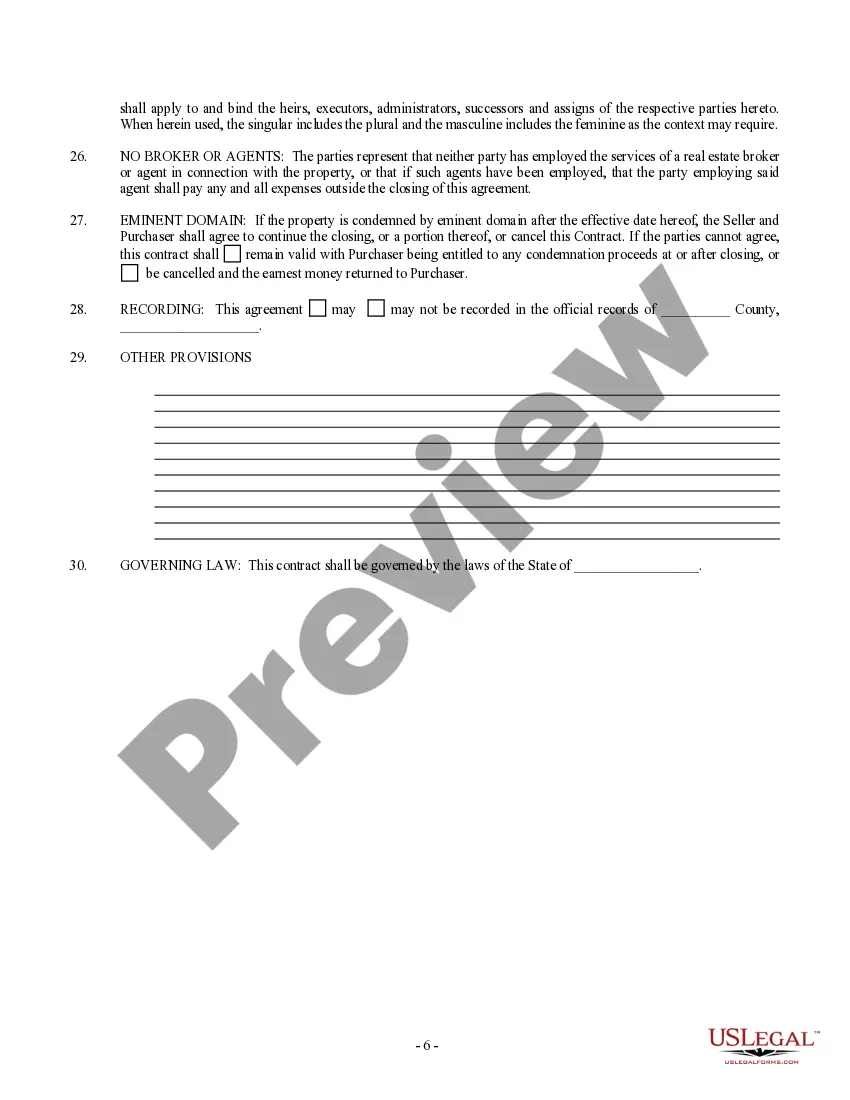

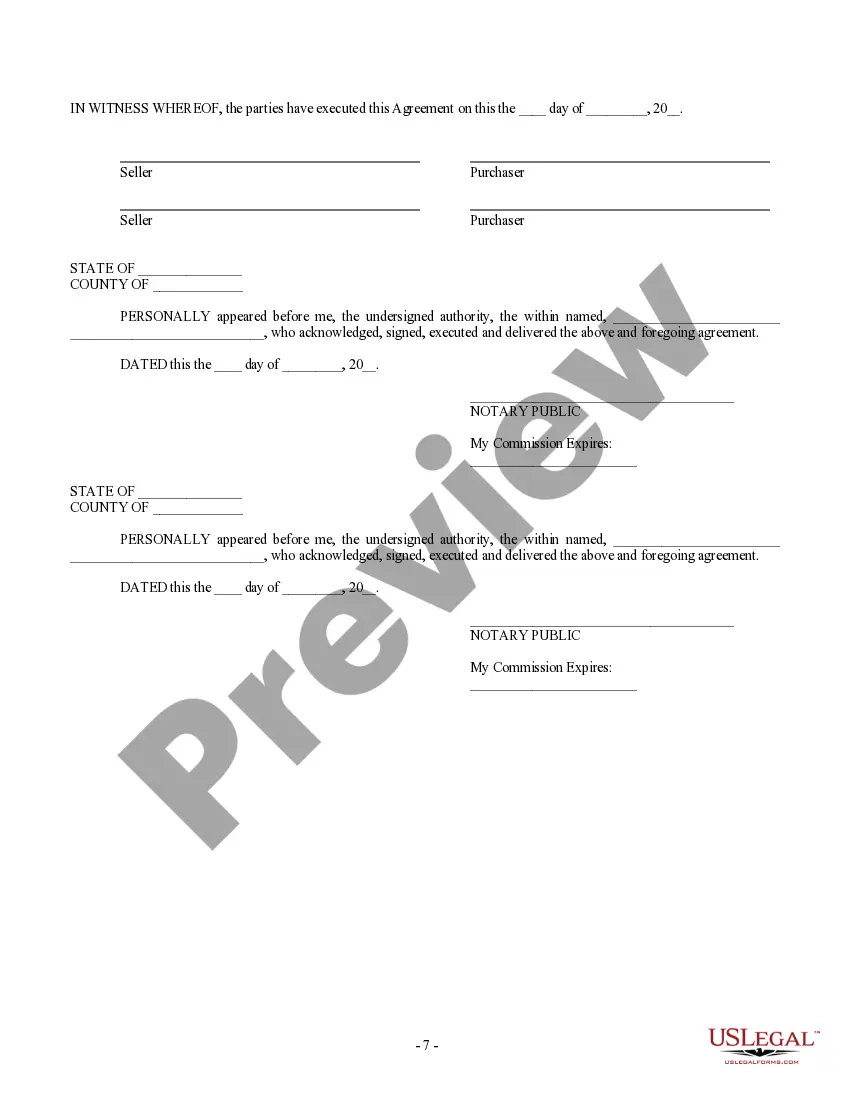

Indiana Option For the Sale and Purchase of Real Estate - Residential Home

Description

How to fill out Option For The Sale And Purchase Of Real Estate - Residential Home?

Are you currently in a location where you require documentation for either business or specific activities nearly every day.

There are numerous legitimate document templates accessible online, but finding reliable ones can be challenging.

US Legal Forms offers thousands of form templates, such as the Indiana Option For the Sale and Purchase of Real Estate - Residential Home, that are designed to satisfy federal and state requirements.

Once you find the right form, click Acquire now.

Select the pricing plan you prefer, fill out the necessary information to create your account, and complete the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Indiana Option For the Sale and Purchase of Real Estate - Residential Home template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for your appropriate city/state.

- Use the Preview option to examine the document.

- Read the description to ensure you have selected the correct form.

- If the form is not what you are looking for, use the Search area to find the form that meets your needs.

Form popularity

FAQ

Flipping (also called wholesale real estate investing) is a type of real estate investment strategy in which an investor purchases a property not to use, but with the intention of selling it for a profit.

