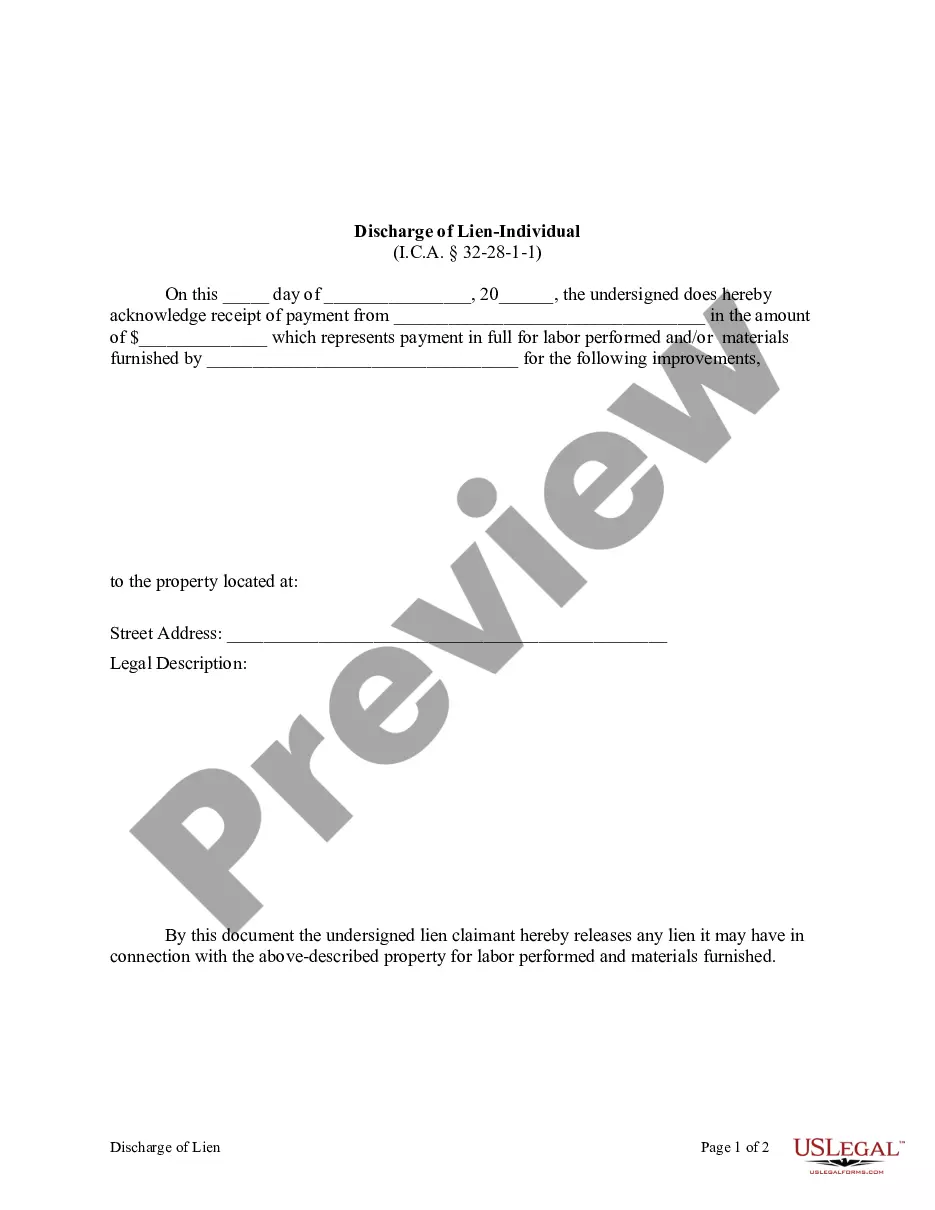

Discharge of Lien - Individual

Note: This summary is not intended to be an all inclusive discussion of Indiana’s Mechanic’s Lien Statute as it applies to private project construction, but does include basic provisions.

Where can I find the Indiana Mechanic’s Lien Laws for Private Construction?

See Indiana Code, Title 32 – Property, Article 28 – Liens on Real Property.

What is a Construction or Mechanic’s Lien?

