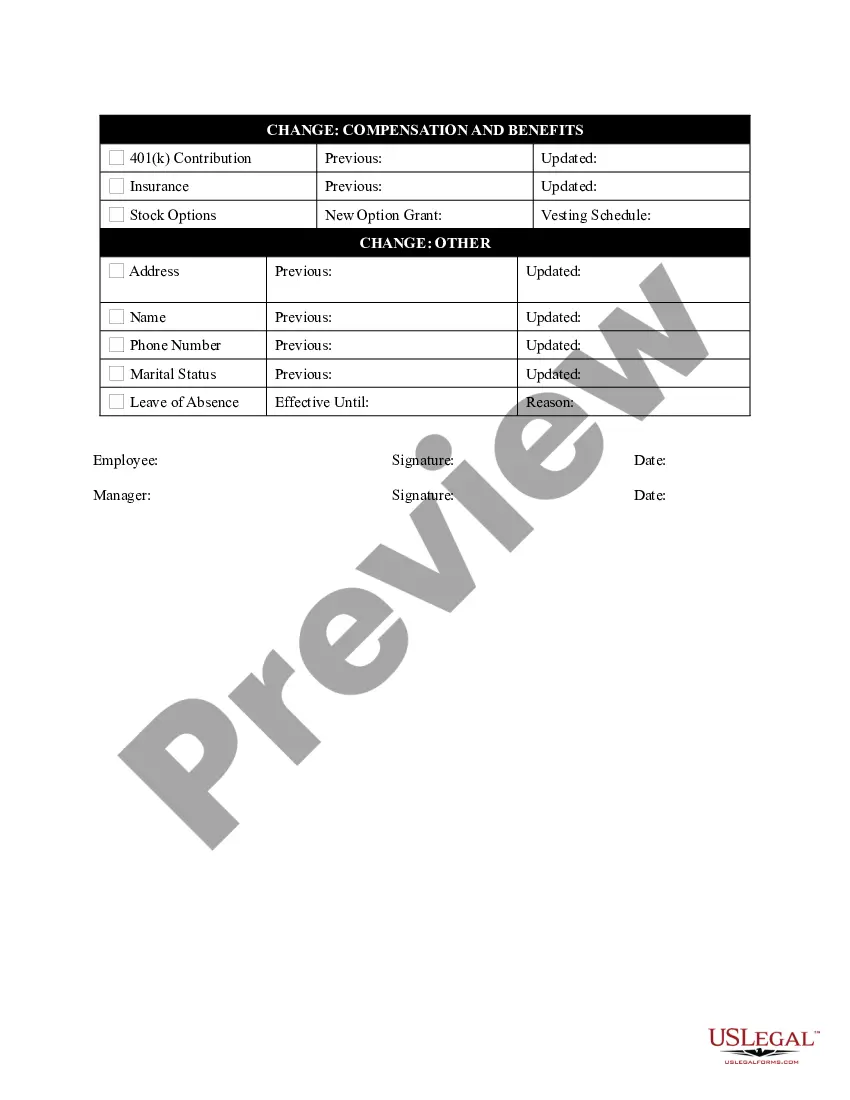

Illinois Personnel Status Change Worksheet

Description

How to fill out Personnel Status Change Worksheet?

