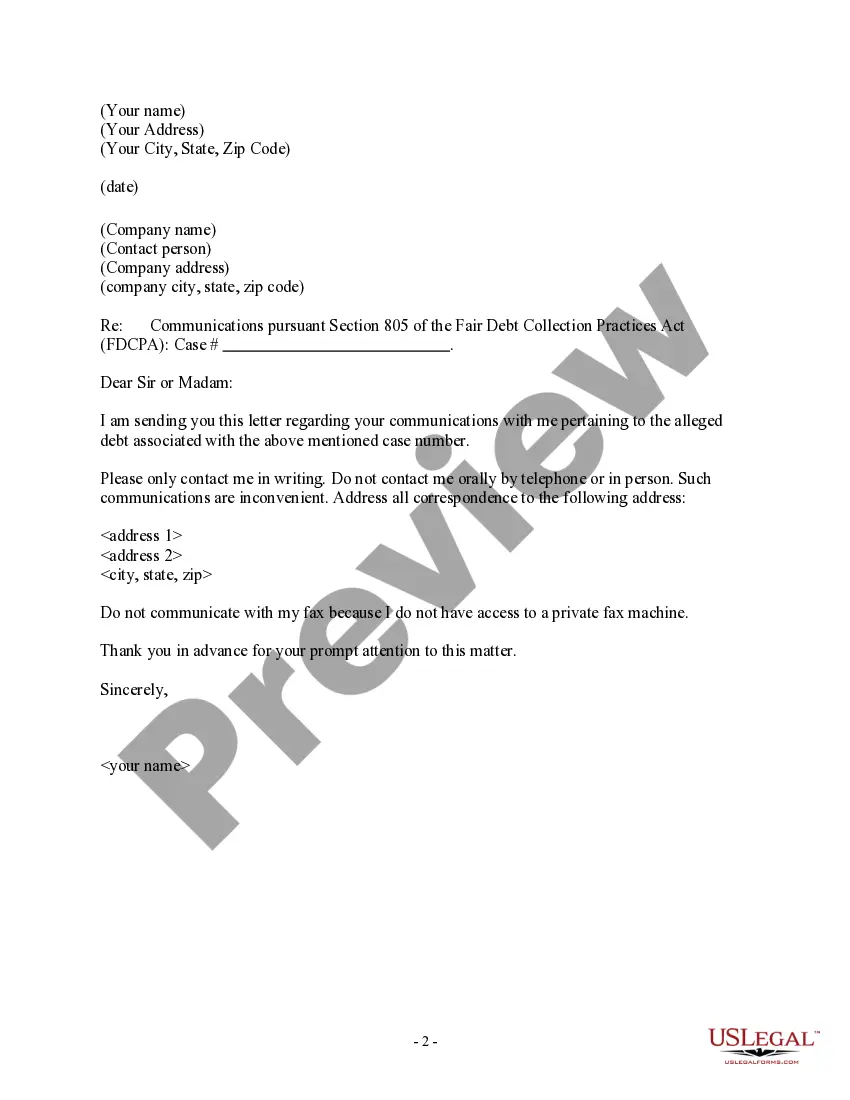

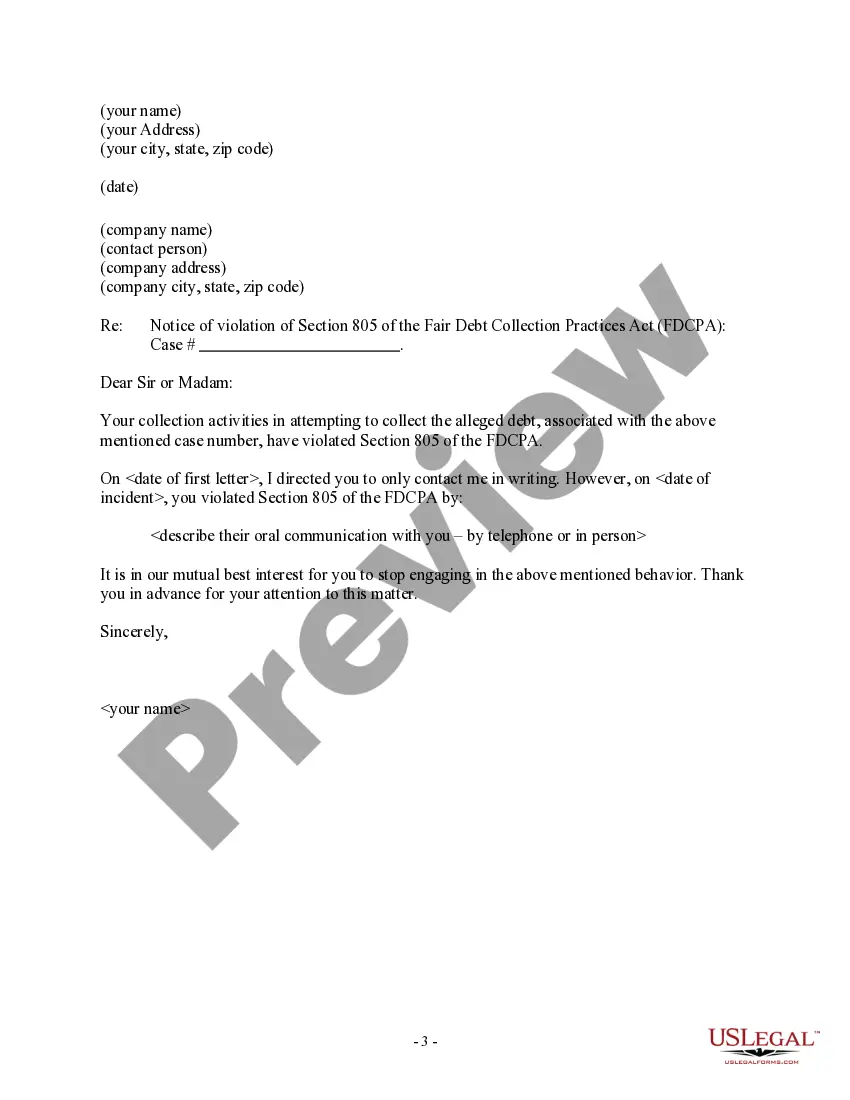

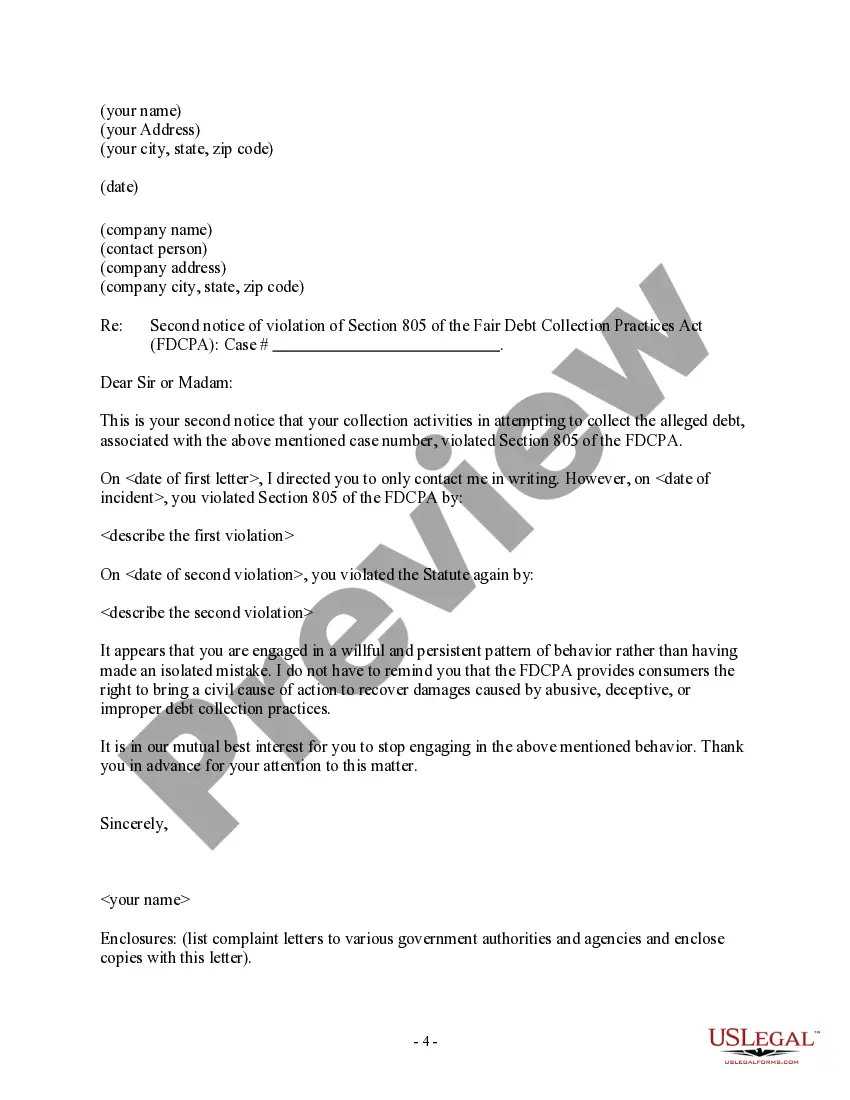

Illinois Letter to Debt Collector - Only Contact Me In Writing

Description

How to fill out Letter To Debt Collector - Only Contact Me In Writing?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal document templates that you can purchase or print.

By using the website, you can locate thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can obtain the latest versions of forms such as the Illinois Letter to Debt Collector - Only Contact Me In Writing within moments.

Click the Review button to examine the form’s content. Read the form description to confirm that you’ve chosen the right form.

If the form does not suit your requirements, use the Search area at the top of the screen to find the one that does.

- If you already have a membership, Log In and obtain the Illinois Letter to Debt Collector - Only Contact Me In Writing from the US Legal Forms library.

- The Download button will appear on every form you view.

- You can access all previously downloaded forms from the My documents tab in your account.

- To use US Legal Forms for the first time, follow these basic instructions to get started.

- Ensure you’ve selected the correct form for your jurisdiction/county.

