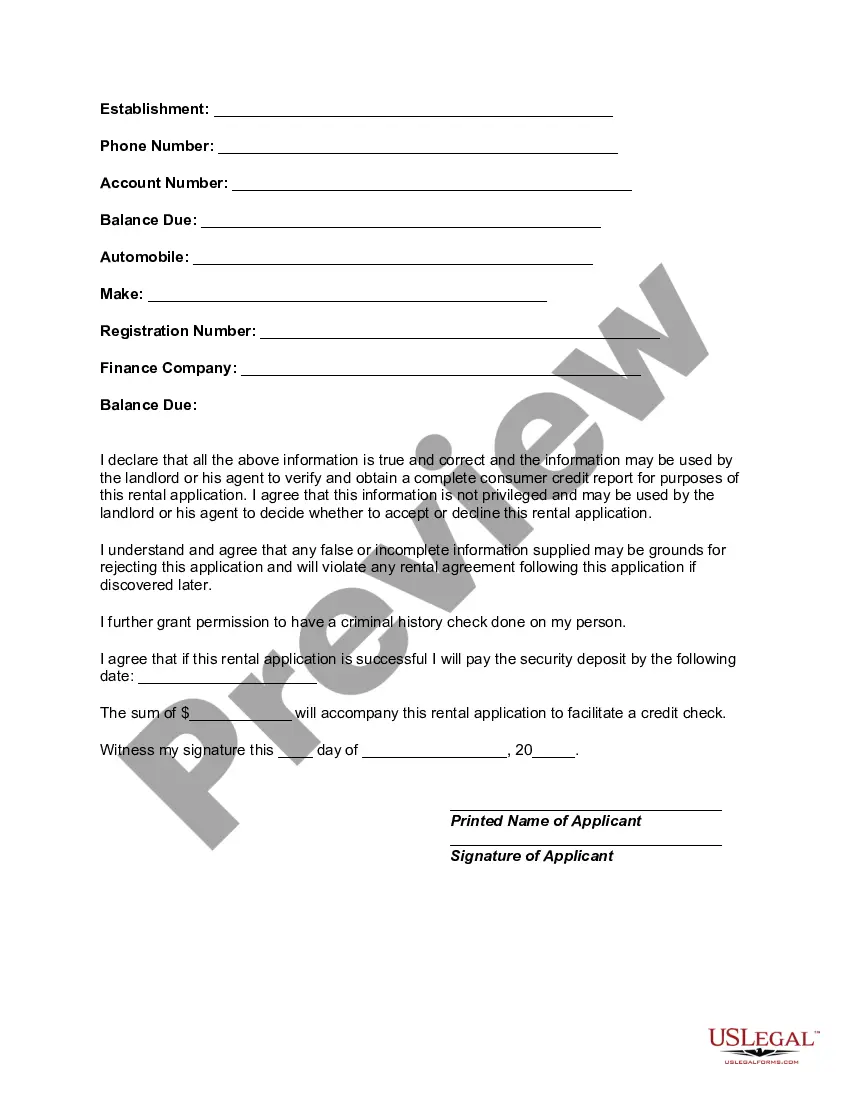

You are not required to provide your bank account number on an Indiana Rental Application Form unless it is specifically requested by the landlord. However, keep in mind that some landlords may prefer this information for background checks or to facilitate rent payments. If you are hesitant, communicate openly with the landlord to clarify your concerns.

To make your Indiana Rental Application Form stand out, be thorough and honest in your responses. Include a cover letter that highlights your qualities as a tenant, such as strong references and consistent payment history. Additionally, offering to provide a larger security deposit or demonstrating flexibility with lease terms can show landlords that you are a serious candidate.

Sharing your bank account number on an Indiana Rental Application Form can be safe, but it is important to take precautions. Always verify the legitimacy of the landlord or property management company before providing sensitive information. If you feel uneasy, consider discussing alternative payment arrangements that do not require sharing your bank account details.

Yes, it is common for landlords to request a checking account number as part of the application process. Landlords may use this information to verify your financial stability or to set up automatic payment options for your rent. However, always ensure that you are comfortable with the landlord's request and that it aligns with your personal privacy preferences.