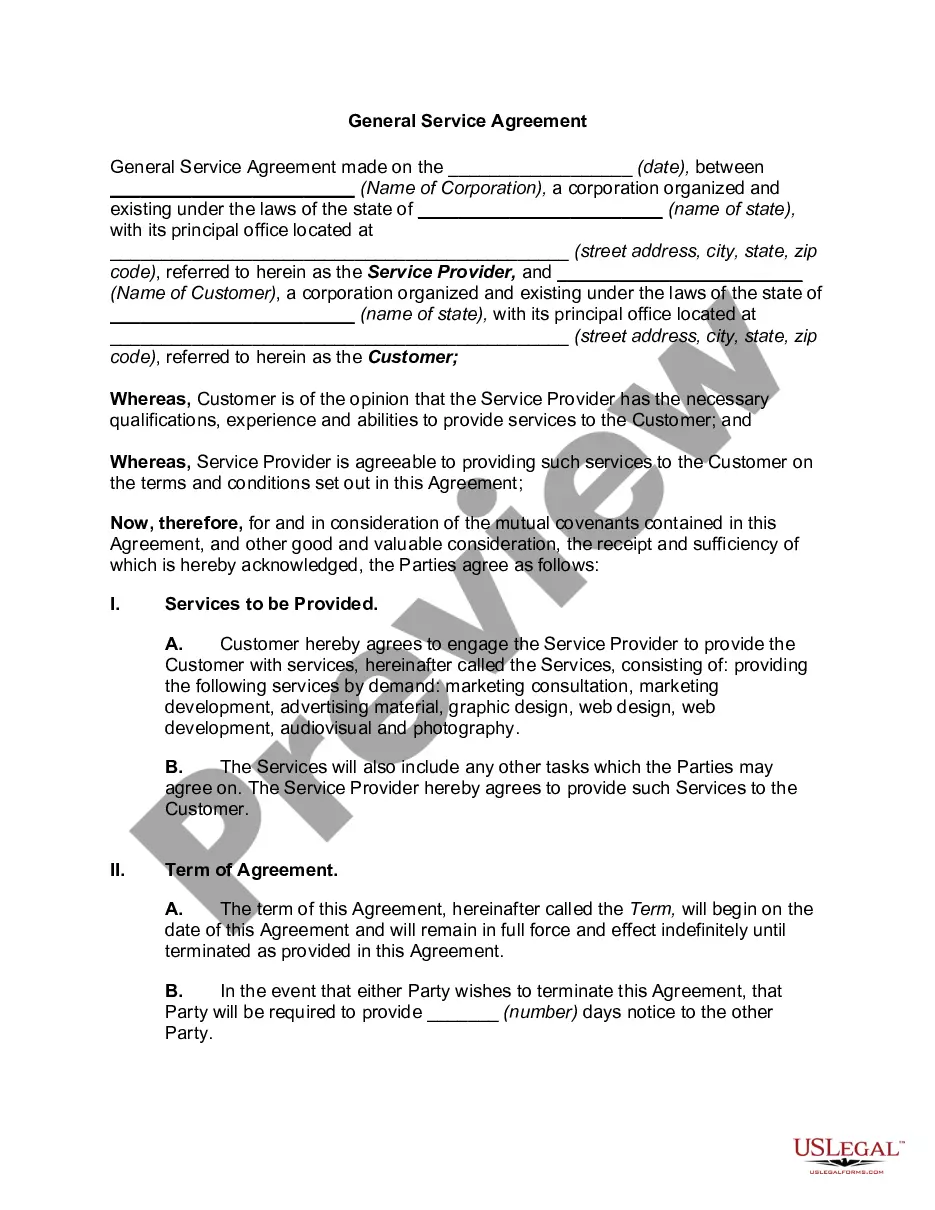

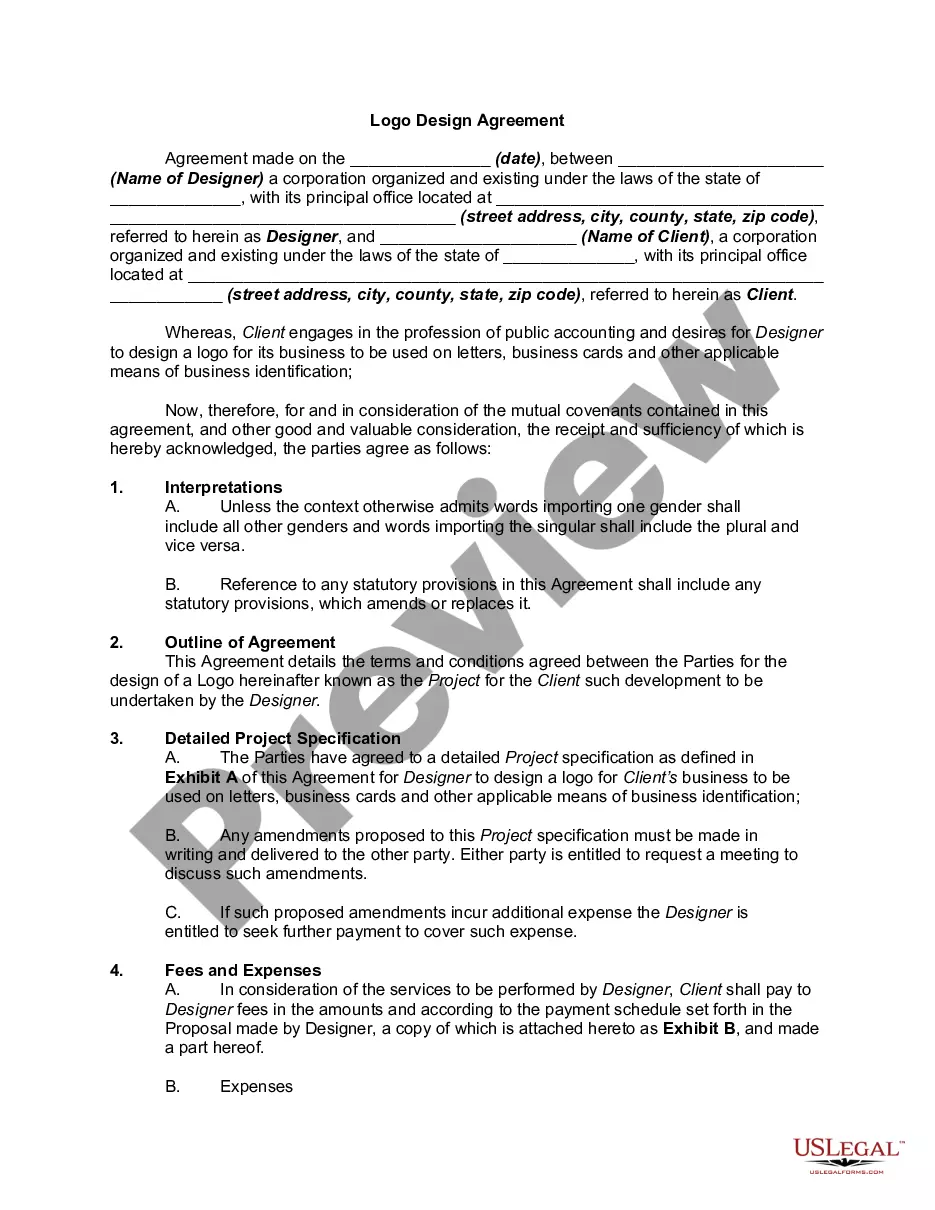

Illinois Statement of Work

Description

How to fill out Statement Of Work?

You can dedicate time on the internet searching for the legal document template that complies with the federal and state regulations you will require.

US Legal Forms offers thousands of legal templates that are evaluated by professionals.

You can download or print the Illinois Statement of Work from our service.

If available, make use of the Review button to view the document template as well.

- If you already have a US Legal Forms account, you can Log In and then click the Download button.

- After that, you can complete, edit, print, or sign the Illinois Statement of Work.

- Every legal document template you obtain is yours indefinitely.

- To get an extra copy of a purchased form, go to the My documents tab and click the relevant button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for your chosen state/city.

- Read the form description to confirm you have picked the appropriate form.

Form popularity

FAQ

A properly written Illinois Statement of Work clearly articulates project goals, deliverables, and timelines without ambiguity. It provides a roadmap for all parties involved, detailing their responsibilities and the metrics for success. By ensuring all critical elements are covered, you create a solid foundation for project execution and evaluation.

What is difference in withholding amount between Married , 0 and Married 1 personal allowance? The more allowances an employee claims, the less is withheld for federal income tax. If you claim 0 allowances, more will be withheld from your check than if you claim 1. The amount also depends on how often you get paid.

