The Fair Credit Reporting Act (FCRA) is designed to help ensure that credit bureaus furnish correct and complete information to businesses to use when evaluating your application. Your rights include:

The right to receive a copy of your credit report. The copy of your report must contain all of the information in your file at the time of your request.

The right to know the name of anyone who received your credit report in the last year for most purposes or in the last two years for employment purposes.

Any company that denies your application must supply the name and address of the credit bureau they contacted, provided the denial was based on information given by the credit bureau.

The right to a free copy of your credit report when your application is denied because of information supplied by the credit bureau. Your request must be made within 60 days of receiving your denial notice.

If you contest the completeness or accuracy of information in your report, you should file a dispute with the credit bureau and with the company that furnished the information to the bureau. Both the credit bureau and the furnisher of information are legally obligated to investigate your dispute.

A right to add a summary explanation to your credit report if your dispute is not resolved to your satisfaction.

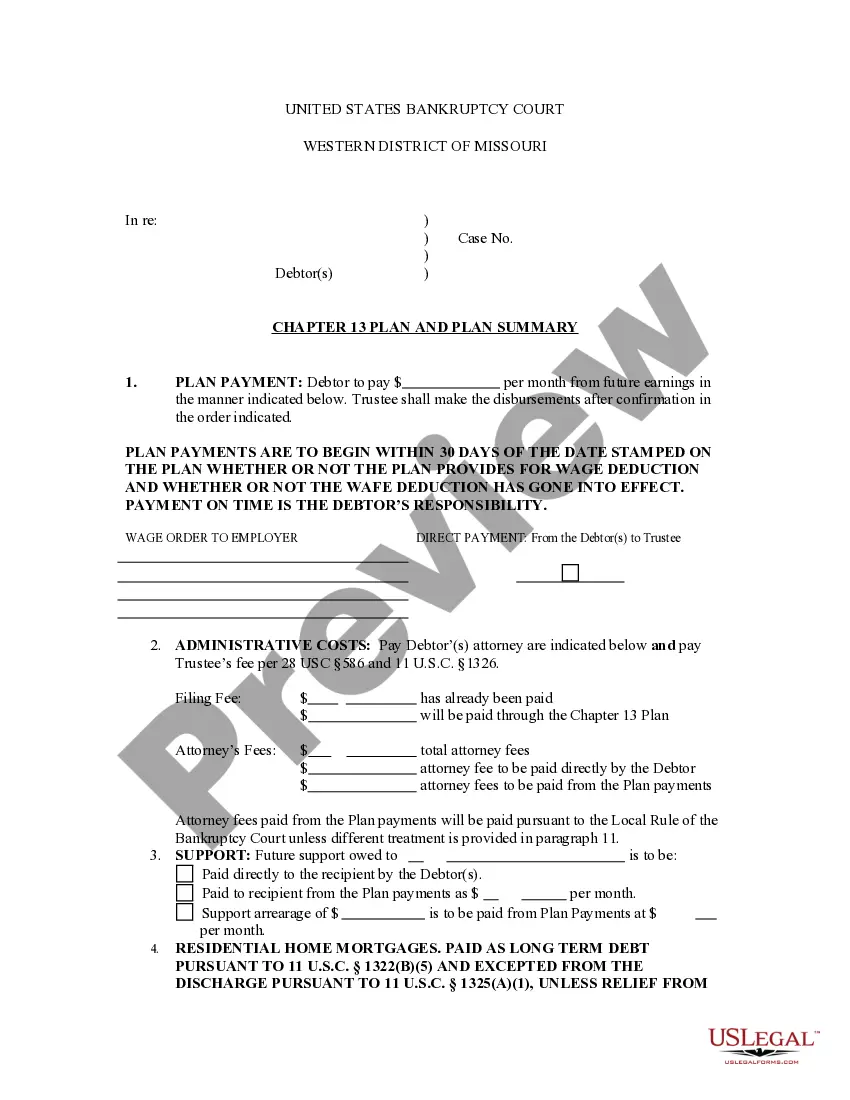

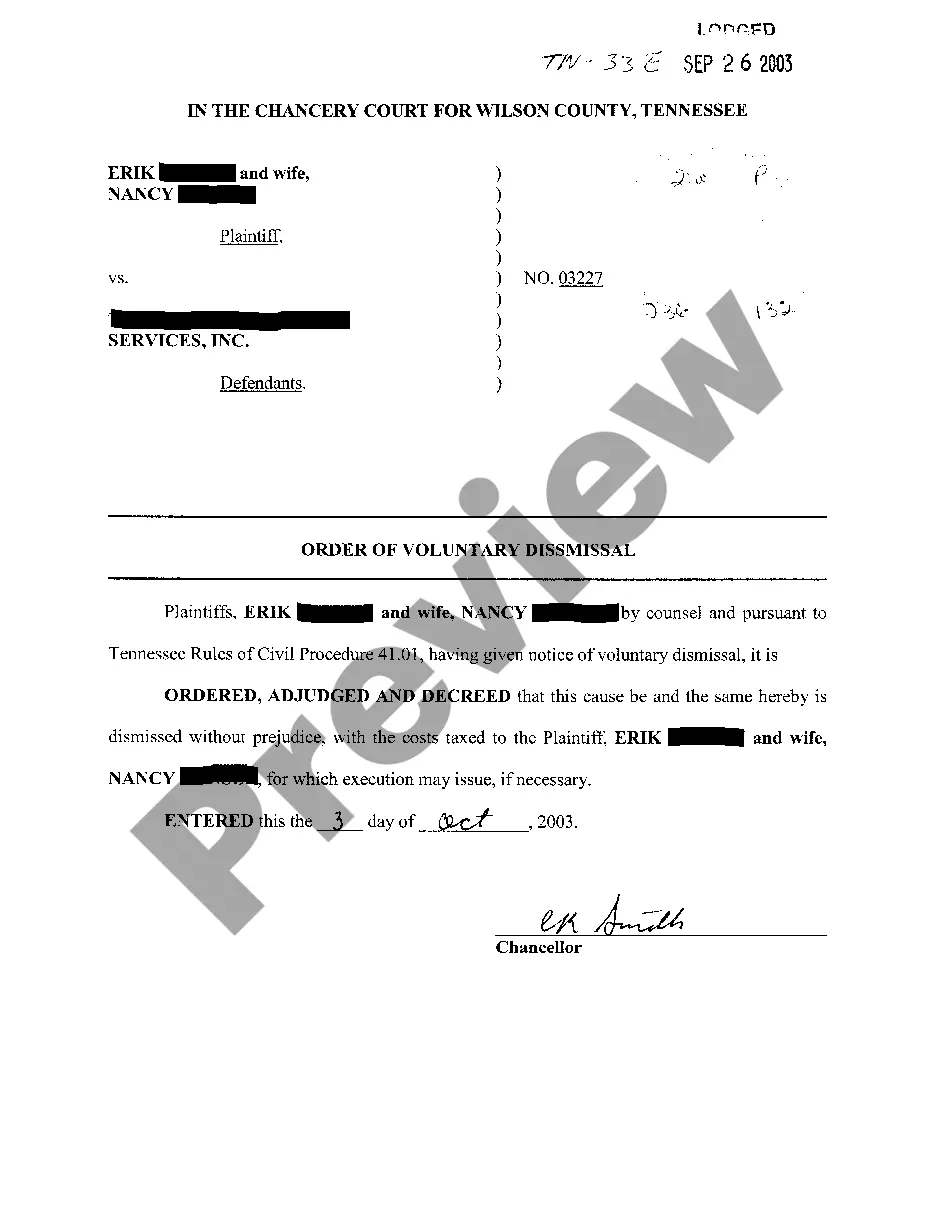

Illinois Request for Disclosure of Reasons for Increasing Charge for Credit Regarding Credit Application Where Action Was Based on Information Not Obtained by Reporting Agency

Description

How to fill out Request For Disclosure Of Reasons For Increasing Charge For Credit Regarding Credit Application Where Action Was Based On Information Not Obtained By Reporting Agency?

If you need to complete, download, or print lawful document themes, use US Legal Forms, the greatest selection of lawful kinds, which can be found on-line. Make use of the site`s basic and convenient lookup to discover the documents you need. Different themes for enterprise and personal functions are sorted by groups and suggests, or keywords. Use US Legal Forms to discover the Illinois Request for Disclosure of Reasons for Increasing Charge for Credit Regarding Credit Application Where Action Was Based on Information Not Obtained by Reporting Agency in a couple of mouse clicks.

When you are previously a US Legal Forms consumer, log in for your bank account and click on the Obtain key to find the Illinois Request for Disclosure of Reasons for Increasing Charge for Credit Regarding Credit Application Where Action Was Based on Information Not Obtained by Reporting Agency. Also you can gain access to kinds you in the past delivered electronically inside the My Forms tab of your respective bank account.

