Pursuant to 15 USC 1692g (Sec. 809 of the Federal Debt Collection Practices Act), a debtor is allowed to challenge the validity of a debt that a collection agency states you owe to the creditor they represent. Use this form letter requires that the agency verify that the debt is actually the alleged creditor's and owed by the alleged debtor.

Guam Letter Requesting a Collection Agency to Validate a Debt that You Allegedly Owe a Creditor

Description

How to fill out Letter Requesting A Collection Agency To Validate A Debt That You Allegedly Owe A Creditor?

Selecting the appropriate legal documents format can be quite challenging.

Naturally, there are numerous templates available online, but how will you find the legal form you require.

Utilize the US Legal Forms website. The platform offers a vast selection of templates, such as the Guam Letter Requesting a Collection Agency to Validate a Debt that You Allegedly Owe a Creditor, which can be utilized for business and personal purposes.

You can view the form using the Preview button and review the form description to ensure it is suitable for you.

- All of the forms are reviewed by experts and comply with state and federal regulations.

- If you are already registered, Log In to your account and click the Download button to retrieve the Guam Letter Requesting a Collection Agency to Validate a Debt that You Allegedly Owe a Creditor.

- Use your account to search through the legal forms you may have obtained previously.

- Visit the My documents section of your account and acquire another copy of the documents you need.

- If you are a new user of US Legal Forms, here are simple guidelines that you can follow.

- First, ensure you have selected the correct form for your city/state.

Form popularity

FAQ

To request verification, send a letter to the collection agency stating that you dispute the validity of the debt and that you want documentation verifying the debt. Also, request the name and address of the original creditor.

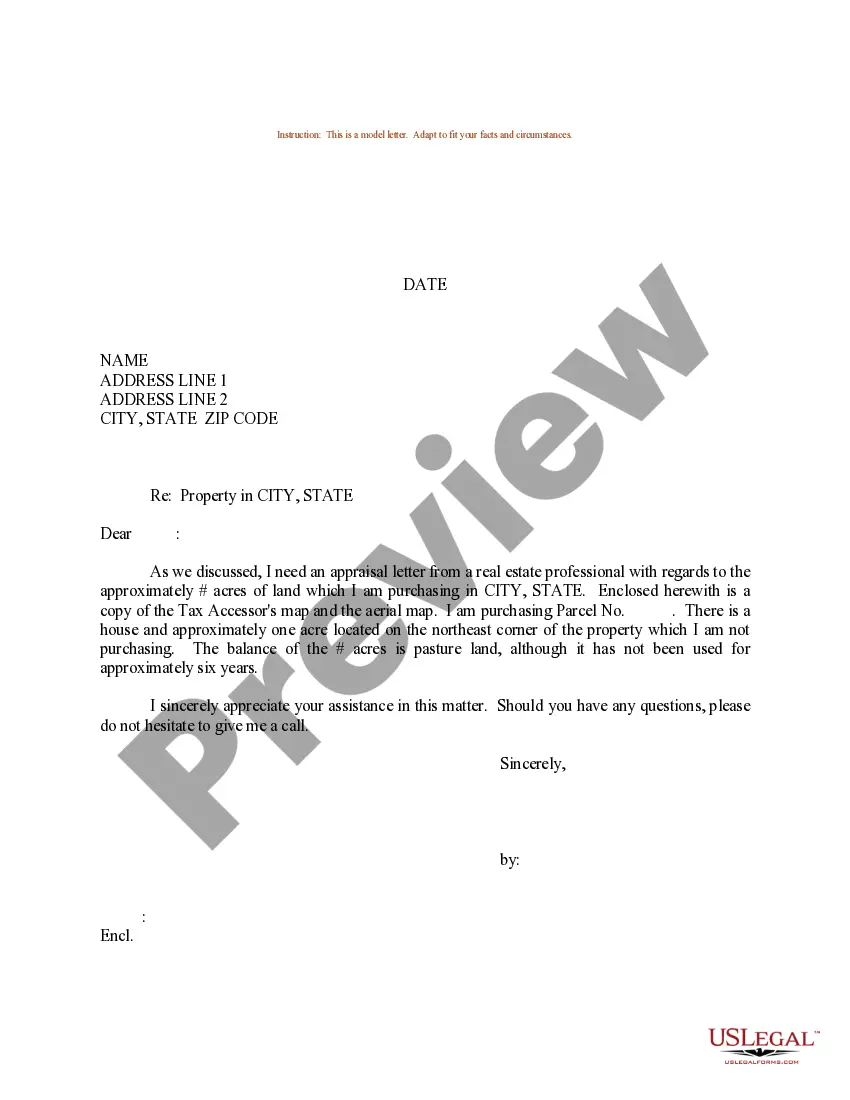

Write and Mail a Letter State that you're requesting validation of the debt or removal of the debt from your credit report. Then mail the letter and request a return receipt so you have proof that you sent it and that the collection agency received it.

