Indiana General Guaranty and Indemnification Agreement

Description

How to fill out General Guaranty And Indemnification Agreement?

You might spend numerous hours online looking for the legal document format that aligns with the state and federal guidelines you need.

US Legal Forms provides a wide variety of legal forms that are evaluated by experts.

You can download or print the Indiana General Guaranty and Indemnification Agreement from my service.

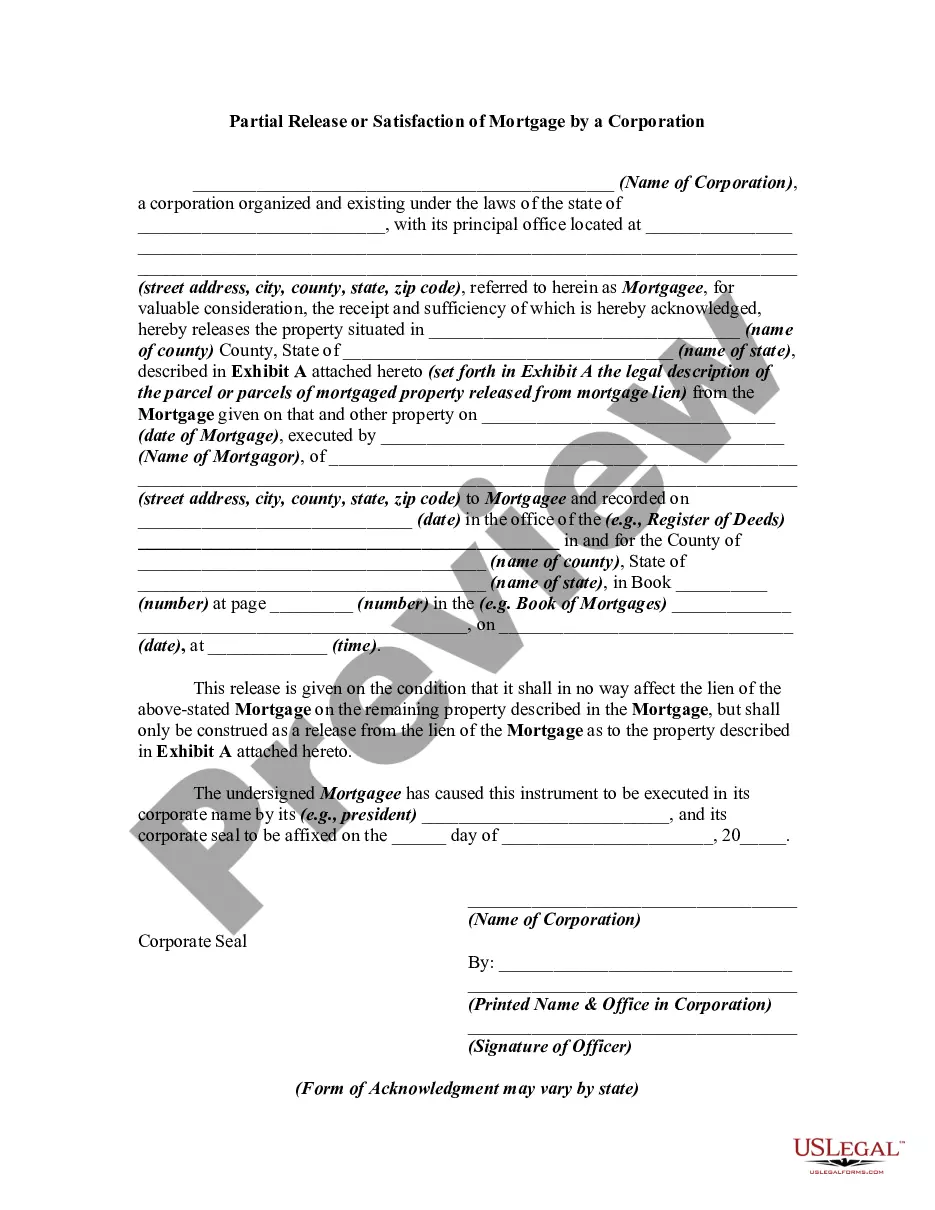

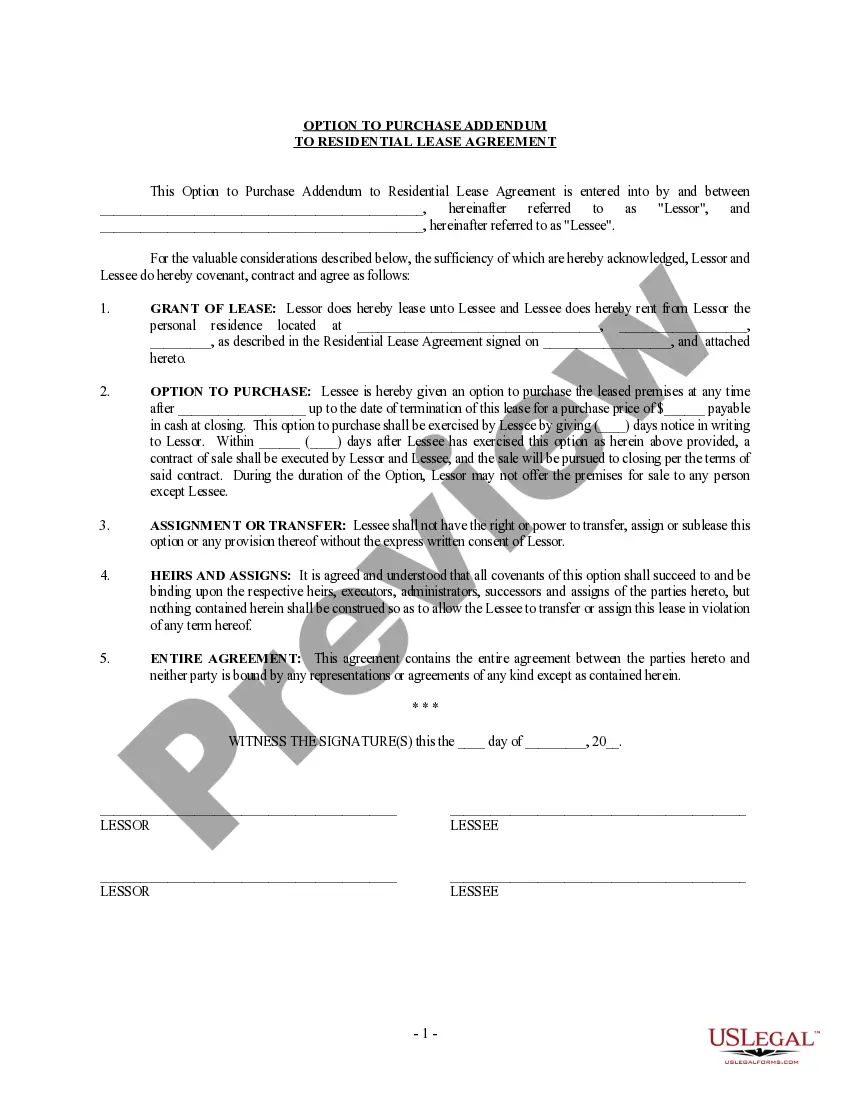

If available, use the Review option to examine the document format as well.

- If you already have a US Legal Forms account, you can Log In and select the Acquire option.

- After that, you can complete, modify, print, or sign the Indiana General Guaranty and Indemnification Agreement.

- Every legal document format you obtain is your property forever.

- To get another copy of any purchased form, navigate to the My documents tab and select the appropriate option.

- If you are visiting the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have chosen the correct document format for the area/city of your choice.

- Check the form description to verify that you have selected the right one.

Form popularity

FAQ

The key differences between guarantees and indemnities include: a guarantee is a secondary liability, which means that there will be another person who is primarily liable for the obligation; whereas, an indemnity imposes a primary liability.

The contract of indemnity is the contract where one person compensates for the loss of the other. Contract of guarantee is a contract between three people where the third person intervenes to pay the debt if the debtor is at default in paying back.

In order for a guarantee to be valid it must meet certain requirements. There are no formal requirements for creating a valid indemnity, so it could be oral, or in writing but not signed.

