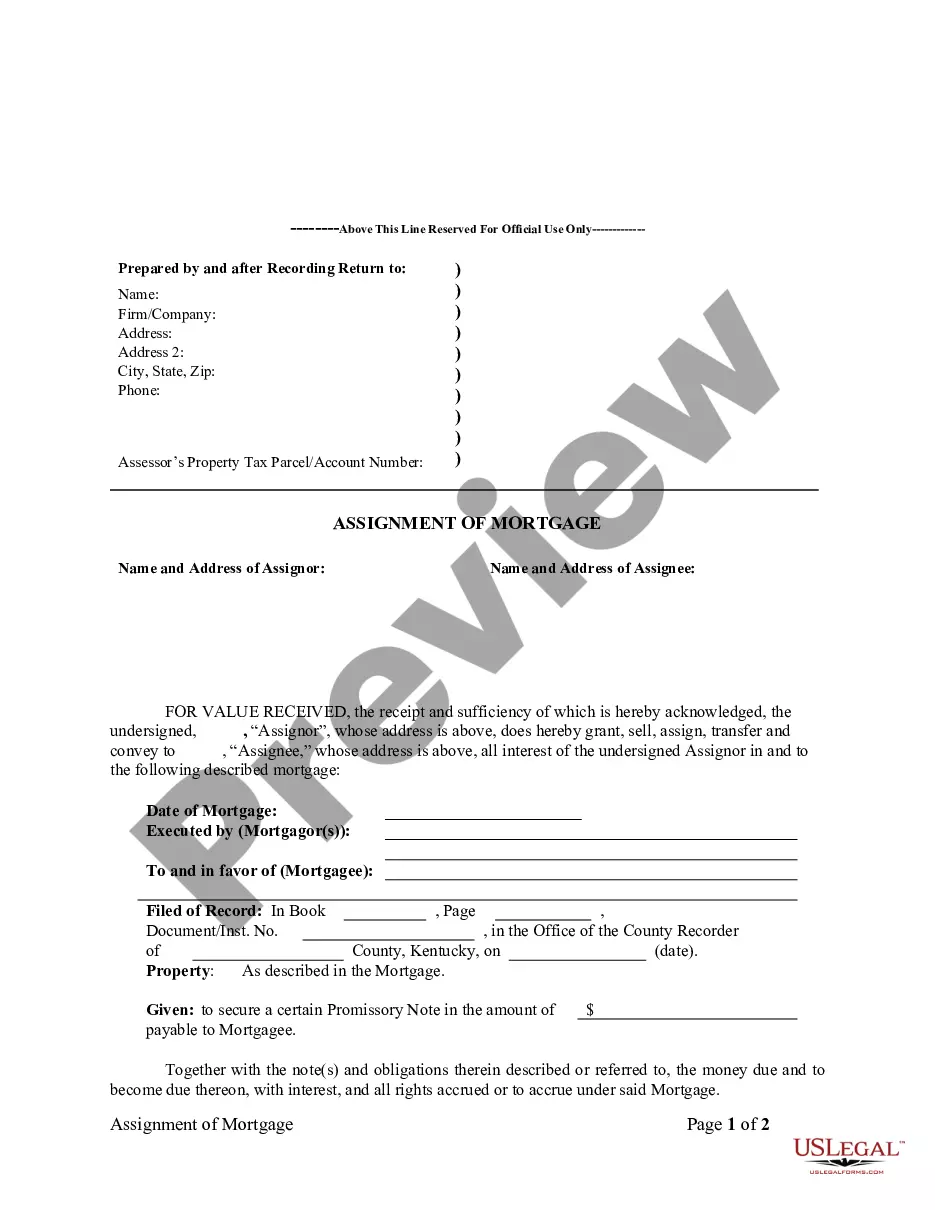

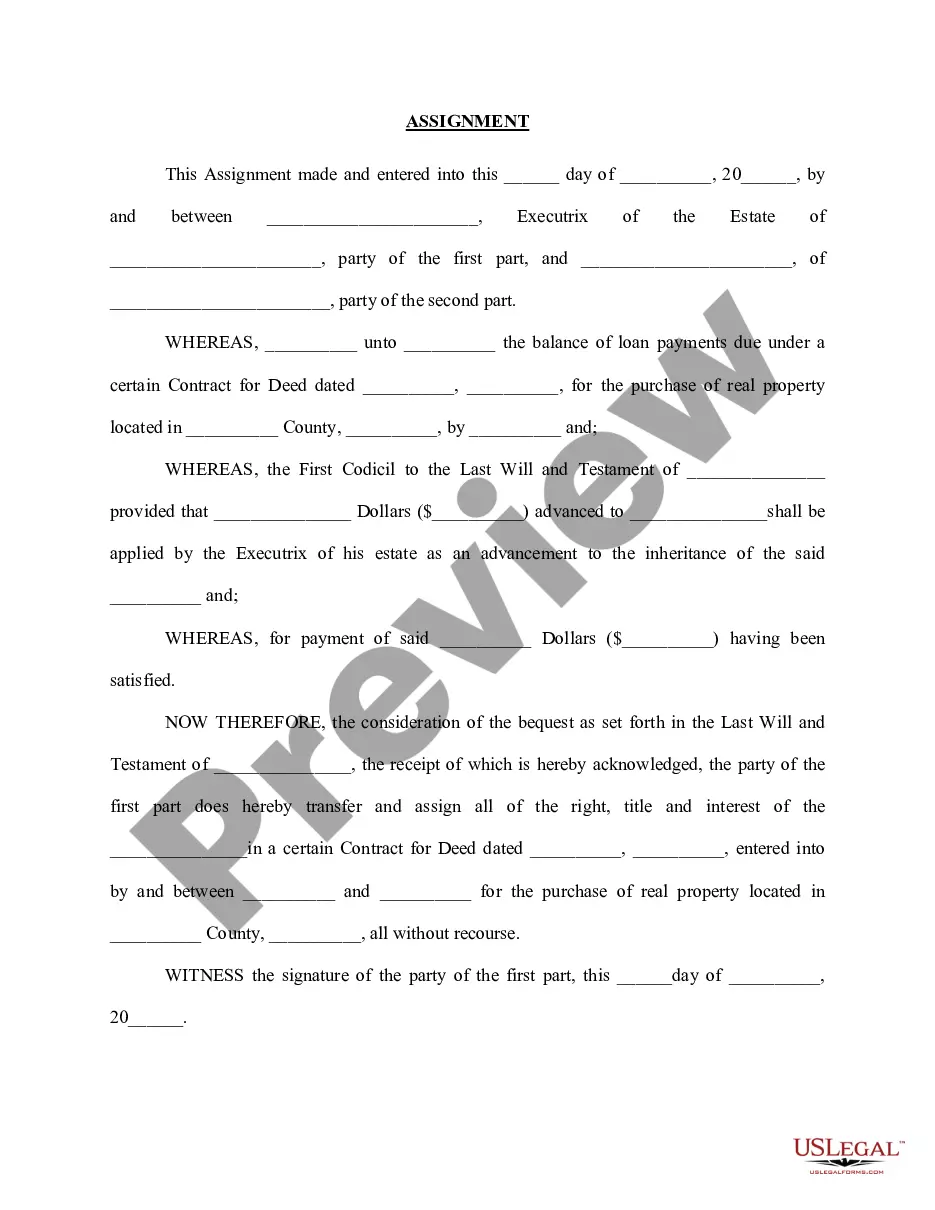

The Indiana Declaration Under Penalty of Perjury for Non-Individual Debtors is a legal document that must be signed by a representative of the business to confirm that the information provided in the document is accurate and truthful. This document is used when a business owes money to an individual or a company and must be signed before any legal action can be taken. There are two types of Indiana Declaration Under Penalty of Perjury for Non-Individual Debtors: 1. General Declaration: This is used when a business owes money to an individual or a company, and a representative must sign the document to confirm the accuracy of the information provided. 2. Specific Declaration: This is used when a business owes money to a specific individual or company, and a representative must sign the document to confirm the accuracy of the information provided. The Specific Declaration requires more detailed information about the debt being owed, such as the creditor's name, address, and the amount of the debt. Both declarations must be signed before any legal action can be taken, and the signer must understand that they are subject to criminal penalties for perjury if they provide false information. The signer must also provide their name, address, and signature on the document.

Indiana Declaration Under Penalty of Perjury for Non-Individual Debtors

Description

How to fill out Indiana Declaration Under Penalty Of Perjury For Non-Individual Debtors?

How much duration and resources do you typically allocate for creating formal documentation.

There’s a better method to obtain such forms than engaging legal professionals or investing hours looking for an appropriate template. US Legal Forms is the premier online repository that provides expertly crafted and verified state-specific legal documents for all purposes, including the Indiana Declaration Under Penalty of Perjury for Non-Individual Debtors.

Another benefit of our service is that you can access previously downloaded documents securely stored in your profile under the My documents tab. Retrieve them anytime and redo your paperwork as often as required.

Conserve time and energy preparing formal documents with US Legal Forms, one of the most dependable online solutions. Join us today!

- Review the form content to ensure it aligns with your state regulations. To accomplish this, examine the form description or utilize the Preview option.

- If your legal template does not fulfill your requirements, find another one using the search bar at the top of the page.

- If you already hold an account with us, Log In and download the Indiana Declaration Under Penalty of Perjury for Non-Individual Debtors. If not, continue to the following steps.

- Click Buy now after locating the correct blank. Choose the subscription plan that best fits your needs to access our library’s complete offerings.

- Sign up for an account and pay for your subscription. You can complete the transaction using your credit card or through PayPal - our service is entirely safe for that.

- Download your Indiana Declaration Under Penalty of Perjury for Non-Individual Debtors onto your device and complete it on a printed hard copy or electronically.