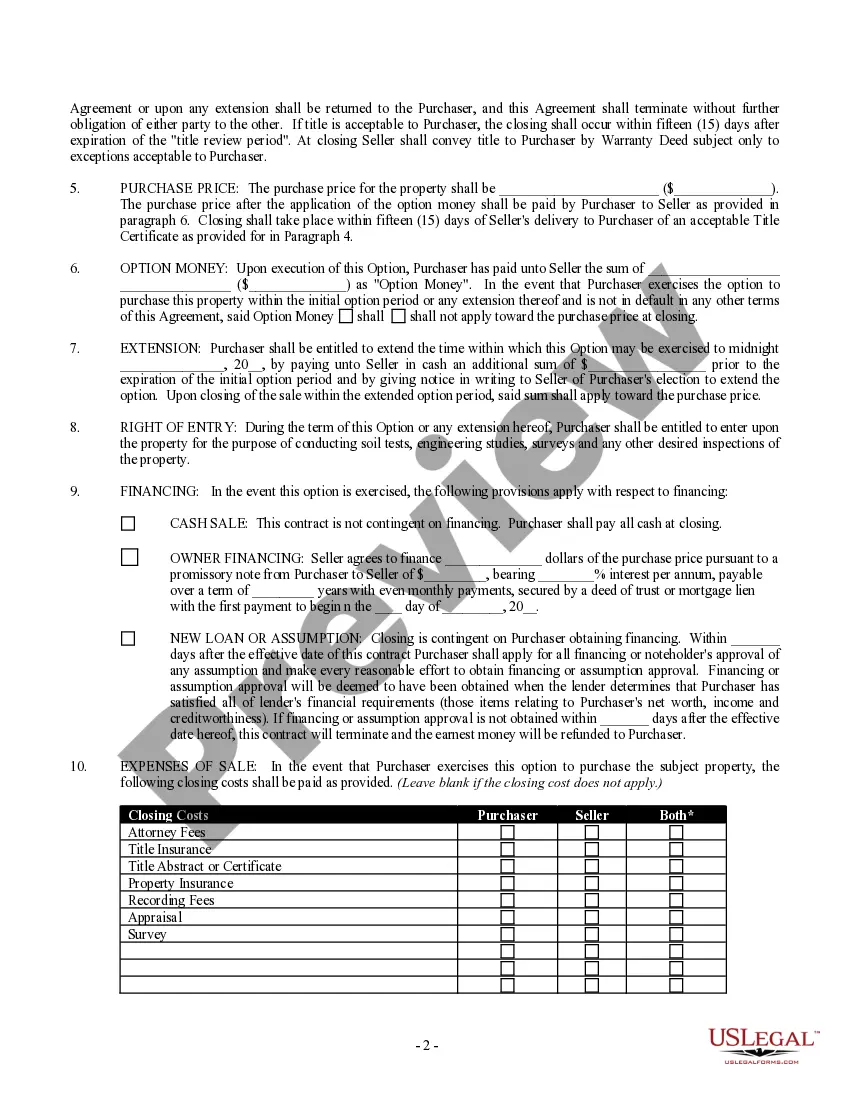

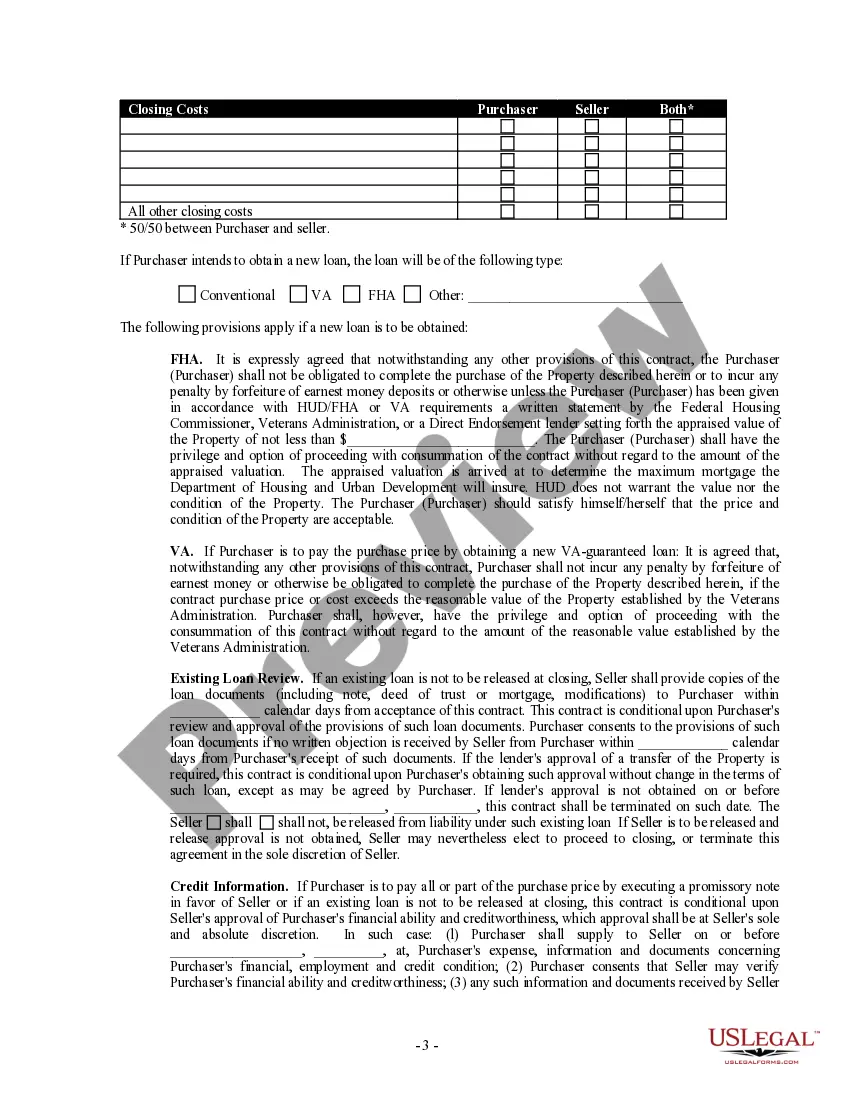

Broadly, a real estate option is a specially designed contract provision between a buyer and a seller. The seller offers the buyer the option to buy a property by a specified period of time at a fixed price. The buyer purchases the option to buy or not buy the property by the end of the holding period.

Micro-flipping is a type of short-term real estate investment that involves buying properties in need of renovations and reselling them quickly for a profit, usually without improvements.

