This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Indiana Assignment of Portion for Specific Amount of Money of Interest in Estate in Order to Pay Indebtedness

Description

How to fill out Assignment Of Portion For Specific Amount Of Money Of Interest In Estate In Order To Pay Indebtedness?

US Legal Forms - one of several greatest libraries of authorized kinds in the States - provides a wide range of authorized papers web templates you may obtain or print. Utilizing the internet site, you can find a huge number of kinds for company and person functions, categorized by categories, suggests, or keywords and phrases.You will find the most recent models of kinds just like the Indiana Assignment of Portion for Specific Amount of Money of Interest in Estate in Order to Pay Indebtedness within minutes.

If you have a subscription, log in and obtain Indiana Assignment of Portion for Specific Amount of Money of Interest in Estate in Order to Pay Indebtedness from your US Legal Forms library. The Obtain switch can look on each and every type you look at. You have access to all formerly downloaded kinds inside the My Forms tab of the account.

In order to use US Legal Forms for the first time, here are basic recommendations to obtain started:

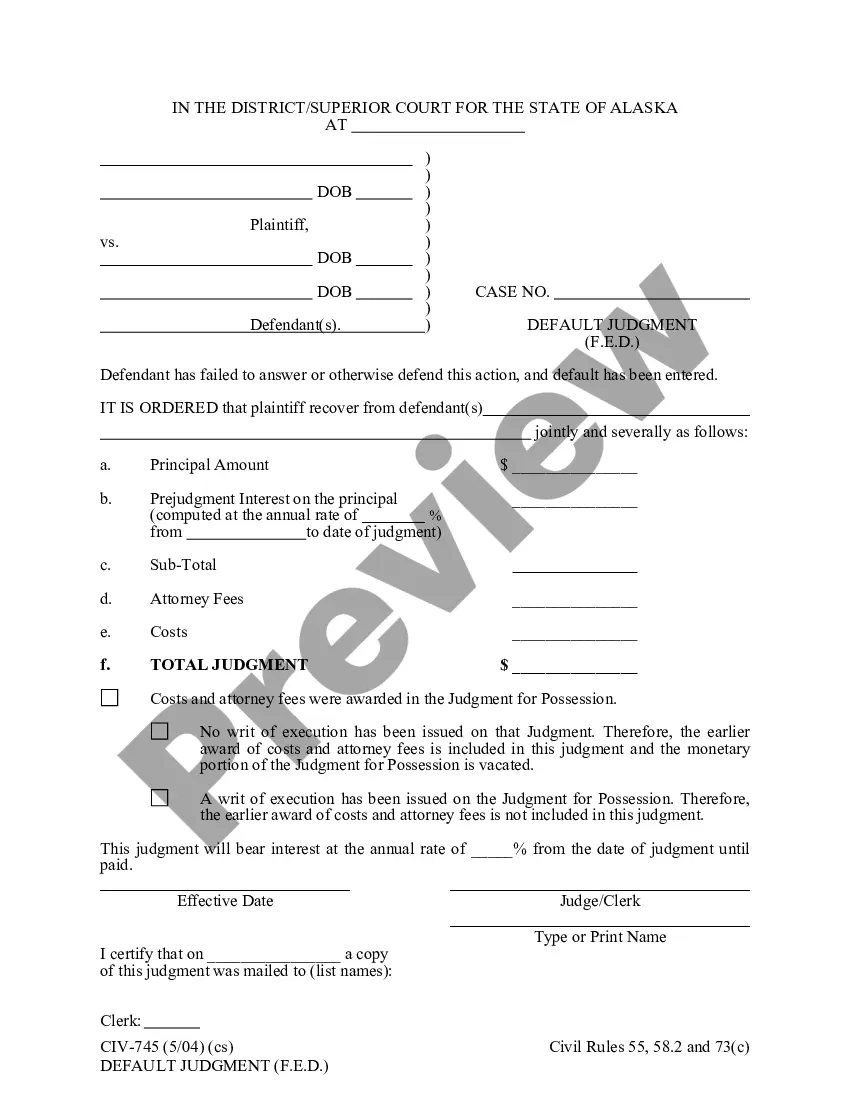

- Make sure you have selected the right type for your personal area/area. Click on the Review switch to review the form`s information. Browse the type information to actually have chosen the correct type.

- When the type does not suit your needs, use the Lookup discipline near the top of the display to obtain the one which does.

- When you are happy with the shape, confirm your decision by visiting the Purchase now switch. Then, opt for the pricing plan you like and provide your credentials to register on an account.

- Approach the purchase. Make use of your credit card or PayPal account to accomplish the purchase.

- Pick the formatting and obtain the shape on your own gadget.

- Make alterations. Load, revise and print and indicator the downloaded Indiana Assignment of Portion for Specific Amount of Money of Interest in Estate in Order to Pay Indebtedness.

Every format you added to your account does not have an expiration particular date and it is yours forever. So, if you want to obtain or print one more copy, just proceed to the My Forms segment and click on in the type you want.

Get access to the Indiana Assignment of Portion for Specific Amount of Money of Interest in Estate in Order to Pay Indebtedness with US Legal Forms, one of the most comprehensive library of authorized papers web templates. Use a huge number of specialist and condition-specific web templates that satisfy your small business or person demands and needs.

Form popularity

FAQ

(a) When a person dies, the person's real and personal property passes to persons to whom it is devised by the person's last will or, in the absence of such disposition, to the persons who succeed to the person's estate as the person's heirs; but it shall be subject to the possession of the personal representative and ...

(g) Except as provided in subsection (h), the will of the decedent shall not be admitted to probate unless the will is presented for probate before the latest of the following dates: (1) Three (3) years after the individual's death.

Specifically, Indiana law prohibits debt collectors from making false or deceptive statements, communicating with third parties about the debt, or threatening to take illegal action. Indiana law also protects the wages of consumers from garnishment.

(d) All claims barrable under subsection (a) shall be barred if not filed within nine (9) months after the death of the decedent. (e) Nothing in this section shall affect or prevent any action or proceeding to enforce any mortgage, pledge, or other lien upon property of the estate.

Statute of Limitations in Indiana If the collection agency does not file within the time frame, the consumer can no longer be sued for that specific debt. In Indiana, the statute of limitations is six years and begins on the date of the last payment on an account.

Section 32-17-14-12 - Transfer on death transfers of tangible personal property (a) A deed of gift, bill of sale, or other writing intended to transfer an interest in tangible personal property is effective on the death of the owner and transfers ownership to the designated transferee beneficiary if the document: (1) ...

The short answer is that an Executor is not liable for the Deceased's debts. However, an Executor is liable for any errors or omissions made in the course of administering an Estate. This includes failing to pay debts or liabilities of the Estate.

Code § 29-1-2-1. Adultery or abandonment. If you are separated from your spouse and "living in adultery" at the time of your spouse's death, or if you have abandoned your spouse without just cause, you will not receive a share of your spouse's estate. Ind.