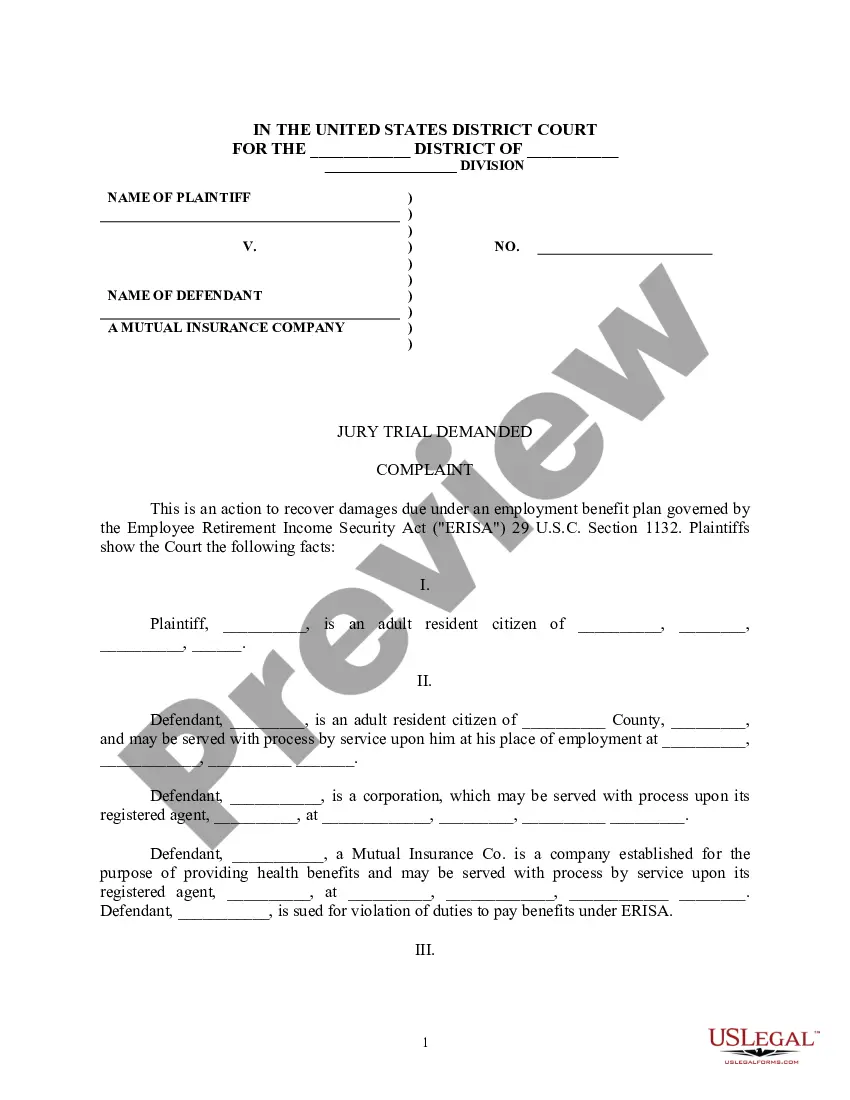

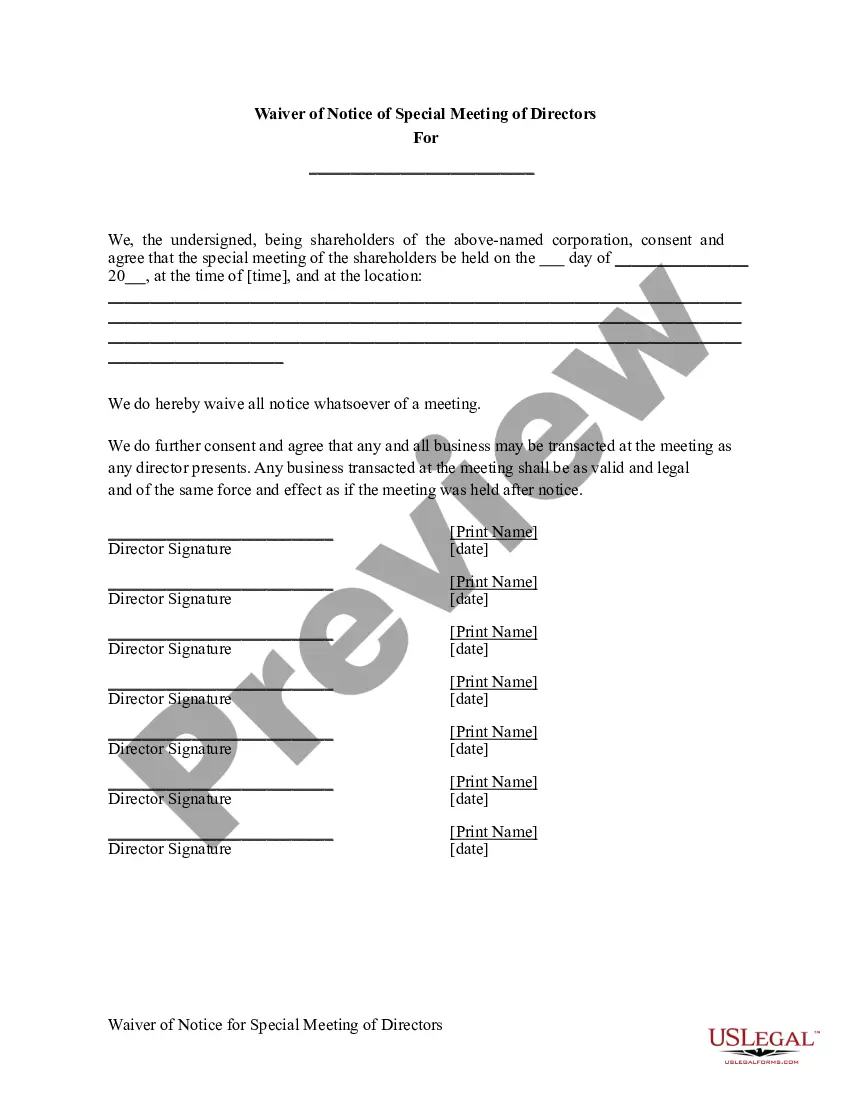

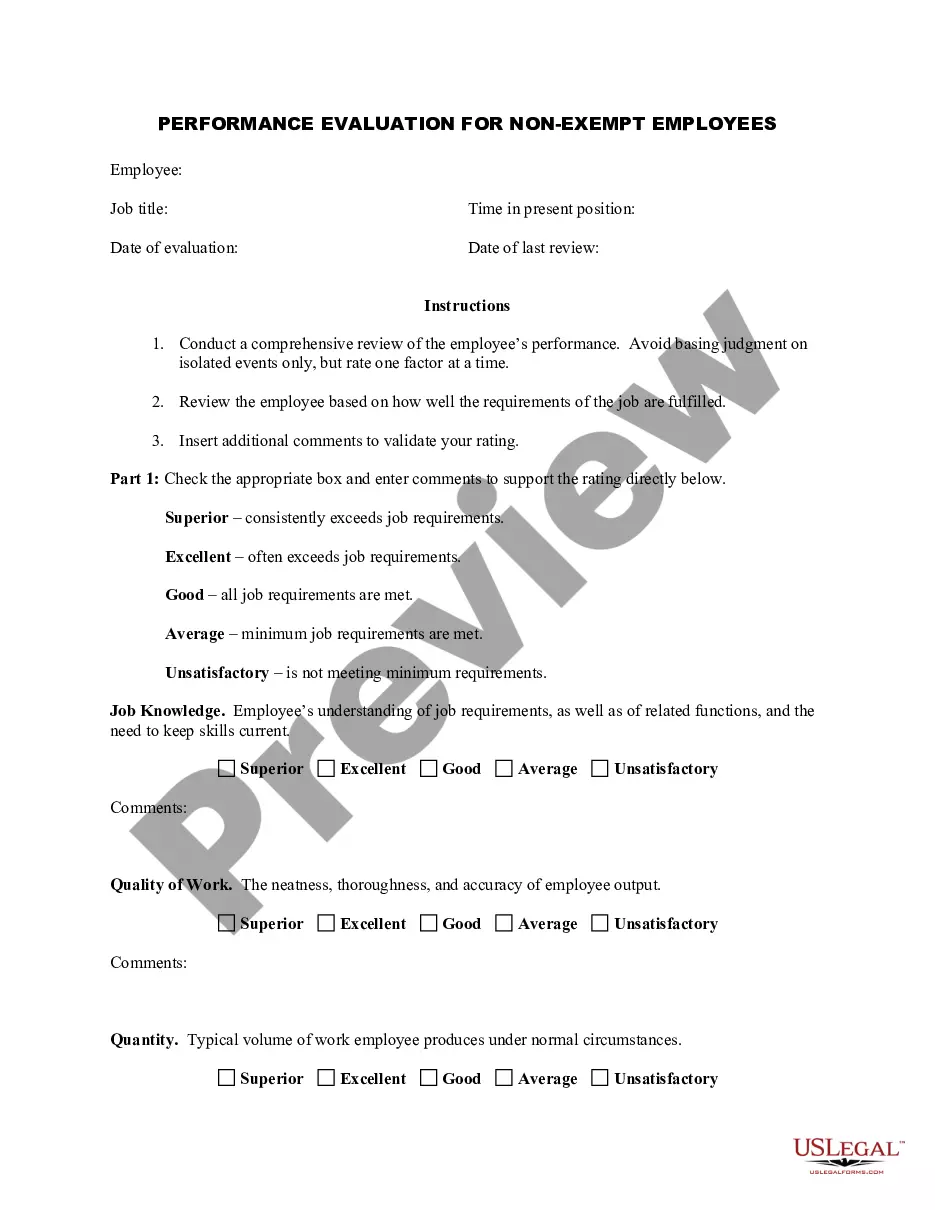

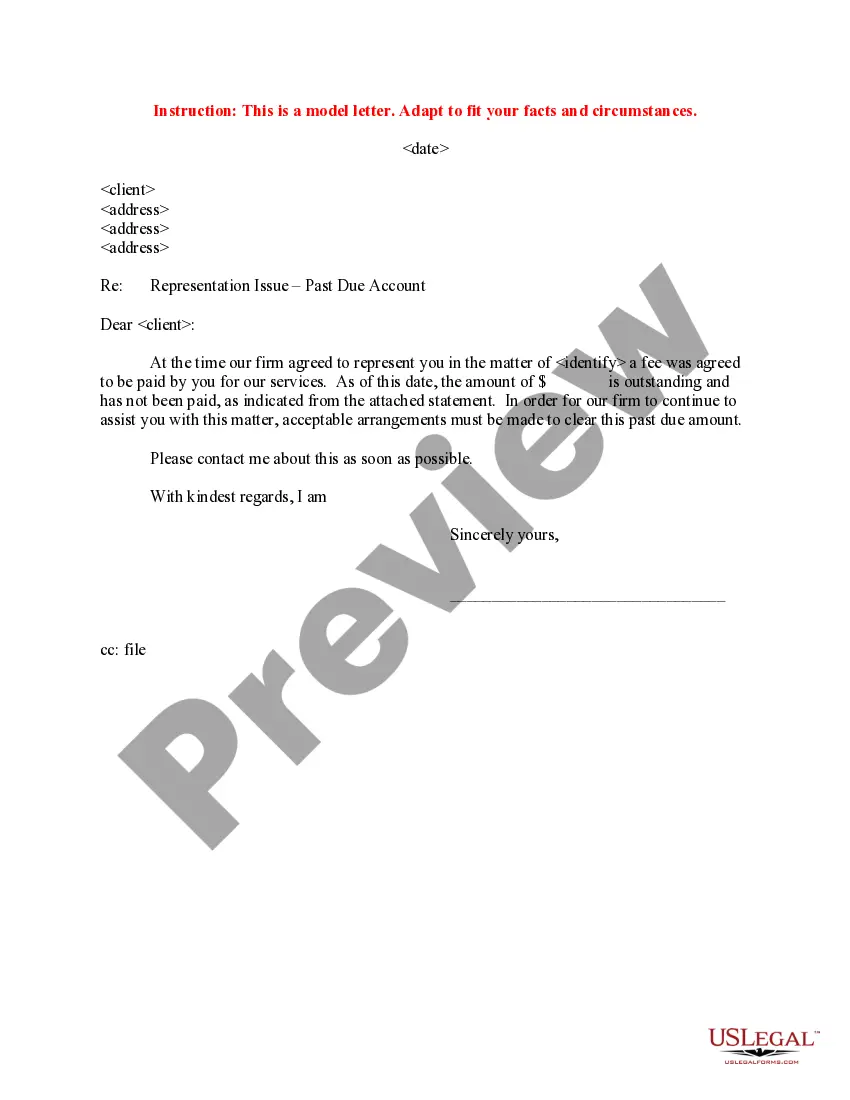

Selecting the top authentic document template can be challenging. Naturally, there are numerous templates available online, but how do you find the authentic document you require? Utilize the US Legal Forms website. This service offers thousands of templates, including the Illinois Personnel Status Change Worksheet, suitable for both business and personal needs. All the forms are reviewed by professionals and comply with federal and state regulations.

If you are already registered, Log In to your account and click the Obtain button to access the Illinois Personnel Status Change Worksheet. Use your account to view the legal forms you have purchased previously. Navigate to the My documents section of your account and download another copy of the document you require.

If you are a new user of US Legal Forms, here are simple steps to follow.

- First, ensure you have selected the correct document for your city/region.

