Indiana Open a Bank Account - Corporate Resolutions Forms

Description

How to fill out Open A Bank Account - Corporate Resolutions Forms?

Should you wish to finalize, retrieve, or create authentic document formats, utilize US Legal Forms, the largest assortment of official forms, accessible online.

Take advantage of the website's simple and user-friendly search feature to find the forms you need.

Various templates for commercial and personal applications are organized by categories and jurisdictions, or keywords.

Step 4. After locating the form you need, click on the Purchase now button. Select the pricing plan you prefer and input your details to register for an account.

Step 5. Complete the transaction. You can use your Visa, Mastercard, or PayPal account to finalize the purchase. Step 6. Select the format of the official document and download it to your device. Step 7. Complete, edit, print, or sign the Indiana Open a Bank Account - Corporate Resolutions Forms. Each official document template you purchase belongs to you indefinitely. You will have access to every form you saved in your account. Choose the My documents section and select a form to print or download again. Finalize and download, and print the Indiana Open a Bank Account - Corporate Resolutions Forms with US Legal Forms. There are thousands of professional and state-specific forms available for your business or personal needs.

- Utilize US Legal Forms to access the Indiana Open a Bank Account - Corporate Resolutions Forms with just a few clicks.

- If you are already a US Legal Forms subscriber, Log In to your account and click the Download button to retrieve the Indiana Open a Bank Account - Corporate Resolutions Forms.

- You can also access forms you have previously stored within the My documents section of your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Ensure you have chosen the form for the correct city/state.