A mechanic’s or construction lien is a statutory lien created in favor of contractors, laborers and materialmen who have performed work or furnished materials in the construction or repair of a building or other real property. The lien attaches to the real property improved by the labor and / or material. The lien has the effect of encumbering the property, thereby insuring payment for the lien holders work, materials or equipment.

How does the mechanic’s lien assist the collection of monies relating to the private projects or improvements?

The Indiana Mechanics’ Lien Statute provides for the ultimate seizure and sale of the property owner’s interest in the real estate to recover the unpaid debt, costs and reasonable attorney’s fees. There are basically three steps in the process: (1) File and “perfect” the Lien; (2) file the lawsuit; and (3) obtain a judgment and execute on that judgment.

What does “perfecting a lien” mean?

It means to satisfy or complete each of the statutorily prescribed steps a lienholder must take in order to establish a legally enforceable lien on the property of another.

Is it possible in Indiana to agree by contract between the owner and the principal contractor that a lien shall not attach to the real estate, building, structure or any other improvement of the owner?

Yes, a contract for the construction, alteration or repair of a Class 2 structure (structure containing one or two dwelling units), or improvement to that structure; construction, alteration or repair of property associated with power generation; or, to prepare property for Class 2 residential construction, may contain a provision in the contract between the owner and the principal contractor that a lien may not attach to the real estate, building, structure, or any other improvement of the owner. BUT, such a contract must satisfy the following requirements:

(1) be in writing;

(2) contain specific reference by legal description of the real estate to be improved;

(3) be acknowledged as provided in the case of deeds; and

(4) be filed and recorded in the recorder’s office of the county in which the real estate, building, structure, or other improvement is situated not more than five

(5) days after the date of execution of the contract.

Note that such a contract is not retroactive and will not affect a lien for labor, material, or machinery supplied before the filing of the contract with the recorder. See I.C. § 32-28-3-1(e)-(g).

Who can file a mechanic’s lien in Indiana?

Indiana statutes permit a lien claim by any person that sells or furnishes on credit any material, labor or machinery for (a) the alteration or repair of a any owner occupied single or double family dwelling, or (b) the original construction of a single or double family dwelling, or (c) construction, alteration, or repair of a Class 2 structure as defined by IC 22-12-1-5. For general commercial construction and unique types of construction that may also qualify for a lien, see IC 32-8-3-1.

What type of notice is required before the mechanic’s lien will attach?

The Indiana Code distinguishes between parties dealing directly with the property owner (“in privity of contract”) and those not dealing directly with the property owner (“not in privity of contract”). The issue is simply one of notice. A one to one relationship leads to the inference that the owner would be aware of the contract with the individual claiming the lien.

Anyone furnishing material, labor or machinery for the “alteration or repair” of an owner occupied single or double family dwelling, and who is not “in privity,” must furnish a written notice of the delivery of materials or labor performed and of the existence of lien rights not later than thirty (30) days after the date of first delivery or labor performed. . See I.C. § 32-28-3-1(h) and Forms IN-01-09 and IN-01A-09.

Anyone furnishing material, labor or machinery for the “original construction” of a single or double family dwelling for the intended occupancy of the owner and who is not “in privity” must furnish a written notice of the delivery or work and of the existence of lien rights to the owner, and record a copy in the county recorder’s office, and not later than sixty (60) days after the date of first delivery or labor performed. See I.C. § 32-28-3-1(i) and Forms IN-02-09 and IN-02A-09.

Anyone furnishing material, labor or machinery on a commercial construction project need not file a “notice of furnishing” or give another form of notice to the owner that they are on the job and providing material or services that may result in a lien.

How is the Lien “filed” or “perfected” in Indiana?

Once again it depends on the whether the claimant has a direct relationship with the owner determines the method for “filing” or “perfecting” the lien.

It is a 2 Step Process if there is no privity with the owner and the project concerns a property that the owner intends to occupy:

A. Within thirty (30) days of the supplier first supplying labor, materials or equipment on the job site, the contractor or supplier must serve the property owners with written notice that the contractor has supplied labor, materials or equipment for the owner’s project and that the contractor or supplier has lien rights. See I.C. § 32-28-3-3(h) and Forms IN-01-09 and IN-01A-09 for property involving alteration or repairs. See I.C. § 32-28-3-3(i) and Forms IN-02-09 and IN-02A-09 for property involving new or original construction.

