Illinois Cosmetologist Agreement - Self-Employed Independent Contractor

Description

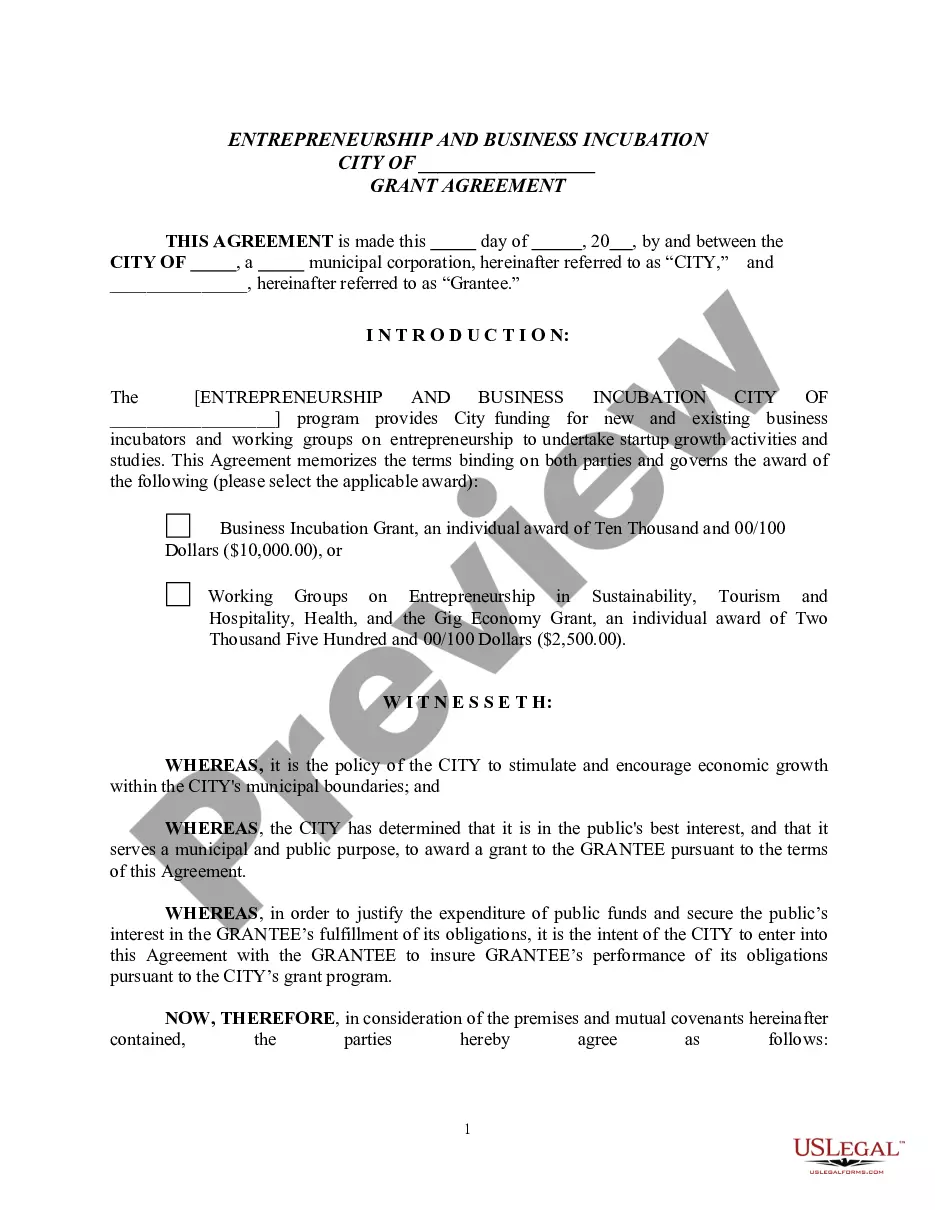

How to fill out Cosmetologist Agreement - Self-Employed Independent Contractor?

US Legal Forms - one of the largest collections of legal documents in the USA - offers a variety of legal form templates that you can download or print.

While navigating the website, you will discover thousands of forms for business and personal use, categorized by types, states, or keywords. You can find the latest versions of forms such as the Illinois Cosmetologist Agreement - Self-Employed Independent Contractor in just moments.

