Illinois Sample Letter for Incorrect Documents Concerning Foreclosure proceedings

Description

How to fill out Sample Letter For Incorrect Documents Concerning Foreclosure Proceedings?

Are you currently within a position the place you need to have files for both organization or person purposes virtually every working day? There are plenty of authorized document layouts available on the Internet, but finding ones you can trust isn`t simple. US Legal Forms gives a large number of type layouts, like the Illinois Sample Letter for Incorrect Documents Concerning Foreclosure proceedings, which can be created to meet state and federal needs.

When you are currently familiar with US Legal Forms site and have a free account, basically log in. After that, you may down load the Illinois Sample Letter for Incorrect Documents Concerning Foreclosure proceedings web template.

Unless you have an profile and want to begin to use US Legal Forms, abide by these steps:

- Get the type you need and make sure it is for your proper city/region.

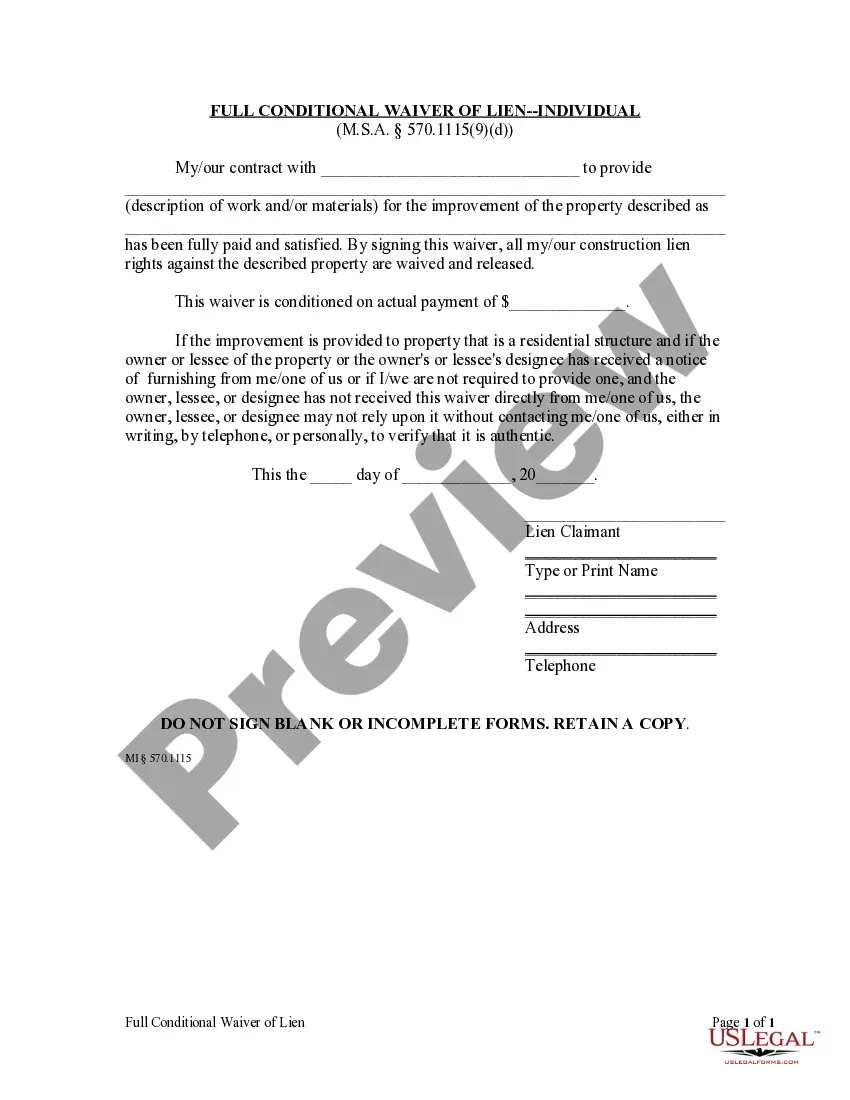

- Use the Review key to examine the shape.

- Read the information to ensure that you have chosen the correct type.

- When the type isn`t what you`re trying to find, use the Research industry to obtain the type that meets your needs and needs.

- If you get the proper type, click Buy now.

- Choose the costs prepare you need, fill in the required information and facts to produce your account, and pay for your order making use of your PayPal or credit card.

- Pick a convenient file file format and down load your duplicate.

Get all the document layouts you possess bought in the My Forms food selection. You can aquire a more duplicate of Illinois Sample Letter for Incorrect Documents Concerning Foreclosure proceedings anytime, if possible. Just click the essential type to down load or print the document web template.

Use US Legal Forms, one of the most extensive collection of authorized varieties, to save lots of time and stay away from mistakes. The services gives skillfully created authorized document layouts which can be used for a selection of purposes. Generate a free account on US Legal Forms and begin producing your daily life a little easier.

Form popularity

FAQ

Redemption. Subject to a few limited exceptions, you have 7 months from the date you are served to pay off your loan in full, either by refinancing the loan or by selling the house or by other means. This is called your right to redeem, and the 7-month period is called the redemption period.

At this point, you're probably wondering what's the best way to stop foreclosure in Illinois. There are three ways - reinstating the loan, redeeming the property before the sale, or filing for bankruptcy. Well, here's some news - filing for bankruptcy is your best option to keep your home!

The required activities that occur during the Pre-Foreclosure phase are 1) Default , 2) Loss Mitigation and 3) Notice of Loan Acceleration. Default. The initial pre-foreclosure activity in any Illinois foreclosure action is a ?default.? A default is when a borrower fails to comply with the terms of a mortgage loan.

In Illinois, it can take approximately 12-15 months for a foreclosure to be completed. Call your lender or a HUD-certified counseling agency as soon as you can.

In Illinois, the foreclosure process can start about 4 months after your first missed mortgage payment. The entire foreclosure process takes several months to complete.