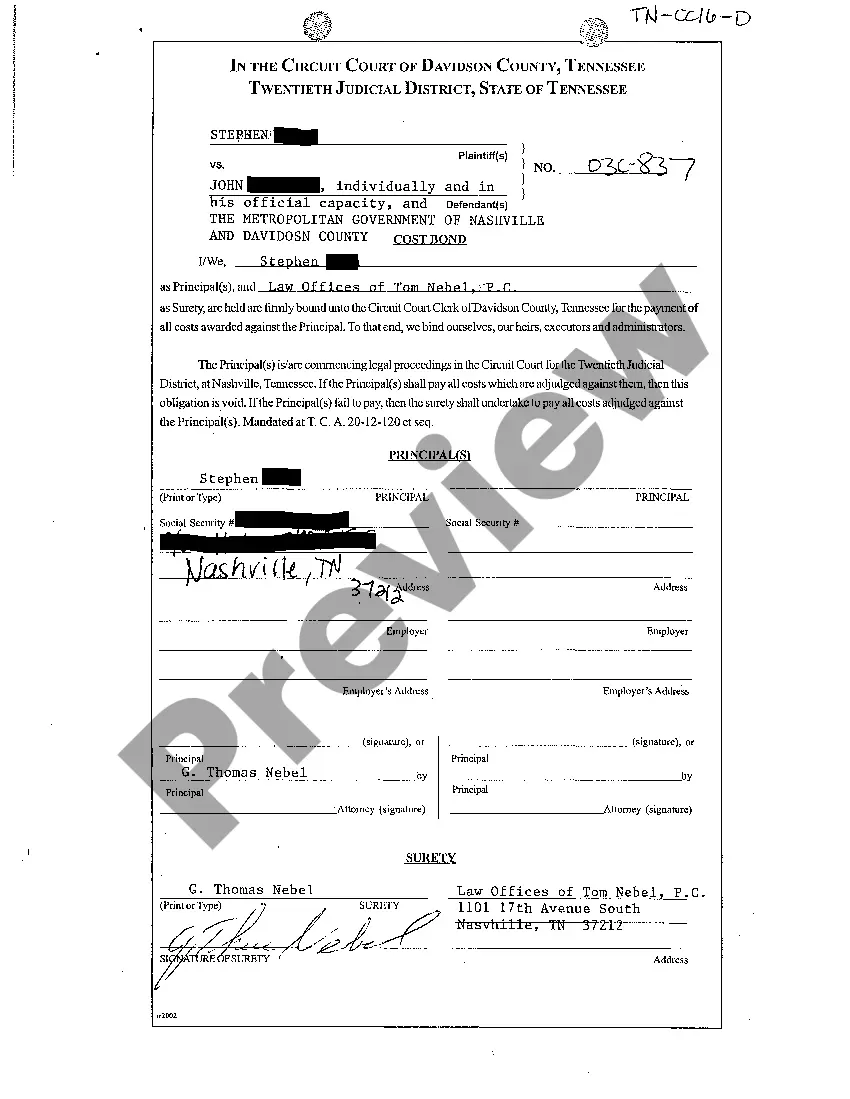

- Step 2. Use the Preview option to review the content of the form. Be sure to read the description.

- Step 3. If you are unsatisfied with the document, utilize the Search area at the top of the screen to find alternative versions of the official document template.

Form popularity

FAQ

A bank resolution is a formal document that grants permission for certain individuals within a company to handle its banking affairs. It specifies who can open accounts, make deposits, and withdraw funds on behalf of the business. In Indiana, having a banking resolution is crucial, especially when setting up your corporate banking relationships. Access our Indiana Open a Bank Account - Corporate Resolutions Forms to create a compliant and effective resolution for your needs.

To obtain a banking resolution, you can create one based on your company's bylaws or operating agreement. It should clearly state the account details and individuals authorized to act on behalf of the business. If you find this process overwhelming, consider using our platform, which offers tailored Indiana Open a Bank Account - Corporate Resolutions Forms. This service simplifies the document preparation, ensuring you have everything needed to proceed.

Yes, to open a bank account for your business in Indiana, you typically need a banking resolution. This document outlines your organization's decision to open the account, specifying who has the authority to act on behalf of the company. Having a proper resolution is essential for compliance and ensures banks recognize your business structure. You can find easy-to-use Indiana Open a Bank Account - Corporate Resolutions Forms on our platform.

Another name for a corporate resolution is a corporate action or corporate decision. This terminology reflects the formal nature of the document that captures significant business decisions made by the governing bodies. When seeking to Indiana Open a Bank Account - Corporate Resolutions Forms, knowing these terms can assist in clarity and understanding during legal consultations. Such knowledge facilitates better communication with your legal advisors.

A company board resolution to open a bank account is a formal directive from the board of directors that specifies the establishment of a corporate bank account. This document not only identifies the authorized signers but also details the scope of their powers. Utilizing Indiana Open a Bank Account - Corporate Resolutions Forms ensures that your bank account complies with all regulatory requirements. This resolution is crucial for maintaining clear operational protocols.

A corporate resolution to open an account indicates that a business has made a collective decision to establish a financial account, typically at a bank. This document is essential to outline who has authorization to operate and manage the account. With Indiana Open a Bank Account - Corporate Resolutions Forms, organizations streamline the process of setting up accounts. It gives every stakeholder clarity about financial responsibilities.

A corporate resolution to open an investment account is a formal statement that grants permission for specific individuals in a company to manage and operate the investment account. This resolution outlines the details of who can access the account and how funds can be invested. By using Indiana Open a Bank Account - Corporate Resolutions Forms, businesses secure their investment strategies. It’s a pivotal document that assures accountability and transparency.

A corporate resolution serves as an official record of decisions made by a company's board of directors or shareholders. It provides clear authority for actions such as opening a bank account. When you Indiana Open a Bank Account - Corporate Resolutions Forms, you establish that the company is acting within its legal framework. This document ensures compliance and protects the organization’s interests.

Writing a corporate resolution involves specifying the meeting's date, location, and attendees. The resolution should provide the exact decision made, including necessary details such as bank information and authorized signers. By implementing Indiana Open a Bank Account - Corporate Resolutions Forms, you can ensure your corporate resolution adheres to all legal standards and requirements, streamlining your banking process.

To write a good resolution letter, clearly state the purpose of the letter and follow a formal structure. Begin with a title, like 'Resolution of the Board of Directors,' followed by the body that outlines the resolution's specifics. Adding a signature section enhances the letter's authenticity, while including essential details helps in the approval process, particularly when utilizing Indiana Open a Bank Account - Corporate Resolutions Forms.