This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Indiana General Form of Claim or Notice of Lien By General Contractor

Description

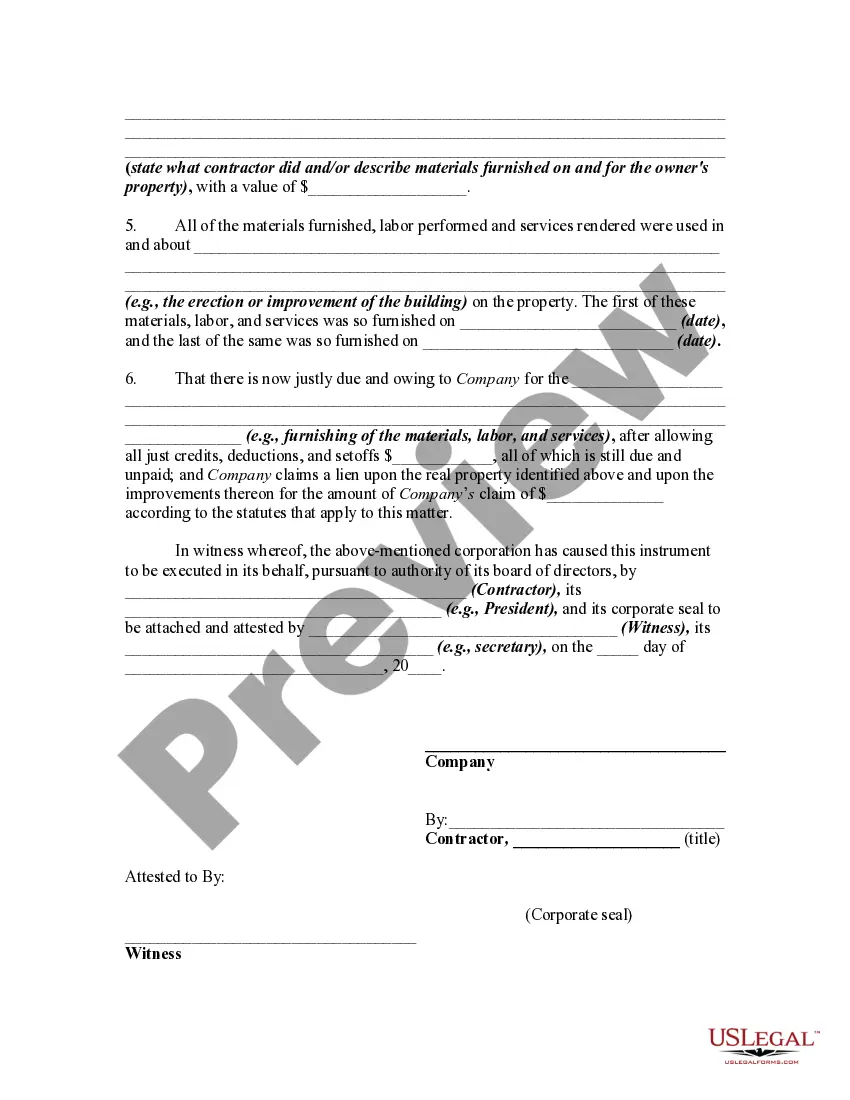

How to fill out General Form Of Claim Or Notice Of Lien By General Contractor?

US Legal Forms - one of the finest collections of legal documents in the USA - provides a variety of legal paper templates you can download or print.

On the website, you can discover thousands of forms for business and personal needs, categorized by groups, states, or keywords.

You can find the latest versions of documents such as the Indiana General Form of Claim or Notice of Lien By General Contractor in moments.

If the form does not meet your requirements, use the Search box at the top of the screen to find one that does.

Once you are satisfied with the form, confirm your choice by clicking on the Download now button. Then select the payment plan you desire and provide your details to register for an account.

- If you already have a membership, Log In and download the Indiana General Form of Claim or Notice of Lien By General Contractor from the US Legal Forms catalog.

- The Download button will appear on every form you view.

- You have access to all previously downloaded forms in the My documents section of your account.

- If you wish to use US Legal Forms for the first time, here are simple steps to help you get started.

- Ensure to have selected the correct form for your region/state.

- Select the Preview button to examine the content of the form.

Form popularity

FAQ

The lien law in Indiana allows contractors, subcontractors, and suppliers to file a claim against a property to secure payment for services. This law is designed to protect the rights of those who provide labor and materials. Understanding these regulations ensures you engage in lawful practices and protect your interests during construction projects.

To confirm a lien release in Indiana, you can check public records at your county recorder's office or online database. By reviewing any filed documents and ensuring they include the proper Indiana General Form of Claim or Notice of Lien By General Contractor, you can verify that the claim has indeed been released.

A lien can last for up to one year in Indiana, unless it is extended by further action. If the lien is not enforced through court action within that one-year period, it will be automatically released. It is essential to manage and monitor any claims made against your property to ensure you are aware of your obligations.

In Indiana, a contractor has 60 days after the completion of a project to file a lien. If the work is not completed, the timeline is based on the agreed completion date. By using the Indiana General Form of Claim or Notice of Lien By General Contractor appropriately, contractors can protect their right to payment.

In Indiana, any contractor, subcontractor, or suppliers who provide labor or materials for a construction project can place a lien on your house. This process is typically initiated using the Indiana General Form of Claim or Notice of Lien By General Contractor. The lien serves as a legal claim against your property, ensuring that those who contributed to the project receive compensation. To protect yourself, it's essential to understand your rights and responsibilities in such situations.

To put a lien on someone's property in Indiana, you must first file the Indiana General Form of Claim or Notice of Lien By General Contractor with the local county recorder. Ensure that you provide all relevant details, including the property address and the amount owed. Filing must occur within 90 days after your last work or delivery to be valid. If you're unsure of the process, platforms like USLegalForms can offer templates and assistance.

In Indiana, contractors generally need a contract to file a lien on a property. However, if they provide services or material and you accepted their work, they may still have a claim. It's best to have a written agreement to clarify terms and avoid surprises later. If you find yourself facing a lien, consulting resources like USLegalForms can provide guidance.

In Indiana, a mechanic's lien lasts for one year from the date of filing. If payment is not received within this timeframe, you may need to pursue foreclosure of the lien in the court. It’s essential to be proactive and vigilant in managing your liens to ensure they do not expire without taking action. Keeping informed about deadlines will help in your recovery efforts.

To file a construction lien in Indiana, complete the Indiana General Form of Claim or Notice of Lien By General Contractor. After that, submit the form to the local county recorder's office where the property is located. It's crucial to be aware of the 90-day deadline after your last service or material delivery to ensure your lien is valid. Ensure that you keep all documentation organized to support your claim.

Indiana does not require a notice of commencement for construction projects. However, issuing this notice can promote transparency between contractors and property owners. By providing this documentation, both parties can stay informed about the commencement of work and the potential for liens. While it's not mandatory, it can be beneficial for all involved.