Pursuant to 15 USC 1692g (Sec. 809 of the Federal Debt Collection Practices Act), a debtor is allowed to challenge the validity of a debt that a collection agency states you owe to the creditor they represent. Use this form letter requires that the agency verify that the debt is actually the alleged creditor's and owed by the alleged debtor.

Arizona Letter Denying that Alleged Debtor Owes Any Part of Debt and Requesting a Collection Agency to Validate that Alleged Debtor Owes such a Debt

Description

How to fill out Letter Denying That Alleged Debtor Owes Any Part Of Debt And Requesting A Collection Agency To Validate That Alleged Debtor Owes Such A Debt?

Are you in a situation where you require documentation for either business or personal reasons almost on a daily basis? There is a wide array of legal document templates available online, but finding forms that you can rely on can be challenging.

US Legal Forms provides thousands of document templates, including the Arizona Letter Denying that Alleged Debtor Owes Any Part of Debt and Requesting a Collection Agency to Validate that Alleged Debtor Owes such a Debt, designed to fulfill state and federal requirements.

If you are already familiar with the US Legal Forms website and have an account, simply Log In. After that, you can download the Arizona Letter Denying that Alleged Debtor Owes Any Part of Debt and Requesting a Collection Agency to Validate that Alleged Debtor Owes such a Debt template.

Access all the document templates you have purchased from the My documents menu. You can obtain another copy of the Arizona Letter Denying that Alleged Debtor Owes Any Part of Debt and Requesting a Collection Agency to Validate that Alleged Debtor Owes such a Debt at any time, if needed. Just click on the required document to download or print the template.

Utilize US Legal Forms, the most comprehensive collection of legal documents, to save time and avoid mistakes. The service provides professionally crafted legal document templates that can be utilized for various purposes. Create an account on US Legal Forms and start making your life a little easier.

- Locate the document you need and ensure it corresponds to the correct city/area.

