Illinois Sample Letter for Insufficient Amount to Reinstate Loan

Description

How to fill out Sample Letter For Insufficient Amount To Reinstate Loan?

If you require to complete, obtain, or generate legal document templates, utilize US Legal Forms, the most extensive assortment of legal forms available online. Take advantage of the site’s straightforward and user-friendly research to locate the documents you need.

A range of templates for commercial and specific purposes are organized by categories and states, or search terms. Use US Legal Forms to find the Illinois Sample Letter for Insufficient Amount to Reinstate Loan in just a few clicks.

If you are currently a US Legal Forms member, Log In to your account and click on the Download button to retrieve the Illinois Sample Letter for Insufficient Amount to Reinstate Loan. You may also access forms you previously submitted electronically in the My documents tab of your account.

Every legal document template you acquire is yours forever. You will have access to every document you downloaded in your account. Click the My documents section and select a document to print or download again.

Be proactive and obtain, and print the Illinois Sample Letter for Insufficient Amount to Reinstate Loan with US Legal Forms. There are numerous professional and state-specific forms you can use for your business or individual needs.

- Step 1. Ensure you have chosen the form for the correct city/state.

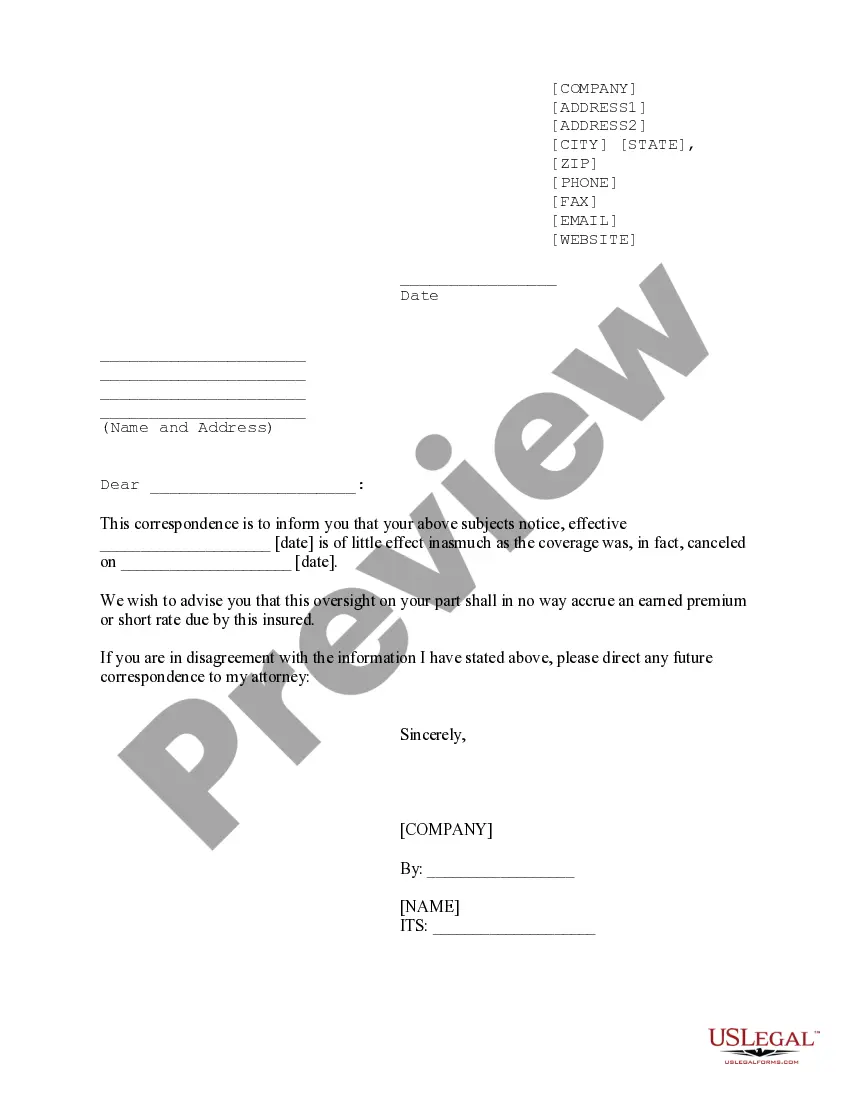

- Step 2. Use the Review option to check the form’s details. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, make use of the Search field at the top of the screen to find other versions of the legal document template.

