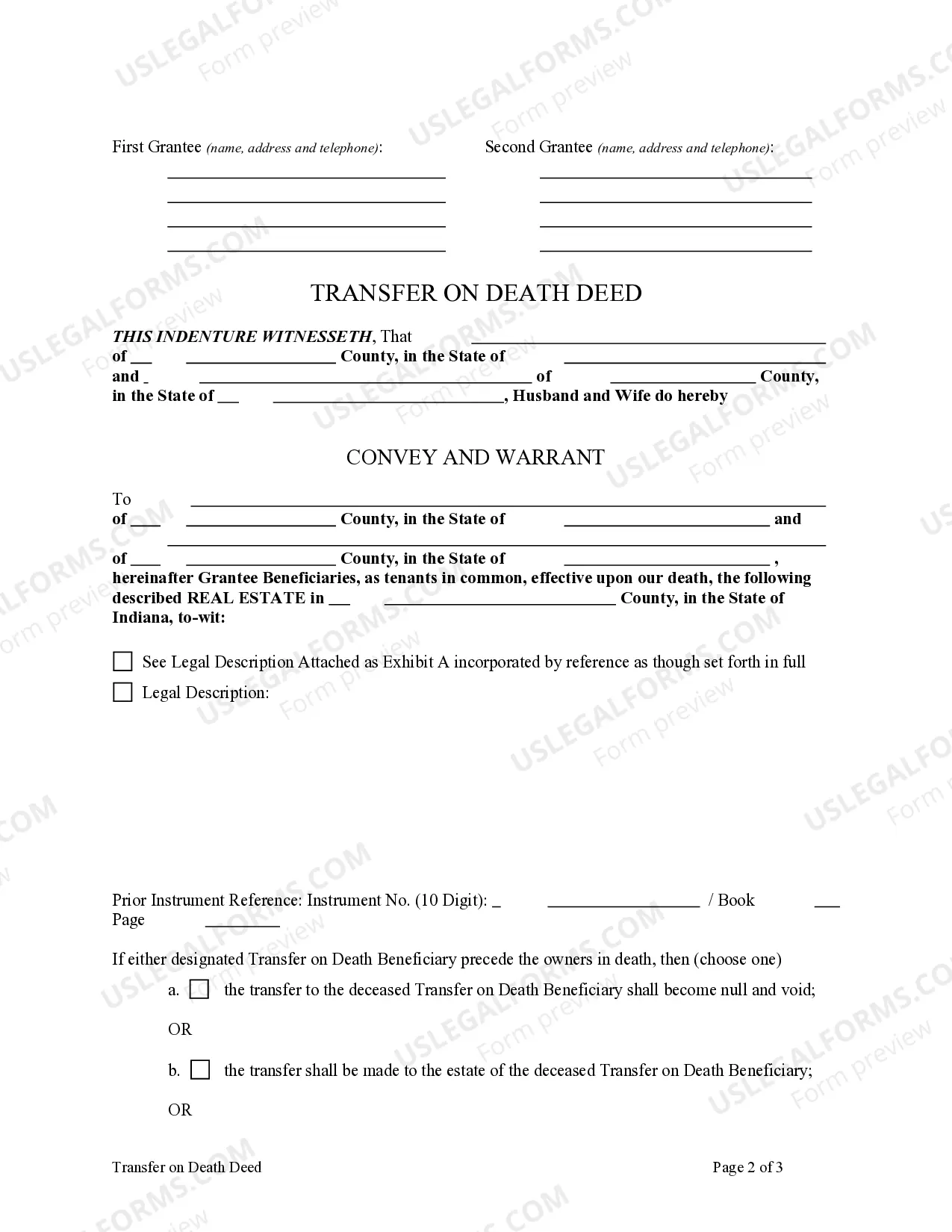

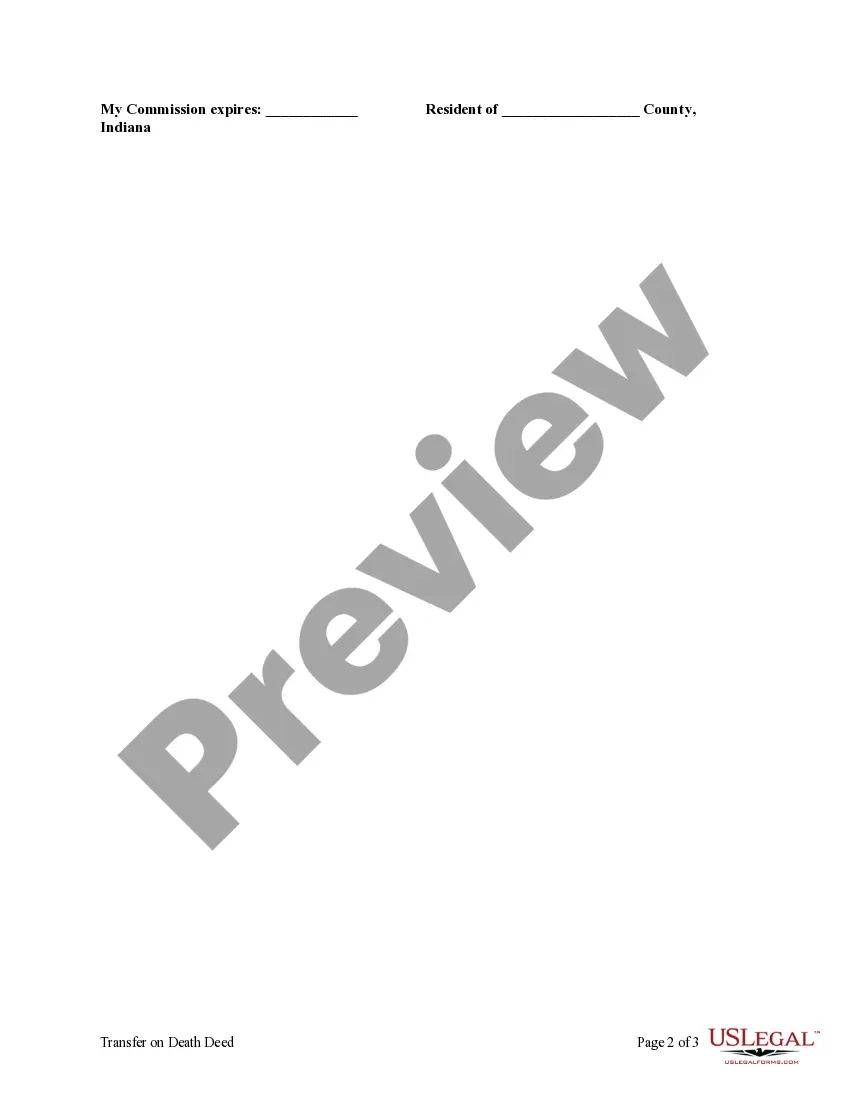

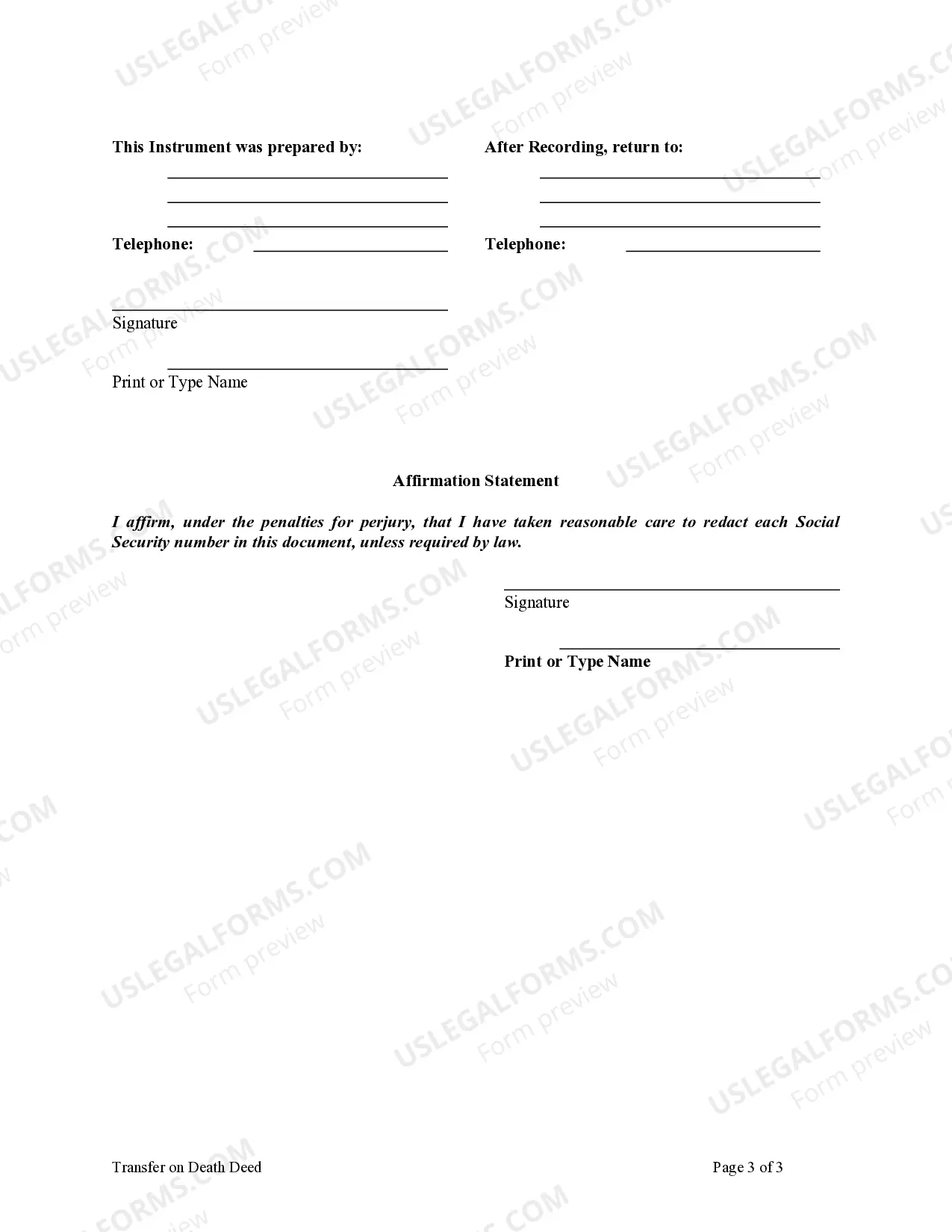

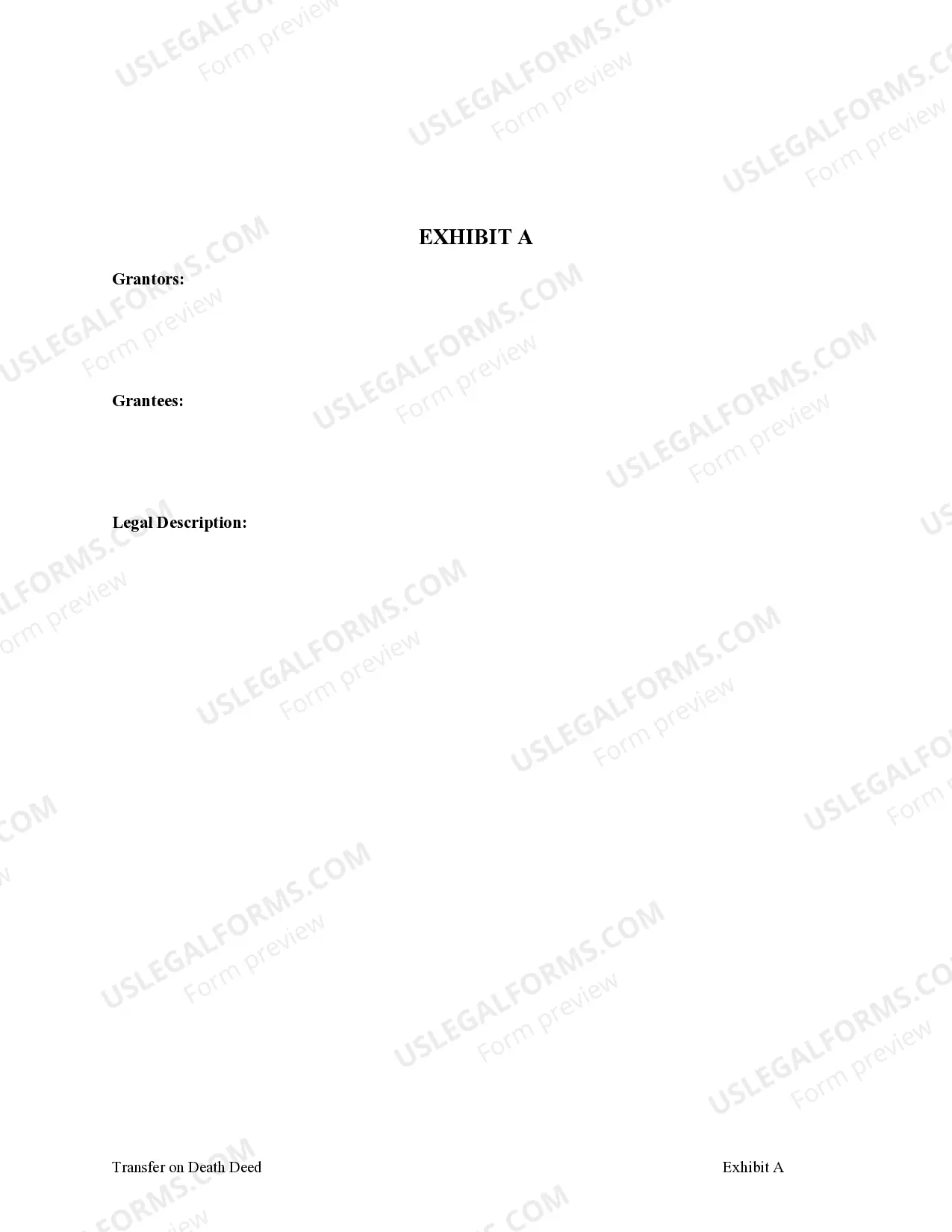

This form is a Transfer on Death Deed where the Grantors are husband and wife and the Grantees are two individuals. This transfer is revocable by either Grantor until their death and effective only upon the death of the last surviving grantor. The grantees take the property as tenants in common. This deed complies with all state statutory laws.

Indiana Transfer on Death Deed - Husband and Wife to Two Individuals

Description

How to fill out Indiana Transfer On Death Deed - Husband And Wife To Two Individuals?