Form popularity

FAQ

A new rule allows debt collectors to contact you on social media, text or email not just by phone. The rule, which was approved last year by the Consumer Financial Protection Bureau's former president Kathleen L. Kraninger, took effect Tuesday, Nov. 30.

What Does a Debt Verification Notice Include? A debt collector has to send you a written statement outlining the specifics of your debt that is in collection. Within five days of contacting you, a debt collector must send you this written notice with the amount of money you owe and the name of the original creditor.

Legally Speaking, Emails are Considered Writings If sent to a consumer by a third-party debt collector, emails must comply with the Fair Debt Collection Practices Act (or FDCPA). If the email communication pertains to healthcare debt, the Health Insurance Portability and Accountability Act (HIPAA) applies.

Legally Speaking, Emails are Considered Writings If sent to a consumer by a third-party debt collector, emails must comply with the Fair Debt Collection Practices Act (or FDCPA).

3 Things You Should NEVER Say To A Debt CollectorAdditional Phone Numbers (other than what they already have)Email Addresses.Mailing Address (unless you intend on coming to a payment agreement)Employer or Past Employers.Family Information (ex.Bank Account Information.Credit Card Number.Social Security Number.

Five years for unwritten debt agreements and open-ended agreements. Ten years for written agreements and promissory notes.

A debt collector has to send you a written statement outlining the specifics of your debt that is in collection. Within five days of contacting you, a debt collector must send you this written notice with the amount of money you owe and the name of the original creditor.

It should be short, concise, to the point and very clear as to what you want. It's imperative that you say as much as you can with as little text as possible. Remember to include the exact amount owed, the invoice number and the due date.

For some folks, that means dealing with calls from debt collectors. Starting late next year, collectors will also be allowed to contact consumers by email, text message, and even through social media, according to the Consumer Financial Protection Bureau.

As of Nov. 30, 2021, debt collectors have new options for how they may communicate with you about debts they're trying to collect. Now they can text you. Text messages, along with emailing and direct messages on social media, are allowed as part of an update to the Fair Debt Collection Practices Act (FDCPA).