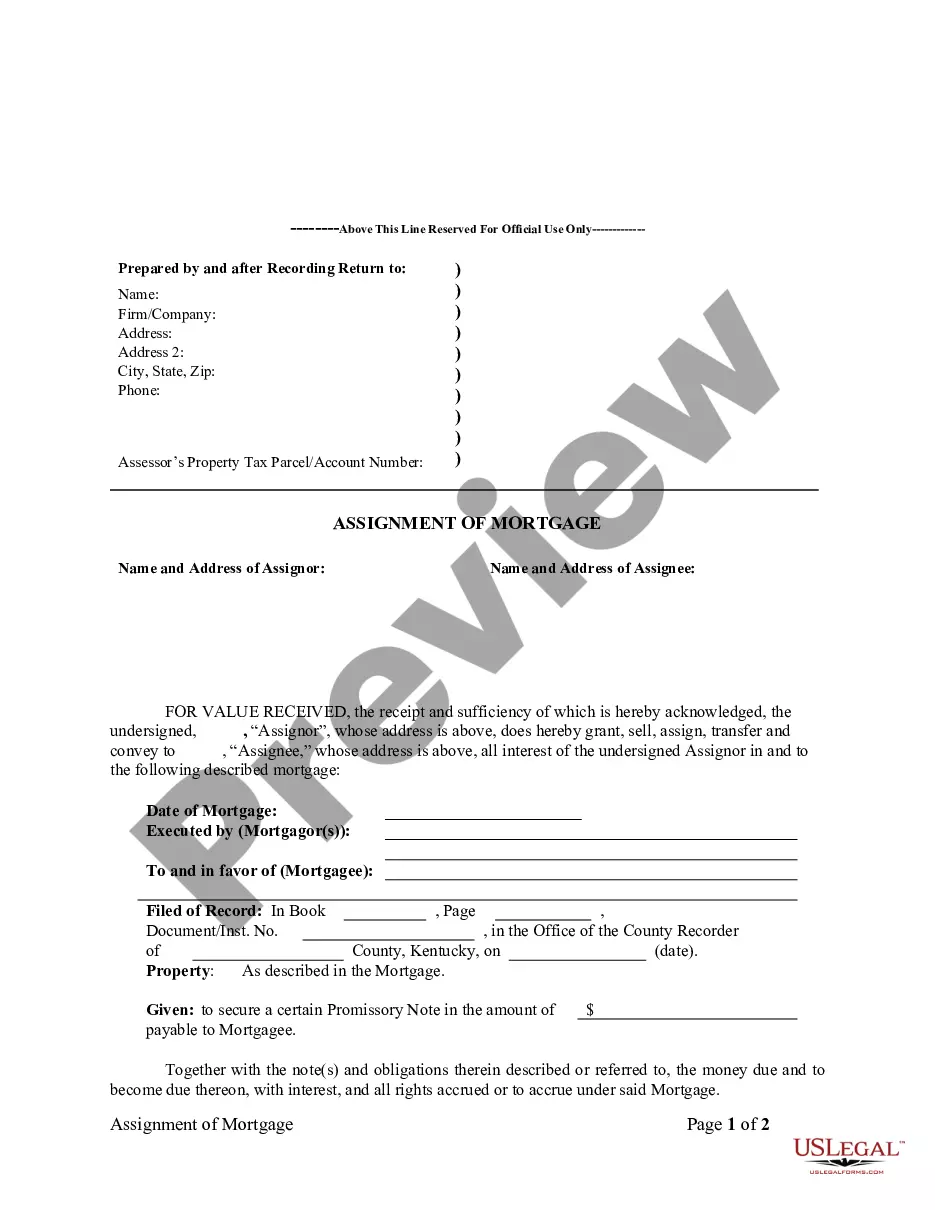

Assignment of Mortgage by Individual Mortgage Holder

Assignments Generally: Lenders, or holders

of mortgages or deeds of trust, often assign mortgages or deeds of trust

to other lenders, or third parties. When this is done the assignee

(person who received the assignment) steps into the place of the original

lender or assignor. To effectuate an assignment, the general rules

is that the assignment must be in proper written format and recorded to

provide notice of the assignment.