Locating Indiana Transfer on Death Deed - Husband and Wife to Two Individuals forms and filling them out may be challenging. To conserve time, money, and effort, utilize US Legal Forms to quickly find the suitable template tailored for your state in just a few clicks. Our legal professionals prepare all documents, so all you need to do is complete them. It truly is that simple.

Log in to your profile and navigate back to the form's section to download the template. All of your saved documents are located in My documents and are accessible at all times for future use. If you haven’t signed up yet, you must create an account.

Review our detailed instructions on how to acquire your Indiana Transfer on Death Deed - Husband and Wife to Two Individuals template in just a few moments.

You can print the Indiana Transfer on Death Deed - Husband and Wife to Two Individuals template or complete it using any online editor. Don’t be concerned about typos because your template can be utilized and submitted, and printed as many times as you need. Explore US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- To obtain an eligible document, verify its appropriateness for your state.

- Use the Preview feature (if available) to view the template.

- If a description is present, read it to understand the specifics.

- Click on the Buy Now button if you have found what you need.

- Select your plan on the pricing page and create your account.

- Indicate if you prefer to pay via credit card or PayPal.

- Download the template in your desired format.

Form popularity

FAQ

To transfer property title to a family member in Indiana, consider using the Indiana Transfer on Death Deed - Husband and Wife to Two Individuals. This approach allows you to designate the new owner while retaining control until your passing. It simplifies the title transfer and ensures that your wishes are honored after your death.

