Illinois Sample Letter regarding Motion to Sell Property of an Estate

Description

How to fill out Sample Letter Regarding Motion To Sell Property Of An Estate?

Finding the right legitimate file template can be quite a battle. Obviously, there are plenty of web templates available on the Internet, but how do you get the legitimate form you will need? Use the US Legal Forms website. The support delivers a large number of web templates, including the Illinois Sample Letter regarding Motion to Sell Property of an Estate, which can be used for company and private needs. All the forms are examined by specialists and satisfy state and federal demands.

When you are presently signed up, log in for your account and click on the Download option to have the Illinois Sample Letter regarding Motion to Sell Property of an Estate. Make use of your account to search through the legitimate forms you may have acquired in the past. Proceed to the My Forms tab of your own account and acquire one more copy of your file you will need.

When you are a brand new consumer of US Legal Forms, allow me to share straightforward recommendations that you should adhere to:

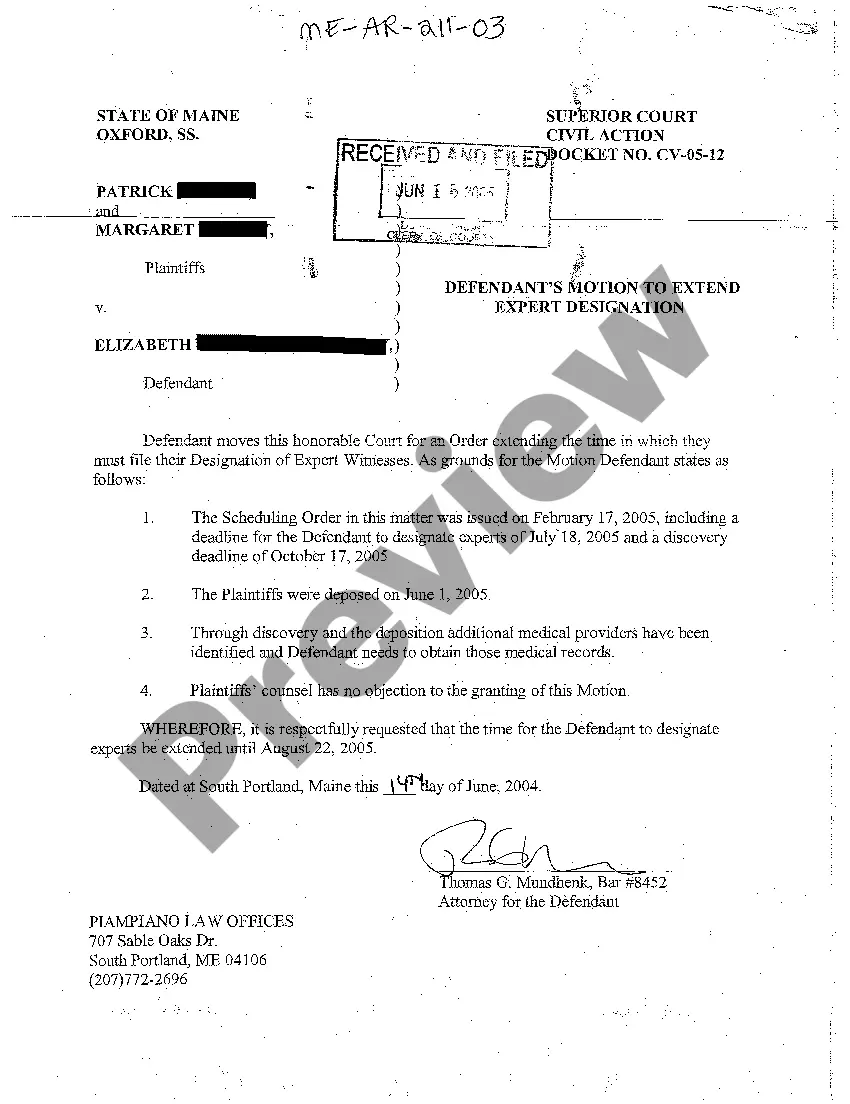

- Very first, ensure you have selected the correct form for your town/state. You are able to look through the form making use of the Preview option and read the form outline to make sure this is the best for you.

- In the event the form does not satisfy your requirements, make use of the Seach industry to discover the right form.

- Once you are certain the form is suitable, go through the Get now option to have the form.

- Select the pricing plan you want and enter in the necessary details. Make your account and pay for the order making use of your PayPal account or bank card.

- Choose the file file format and down load the legitimate file template for your gadget.

- Total, change and printing and indicator the attained Illinois Sample Letter regarding Motion to Sell Property of an Estate.

US Legal Forms may be the biggest collection of legitimate forms for which you can find numerous file web templates. Use the service to down load professionally-manufactured documents that adhere to state demands.

Form popularity

FAQ

What Are the Primary Methods for Avoiding Probate in Illinois? The primary methods for avoiding probate in Illinois include joint tenancy, living trusts, beneficiary designations, and Payable-on-Death (POD) or Transfer-on-Death (TOD) accounts.

The probate process in Illinois can last up to twelve months.

Closing of an Illinois Probate Estate The executor must file a final accounting with the court showing how estate assets were handled. The accounting will list the assets, possible income the estate generated, the amount paid for any debts or other expenses, and the distributions made to beneficiaries.

Deadline to close the estate: 14 months from the date the will is admitted to probate. If the estate remains open after 14 months, the court will expect the representative to account or report to the court to explain why the estate needs to remain open.

Yes, a house can be sold while in probate. In fact, it is often necessary to sell the property in order to pay off debts and distribute assets to beneficiaries. However, it is important to understand that the probate process can take several months or even longer, so selling the house may not be a quick process.

Yes, a house can be sold while in probate. In fact, it is often necessary to sell the property in order to pay off debts and distribute assets to beneficiaries. However, it is important to understand that the probate process can take several months or even longer, so selling the house may not be a quick process.

While the executor possesses the authority to sell estate property, it must be done diligently and transparently. Selling at fair market value safeguards beneficiaries' interests, respecting the testator's wishes while navigating the complexities of the estate settlement.