If you work with US Legal Forms the very first time, follow the instructions under:

- Step 1. Ensure you have chosen the form for your right area/nation.

- Step 2. Use the Review solution to examine the form`s content. Never forget to read through the description.

- Step 3. When you are not happy with the form, make use of the Lookup industry near the top of the screen to get other versions in the lawful form web template.

- Step 4. After you have located the form you need, click the Purchase now key. Opt for the pricing program you like and include your qualifications to sign up to have an bank account.

- Step 5. Process the purchase. You may use your bank card or PayPal bank account to perform the purchase.

- Step 6. Find the formatting in the lawful form and download it in your product.

- Step 7. Comprehensive, modify and print or sign the Illinois Request for Disclosure of Reasons for Increasing Charge for Credit Regarding Credit Application Where Action Was Based on Information Not Obtained by Reporting Agency.

Each lawful document web template you purchase is yours eternally. You possess acces to every single form you delivered electronically with your acccount. Click on the My Forms area and choose a form to print or download once again.

Compete and download, and print the Illinois Request for Disclosure of Reasons for Increasing Charge for Credit Regarding Credit Application Where Action Was Based on Information Not Obtained by Reporting Agency with US Legal Forms. There are millions of specialist and express-particular kinds you can utilize to your enterprise or personal requirements.

Form popularity

FAQ

What can I do if there is an error in my credit report? Federal law gives you the right to submit a dispute and request an investigation when you discover an error in your credit report.

The Fair Credit Reporting Act (FCRA) , 15 U.S.C. § 1681 et seq., governs access to consumer credit report records and promotes accuracy, fairness, and the privacy of personal information assembled by Credit Reporting Agencies (CRAs).

The federal Fair Credit Reporting Act or ?FCRA? is one of the strongest consumer protection laws, and it requires accurate and fair credit reporting. It also protects consumer privacy.

Inaccurate, incomplete, or unverifiable information must be removed or corrected, usually within 30 days. However, a consumer reporting agency may continue to report information it has verified as accurate.

The Fair Credit Reporting Act which was effective on October 26, 1970 is the law that Carlos can use to take action with on his case of errors on his credit report.