- You can browse the form using the Review button and read the form description to confirm it is suitable for you.

- If the form does not meet your requirements, utilize the Search section to find the appropriate document.

- Once you are confident the form is correct, click the Get now button to obtain the document.

- Choose the pricing plan you want and enter the necessary information. Create your account and complete the transaction using your PayPal account or credit card.

- Select the file format and download the legal document template for your device.

Form popularity

FAQ

Line 3 of the IL W-4 form allows you to specify the number of allowances you wish to claim. This line is important as it directly affects how much state tax is withheld from your paycheck. Filling this line out accurately can help you avoid under-withholding or over-withholding throughout the year. You can refer to the Illinois Personnel Status Change Worksheet to guide your calculations.

An Illinois withholding allowance sheet is a form used to calculate the number of allowances an employee claims for income tax withholding purposes. This sheet helps determine the amount of state income tax that is withheld from your paycheck. It's essential to fill out this sheet accurately to ensure that the right amount is withheld, aligning with your tax obligations. A well-completed Illinois Personnel Status Change Worksheet can guide you through this process.

How to fill out a W-4 formStep 1: Personal information.Step 2: Account for multiple jobs.Step 3: Claim dependents, including children.Step 4: Refine your withholdings.Step 5: Sign and date your W-4.» MORE: See more about what it means to be tax-exempt and how to qualify.

By placing a 0 on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period.

How to Complete the New Form W-4Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number.Step 2: Indicate Multiple Jobs or a Working Spouse.Step 3: Add Dependents.Step 4: Add Other Adjustments.Step 5: Sign and Date Form W-4.

Claiming zero allowances can lead to a bigger refund, but it also means you're likely overpaying on your taxes. Although you may receive a larger refund following your filing, you will also be more financially constrained throughout the previous 11 months of the year.

Tips. While claiming one allowance on your W-4 means your employer will take less money out of your paycheck for federal taxes, it does not impact how much taxes you'll actually owe. Depending on your income and any deductions or credits that apply to you, you may receive a tax refund or have to pay a difference.

How to file a W-4 form in 5 StepsStep 1: Enter your personal information. The first step is filling out your name, address and Social Security number.Step 2: Multiple jobs or spouse works.Step 3: Claim dependents.Step 4: Factor in additional income and deductions.Step 5: Sign and file with your employer.

How to Complete the New Form W-4Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number.Step 2: Indicate Multiple Jobs or a Working Spouse.Step 3: Add Dependents.Step 4: Add Other Adjustments.Step 5: Sign and Date Form W-4.

How Many Allowances Should I Claim if I'm Single? If you are single and have one job, you can claim 1 allowance. There's also the option of requesting 2 allowances if you are single and have one job.