- Step 4. Once you have located the form you need, click on the Buy now button. Select the pricing plan you prefer and enter your information to register for the account.

- Step 5. Process the payment. You can utilize your credit card or PayPal account to complete the transaction.

- Step 6. Choose the format of the legal document and download it to your device.

- Step 7. Complete, modify, and print or sign the Illinois Sample Letter for Insufficient Amount to Reinstate Loan.

Form popularity

FAQ

To stop foreclosure in Illinois, you have several options available. You can negotiate with your lender for a loan modification or consider filing for bankruptcy, which may provide temporary relief. Additionally, you can use an Illinois Sample Letter for Insufficient Amount to Reinstate Loan to present your case and express your commitment to making payments. Remember, timely and clear communication with your lender can make a significant difference in the outcome.

To claim surplus funds from foreclosure in Illinois, you need to follow specific legal procedures. After the foreclosure sale, if the sale total is more than what you owe on the mortgage, you can file a motion in court for the surplus. This process can be intricate, and using resources like uslegalforms can provide templates and information that simplify your claim to the surplus funds. An Illinois Sample Letter for Insufficient Amount to Reinstate Loan may also help in your communication with the court if you are facing additional mortgage issues.

In Illinois, lenders usually start the foreclosure process after you miss three consecutive mortgage payments. This is crucial to understand, as lenders often notify you of your missed payments before moving forward. It's important to keep clear communication with your lender during this time. Consider using an Illinois Sample Letter for Insufficient Amount to Reinstate Loan to express your intent to cure the default.

The right of redemption in Illinois allows homeowners to reclaim their property after a foreclosure sale by paying the total amount owed, including costs and fees. This process typically lasts for a specific period, usually from the sale date to about 30 days after. Knowing your rights and options, including an Illinois Sample Letter for Insufficient Amount to Reinstate Loan, can empower you to take necessary actions to protect your home.

Income withholding for support in Illinois refers to the legal process of deducting funds from a person's paycheck to fulfill child support or alimony obligations. This garnishment ensures consistent support payments to family members. Understanding this can help when facing financial challenges; when combined with an Illinois Sample Letter for Insufficient Amount to Reinstate Loan, it may provide negotiating power with creditors.

Reinstating property means that a homeowner brings their mortgage current by paying all overdue amounts and fees. This process halts foreclosure proceedings, reinstating the homeowner's rights under the mortgage agreement. To navigate this effectively, consider using an Illinois Sample Letter for Insufficient Amount to Reinstate Loan to present your case to the lender.

The right to reinstate a mortgage in Illinois allows borrowers to remedy their default by paying the overdue amount before the foreclosure sale occurs. This right helps prevent the loss of the home and provides an opportunity to negotiate terms with the lender. An Illinois Sample Letter for Insufficient Amount to Reinstate Loan can assist you in drafting your request clearly and professionally.

A mortgagor in default can exercise the right of reinstatement at any point before the foreclosure sale. Illinois law allows borrowers to catch up on missed payments and related fees, thereby stopping the foreclosure process. This is often where an Illinois Sample Letter for Insufficient Amount to Reinstate Loan can be beneficial to streamline communication with your lender.

In Illinois, there isn't a fixed grace period for missing mortgage payments. Typically, lenders can begin the foreclosure process after three missed payments. However, homeowners can often negotiate a loan modification or reinstatement options, including utilizing an Illinois Sample Letter for Insufficient Amount to Reinstate Loan to communicate effectively with their lender.