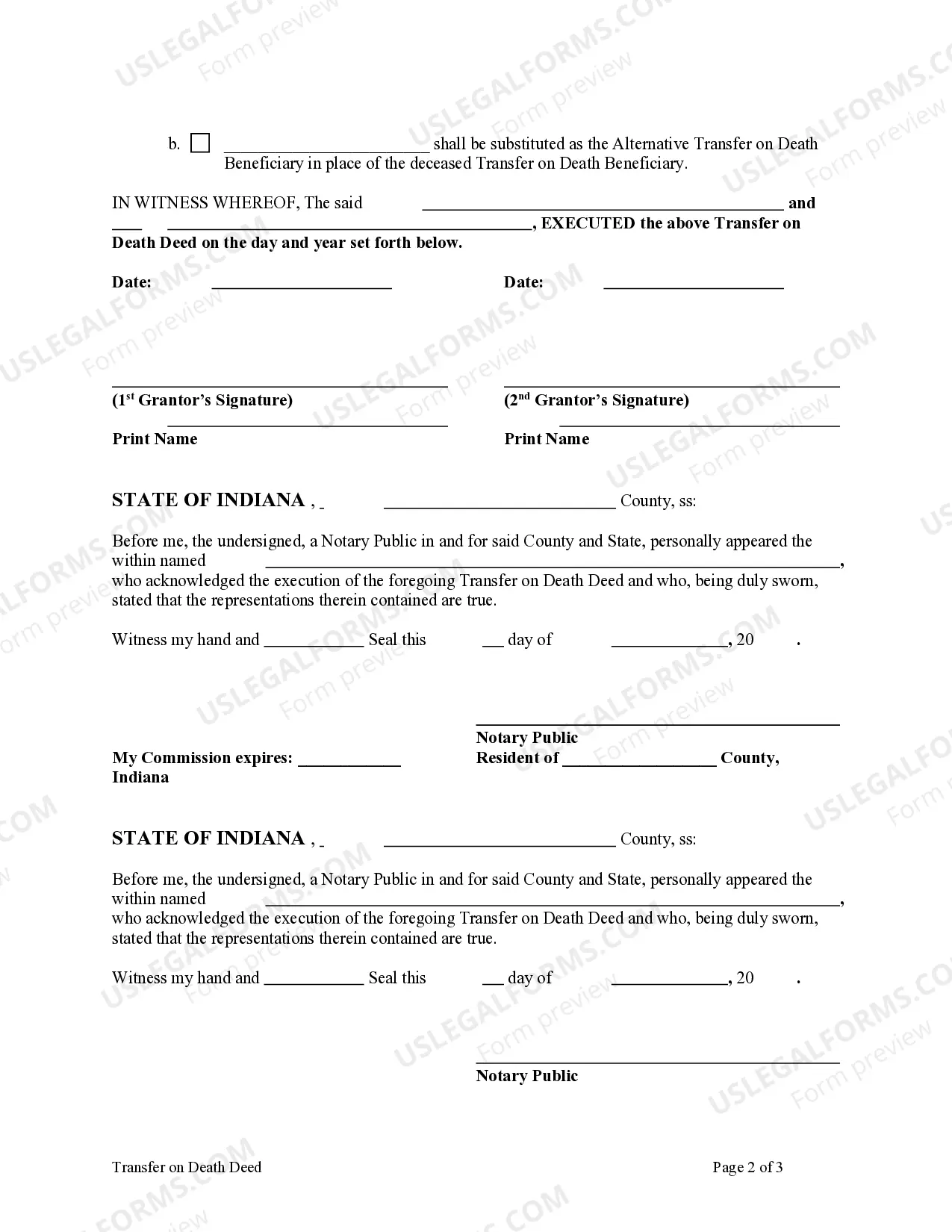

Discuss the terms of the deed with the new owners. Hire a real estate attorney to prepare the deed. Review the deed. Sign the deed in front of a notary public, with witnesses present. File the deed on public record.