B. Within sixty (60) days of the last day the contractor or supplier, described in A., provided labor, materials or equipment on the job site, the contractor or supplier must file a NOTICE OF LIEN with the Recorder’s Office in the County where the project is located. See I.C. § 32-28-3-3 and Forms IN-03-09 and IN-03A-09 OR IN-04-09 and IN-04A-09.

For “In Privity” Claimants and Commercial or Industrial Contractors and Suppliers providing labor, materials or equipment on a commercial construction project, regardless of privity, they need only carry out one step in order to perfect their lien: File the Notice of Mechanics Lien within 60 days of last day labor, materials or equipment was supplied. See I.C. § 32-28-3-3 and Forms IN-03-09 and IN-03A-09.

How long does the Lien remain enforceable?

In Indiana, as a general rule, the lien holder must file a suit to enforce his lien within one (1) year of the filing of his Claim of Lien or have his lien rendered null and void. Indiana statute does allow for the extension of this period if the leinholder and all parties with an interest in the property file a written agreement to that effect within the one (1) year period. IC 32-8-3-6(a)(2).

Are Indiana mechanic’s liens assignable?

Indiana statutes on construction liens do not specifically speak to whether liens may be assigned to other parties.

Does this State require a notice prior to starting work, or after work has been completed?

No. Indiana statutes do not require a Notice of Commencement or a Notice of Completion as in some other States.

Does this State permit a person with an interest in property to deny responsibility for improvements?

No. Indiana statutes do not have a provision which permits the denial of responsibility for improvements.

Is a notice attesting to the discharge or satisfaction of a lien provided for or required in Indiana?

When the lien is satisfied, the holder or custodian of a mechanic’s lien must discharge, release and acknowledge satisfaction of the mechanic’s lien using an instrument that complies with statute. See I.C. § 32-28-1-1 and Forms: Discharge – IN-08-09, IN-08A-09; Partial Discharge – IN-09-09, IN-09A-09. IN-010-09, IN-010A-09.

Does the law in Indiana provide for a penalty is a lien holder wrongfully refuses to discharge or acknowledge satisfaction of the lien?

Yes. If the owner, or other person having the right to demand the release of the lien makes a written demand in proper form to the holder or owner of the lien to discharge or acknowledge satisfaction of the lien and the lien holder refuses to act after 15 days of receipt, the court can order a penalty up to a maximum of $500.00, costs and a reasonable attorneys fee. See I.C. § 32-28-1-2.

Does the Indiana Code contain other provisions relating to the release of mechanic’s liens?

Yes. See Chapter 6, § § 32-28-6-1 and 32-28-6-2 which provides penalties when a lienholder refuses to release a lien that has been paid. This subsection provides for the filing of a affidavit by the owner or other party with an interest attesting to (1) lapse of 13 months or more since the lien was filed; (2) no suit has been filed for enforcement of the lien; and (3) no unsatisfied judgment has been rendered on the lien. See IN-08-09 Release of Lien as an example of a form that could be used by a lien holder to provide a property owner with documentation that the lien has been satisfied after payment in full.

Does Indiana have a mechanism for the owner to use in shortening the one year window for enforcement of the lien?

Indiana law does permit a property owner to serve a Notice of Demand to Commence Suit (Form IN-06-09 and IN-06A-09) upon a lien holder. The lien holder then has thirty (30) days from receipt of that demand to file suit or have his lien rendered null and void. After thirty (30) days the property owner or other party in interest may file with the county recorder an affidavit which states that a demand to commence suit was made and time within which to respond has expired. See IN-011-09 and IN-011A-09. Indiana law requires a county recorder to certify in the county record that said lien is fully released. IC 32-8-3-10.

Does this Indiana permit the use of a bond to release a lien?

Yes. Indiana statute states that “In all proceedings commenced to enforce the lien, the defendant or owner of the property… may file in such proceedings a written undertaking with surety to be approved by the court … Upon the filing of such an undertaking, the court shall enter an order releasing said property from such lien and thereafter such property shall be discharged from said lien.” IC 32-8-3-11.