Illinois Complaint Against Drawer of Check that was Dishonored Due to Insufficient Funds (Bad Check)

Description

How to fill out Complaint Against Drawer Of Check That Was Dishonored Due To Insufficient Funds (Bad Check)?

It is possible to devote time on the Internet trying to find the lawful record web template that meets the state and federal needs you require. US Legal Forms supplies 1000s of lawful types which are reviewed by pros. It is simple to obtain or print the Illinois Complaint Against Drawer of Check that was Dishonored Due to Insufficient Funds (Bad Check) from your services.

If you already possess a US Legal Forms bank account, you may log in and then click the Acquire button. Afterward, you may full, edit, print, or signal the Illinois Complaint Against Drawer of Check that was Dishonored Due to Insufficient Funds (Bad Check). Every single lawful record web template you buy is the one you have forever. To have yet another backup for any acquired kind, proceed to the My Forms tab and then click the corresponding button.

If you use the US Legal Forms website the very first time, keep to the straightforward recommendations listed below:

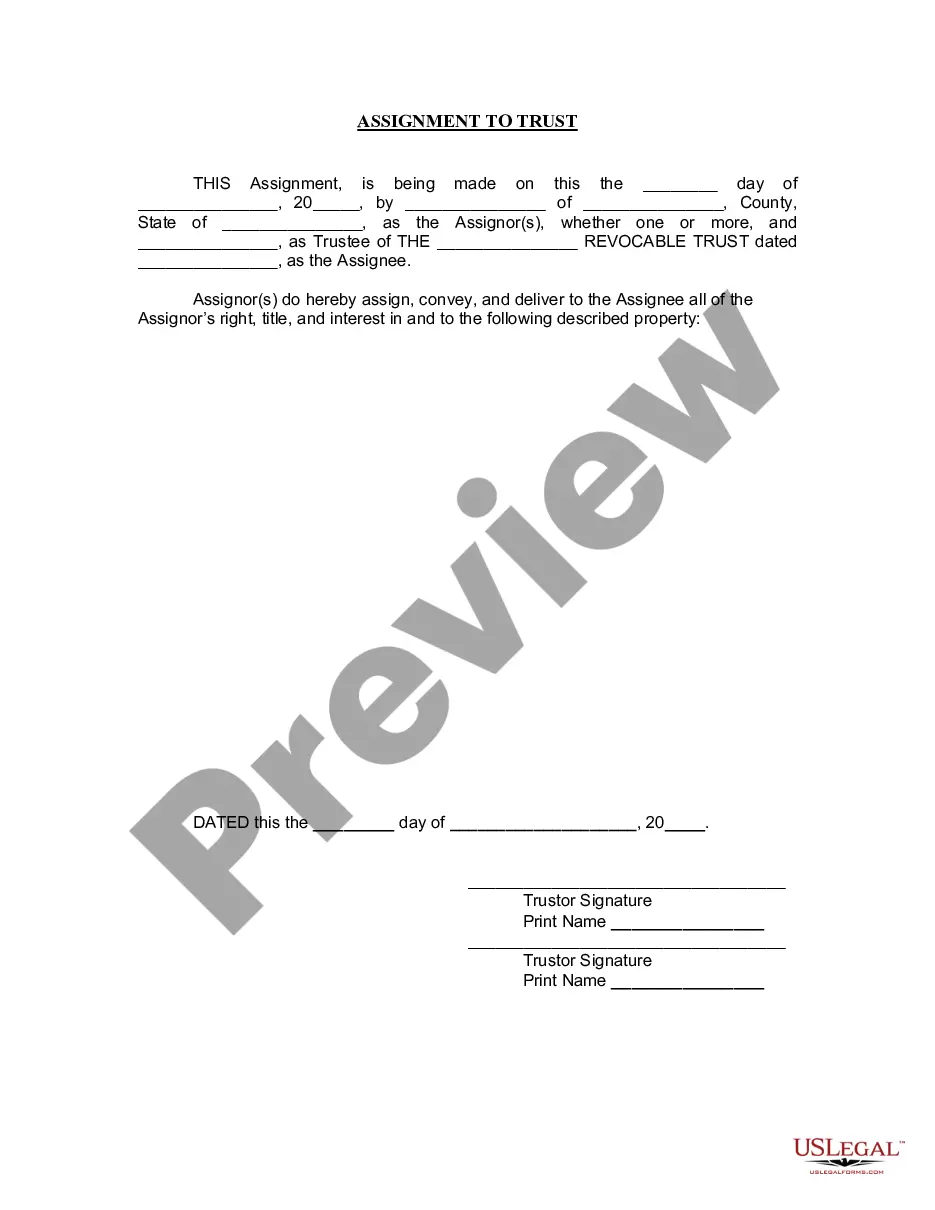

- Initial, be sure that you have chosen the correct record web template to the state/metropolis of your liking. Look at the kind description to ensure you have picked the correct kind. If accessible, take advantage of the Preview button to check through the record web template at the same time.

- If you wish to find yet another model of the kind, take advantage of the Lookup area to find the web template that fits your needs and needs.

- Once you have identified the web template you desire, click on Get now to carry on.

- Select the prices plan you desire, type your accreditations, and sign up for a merchant account on US Legal Forms.

- Comprehensive the deal. You can utilize your bank card or PayPal bank account to fund the lawful kind.

- Select the formatting of the record and obtain it in your gadget.

- Make alterations in your record if required. It is possible to full, edit and signal and print Illinois Complaint Against Drawer of Check that was Dishonored Due to Insufficient Funds (Bad Check).

Acquire and print 1000s of record web templates using the US Legal Forms Internet site, which offers the biggest variety of lawful types. Use skilled and condition-certain web templates to tackle your organization or specific demands.

Form popularity

FAQ

The payee can try to enforce your promise to pay the face amount of the check. They can also demand a $25 bad check fee, permitted by Illinois law. To get it, the payee must make a written demand that gives you 30 days to make the check good and pay the fee.

Penalties for Check Fraud Under 720 ILCS 5/17-1, the commission of a ?deceptive practice? will generally be considered a Class A misdemeanor, which is punishable by up to one year in jail and a fine of $2,500. The law sets out several exceptions that will upgrade the offense to Class 4 felony, however.

In the state of Illinois, it's possible to go to jail for writing a bad check. The crime of doing so falls under ?financial institution fraud,? and it's punishable by time in jail or in prison.

Key Takeaways. A rubber check is a check that cannot be cashed because of insufficient funds or a stop-payment order made by the sender.

It is considered a criminal offense, however, under 720 ILCS 5/17-1(B) to issue or deliver a check or other order for the payment of money to a third party when the writer knows that it will not be paid by the bank upon which it was issued.

Knowingly writing a bad check is an act of fraud and it's punishable by law. Criminal penalties for people who tender checks knowing that there are insufficient funds in their accounts can vary by state. Some states require an intent to commit fraud.

In cases where the total value of stolen money is between $301 and $10,000, you could be charged with a Class 3 felony, and could face a possible prison sentence as long as five years and a fine as large as $25,000.

When there are insufficient funds in an account, and a bank decides to bounce a check, it charges the account holder an NSF fee. If the bank accepts the check, but it makes the account negative, the bank charges an overdraft fee. If the account stays negative, the bank may charge an extended overdraft fee.