If you already have a subscription, Log In to download the Illinois Cosmetologist Agreement - Self-Employed Independent Contractor from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously saved forms in the My documents section of your account.

Process the payment. Use your credit card or PayPal account to complete the transaction.

Select the format and download the form to your device. Edit. Complete, modify, print, and sign the downloaded Illinois Cosmetologist Agreement - Self-Employed Independent Contractor. Every template you add to your account does not expire and is yours indefinitely. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you need. Access the Illinois Cosmetologist Agreement - Self-Employed Independent Contractor with US Legal Forms, the most extensive library of legal document templates. Utilize thousands of professional and state-specific templates that suit your business or personal needs and requirements.

- If you are using US Legal Forms for the first time, here are simple steps to get started.

- Ensure you have selected the correct form for your city/region. Click on the Review button to examine the form's content.

- Check the form description to confirm that you have chosen the right document.

- If the form does not meet your requirements, utilize the Search box at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Buy now button.

- Then, choose the pricing plan you prefer and provide your information to sign up for an account.

Form popularity

FAQ

To be classified as self-employed, an individual must operate a business or provide services independently of a traditional employer. This includes making your own business decisions, managing finances, and reporting income through forms like the 1099. If you work under contracts like the Illinois Cosmetologist Agreement - Self-Employed Independent Contractor, you are recognized as self-employed, enjoying the benefits and responsibilities that come with it.

Receiving a 1099 tax form typically indicates that you are self-employed. This form is issued to independent contractors and freelancers, reflecting the income you earned throughout the year. If you are working under the Illinois Cosmetologist Agreement - Self-Employed Independent Contractor, your 1099 income confirms your self-employed status.

Yes, independent contractors are considered self-employed. When you enter into an agreement, such as the Illinois Cosmetologist Agreement - Self-Employed Independent Contractor, you take on the role of a business owner. This means you are responsible for your income, taxes, and overall business operations, distinguishing you from traditional employment.

An independent contractor in cosmetology provides services on their terms rather than as an employee. This relationship is typically established through agreements such as the Illinois Cosmetologist Agreement - Self-Employed Independent Contractor. Here, the contractor manages their business affairs, including client relationships and financial responsibilities, while complying with state regulations.

Self-employed and independent contractor essentially mean the same thing but may carry different connotations. Self-employed often suggests a broader scope of entrepreneurship, while independent contractor specifically refers to contractual work arrangements. When discussing the Illinois Cosmetologist Agreement - Self-Employed Independent Contractor, clarity is key, so use the term that best fits the specific situation.

The independent contractor law in Illinois defines the legal relationship between workers and employers. In this context, an independent contractor operates under a contract, such as the Illinois Cosmetologist Agreement - Self-Employed Independent Contractor. This agreement outlines the terms, responsibilities, and rights of both parties, helping to ensure compliance with state regulations.

Filing taxes as an independent contractor may seem complex at first, but it becomes manageable with proper organization. Keeping detailed records of your earnings and expenses simplifies the process significantly. Additionally, utilizing platforms like US Legal Forms can provide you with essential tools and guidance to help navigate the tax requirements tied to your Illinois Cosmetologist Agreement - Self-Employed Independent Contractor.

Independent hairstylists file taxes as self-employed individuals, reporting their income on Schedule C of their IRS tax return. It's essential to keep comprehensive records of your income and expenses throughout the year. If you have questions about your filings, the US Legal Forms platform provides resources to simplify this process, ensuring you understand all requirements of the Illinois Cosmetologist Agreement - Self-Employed Independent Contractor.

Filing taxes as a hairstylist involves reporting your income accurately and locating the appropriate tax forms, such as the 1040 and Schedule C. You will need to calculate your earnings along with any business expenses incurred during the year, which can lower your taxable income. Remember, when you operate under an Illinois Cosmetologist Agreement - Self-Employed Independent Contractor, certain deductions may apply, so keep track of relevant receipts.

To complete an Illinois Cosmetologist Agreement - Self-Employed Independent Contractor, start by entering your personal information, including your name and address. Next, specify the services you will provide and the agreed payment terms. Make sure to include any additional clauses that outline the responsibilities and rights of both parties. Lastly, sign and date the document to make it legally binding.