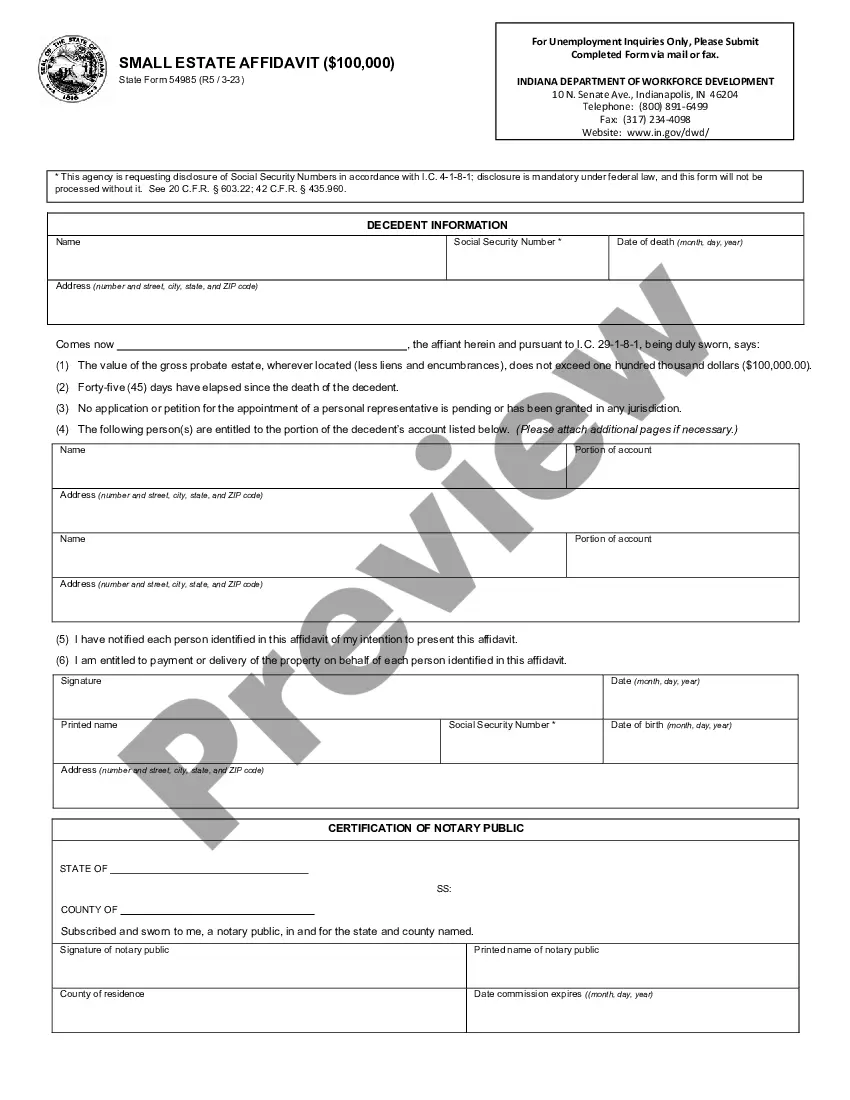

When someone who owns real property dies, the property goes into probate or it automatically passes, by operation of law, to surviving co-owners. Often, surviving co-owners do nothing with the title for as long as they own the property. Yet the best practice is to remove the deceased owner's name from the title.

Joint property, shares and bank accounts In most cases, you don't have to pay any Stamp Duty or tax when you inherit property, shares or the money in joint bank accounts you owned with the deceased.

TOD becomes effective for joint accounts if both owners pass away simultaneously. Joint and TOD registration generally allow an account to pass outside the probate estate, enabling the surviving owner or beneficiaries to avoid the time and expense of that process for this account.

If one co-owner dies, their interest in the property automatically passes to the surviving co-owner(s), whether or not they have a will. As tenants in common, co-owners own specific shares of the property. Each owner can leave their share of the property to whoever they choose.

If you own an account jointly with someone else, then after one of you dies, in most cases the surviving co-owner will automatically become the account's sole owner. The account will not need to go through probate before it can be transferred to the survivor.

Will bank accounts be frozen?You will need a tax release, death certificate, and Letters of Authority from probate court to have access to the account. A joint account with a surviving spouse will not be frozen and will remain fully and immediately available to the surviving spouse.

They are shorthand for transfer on death and joint tenancy with right of survivorship two designations that permit automatic transfer of assets from a deceased individual to a surviving individual.In some states, a TOD or JTWROS beneficiary designation is even allowed for real property.

In most cases, the surviving owner or heir obtains the title to the home, the former owner's death certificate, a notarized affidavit of death, and a preliminary change of ownership report form. When all these are gathered, the transfer gets recorded, the fees are paid, and the county issues a new title deed.