Satisfactions Generally: Once a mortgage

or deed of trust is paid, the holder of the mortgage is required to satisfy

the mortgage or deed of trust of record to show that the mortgage or deed

of trust is no longer a lien on the property. The general rule is that

the satisfaction must be in proper written format and recorded to provide

notice of the satisfaction. If the lender fails to record a satisfaction

within set time limits, the lender may be responsible for damages set by

statute for failure to timely cancel the lien. Depending on your state,

a satisfaction may be called a Satisfaction, Cancellation, or Reconveyance.

Some states still recognize marginal satisfaction but this is slowly being

phased out. A marginal satisfaction is where the holder of the mortgage

physically goes to the recording office and enters a satisfaction on the

face of the the recorded mortgage, which is attested by the clerk.

Kentucky Law

Execution of Assignment or Satisfaction: Must

be signed by the mortgagee.

Assignment: An assignment must be in writing

and recorded.

Demand to Satisfy: Written demand required.

See below, Penalty.

Recording Satisfaction: A holder of a lien

on real property shall release the lien in the county clerk's office where

the lien is recorded within thirty (30) days from the date of satisfaction.

Marginal Satisfaction: Not allowed.

Penalty: If the court finds that the lienholder

received written notice of its failure to release and lacked good cause

for not releasing the lien, the lienholder shall be liable to the owner

of the real property in the amount of one hundred dollars ($100) per day

for each day, beginning on the fifteenth day after receipt of the written

notice, of the violation for which good cause did not exist. A lienholder

that continues to fail to release a satisfied real estate lien, without

good cause, within forty-five (45) days from the date of written notice

shall be liable to the owner of the real property for an additional four

hundred dollars ($400) per day for each day for which good cause did not

exist after the forty-fifth day from the date of written notice, for a

total of five hundred dollars ($500) per day for each day for which good

cause did not exist after the forty-fifth day from the date of written

notice. The lienholder shall also be liable for any actual expense including

a reasonable attorney's fee incurred by the owner in securing the release

of real property by such violation.