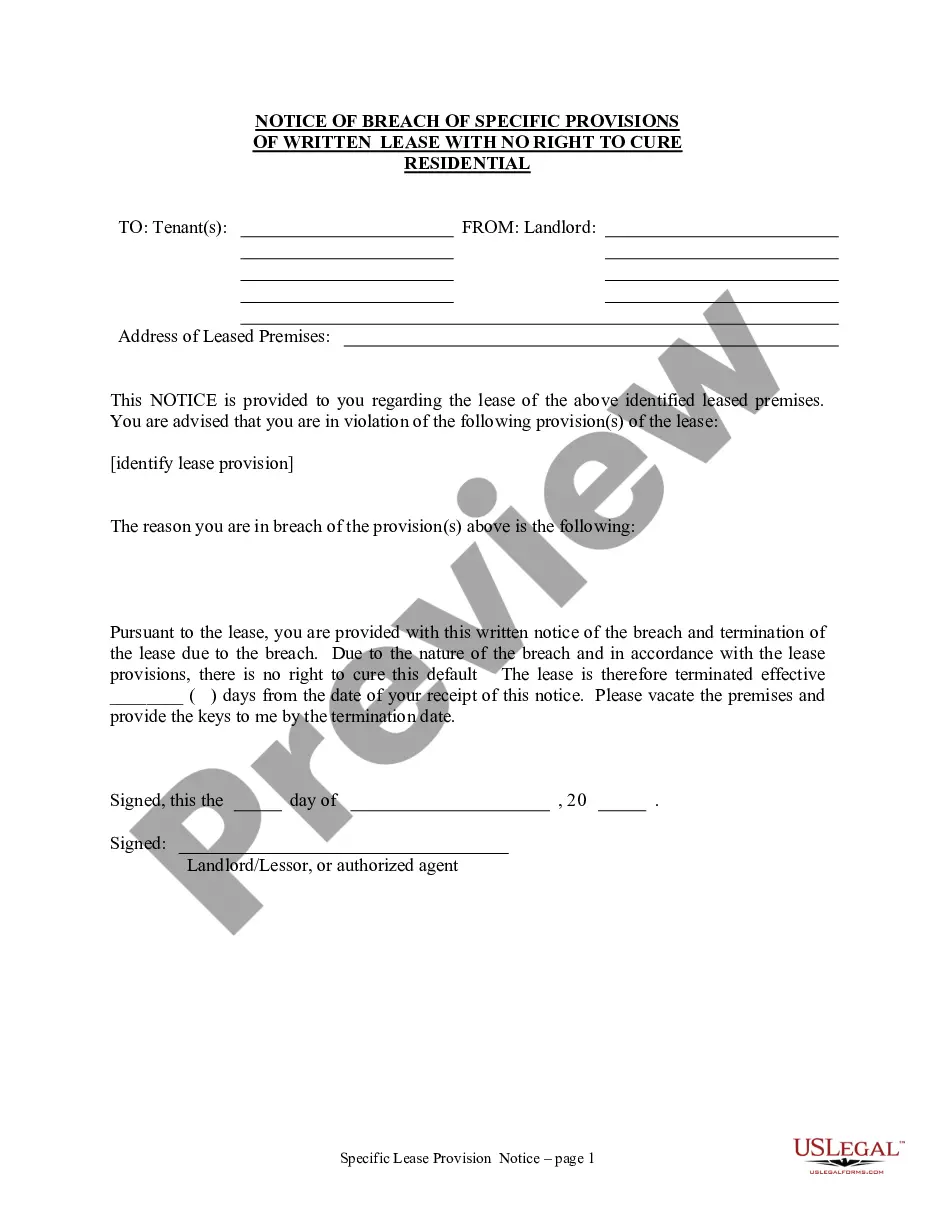

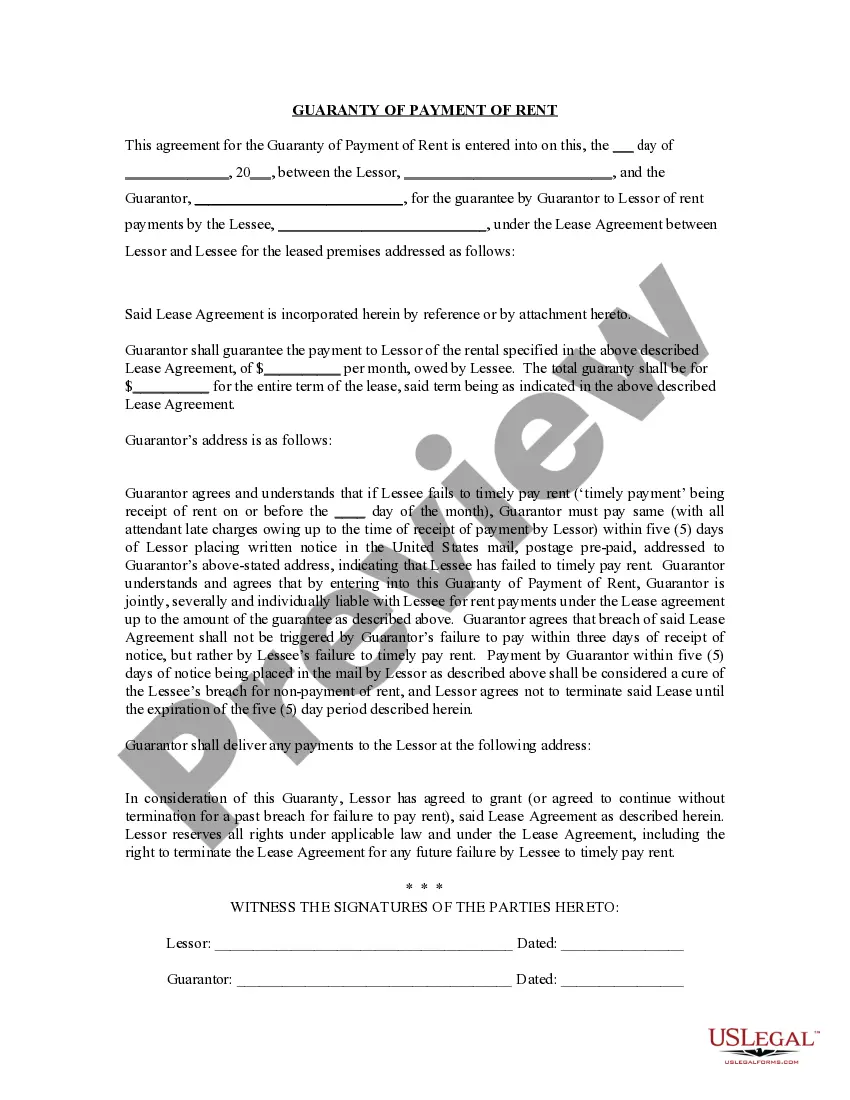

- Use the Preview button to review the form.

- Check the description to ensure you have selected the right document.

- If the document is not what you are looking for, utilize the Search section to find the form that suits your needs and requirements.

- Once you find the correct document, click Get now.

- Choose the pricing plan you prefer, fill in the required details to create your account, and place an order using your PayPal or credit card.

- Select a convenient document format and download your copy.

Form popularity

FAQ

The best sample for a debt validation letter is one that follows a clear structure, starting with your contact information, the collector’s information, and a concise request for validation. Ensure it includes the phrase 'Arizona Letter Denying that Alleged Debtor Owes Any Part of Debt and Requesting a Collection Agency to Validate that Alleged Debtor Owes such a Debt' to reinforce your intent. Additionally, finding templates on platforms like uslegalforms can guide you in drafting an effective letter.

The Federal Trade Commission advises that you be as specific as possible in the letter about the reason why you think you do not owe this debt (or owe all of it, if you're disputing the amount), but you should give as little personal information as possible in the letter.

The debt dispute letter should include your personal identifying information; verification of the amount of debt owed; the name of the creditor for the debt; and a request the debt not be reported to credit reporting agencies until the matter is resolved or have it removed from the report, if it already has been

If a debt collector fails to verify the debt but continues to go after you for payment, you have the right to sue that debt collector in federal or state court. You might be able to get $1,000 per lawsuit, plus actual damages, attorneys' fees, and court costs.

A debt validation letter is what a debt collector sends you to prove that you owe them money. This letter shows you the details of a specific debt, outlines what you owe, who you owe it to, and when they need you to pay. Get help with your money questions.

If you have inaccurate or incomplete collection accounts on your credit report, the Fair Credit Reporting Act gives you the power to dispute this information directly with the credit bureaus or creditor. You can send a dispute using the dispute form on each credit bureau's website.

At a minimum, proper debt validation should include an account balance along with an explanation of how the amount was derived. But most debt collectors respond with an account statement from the original creditor as debt validation and that's generally considered sufficient.

A debt validation letter should include the name of your creditor, how much you supposedly owe, and information on how to dispute the debt. After receiving a debt validation letter, you have 30 days to dispute the debt and request written evidence of it from the debt collector.

Address the letter to the collection agency that reported the debt to the credit bureau. State that you're requesting validation of the debt or removal of the debt from your credit report. Then mail the letter and request a return receipt so you have proof that you sent it and that the collection agency received it.

Format the letter thusly: Your full name and address. The collections agency's name and address. A request for the amount of the debt claimed to be owed. A request for the name of the original creditor. A request for the judgment information (if applicable) A request for proof of the company's license.