How to Complete the New Form W-4Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number.Step 2: Indicate Multiple Jobs or a Working Spouse.Step 3: Add Dependents.Step 4: Add Other Adjustments.Step 5: Sign and Date Form W-4.

Tips. While claiming one allowance on your W-4 means your employer will take less money out of your paycheck for federal taxes, it does not impact how much taxes you'll actually owe. Depending on your income and any deductions or credits that apply to you, you may receive a tax refund or have to pay a difference.

Form ST-1, Step 2: Taxable ReceiptsEnter your Gross Sales on your Illinois form ST-1 on line 1 Total Receipts under Step 2: Taxable Receipts. The Illinois filing system will automatically round this number to the closest dollar amount.

You can claim anywhere between 0 and 3 allowances on the 2019 W4 IRS form, depending on what you're eligible for. Generally, the more allowances you claim, the less tax will be withheld from each paycheck. The fewer allowances claimed, the larger withholding amount, which may result in a refund.

By placing a 0 on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period. 2.

Should I 0 or 1 on a Form W4 for Tax Withholding Allowance being a dependent? If you put "0" then more will be withheld from your pay for taxes than if you put "1"--so that is correct. The more "allowances" you claim on your W-4 the more you get in your take-home pay.

Claiming 1 reduces the amount of taxes that are withheld from weekly paychecks, so you get more money now with a smaller refund. Claiming 0 allowances may be a better option if you'd rather receive a larger lump sum of money in the form of your tax refund.

A single filer with no children should claim a maximum of 1 allowance, while a married couple with one source of income should file a joint return with 2 allowances. You can also claim your children as dependents if you support them financially and they're not past the age of 19.