How to Write a Debt Verification LetterDetermine the exact amounts you owe.Gather documents that verify your debt.Get information on who you owe.Determine how old the debt is.Place a pause on the collection proceedings.

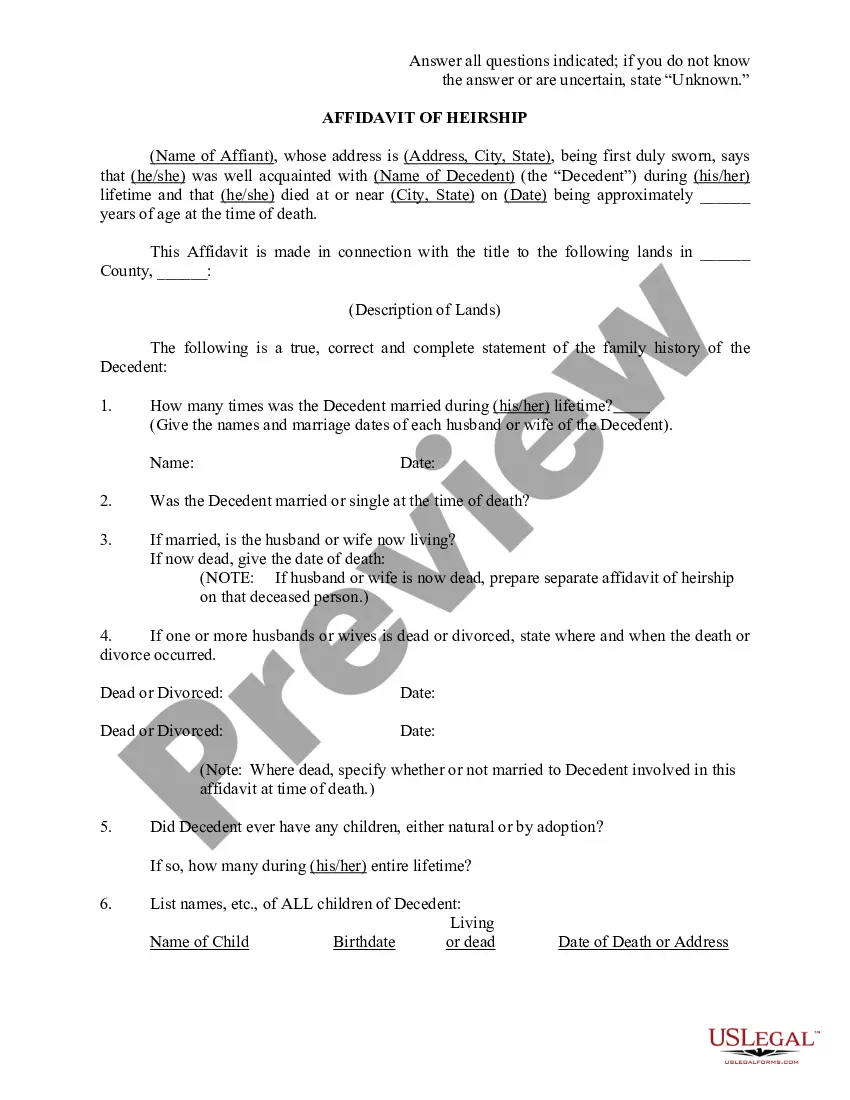

The name of the creditor. The assumption that the debt will be valid unless you dispute it within 30 days. Notification that you can request verification of the debt within 30 days. Notification that you can request the name and address of the original creditor within 30 days2feff

A debt validation letter should include the name of your creditor, how much you supposedly owe, and information on how to dispute the debt. After receiving a debt validation letter, you have 30 days to dispute the debt and request written evidence of it from the debt collector.

A debt validation letter is what a debt collector sends you to prove that you owe them money. This letter shows you the details of a specific debt, outlines what you owe, who you owe it to, and when they need you to pay.

To request verification, send a letter to the collection agency stating that you dispute the validity of the debt and that you want documentation verifying the debt. Also, request the name and address of the original creditor.

The key is to be thorough in your request for debt verification. In your letter, ask for details on: Why the collector thinks you owe the debt: Ask who the original creditor is and request documentation that verifies you owe the debt, such as a copy of the original contract.

A debt validation letter should include the name of your creditor, how much you supposedly owe, and information on how to dispute the debt. After receiving a debt validation letter, you have 30 days to dispute the debt and request written evidence of it from the debt collector.

I am requesting that you provide verification of this debt. Please send the following information: The name and address of the original creditor, the account number, and the amount owed. Verification that there is a valid basis for claiming I am required to pay the current amount owed.