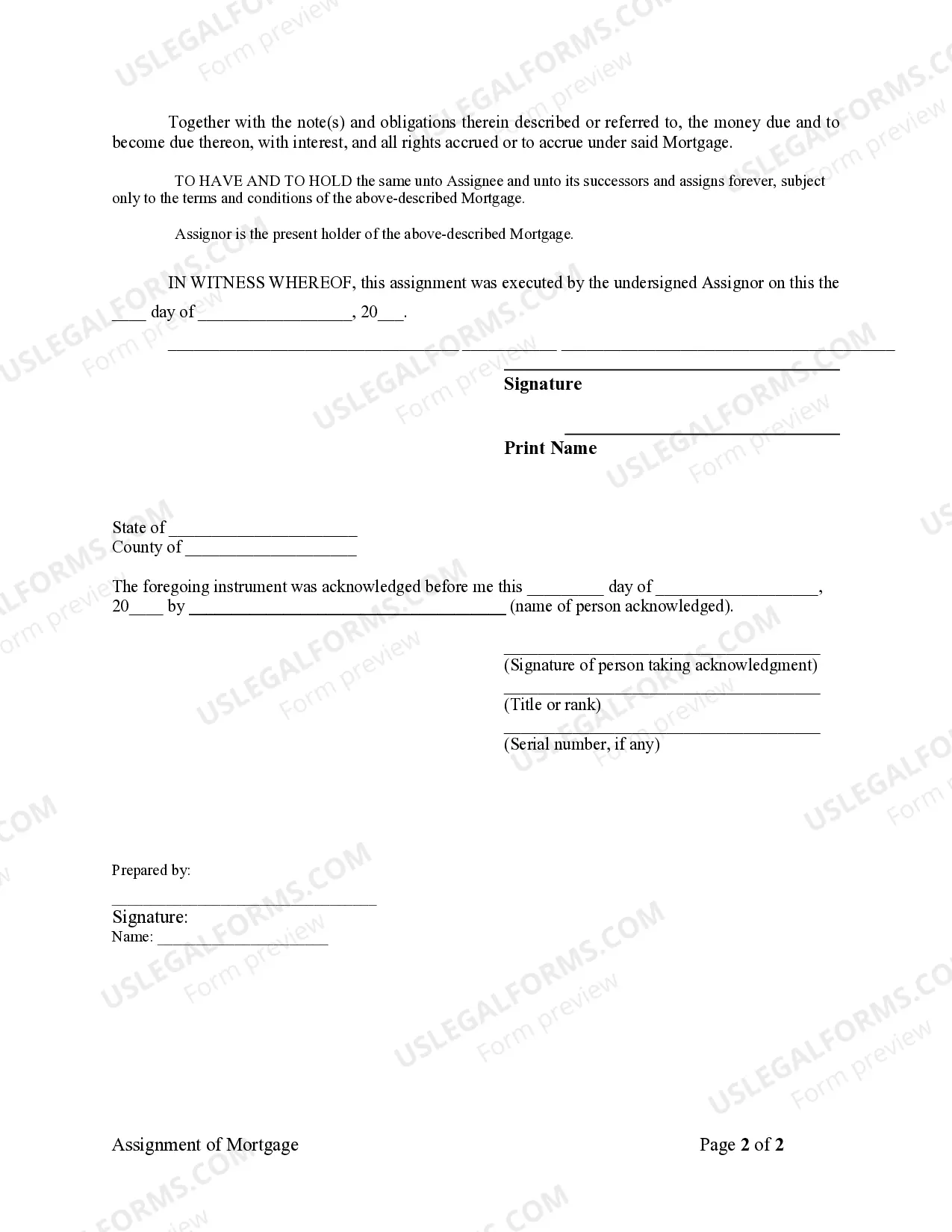

Acknowledgment: An assignment or satisfaction

must contain a proper Kentucky acknowledgment, or other acknowledgment

approved by Statute.

Kentucky Statutes

382.290 Recording of mortgages and deeds retaining liens -- Assignment

-- Discharge -- Form of record -- Clerk's fee.

(1) In recording mortgages and deeds in which liens are retained

(except railroad mortgages securing bonds payable to bearer), there shall

be left a blank space immediately after the record of the deed or mortgage

of at least two (2) full lines for each note or obligation named in the

deed or mortgage, or in the alternative, at the option of the county clerk,

a marginal entry record may be kept for the same

purposes as the blank space. Each entry in the marginal entry record

shall be linked to its respective referenced instrument in the indexing

system for the referenced instruments.

(2) When any note named in any deed or mortgage is assigned to

any other person, the assignor may, over his own hand, attested by the

clerk, note such assignment in the blank space, or in a marginal entry

record, beside a listing of the book and page of the document being assigned, and when any one (1) or more

of the notes named in any deed or mortgage is paid, or otherwise released

or satisfied, the holder of the note, and who appears from the record to

be such holder, may release the lien, so far

as such note is concerned, by release, over his own hand, attested

by the clerk. Each entry in the marginal entry record shall be linked to

its respective referenced instrument in the indexing system for the referenced

instrument.

(3) No person who does not, from such record or assignment of record,

appear at the time to be the legal holder of any note secured by lien in

any deed or mortgage, shall be permitted to release the lien securing any

such note, and any release made in contravention of this section shall

be void; but this section does not change the existing law if no such entry

is made.

(4) For each assignment and release so made and attested by the

clerk, he may charge a fee pursuant to KRS 64.012 to be paid by the person

executing the release or noting the assignment.

(5) If such assignment of a note is made by separate instrument

or by deed assigning the note, or in a marginal entry record, the instrument

of writing or deed or marginal entry record shall set forth the date of

notes assigned, a brief description of notes, the name and post office

address of assignee, and the deed book and page of the instrument wherein

the lien or mortgage is recorded and the clerk or deputy clerk

receiving such instrument of writing or deed of assignment for

record shall at the option of the county clerk immediately either link

the assignment and its filing location to its respective referenced instrument

in the indexing system for the

referenced instrument, or endorse at the foot of the record in

the space provided in subsection (1), "The notes mentioned herein (giving

a brief description of notes assigned) have been transferred and assigned

to (insert name and address of assignee) by deed of assignment (or describe

instrument) dated and recorded in deed book .... page ....," and attest

such certificate. For making such notation on the record the clerk shall

be allowed a fee pursuant to KRS 64.012 for each notation so made, to be

paid by the party filing the instrument of writing or deed of assignment.

(6) No holder of a note secured by lien retained in either deed

or mortgage shall lodge for record, and no clerk or deputy clerk shall

receive and permit to be lodged for record, any deed or instrument of writing

that does not comply with the provisions of this section.

382.335 Certain information to be included in instruments in

order for them to be recorded.