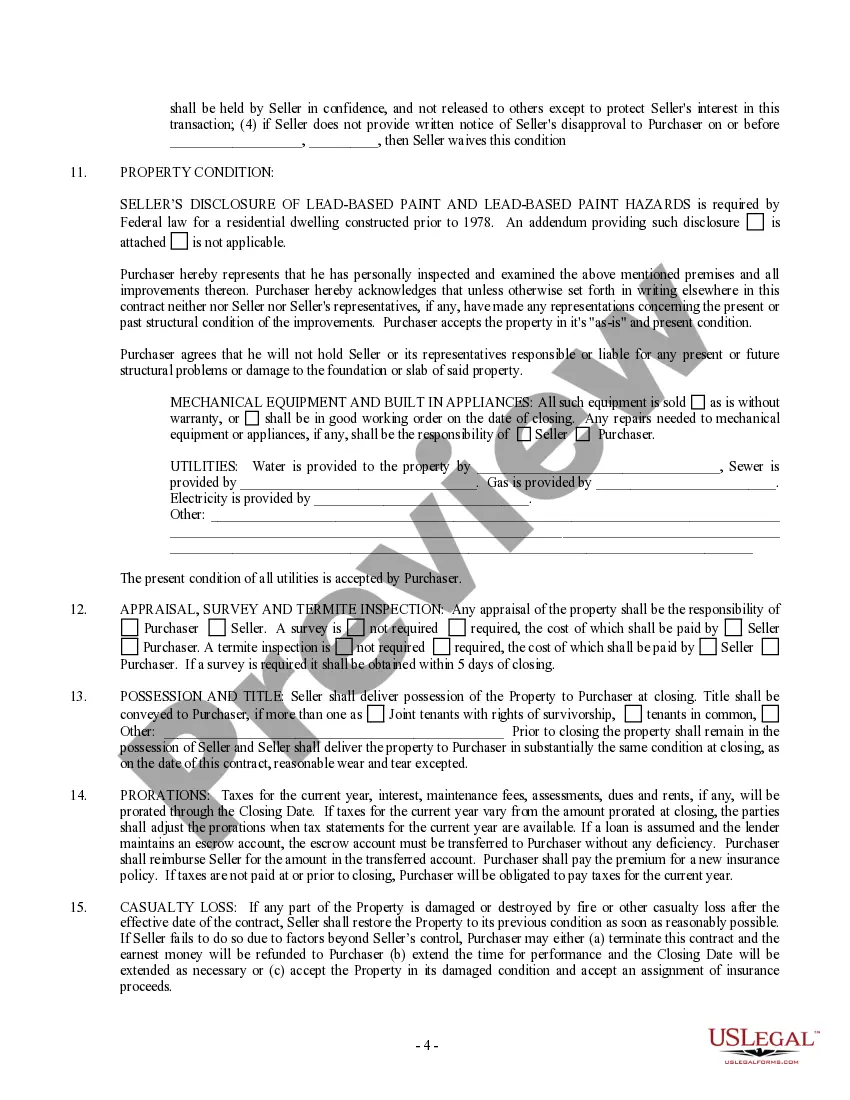

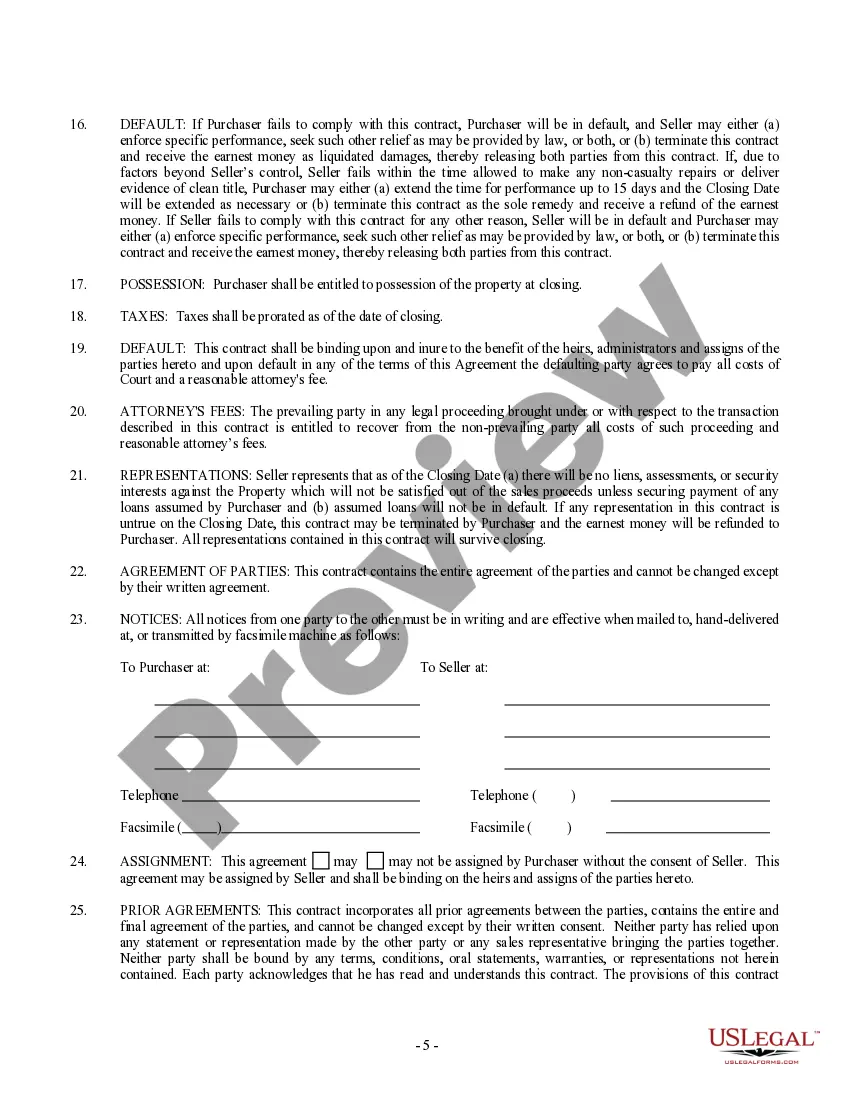

Any purchase agreement should include at least the following information:The identity of the buyer and seller.A description of the property being purchased.The purchase price.The terms as to how and when payment is to be made.The terms as to how, when, and where the goods will be delivered to the purchaser.More items...?

Come to the bargaining table prepared by making sure your home offer includes these essential key points.The date and amount of deposit (earnest money).Your name as buyer and the property owner's name as seller.The total purchase price.Full legal description and street address of the property.More items...

House flipping is when a real estate investor buys houses and then sells them for a profit. In order for a house to be considered a flip, it must be bought with the intention of quickly reselling.

Broadly, a real estate option is a specially designed contract provision between a buyer and a seller. The seller offers the buyer the option to buy a property by a specified period of time at a fixed price. The buyer purchases the option to buy or not buy the property by the end of the holding period.

House flipping typically refers to buyers who purchase distressed properties, fix them up, and then resell them for a profit. They'll typically find these properties via foreclosures, bank short sales, or property auctions.

The 70% rule helps home flippers determine the maximum price they should pay for an investment property. Basically, they should spend no more than 70% of the home's after-repair value minus the costs of renovating the property.

The purpose of an options contract in real estate is to offer the buyer alternatives. Outcomes may vary according to the type of buyer, including early exercise, option expiration, or second-buyer sales. Real estate professionals use option contracts to provide flexibility on specific types of real estate transactions.