Most guarantees in today's market are drafted as joint and several guarantees, meaning that each guarantor is both jointly liable (as a member of the group) and individually liable (on its own separately), to the lender for the repayment in full of a borrower's indebtedness.

An indemnity is a primary obligation; it does not depend on having to prove a breach of a contractual obligation. This offers a number of advantages over bringing a damages claim for a breach of contract: An indemnity will typically be triggered by losses being incurred, without the need to prove any "fault".

A guarantee is an agreement to meet someone else's agreement to do something usually to make a payment. An indemnity is an agreement to pay for a cost or reimburse a loss incurred by someone else.

When the term indemnity is used in the legal sense, it may also refer to an exemption from liability for damages. Indemnity is a contractual agreement between two parties. In this arrangement, one party agrees to pay for potential losses or damages caused by another party.

The key differences between guarantees and indemnities include: a guarantee is a secondary liability, which means that there will be another person who is primarily liable for the obligation; whereas, an indemnity imposes a primary liability.

The key differences between guarantees and indemnities include: a guarantee is a secondary liability, which means that there will be another person who is primarily liable for the obligation; whereas, an indemnity imposes a primary liability.

Guaranty Agreement a two-party contract in which the first party agrees to perform in the event that a second party fails to perform. Unlike a surety, a guarantor is only required to perform after the obligee has made every reasonable and legal effort to force the principal's performance.