(1) No county clerk shall receive or permit the recording of any

instrument by which the title to real estate or personal property, or any

interest therein or lien thereon, is conveyed, granted, encumbered, assigned,

or otherwise disposed of; nor receive any instrument or permit any instrument,

provided by law, to be recorded as evidence of title to real estate; and

shall not receive or permit any instrument, relating to the organization

or dissolution of a private corporation, unless the instrument has endorsed

on it, a printed, typewritten, or stamped statement showing the name and

address of the individual who prepared the instrument, and the statement

is signed by the individual. The person who prepared the instrument may

execute his signature by affixing a facsimile of his signature on the instrument.

This subsection shall not apply to any instrument executed or acknowledged

prior to July 1, 1962.

(2) No county clerk shall receive or permit the recording of any

instrument by which the title to real estate or any interest therein is

conveyed, granted, assigned, or

otherwise disposed of unless the instrument contains the mailing

address of the grantee or assignee. This subsection shall not apply to

any instrument executed or acknowledged prior to July 1, 1970.

(3) This section shall not apply to wills or to statutory liens

in favor of the Commonwealth.

(4) No county clerk shall receive, or permit the recording of, any

instrument by which real estate, or any interest therein, is conveyed,

granted, assigned, transferred, or otherwise disposed of unless the instrument

complies with the official indexing system of the county. The indexing

system shall have been in place for at least twenty-four (24) months prior

to July 15, 1994 or shall be implemented for the purpose of allowing computerized

searching for the instruments of record of the county clerk. If a county

clerk requires a parcel identification number on an instrument before recording,

the clerk shall provide a computer terminal, at no

charge to the public, for use in finding the parcel identification

number. The county clerk may make reasonable rules about the use of the

computer terminal, requests

for a parcel identification number, or both.

(5) The receipt for record and recording of any instrument by the

county clerk without compliance with the provisions of this section shall

not prevent the record of filing of the instrument from becoming notice

as otherwise provided by law, nor impair the admissibility of the record

as evidence.

382.365 Release of lien, with notice to property owner, within

thirty days of satisfaction -- Proceeding against lienholder in District

Court or Circuit Court -- Liability of lienholder when lien not released

or notice not sent -- Notice to state or lienholder.

(1) A holder of a lien on real property, including a lien provided

for in KRS 376.010, shall release the lien in the county clerk's office

where the lien is recorded within thirty (30) days from the date of satisfaction.

(2) A proceeding may be filed by any owner of real property or any

party acquiring an interest in the real property in District Court or Circuit

Court against a lienholder

that violates subsection (1) of this section. A proceeding filed

under this section shall be given precedence over other matters pending

before the court.

(3) Upon proof to the court of the lien being satisfied, the court

shall enter a judgment releasing the lien. The judgment shall be with costs

including a reasonable attorney's fee. If the court finds that the lienholder

received written notice of its failure to release and lacked good cause

for not releasing the lien, the lienholder shall be liable to the owner

of the real property in the amount of one hundred dollars ($100) per day

for each day, beginning on the fifteenth day after receipt of the written

notice, of the violation for which good cause did not exist.

(4) A lienholder that continues to fail to release a satisfied

real estate lien, without good cause, within forty-five (45) days from

the date of written notice shall be liable to the owner of the real property

for an additional four hundred dollars ($400) per day for each day for

which good cause did not exist after the forty-fifth day from the date

of written notice, for a total of five hundred dollars ($500) per day for

each day for which good cause did not exist after the forty-fifth day from

the date of written notice. The lienholder shall also be liable for any

actual expense including a reasonable attorney's fee incurred by the owner

in securing the release of real property by such violation.

(5) The former holder of a lien on real property shall send by regular

mail a copy of the lien release to the property owner at his last known

address within seven (7) days of the release. A former lienholder that

violates this subsection shall be liable to the owner of the real property

for fifty dollars ($50) and any actual expense incurred by the owner in

obtaining documentation of the lien release.

(6) For the purposes of this section, "date of satisfaction" means

that date of receipt by a holder of a lien on real property of a sum of

money in the form of a certified check, cashier's check, wired transferred

funds, or other form of payment satisfactory to the lienholder that is

sufficient to pay the principal, interest, and other costs owing on the

obligation that is secured by the lien on the property.

(7) The provisions of this section shall not apply when a lienholder

is deceased and the estate of the lienholder has not been settled.

(8) The state licensing agency, if applicable, or any holder of

a lien on real property shall be notified of the disposition of any actions

brought under this section against the lienholder.

(9) The provisions of this section shall be held and construed as

ancillary and

supplemental to any other remedy provided by law.